You’ve in all probability heard the phrase “retracement” or “retrace” fairly regularly in the event you’re serious about buying and selling the monetary markets. However do you really know what worth retracements are, why they’re so vital and the best way to correctly benefit from them? Maybe not, however even in the event you do, at the moment’s lesson goes to shed new mild on the best way to make the most of these extraordinarily highly effective market occasions…

You’ve in all probability heard the phrase “retracement” or “retrace” fairly regularly in the event you’re serious about buying and selling the monetary markets. However do you really know what worth retracements are, why they’re so vital and the best way to correctly benefit from them? Maybe not, however even in the event you do, at the moment’s lesson goes to shed new mild on the best way to make the most of these extraordinarily highly effective market occasions…

A retracement in a market is a reasonably straightforward idea to outline and perceive. Merely put, it’s precisely what it appears like: a interval when worth retraces again on a current transfer, both up or down. Take into consideration “retracing your steps”; going again the identical manner you got here. It’s mainly a reversal of a current worth transfer.

Why are retracements vital? For a variety of causes: They’re alternatives to enter the market at a “higher worth”, they permit for optimum cease loss placement, improved danger reward and extra. A retrace entry is extra conservative than a “market entry” for instance and is taken into account a “safer” entry kind. In the end, the purpose of a dealer is receive the perfect entry worth and handle danger pretty much as good as doable while additionally rising returns; the retracement entry is a instrument that permits you to do all three of this stuff.

This lesson will cowl all facets of buying and selling retracements and can make it easier to perceive them higher and put them to make use of to hopefully enhance your general buying and selling efficiency.

Now, let’s talk about a number of the Professionals and Cons of retracement buying and selling earlier than we have a look at some instance charts…

Professionals of Retracement Buying and selling

Let’s speak about a number of the many “Professionals” of retracement buying and selling. To be trustworthy, retracement buying and selling is mainly the way you commerce like a sniper, which, in the event you’ve adopted me for any size of time, is my most popular methodology of buying and selling.

- Increased Chance Entries – The very nature of a pull again or retrace signifies that worth is more likely to proceed transferring within the course of the preliminary transfer when the retrace ends. Therefore, in the event you see a powerful worth motion sign at a stage following a retracement, it’s very high-probability entry as a result of all indicators are pointing to cost bouncing from that time. Now, it doesn’t all the time occur, however ready for a retrace to a stage with a sign, is the highest-probability manner you possibly can commerce. Markets rotate again to the “imply” or “common” worth time and again; that is clear by taking a look at any worth chart for a couple of minutes. So, once you see this rotation or retrace occur, begin on the lookout for an entry level there as a result of it’s a a lot higher-probability entry level than merely coming into “at market” like most merchants do.

- Fewer Untimely Cease-Outs – A retracement permits extra flexibility with cease loss placement. Primarily, in that you could place the cease additional away from any space on the chart that’s more likely to be hit (if the commerce you’re taking is to exercise in any respect). Inserting stops additional away from key ranges or transferring averages or additional away from a pin bar excessive or low for instance, offers the commerce the next likelihood of figuring out.

- Higher Threat Rewards – Retracement entries theoretically let you place a “tighter” cease loss on a commerce since you’re coming into nearer to a key stage otherwise you’re coming into at a pin bar 50% stage on a commerce entry trick entry for instance. So, must you select to take action, you possibly can place a cease a lot nearer than in the event you entered a commerce that didn’t occur after a retrace or in the event you entered a pin bar commerce on the excessive or low of the pin, for instance. Instance: a 100 pip cease and 200 pip goal can simply grow to be a 50 pip cease and 250 pip goal on a retrace entry. Be aware: you don’t want to position a tighter cease, it’s non-compulsory, however the possibility IS There on a retrace entry if you would like it. The choice, utilizing a typical width cease has the benefit of reducing the possibilities of a untimely cease out.

- A danger reward will also be barely elevated even in the event you use a typical cease loss, as a substitute of a “tighter one”. Instance: a 100 pip cease and a 200 pip goal can simply grow to be a 100 pip cease and a 250 pip goal. Why? It’s as a result of a retrace entry permits you to enter the market when it has “extra room” to run in your course, on account of the truth that worth has pulled again and it thus has extra distance to maneuver earlier than it retraces once more as in comparison with in the event you entered at a “worse worth” additional up or down.

Cons of Retracement Buying and selling

In fact I’m going to be trustworthy with you and allow you to know a number of the “cons” of retracement buying and selling, there are just a few that try to be conscious of. Nevertheless, this doesn’t imply you shouldn’t attempt to study retracement buying and selling and add it to your buying and selling “toolbox”, as a result of the professionals FAR outweigh the cons.

