Shares of British chip designer Arm (ARM) surged in value after its inventory market debut on Thursday – closing up 25% from its IPO value. The positive factors put the corporate’s valuation at greater than $64 billion, making it the largest new providing in 2 years.

Arm’s robust efficiency is predicted to have a constructive impression on the IPO pipeline, the place a number of corporations are scheduled to go public within the coming weeks — together with grocery supply service Instacart, German footwear maker Birkenstock, and advertising automation platform Klaviyo. Ought to these IPOs additionally succeed, Wall Avenue is anticipating a wave of inventory market launches in 2024 as non-public corporations which have been sitting on the sidelines flip public. After a lull lasting for about 18 months, the U.S. IPO market has already seen a pickup, with roughly 16 corporations initiating the submitting course of in August.

All of that is nice information for the Wall Avenue banks that assist carry these corporations to market, because the charges they generate will be substantial. Underwriting charges vary a median of 4% to 7% of gross IPO proceeds, which may add up shortly. In reality, Arm is predicted to pay as a lot as $104 million in charges, which will probably be cut up amongst a number of funding banks resembling Goldman Sachs and J.P. Morgan. Each corporations had prime spots throughout 2021’s banner IPO 12 months, and beneath are their charts, that are starting to point out indicators of turning constructive.

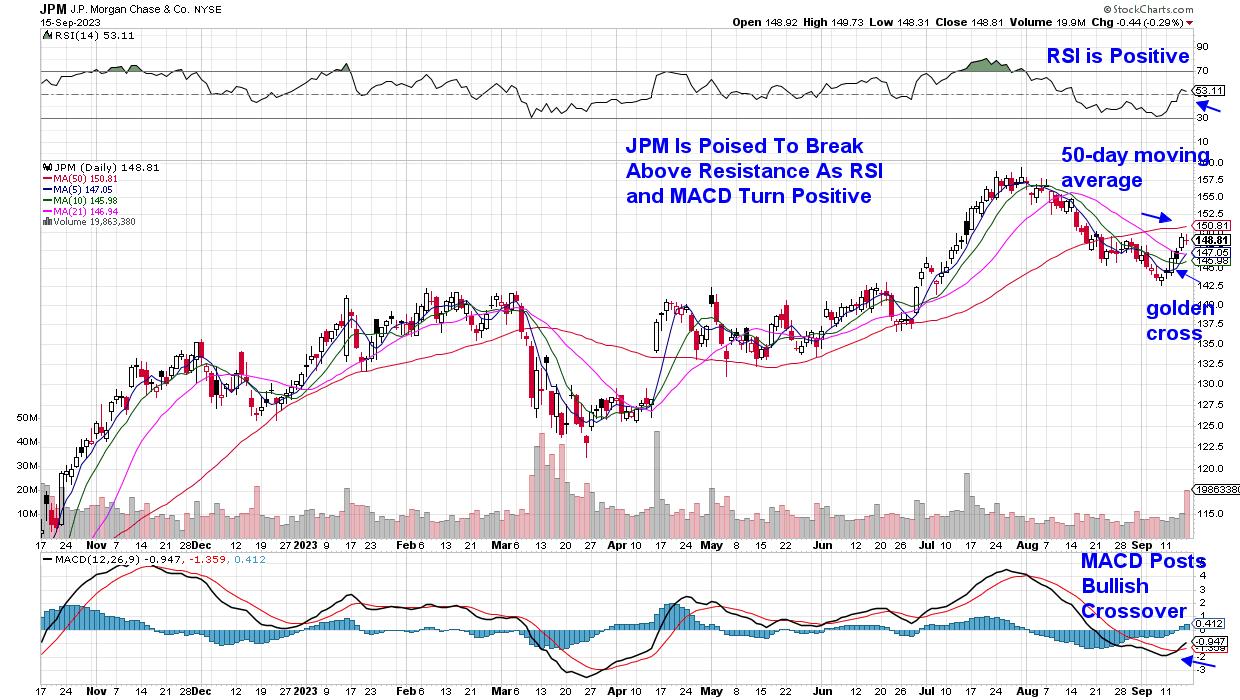

DAILY CHART OF J.P. MORGAN

J.P. Morgan (JPM) closed above its 10- and 21-day shifting averages final week on comparatively excessive quantity, which, in flip, pushed the RSI into constructive territory. The MACD has posted a bullish crossover, with the black line crossing above the pink. The subsequent huge hurdle will probably be a detailed above its 50-day shifting common, which might verify a brand new uptrend.

DAILY CHART OF GOLDMAN SACHS (GS)

Goldman Sachs (GS) is a little more superior in its efforts to show bullish. The inventory closed above its key 50- and 200-day shifting averages following a rally that pushed the MACD into constructive territory, the place it joined the already constructive RSI. Final week’s acquire has put the inventory’s value effectively above its shifting averages, in order that it could enter a interval of consolidation whereas these shifting averages catch up.

Whereas most traders within the U.S. seemingly have not heard of Arm, most use the corporate’s merchandise each day, as the corporate designs and creates chips utilized in smartphones, laptops, and video video games. The corporate is predicted to play an enormous function in AI adoption, which is claimed to have pushed most of Thursday’s shopping for. Outdoors of Arm’s rally, nonetheless, value motion amongst Semiconductor shares was fairly damaging final week, with the group slumping additional beneath its key shifting averages and posting a damaging RSI and MACD (utilizing ETF SOXX).

Longer-term, although, the outlook stays constructive for key Semiconductor chip suppliers, and if you would like to be alerted to when these names enter new uptrends and are in robust purchase zones, use this hyperlink right here to trial my twice weekly MEM Edge Report for a nominal charge. This report specializes on retaining subscribers on prime of crucial turns available in the market, and people shares which might be ready to learn essentially the most.

Warmly,

Mary Ellen McGonagle, MEM Funding Analysis

Mary Ellen McGonagle is an expert investing guide and the president of MEM Funding Analysis. After eight years of engaged on Wall Avenue, Ms. McGonagle left to grow to be a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with shoppers that span the globe, together with huge names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Study Extra