Transportation has been powered by fossil fuels for greater than a century, first with coal after which oil. Electrical Automobiles (EVs) are set to shake up that paradigm. Traders see that change coming, and so they’re searching for the very best EV shares and ETFs of 2023.

Regardless of the eye garnered by main US EV makers, the change is pushed by China, the place EVs and plug-in automobiles (together with hybrids) make up 35% of complete gross sales. China represents 58% of EV gross sales worldwide. This development is simply getting began within the West, with EVs & hybrids making up solely 8.4% of US gross sales in 2023.

Finest EV Shares

EVs are a radical departure from classical cars. The core distinction is within the want for a big and complicated battery pack, whereas the engines are comparatively easy and straightforward to take care of.

So, on this sector, success usually depends on excellent battery know-how and general R&D efforts, making pure EV firms just a little extra like tech shares and fewer like traditional automakers.

We’ll attempt to supply a various view of the sector and concentrate on a number of of the very best EV shares, however we received’t even come near overlaying all of the probably engaging shares.

This record of the very best EV shares and ETFs is designed as an introduction; if one thing catches your eye, you’ll wish to do further analysis!

1. Tesla, Inc. (TSLA)

| Market Cap | $810B |

| P/E | 83.02 |

| Dividend Yield | – N/A |

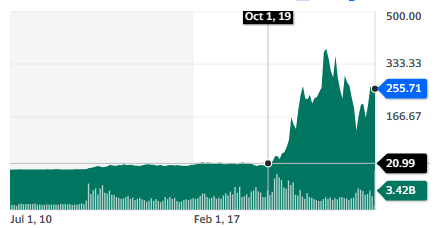

By market cap, the most important EV firm on this planet, Tesla, has been on the heart of monetary markets’ consideration for years. It gathers an virtually cult-like following, in addition to equally opinionated haters. The lightning rod for all kinds of heated opinions is Tesla’s eccentric CEO, Elon Musk.

Tesla’s largest contribution to the EV market has been to make the sector “cool”, with the Roadster 1.0, with efficiency similar to a Porsche (and a fairly related price ticket). It elevated the picture of EVs from boring inexperienced to a gold-plated standing image.

Tesla is a really tech-driven firm and can be energetic within the power markets (photo voltaic and battery packs) and is trying to turn out to be the winner within the race for creating the primary totally self-driving vehicles.

So much hinges on this newest ambition, with Tesla’s market cap typically being bigger than the remainder of the automotive {industry} mixed.

Tesla inventory value and valuation multiples are excessive, reflecting the equally excessive market expectations. So traders in Tesla will should be cautious that a minimum of a few of the outsized ambitions of the corporate and Elon Musk succeed, just like the enlargement into utility-scale batteries, electrical semi vehicles, and self-driving “robotaxis”.

The query with Tesla will not be the standard of the corporate however its skill to justify the extraordinary valuation the market has positioned on it. Valuation issues, and whereas TSLA is undoubtedly the most well-liked EV inventory, that doesn’t essentially make it the very best EV inventory.

📈 Be taught extra: If you’re involved in investing in Elon Musk’s firms, our current vlogs supply a simple information to purchasing Boring Firm inventory and a sensible breakdown of choices for investing in SpaceX inventory.

2. BYD Firm Restricted (BYDDY)

| Market Cap | $101B |

| P/E | 31.45 |

| Dividend Yield | 0.49% |

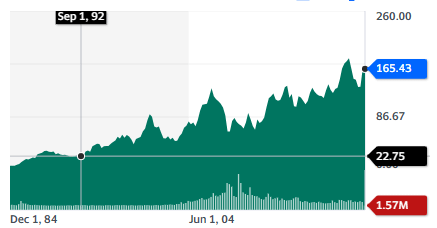

The most effective EV shares out there may be BYD, which is the strongest driver of China’s industry-leading EV revolution, having bought 1,860,000 automobiles in 2022 for €20.3B of revenues, making it one of many largest non-public firms in China. It began to make EVs in 2003, lengthy earlier than they moved onto heart stage.

The corporate is energetic in a number of sectors past EVs, like trains, buses, vehicles, and industrial tools, even when EVs are the core of the corporate’s enterprise.

Whereas largely staying away from the North American market because of the USA/China rivalry, BYD is increasing abroad, particularly in Europe, the place it’s launching €30,000 fashions with 265-mile ranges. BYD appears set to beat Tesla and different Western producers to the {industry}’s holy grail, the inexpensive and “technically ok” mass-market EV.

This makes BYD some of the possible winners within the Chinese language automakers racing to develop overseas, maybe in a repeat of the success of Japanese automakers within the Nineteen Eighties.

BYD was a long-term holding of Warren Buffett, who purchased it early. He lately lowered his publicity, doubtlessly cautious of geopolitical dangers (he bought TSMC shares in the identical interval). That is one thing to bear in mind for US traders, with BYD’s US itemizing a possible goal for sanctions in case of escalating commerce wars.