- Extra Missed Trades: Good trades will “get away” typically when ready for a retracement that doesn’t occur, for instance. This could check your nerves and buying and selling mindset and can annoy even the perfect merchants. However belief me, lacking out on trades just isn’t the worst factor on the earth and it’s higher to overlook out on some trades than to over-trade, that’s for positive.

- Much less Trades in Normal – A whole lot of the time, markets merely don’t retrace sufficient to set off the extra conservative entry that comes with a pull again. As a substitute, they might simply maintain going with minimal retracements. This implies you should have much less probabilities to commerce general as in comparison with somebody who isn’t primarily ready for retraces.

- Because of the above two factors, retracement buying and selling might be irritating and takes unbelievable self-discipline. Nevertheless, in the event you develop this self-discipline you’ll be WELL forward of the lots of shedding merchants and so retracement buying and selling may also help you develop the self-discipline it’s essential to need to succeed at buying and selling it doesn’t matter what entry methodology you find yourself utilizing.

Retracements Present Flexibility in Cease Loss Placements

Inserting your cease loss on the improper level can get you knocked out of a commerce prematurely, that you just in any other case had been proper on. By studying to anticipate market pull backs or retracements, you’ll not solely enter the market at a higher-probability level, however you’ll additionally be capable to place your cease loss at a a lot safer level on the chart.

- Fairly often, merchants get discouraged as a result of they get stopped out of a commerce that technically they had been proper on. Inserting a cease loss on the improper level on a chart can get you taken out of a commerce earlier than the market actually has an opportunity to get moving into your course. A retracement provides up a nifty resolution to this drawback by permitting you to place a safer and wider cease loss on a commerce, supplying you with a greater likelihood at earning money on that commerce.

- When a market retraces or pulls again, particularly inside a trending market, it’s offering you with a possibility to position your cease loss at a degree on the chart that could be a lot much less more likely to knock you out of a commerce. Since most retraces occur into assist or resistance ranges, you possibly can place the cease loss additional past that stage (safer) which is considerably much less more likely to be hit than if it was nearer to the extent. Utilizing what I name a “commonplace” cease loss (not a decent one) on this occasion gives you the perfect likelihood at avoiding a untimely knock-out of a commerce.

The Totally different Retrace Entry Sorts: Examples

Subsequent, let’s check out a number of the totally different retrace entry varieties to be able to get a transparent have a look at what they may appear like…

- Retrace Entry With out Value Motion Sign

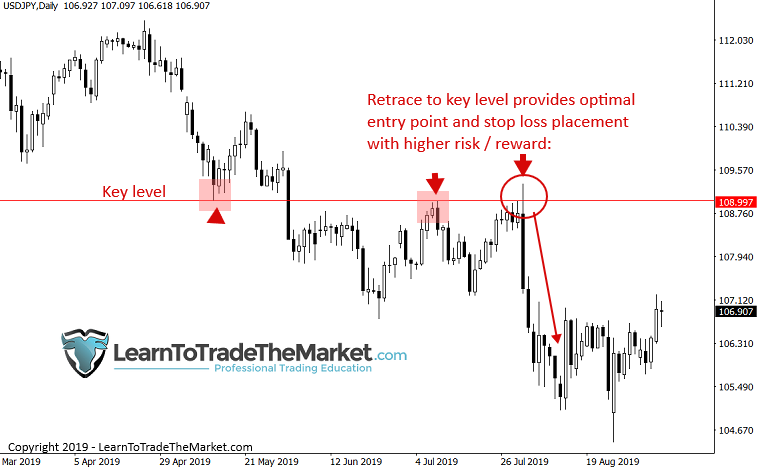

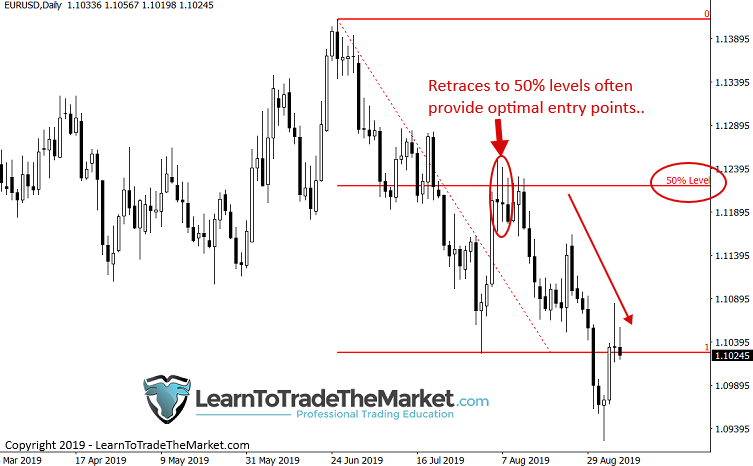

Within the instance beneath, you possibly can see worth retraced or pulled again to the important thing horizontal stage proven within the chart. There was no apparent worth motion sign right here however we are able to see worth shortly sold-off from that stage after simply barely pushing above it. This supplied merchants a really excessive potential danger reward state of affairs in the event that they entered on a “blind entry” on the stage with a decent cease loss…

