EUR/USD: ECB Triggers Euro Collapse

● The previous week was marked by two vital occasions. The primary was the discharge of Client Worth Index (CPI) knowledge in the USA on September 13. The second was the assembly of the European Central Financial institution’s (ECB) Governing Council on September 14.

Relating to the primary occasion, the annual CPI in the USA rose from 3.2% in July to three.7% in August, surpassing market forecasts of three.6%. On a month-to-month foundation, the CPI elevated from 0.2% to 0.6%, exactly consistent with market expectations. Monetary markets reacted comparatively tepidly to this knowledge. In keeping with CME Group, there’s a 78.5% probability that the Federal Open Market Committee (FOMC) will keep the important thing rate of interest at its present degree of 5.50% each year throughout its assembly on September 20. Nevertheless, the CPI statistics present the regulator some room for manoeuvre when it comes to tightening financial coverage sooner or later. If inflation in the USA continues to rise, there’s a excessive chance that the Federal Reserve will improve the refinancing fee by one other 25 foundation factors (bps). That is particularly seemingly on condition that the U.S. financial system is demonstrating steady development and the nationwide labor market stays strong. The printed variety of preliminary unemployment claims was 220K, which was decrease than the forecasted 225K.

● The second occasion triggered a significantly extra unstable response. On Thursday, September 14, the ECB raised its key rate of interest for the euro by 25 foundation factors (bps) for the tenth consecutive time, transferring it from 4.25% to 4.50%. That is the very best it has reached since 2001. Consultants had various opinions on the transfer, labelling it as both hawkish or dovish. Nevertheless, in concept, an rate of interest improve ought to have supported the widespread European forex. Contrarily, EUR/USD fell beneath the 1.0700 mark, recording an area low at 1.0631. The final time it reached such depths was within the spring of 2023.

The decline within the euro was attributed to dovish feedback made by the ECB’s management. One might deduce from these that the central financial institution had already introduced charges to ranges that, if sustained over an prolonged interval, ought to convey inflation inside the Eurozone all the way down to the goal 2.0%. ECB President Christine Lagarde’s assertion, “I am not saying we’re on the peak of charges,” did not impress traders. They concluded that the present hike to 4.50% is probably going the final step on this tightening cycle of financial coverage. Because of this, with the backdrop that the Federal Reserve should elevate its fee to five.75%, bears in EUR/USD have gained a noticeable benefit.

● Bearish momentum elevated even additional following Thursday’s launch of information indicating that U.S. retail gross sales for August elevated by 0.6% month-over-month (MoM), considerably exceeding the 0.2% forecast. On the identical time, the Producer Worth Index (PPI) for August rose by 0.7%, additionally surpassing expectations and the earlier studying of 0.4%.

● “We anticipate that the relative energy of the U.S. financial system will proceed to place stress on EUR/USD within the coming months, as the expansion differential will play a number one function. We keep our forecast for the cross to be on the 1.0600-1.0300 vary over the subsequent 6-12 months,” remark strategists at Danske Financial institution, certainly one of Northern Europe’s main banks. They proceed: “On condition that it is onerous to ascertain a pointy shift within the present U.S. greenback dynamics, and with commodity costs at present rising, we could attain our 6-month forecast for the cross sooner than anticipated.”

HSBC strategists predict an excellent sooner decline for the pair, anticipating that it’ll attain the 1.0200 degree by the tip of this yr. In keeping with specialists at ING, the pair might drop to the 1.0600-1.0650 space across the time of the Federal Reserve assembly within the upcoming week. “We consider that, at this stage, the EUR/USD fee shall be more and more influenced by the greenback,” they write. “Markets have acknowledged that the ECB has more than likely reached its peak rate of interest, which implies that Eurozone knowledge ought to change into much less related. We would see EUR/USD rise once more at present [September 15], however a return to the 1.0600/1.0650 space across the date of the Federal Reserve assembly appears extremely seemingly.”.

● As of the time of penning this assessment, on the night of Friday, September 15, the pair certainly rose and ended the five-day buying and selling interval on the 1.0660 mark. 55% of specialists are in favour of a continued upward correction, whereas 45% agree with ING economists’ opinion and voted for a decline within the pair. As for technical evaluation, nearly nothing has modified over the previous week. Among the many development indicators and oscillators on the D1 timeframe, 100% are nonetheless favouring the U.S. forex and are colored in pink. Nevertheless, 25% of the most recent indicators sign that the pair is oversold. Instant assist for the pair is situated within the 1.0620-1.0630 space, adopted by 1.0515-1.0525, 1.0480, 1.0370, and 1.0255. Bulls will encounter resistance within the 1.0680-1.0700 zone, then at 1.0745-1.0770, 1.0800, 1.0865, 1.0895-1.0925, 1.0985, and 1.1045.