BYD might be among the best EV shares of a non-US firm, and the ADRTs commerce within the US, making them simply accessible. You’ll nonetheless want a cautious evaluation of geopolitical danger!

3. Toyota Motor Company (TM)

| Market Cap | $224B |

| P/E | 13.06 |

| Dividend Yield | 3.02% |

Most traditional automakers have been reluctant to show towards EVs for a number of causes.

- Prices sunk into inside combustion engine (ICE) applied sciences and provide chains.

- Preliminary limitations of EVs (vary, security, prices, and so on.).

- Massive CAPEX required for battery tech, new meeting traces, and so on…

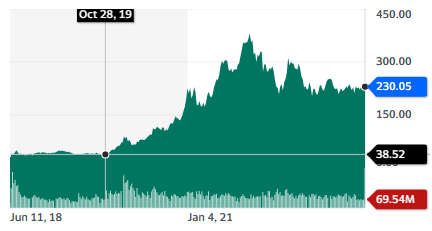

Toyota was gradual to embrace EVs. For a very long time, it most popular to push for a mixture of ICE and hybrid vehicles as an alternative.

This has radically modified lately, with the disclosing of plans for a 900-mile battery with a brief charging time. This excellent efficiency could be made attainable by Toyota’s advances in solid-state battery know-how, an elusive know-how that guarantees efficiency leaps forward of lithium-ion: safer, extra cost, faster cost, much less weight, and so on…

These solid-state battery EVs ought to turn out to be obtainable in 2027-2028, leaving Toyota sufficient time to construct up the required battery factories and ramp up manufacturing to an enormous scale.

Toyota is without doubt one of the greatest EV shares for traders skeptical of the mainstream narrative round EVs. The corporate has been a number one automaker for many years and excels at mass-producing vehicles effectively.

The EV market is brimming with engaging shares, and figuring out the very best EV shares will be difficult. Toyota’s gradual adoption of EVs was not a mistake however as an alternative an astute enterprise determination. Reasonably than be a part of the horde churning out technologically related vehicles, Toyota might have waited for a battery know-how that provides it a technological benefit to match its model presence, manufacturing capability, and popularity for high quality and sturdiness.

4. ON Semiconductor Company (ON)

| Market Cap | $44.1B |

| P/E | 25.09 |

| Dividend Yield | – N/A |

The technological enhancements in engines and batteries for EVs depend on techniques referred to as “energy electronics”. They permit for enormous quantities of power to be moved round a machine in a managed and secure style.

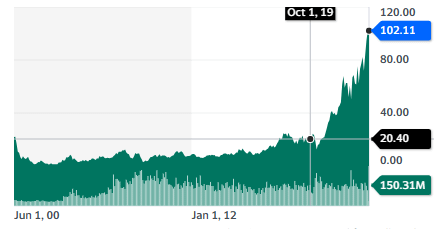

A pacesetter on this phase is ON Semiconductors, whose tools makes use of silicon carbide, a sort of silicon compound used for high-energy electrical techniques. With out it, quick charging and excessive efficiency of EVs could be not possible.

ON’s merchandise are additionally utilized in different sectors utilizing excessive energy, like telecommunications, computing, inexperienced power, and industrial actions. The power and EV sectors are the place the corporate expects most of its projected 7-9% CAGR to come back from. This makes it a robust contender when contemplating the very best EV shares for potential long-term development.

The corporate’s management in silicon carbide allowed it to develop revenues by 26% within the 2020-2022 interval and to multiply its free money stream 10x since 2019, reaching $1.6B in 2022. The corporate expects its free money stream to double by 2027.

Whereas very aggressive, this development goal is likely to be achievable, with virtually all the largest firms energetic in EV, electronics, instruments, telecom, photo voltaic, and knowledge showing on the corporate’s consumer record.

That is extra of a “pick-and-shovel” sort of inventory with a really robust development profile, whose predominant thesis is the continued electrification of the world, from the commercial sector to power era techniques, heating, and transportation.

Inventors will nonetheless should be cautious of valuation, as the corporate at present trades at a somewhat excessive value to free money stream a number of.

5. Up to date Amperex Know-how Co., Restricted – CATL (300750.SZ)

| Market Cap | $141B |

| P/E | 24.60 |

| Dividend Yield | 1.27% |

Within the hunt for the very best EV shares, one can’t overlook China-based CATL, THE world’s uncontested chief in battery manufacturing, producing round half of the world’s complete batteries if measured by GWh. This makes it a primary provider of the EV {industry}’s most important part.

CATL began as a battery provider to the electronics {industry} and rapidly embraced EV batteries, being one of many first suppliers to Chinese language automakers and Tesla.

The corporate has invested a large quantity of R&D efforts into new battery applied sciences. This offers the corporate a novel lead in new chemistries:

- Lithium iron/ferrum phosphate (LFP) battery know-how, used for reasonable and “dense sufficient” batteries with low prices, is an effective candidate for reasonable EV designs.

- A 160 Wh / kg Sodium-ion battery, introduced in 2021, which makes use of sodium as an alternative of lithium, cuts prices and removes the dangers of lithium shortages and extremely risky costs.

- A 330 Wh/ kg ultra-durable “million miles” battery that fees to 80% in 5 minutes is prepared for commercialization, which ought to undoubtedly handle the issue of sturdiness and the “anxiousness vary” for EVs.

And that is just for soon-to-be commercialized battery tech. CATL has additionally introduced a record-breaking 500 Wh/kg “condensed” battery, which might be as dense as some proposed solid-state batteries whereas nonetheless counting on better-understood lithium-ion provide chains.

The distinctive manufacturing scale of CATL makes it a central provider for any automaker trying to launch EV fashions with out spending tens of billions in battery R&D.

CATL’s innovation capability additionally makes it a primary candidate to learn from the rising demand for utility-scale batteries, the place totally different battery chemistries, extra targeted on sturdiness and prices than density, is likely to be a better option than lithium-ion chemistry.

Whereas it’s among the many greatest EV shares obtainable, buying CATL inventory has its challenges. The principle danger for traders on this firm will not be business-related however the rising US-China tensions, with the inventory solely listed in Chinese language exchanges.

A repeat of Huawei falling underneath sanctions and being banned from promoting to Western markets is a distant however very actual risk. So cautious diversification is very really useful regardless of CATL’s lead within the {industry}.

Finest EV ETFs

The EV sector is quickly altering, and figuring out the very best EV shares for long-term features is usually a problem. That makes diversification crucial. For a lot of traders, particularly these with restricted funds, that makes an ETF a gorgeous alternative.

1. KraneShares Electrical Automobiles & Future Mobility Index ETF (KARS)

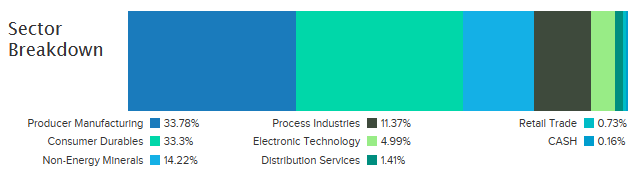

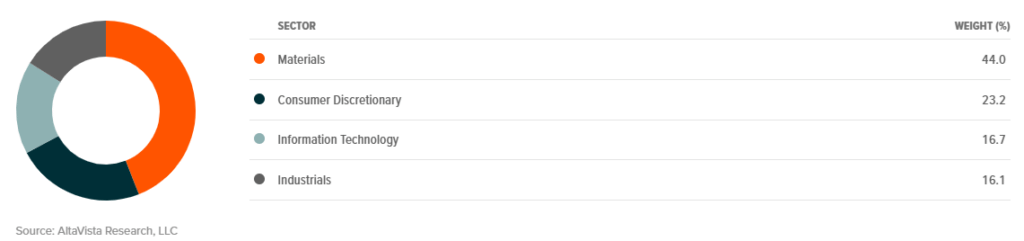

This ETF covers a lot of the EV and battery producers, its prime holdings being Tesla, Panasonic, Rivian, and Samsung. It additionally consists of some producers of battery metals (nickel, cobalt, lithium).

2. World X Autonomous & Electrical Automobiles ETF (DRIV)

This ETF focuses on the tech facet of the EV {industry}, with a robust concentrate on the chief of autonomous driving. So, it consists of not solely Tesla and Toyota but in addition AI leaders like NVidia, Apple, Alphabet, and Intel.

This makes it an ETF for traders who imagine within the imminence and significance of AI & self-driving however aren’t certain who will dominate these sectors.

3. World X Lithium & Battery Tech ETF (LIT)

EV development is driving demand for batteries and for lithium. This ETF is sweet for getting publicity to those key suppliers of the EV {industry} whose fortunes will likely be linked to EV adoption. This ETF is closely targeted on commodity producers, adopted by the most important battery producers and EV producers.

4. iShares Self-Driving EV and Tech ETF (IDRV)

This ETF is targeted on smaller EV firms, with its prime holdings being formidable startups like Rivian, Xpeng, and Li Automotive. It additionally consists of bigger automakers and lithium producers. This could make it a extra risky ETF but in addition one with extra upside potential in case these firms continue to grow or are the primary to resolve self-driving.

Conclusion on the Finest EV Shares and ETFs

EVs are virtually definitely going to dominate the transportation sector finally. The questions are how briskly and with which know-how. Fans count on it to occur in a short time, whereas skeptics imagine it’ll a minimum of require important progress in battery know-how to see mass adoption, just like the one promised by solid-state batteries or new chemistries.

The solutions to those questions will have an effect on the alternatives traders will make and their perceptions of what are the very best EV shares for the long run.

The EV sector has additionally been a really energetic and fashionable sector up to now years, usually driving valuations to astronomical and probably unsustainable ranges. Consideration to valuation metrics and avoiding overpayment is likely to be essential for good future returns.

Lastly, the rising strategic significance of this {industry} makes it a probable heart of focus in a commerce conflict, geopolitical rivalry, and different political interferences. Geographical diversification will likely be necessary as nicely.