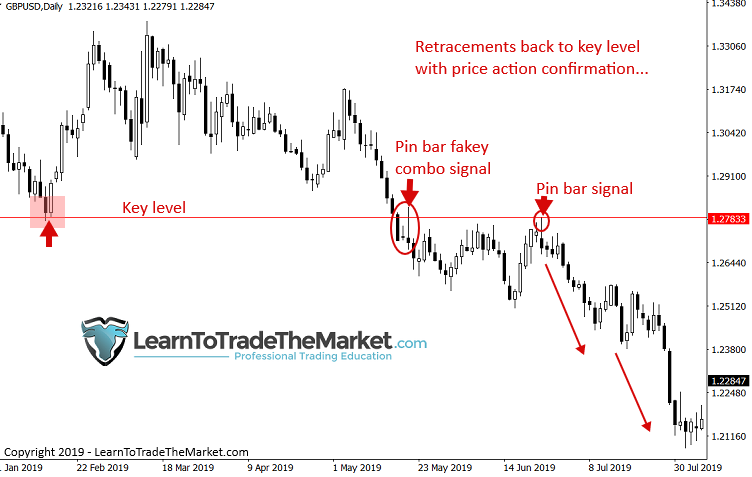

- Retrace to Key Degree with Value Motion Confluence

Maybe my favourite buying and selling technique of all time is the next instance: Look forward to worth to retrace again up or all the way down to an present key stage on the every day chart timeframe, then look ahead to an apparent worth motion sign to kind there. For my part, that is the highest-probability method to commerce…

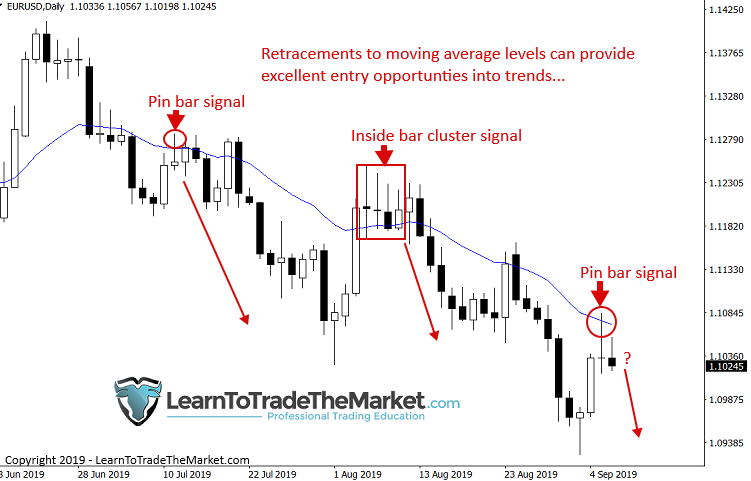

- Retrace to Shifting Common (rotation to the imply)

Markets tend to retrace to the imply or common worth, which you’ll see by placing a transferring common in your charts. Proven beneath is the 21 day ema, a stable short-term transferring common to see the development on the every day chart. When worth retraces again to this stage you need to watch intently for worth motion indicators forming there to get a high-probability entry and get in on a trending market…

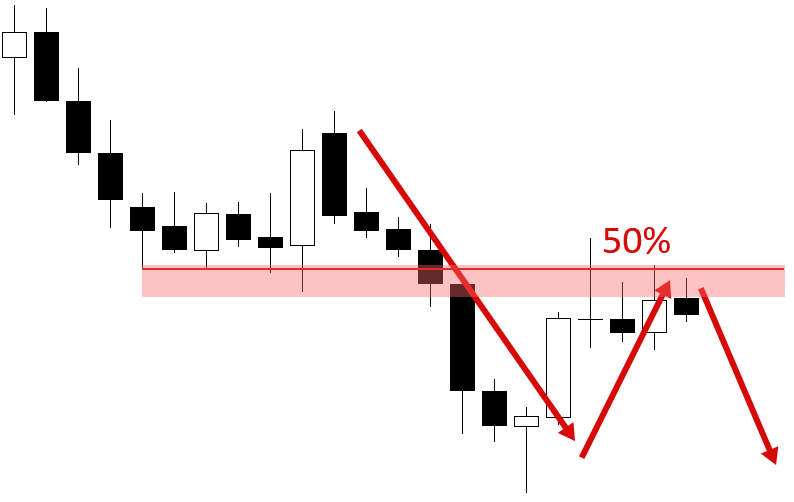

Value tends to retrace roughly 50% of any main transfer and sometimes instances even short-term strikes. It is a well-documented phenomenon and in the event you have a look at any chart you possibly can see it occurs, A LOT. Therefore, we are able to look ahead to pull backs to those 50% areas as they’ll fairly often be formidable ranges for worth to maneuver past, and because of this, worth strikes again within the course of the preliminary transfer from that fifty% stage. It doesn’t occur EVERY time, however it occurs usually sufficient to make it a essential instrument in your retracement buying and selling instrument field…