● The upcoming week shall be fairly eventful. On Tuesday, September 19, shopper inflation knowledge (CPI) for the Eurozone shall be launched. Undoubtedly, essentially the most vital day of the week, and maybe even the upcoming months, shall be Wednesday, September 20, when the FOMC assembly of the Federal Reserve will happen. Along with the rate of interest resolution, traders count on to glean precious data from the FOMC’s long-term forecasts in addition to throughout the press convention led by the Federal Reserve’s administration. On Thursday, September 21, the standard preliminary jobless claims knowledge shall be printed in the USA, together with the Federal Reserve Financial institution of Philadelphia’s Manufacturing Exercise Index. Friday guarantees a deluge of enterprise exercise statistics, with the discharge of PMI knowledge for Germany, the Eurozone, and the USA.

GBP/USD: Awaiting the Financial institution of England Assembly

● In keeping with latest statistics, the UK financial system goes by a difficult interval. Among the extra emotional analysts even describe its situation as dire. GBP/USD continued to say no in opposition to the backdrop of disappointing GDP knowledge for the nation. In keeping with the most recent figures launched by the Workplace for Nationwide Statistics (ONS) on Wednesday, September 13, the British financial system contracted by -0.5% on a month-to-month foundation, in comparison with an anticipated decline of -0.2%.

The day earlier than, on Tuesday, the ONS printed equally disheartening knowledge in regards to the labor market. The unemployment fee for the three months by July rose to 4.3%, in comparison with the earlier determine of 4.2%. Employment decreased by 207,000 jobs, whereas the financial system misplaced 66,000 jobs a month earlier. The market consensus forecast had been for a discount of 185,000 jobs.

● The Financial institution of England’s (BoE) efforts to fight inflation look like slightly modest. Though the annual fee of value development within the UK has decreased from 7.9% to six.8% (the bottom since February 2022), inflation stays the very best among the many G7 international locations. Furthermore, the core Client Worth Index (CPI) remained unchanged from the earlier month at 6.9% year-on-year, solely 0.2% beneath the height set two months earlier.

Sarah Briden, the Deputy Governor of the BoE, believes that the “dangers to inflation […] are at present to the upside,” and that it’ll solely attain the goal degree of two% two years from now. In the meantime, in response to quarterly survey knowledge, solely 21% of the nation’s inhabitants is happy with what the Financial institution of England is doing to regulate value development. This marks a brand new report low.

● Analysts at Canada’s Scotiabank consider that the decline of GBP/USD might proceed to 1.2100 within the coming weeks, and additional to 1.2000. Economists on the French financial institution Societe Generale maintain the same view. In keeping with them, whereas a fall to 1.1500 appears unlikely, the pair might very nicely attain 1.2000.

● GBP/USD concluded the previous week at a mark of 1.2382. The median forecast suggests that fifty% of analysts count on the pair to right upwards, 35% anticipate additional motion downwards, and the remaining 15% level eastward. On the D1 chart, 100% of development indicators and oscillators are colored pink, with 15% indicating that the pair is in oversold territory. If the pair continues to maneuver south, it is going to encounter assist ranges and zones at 1.2300-1.2330, 1.2270, 1.2190-1.2210, 1.2085, 1.1960, and 1.1800. Within the occasion of an upward correction, the pair will face resistance at 1.2440-1.2450, 1.2510, 1.2550-1.2575, 1.2600-1.2615, 1.2690-1.2710, 1.2760, and 1.2800-1.2815.

● Among the many key occasions associated to the UK financial system, the publication of the Client Worth Index (CPI) on Wednesday, September 20, stands out. This inflation indicator will undoubtedly impression the Financial institution of England’s resolution on rates of interest (forecasted to rise by 25 bps, from 5.25% to five.50%). The BoE assembly will happen on Thursday, September 21. Moreover, towards the tip of the workweek, knowledge on retail gross sales and the UK’s Buying Managers’ Index (PMI) shall be launched.

USD/JPY: No Surprises Anticipated from the Financial institution of Japan But

● For the reason that starting of this yr, the yen has been regularly dropping floor to the U.S. greenback, with USD/JPY returning to November 2022 ranges. It is price noting that it was a yr in the past at these heights that the Financial institution of Japan (BoJ) initiated lively forex interventions. This yr, nevertheless, the BoJ has to this point engaged solely in verbal interventions, though fairly actively: high-ranking Japanese officers are continuously making public feedback.