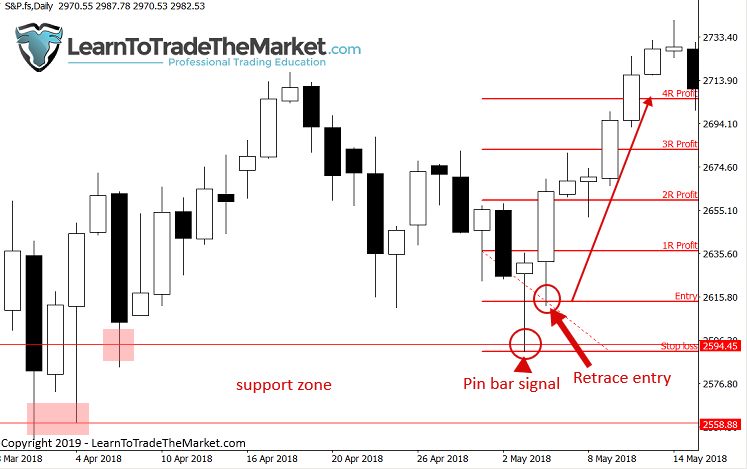

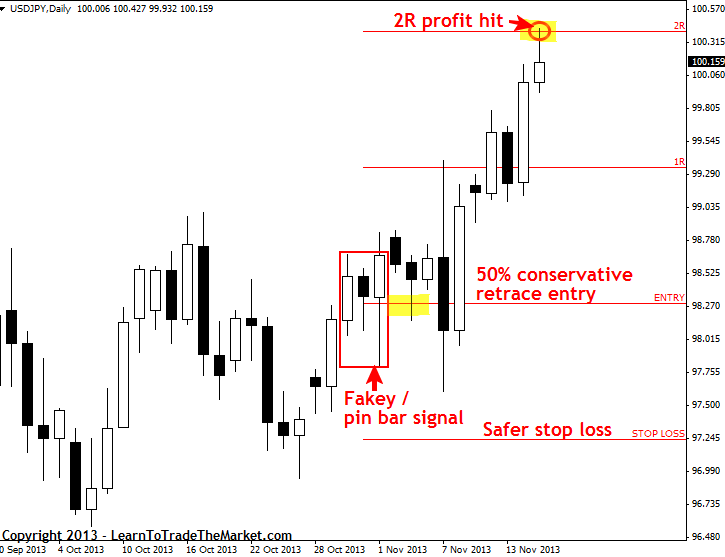

- Retrace Entry of a Sign Bar or Sign Space

One more manner we are able to make the most of retracements can also be very efficient but a little bit totally different than these we now have mentioned already. What we’re taking a look at beneath is what I name a “50% pin bar retrace“. Usually, on longer-tailed pin bars, you will notice worth retraces round half the gap from excessive to low of the sign bar, offering you the potential to enter at a greater worth and get a safer or tighter cease loss.

Instance 1: You’ll be able to see beneath how a 4R revenue was attainable by ready for the retrace and coming into close to the pin’s 50% stage.

Instance 2: You’ll be able to see beneath how a 2R revenue was attainable by ready for the retrace and coming into close to the fakey patterns 50% space.

- Retrace Entry Again to an Occasion Space or Prior PA Sign

When worth retraces again to what I name an “occasion space” it’s a really high-probability space to search for trades at. As you possibly can see beneath, worth retraces again to an present occasion space the place a pin bar sign fashioned after which types one other (bearish this time) pin bar earlier than an enormous sell-off takes place…

Conclusion

You now have a stable introduction and (hopefully) understanding of what worth motion retracements are, why are they vital and the best way to commerce them. While there is a little more to it than what I mentioned right here, this lesson offers you an excellent basis to construct from and gives you with some instruments you can begin placing to work in your buying and selling routine this week and into the long run.

If you wish to study extra about retracement buying and selling and get every day updates on any potential retracement trades, try my skilled buying and selling course and observe my every day commerce setups publication. It will each deepen your understanding of retracements and in addition make it easier to apply these ideas to real-time worth motion indicators then you possibly can check and examine the outcomes between aggressive entries (like these on this article) and conventional entries that you just’re in all probability extra aware of. Keep in mind, I’m all the time right here that will help you and share my information with you, so continue learning and working towards.

Please Depart A Remark Under With Your Ideas On This Lesson…

If You Have Any Questions, Please Contact Me Right here.