In a latest interview with Yomiuri newspaper, BoJ Governor Kazuo Ueda acknowledged that the central financial institution would possibly abandon its destructive rate of interest coverage if it concludes that sustainable inflation targets of two% have been achieved. In keeping with Ueda, by year-end, the regulator could have ample knowledge to evaluate whether or not situations are ripe for a coverage shift.

This verbal intervention had an impression: markets responded with a strengthening of the yen. Nevertheless, the “magic” was short-lived, and USD/JPY quickly resumed its upward trajectory, closing the five-day buying and selling interval at 147.84.

● Economists at Danske Financial institution consider that the worldwide surroundings favours the Japanese yen and forecast a decline in USD/JPY to 130.00 over a 6-12 month horizon. “We consider that yields within the U.S. are peaking or near it, which is the first argument for our bearish stance on USD/JPY,” they state. “Moreover, below present world financial situations, the place development and inflation charges are declining, historical past means that these are beneficial situations for the Japanese yen.” Danske Financial institution additionally anticipates {that a} recession might start in the USA inside the subsequent two quarters, prompting the Federal Reserve to chop greenback rates of interest. Till the Federal Reserve concludes its easing cycle, the Financial institution of Japan is predicted to keep up its financial coverage unchanged. Due to this fact, any motion from the BoJ earlier than the second half of 2024 is unlikely.

● As for short-term forecasts, Societe Generale doesn’t rule out the likelihood that following the FOMC resolution by the Federal Reserve on September 20, USD/JPY might transfer nearer to the 150.00 mark. As for the Financial institution of Japan’s assembly on Friday, September 22, no surprises are anticipated, and it’ll seemingly contain one other spherical of verbal intervention. In the meantime, the overwhelming majority of surveyed specialists (80%) consider that if the Federal Reserve fee stays unchanged, USD/JPY has a excessive probability of correcting downward. Solely 10% count on the pair to proceed its upward trajectory, whereas one other 10% take a impartial stance. All development indicators and oscillators on the D1 time-frame are colored inexperienced, though 10% of those are signalling overbought situations.

The closest assist ranges are situated within the 146.85-147.00 zone, adopted by 145.90-146.10, 145.30, 144.50, 143.75-144.05, 142.90-143.05, 142.20, 141.40-141.75, 140.60-140.75, 138.95-139.05, and 137.25-137.50. The closest resistance is at 147.95-148.00, adopted by 148.45, 148.85-149.10, 150.00, and eventually, the October 2022 excessive of 151.90.

● We’ve got already talked about the Financial institution of Japan’s assembly on September 22. No vital financial knowledge in regards to the state of the Japanese financial system is scheduled for launch within the coming week. Merchants must be conscious, nevertheless, that Monday, September 18, is a public vacation in Japan because the nation observes Respect for the Aged Day.

CRYPTOCURRENCIES: Loss of life Cross and Bitcoin Paradoxes

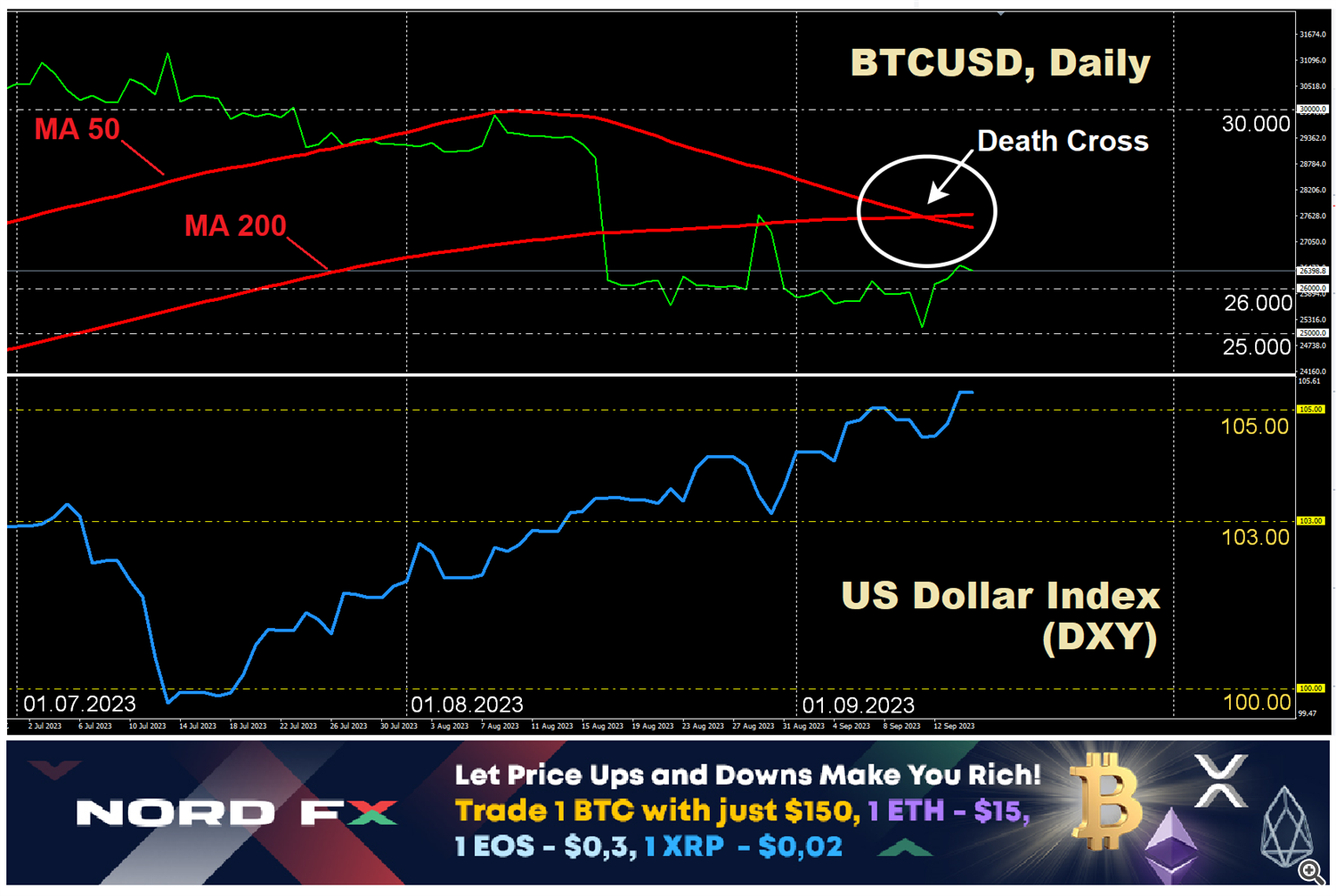

● A “Loss of life Cross,” indicated by the intersection of the 50-day and 200-day transferring averages, has appeared on bitcoin’s each day chart. This sample final emerged in mid-January 2022, and was adopted by an almost threefold lower in bitcoin’s value by November, which is trigger for concern. Apparently, the same Loss of life Cross was noticed in July 2021, however didn’t end in a value decline, providing some reassurance.

● The present week within the cryptocurrency market has been marked by excessive volatility, with buying and selling volumes for the main cryptocurrency reaching $15 billion. Such ranges of exercise are sometimes solely seen round main macroeconomic occasions. On this case, they embody the discharge of U.S. inflation knowledge on Wednesday, September 13, and the upcoming Federal Reserve assembly on September 20.

The BTC/USD weekly chart confirmed the next tendencies. On Monday, September 11, the value of bitcoin fell beneath $25,000, regardless of a weakening greenback and rising inventory indices. This decline was fueled by rumors that the controversial FTX change was planning to promote digital belongings as a part of a chapter continuing. On Tuesday, traders resumed shopping for at decrease ranges, pushing the coin’s value above $26,500. On Thursday, following the ECB’s resolution on rates of interest, bitcoin continued to strengthen its place, reaching a excessive of $26,838. This occurred even because the greenback was strengthening.

In actual fact, the latest value dynamics are fairly paradoxical. Think about BTC/USD as a set of scales. When one aspect turns into heavier, it goes down whereas the opposite goes up. But, we witnessed either side concurrently descending and ascending. In keeping with some analysts, there was no basic rationale behind these bitcoin actions. With low liquidity and falling market capitalization, the asset was merely being “shifted” from one group of speculators to a different.

● Even the testimony of Gary Gensler, the Chairman of the U.S. Securities and Trade Fee (SEC), earlier than the U.S. Senate didn’t spook market individuals. He acknowledged that the overwhelming majority of cryptocurrencies fall below the jurisdiction of his company. Consequently, all intermediaries out there, exchanges, brokers, sellers, and clearing businesses, are required to register with the SEC.

Gensler in contrast the present state of the crypto business to the “wild west” years of the early twentieth century, when securities market laws was nonetheless being developed. Throughout these years, the company took a collection of strict enforcement actions to rein within the business, and lots of instances ended up in courtroom. Comparable measures are wanted at present, not solely to function a deterrent to companies but in addition to guard traders, the SEC Chairman acknowledged. (It is price noting that, in response to Ripple CEO Brad Garlinghouse, the SEC is in charge for the U.S. changing into one of many “worst locations” to launch cryptocurrency tasks.)

● However except for the SEC, there are different regulators, such because the Federal Reserve. It is clear that the Fed’s choices and forecasts, which shall be introduced on September 20, will impression the dynamics of dangerous belongings, together with cryptocurrencies. Mike McGlone, Senior Macro Strategist at Bloomberg Intelligence, has already warned traders that the close to future for the crypto sector seems to be difficult. In keeping with him, digital belongings gained recognition throughout a interval of near-zero rates of interest. Nevertheless, as financial coverage shifts, challenges might come up for the business. McGlone identified that the yield on U.S. Treasury bonds is predicted to achieve 5.45% by November, based mostly on futures contracts. In distinction, from 2011 to 2021, this yield was solely about 0.6% yearly, a interval throughout which bitcoin and different digital belongings noticed vital development. Due to this fact, a liquidity outflow from cryptocurrencies wouldn’t be shocking.

● As soon as once more, many analysts are providing constructive medium- and long-term forecasts however destructive short-term outlooks. Michael Van De Poppe, founding father of enterprise agency Eight, predicts a closing value correction for the main cryptocurrency earlier than an impending bull rally. In keeping with him, if bears handle to breach the exponential transferring common line, at present at $24,689, the coin might drop to as little as $23,000 in a worst-case state of affairs. Van De Poppe believes this upcoming correction represents the final probability to purchase bitcoin at a low value.

Dan Gambardello, founding father of Crypto Capital Enterprise, predicts that the subsequent bull cycle might be essentially the most spectacular within the cryptocurrency market. Nevertheless, he additionally reminds traders that the crypto market follows cycles and seems to be in an accumulation section. Given this, Gambardello warns that there is a risk that bitcoin’s value might drop to $21,000 within the coming weeks. He attributes this potential decline to market manipulation by main gamers who could also be driving down costs to build up cash in anticipation of the subsequent bull run.

In keeping with a preferred skilled referred to as CrypNuevo, the flagship cryptocurrency might quickly attain a $27,000 mark. Nevertheless, the analyst emphasised that that is more likely to be a false transfer, and a dip all the way down to round $24,000 must be anticipated thereafter. (It is price noting that on August 17, the BTC value broke by the ascending development line that began in December 2022 and settled beneath it, indicating a excessive danger of a protracted bearish development.)

● As for the short-term prospects of the main altcoin, in addition they look like lower than optimistic. Analysts at Matrixport have warned that if ETH drops to $1,500, the trail to $1,000 can be open: a degree the specialists think about justifiable based mostly on their income projections for the Ethereum blockchain ecosystem. Matrixport notes that ETH just isn’t a “tremendous sound cash” able to resisting inflation, because the variety of cash minted final week exceeded the quantity burned by 4,000. This represents a deviation from the deflationary mannequin that the blockchain adopted with the consensus algorithm transition from Proof of Work (PoW) to Proof of Stake (PoS).

Analyst Benjamin Cowen units an excellent decrease goal. He claims that Ethereum is on the point of “excessive volatility,” probably plummeting to a variety between $800 and $400 by the tip of the yr. The rationale stays the identical: a potential decline within the profitability of blockchain platforms constructed on ETH sensible contract applied sciences. In keeping with Cowen, each ETH bulls and bears “have crashed and did not execute their methods,” which can end in each events locking of their losses by the tip of 2023.

● With three and a half months remaining till the tip of the yr, the present state of the market on the time of penning this assessment, Friday night, September 15, exhibits ETH/USD buying and selling round $1,620 and BTC/USD at $26,415. The full market capitalization of the crypto market stands at $1.052 trillion, up from $1.043 trillion per week in the past. The main cryptocurrency accounts for 48.34% of the market, whereas the first altcoin makes up 18.84%. The Crypto Concern & Greed Index for bitcoin stays within the ‘Concern’ zone at 45 factors, albeit inching nearer to the ‘Impartial’ zone (it was 46 factors per week in the past).

NordFX Analytical Group

Discover: These supplies will not be funding suggestions or tips for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and can lead to a whole lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx