Earlier than you begin (Should Learn!)

It is crucial to grasp that Pattern Guardian Professional EA (TGP) just isn’t a set-and-forget system; however a complicated, dynamic ally in your buying and selling endeavors. TGP stands out within the realm of knowledgeable advisors by providing unprecedented customization choices catering to particular person buying and selling kinds and methods. Whether or not you are a scalper, a swing dealer, or have a special method, TGP might be tailor-made to satisfy your particular wants and objectives, automating your buying and selling operations with precision and reliability. Furthermore, TGP is designed with proprietary buying and selling companies (AKA Prop Corporations) in thoughts, geared up with options that transcend fundamental automation. It permits for granular management over buying and selling parameters, threat administration settings, and operational toggles that may be instrumental in aligning it with strict buying and selling mandates and threat protocols typical of prop buying and selling entities. Nevertheless, the facility of TGP calls for a superb degree of proficiency from its customers. Familiarity with the basics of foreign currency trading, technical evaluation, EAs and the Meta Dealer (MT4 and MT5) platform is crucial. You also needs to be snug with fundamental threat administration ideas and have a transparent understanding of your buying and selling plan. Bear in mind, TGP is a instrument to implement your methods robotically, not a magic wand or a holy grail that ensures earnings. It requires cautious setup and knowledgeable decision-making about buying and selling preferences and threat settings.

NOTE: Earlier than buying and selling your dwell accounts utilizing TGP, guarantee your buying and selling account is satisfactorily funded and that you’ve got examined TGP in a demo surroundings for a minimum of 1 to three months, will depend on your experience and buying and selling abilities, to familiarize your self with its functionalities and settings.

NOTE: All distance values in TGP settings are in factors and never pips

Configurations and Settings:

TGP settings are designed to give you intensive customization choices to optimize your buying and selling technique. Settings are categorized as beneath:

- Panel Settings

- Pattern Starter Indicator Settings

- MAs Filter

- Cycles First and Prime-ups Entries Settings

- Cycle Administration Settings

- Account Administration Settings

- Common and Alerts Settings

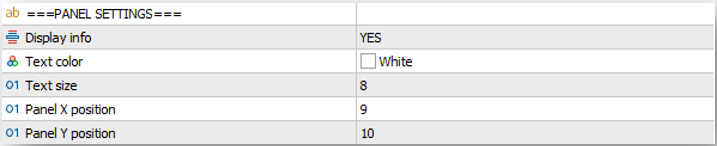

Panel Settings:

You possibly can customise whether or not to have a show on the chart or not, the textual content colour and measurement, and the panel place by adjusting the X and Y values.

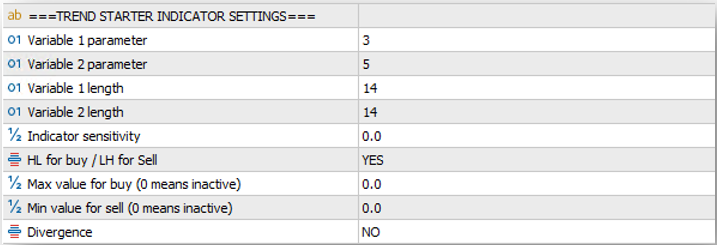

Pattern Starter Indicator Settings:

TGP operates on a novel idea of buying and selling cycles, initiated by the integral Pattern Starter Indicator (TSI). The TSI, embedded inside TGP, initiates these cycles when the TSI parameters are met to set off a sign, guiding the system to execute trades primarily based in your predefined settings. TSI is a non-repaint indicator as soon as plotted on the candle shut. Though the TSI is a core part of TGP, it capabilities behind the scenes, not displaying alerts in your charts. This design ensures a streamlined consumer expertise. Nevertheless, for merchants needing visible cues, we advocate buying the standalone TSI from the MQL5 market. Whereas not necessary for TGP’s operation, visualizing TSI alerts can present further readability and perception into the initiation of buying and selling cycles, enhancing your situational consciousness.

Variables and lengths: TSI consists of two most important oscillators (Variable 1 and a couple of) that present a buying and selling sign once they cross on the shut of the candle. Variable 1 (blue) is the quick oscillator, whereas Variable 2 (Pink) is the sluggish one. You possibly can outline each variables’ values and size. It is suggested to set the variables between 3 and 10, and the lengths above 4 (the decrease the variables, and lengths, the upper variety of alerts, therefore extra noise).

Sensitivity lets you outline the sensitivity of the cross overs. In so many situations, the variable values distance after the cross is extraordinarily small, therefore you would like to disregard it. It is suggested to set it between 0 and a couple of (In the event you set it above that, you’re going to get fewer alerts).

HL for purchase / LH for Promote filter: Is a novel filter that instructions the TGP to think about a purchase sign ONLY if the present cross sign was greater than the earlier cross sign (Larger Low), and vice a versa (Decrease Excessive) for promote sign.

Max and min worth for purchase and promote: You won’t need to purchase in an overbought situation, and vice a versa, therefore you should use this filter to set the max variable 1 worth to purchase (or min to promote)

Divergence: This filter lets you solely think about the alerts with divergence happens between the highs and lows of the indicator vs. value.

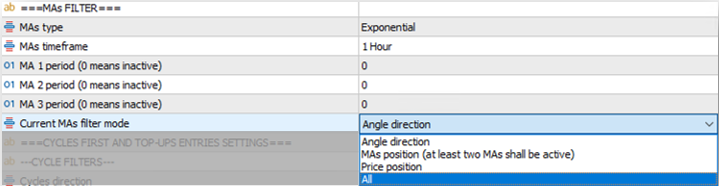

MAs Filter:

Pattern Guardian Professional (TGP) incorporates Transferring Averages filter that consists of three MAs with 4 completely different modes to reinforce commerce accuracy. These superior settings will assist pinpoint extra exact entry factors by highlighting broader market traits. On this part, we’ll unpack how TGP makes use of shifting averages in tandem with its core options to optimize your buying and selling outcomes. Dive in to grasp this added layer of refinement.

MAs sort: Choose the specified MA sort from a drop-down menu (EMA, SMA…. and so forth.)

MAs timeframe: Choose the specified MA timeframe from a drop-down menu, (5min, 15min, 1hr, 1d…and so forth.)

MA1,2 and three interval: Enter the specified MA(s) interval for the chosen MA(s). Enter 0, and the related MA can be ignored.

Present MAs filter mode: On the shut of each candle, TGP will examine the chosen MA(s) and filter trades primarily based on the chosen filter mode. Allow us to take the beneath instance, to clarify the completely different MAs filter modes: Assume you chose Exponential MA, 1 hour timeframe, MA1=10, MA2=50 and MA3=100.

Angle path: If all three EMAs (10,50, and 100) are pointing up, then solely BUY alerts can be thought-about, and vice versa for a SELL.

MAs place: If all three EMAs (10,50, and 100) are positioned on prime of one another, then solely BUY alerts can be thought-about, and vice versa for a SELL (clearly when you chosen this mode, you shall choose a minimum of two MAs on this choice). Notice: If the place order is 50, 10 and 200, then no alerts can be thought-about.

Value Place: If the present value is above all three EMAs (10,50, and 100), then solely BUY alerts can be thought-about, and vice versa for a SELL. Notice: If the value is above the 50, and 200, however beneath the ten, then no alerts can be thought-about.

All: If all three EMAs (10,50, and 100) are pointing up, and positioned on prime of one another, and the present value is above all three of them, then solely BUY sign can be thought-about, and vice versa for a SELL. Notice: If you choose this, you shall count on fewer trades.

Cycles First and Prime-up Entries Settings

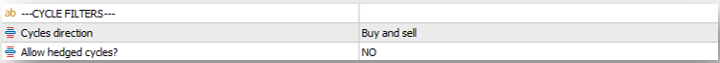

Cycles Filters

Cycles Course: Determines the buying and selling path, both shopping for, promoting, or each.

Permit Hedged Cycles: If set to “YES”, TGP permits shopping for and promoting on the similar time (Hedging). If “NO”, hedging is disabled.

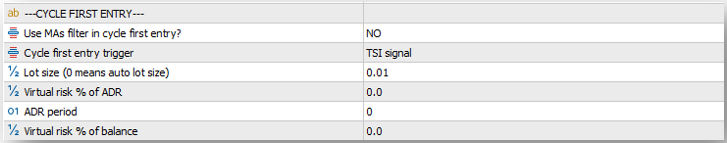

Cycle First Entry

A purchase or promote cycle can be initiated by the cycle first entry. This part will enable you to outline your cycles initiation parameters.

Use MAs filter in cycle first entry: Allows or disables the MAs filter beforehand defined for the preliminary entry of a cycle.

Cycle first entry set off: Not a fan of full automation of entries? This parameter is for you, as it’ll can help you determine whether or not the TGP shall use TSI to provoke the cycles, otherwise you do it manually.

TSI sign: When chosen, the cycle can be initiated primarily based on the sign and filter parameters beforehand chosen.

Manually: When chosen, no automated cycle initiation will take please, and you’ll have to place the orders manually utilizing the TGP panel

Lot measurement (0 means auto lot measurement): Specify the specified lot measurement for the cycle preliminary commerce. Enter 0, and TGP will calculate the lot measurement primarily based on the following parameters.

Digital threat % of ADR: This setting permits merchants to outline their digital cease distance as a share of the Common Each day Vary (ADR). This distance can be used to calculate the lot measurement. The upper the %, the broader the space, therefore decrease lot measurement.

ADR interval: Defines what number of days to be thought-about in calculating the ADR (normally between 10 and 20 is an efficient suggestion).

Digital threat % of steadiness: Specifies the danger degree as a share of the account steadiness. The upper the %, therefore greater lot measurement.

(NOTE: You don’t want to fret in regards to the lot measurement calculation and the way is it pushed, as it’s all calculations are imbedded inside TGP code, therefore supplies you with peace on thoughts, and full adaptability on all foreign money pairs, and CFDs. But I’ve positioned an instance on the finish of this guide in case you need to understand how the lot sizing is calculated)

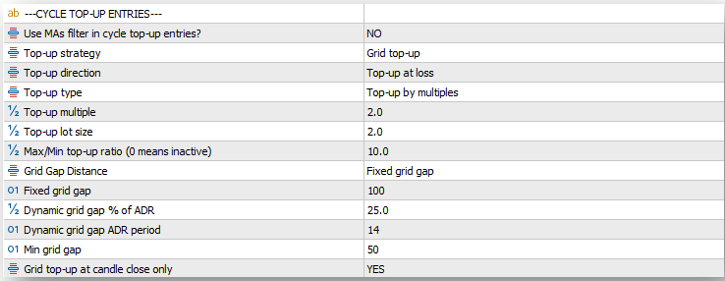

Cycle Prime-up Entries

As soon as the cycle is initiates, TGP supplies many choices for top-up trades (i.e., grid buying and selling, martingale, snowballing…. and so forth.)

Use MAs filter in cycle top-up entries: Allows or disables the MAs filter beforehand defined for top-up entries.

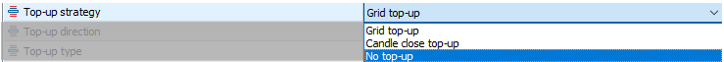

Prime-up technique: You could have three decisions from a drop-down checklist.

Grid top-up: Prime-up trades can be positioned on a grid with predefined distance parameters from the beforehand open commerce.

Candle shut top-up: Trades can be positioned on the shut of every candle on the chosen chart timeframe.

No top-up: Prime-up trades can be disabled.

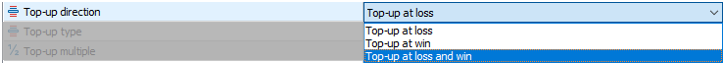

Prime-up path: You could have three decisions from a drop-down checklist.

Prime-up at loss: Prime-up trades will solely be triggered when account is in floating loss.

Prime-up at win: Prime-up trades will solely be triggered when account is in floating revenue.

Prime-up at loss and win: Prime-up trades can be positioned whether or not the account is floating loss or revenue.

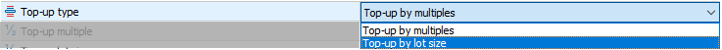

Prime-up sort: You could have two decisions from a drop-down checklist.

Prime-up by a number of: Prime-up commerce can be multiplied by this issue from the earlier commerce.

Prime-up by lot measurement: Prime-up commerce lot measurement will improve/lower by this worth from the earlier commerce. Notice: -ve worth means lower, and +ve worth means improve.

Prime-up a number of: If the top-up by a number of choice is chosen, enter the a number of worth right here. Notice: 1 means, all top-up trades lot measurement can be equal to the earlier commerce, above 1 means top-up lot measurement improve, and beneath 1 means top-up lot measurement lower.

Prime-up lot measurement: If the top-up by lot measurement choice is chosen, enter the lot measurement worth right here that you simply need to add on prime of the earlier commerce. Notice: 0 means, all top-up trades lot measurement can be equal to the earlier commerce, +ve worth means top-up lot measurement improve, and -ve worth means top-up lot measurement lower.

Max/Min top-up ratio: Units a cap or flooring on the lot measurement for the top-up trades in respect to the cycle first entry. Instance: If this worth is ready to five, and the cycle first entry was 0.1 tons, then the utmost top-up lot measurement can be 0.5 tons.

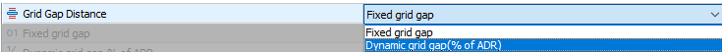

Grid hole distance: You could have two decisions from a drop-down checklist.

Mounted grid hole: Selected this feature to set your grid hole measurement.

Dynamic grid hole: Selected this feature to let TGP calculate the grid hole primarily based on a share of the Common Each day Vary.

Mounted grid hole: In the event you chosen the mounted grid hole choice, enter the specified hole measurement on this subject (In Factors and never pips).

Dynamic grid hole % of ADR: In the event you chosen the dynamic grid hole, enter the specified % of the ADR to calculate the hole measurement. Instance: If the ADR is presently at 880 factors, and also you enter this subject as 50, then the grid distance at that second can be 440 factors (44 pips).

Dynamic grid hole ADR interval: Defines the interval for the dynamic grid hole’s ADR calculation.

Min Grid Hole: Vital to be set with the dynamic grid hole calculation, to set a min worth for the grid distance.

Grid top-up at candle shut solely: If set to “YES”, top-ups in a grid technique will solely happen as soon as a candle closes past a grid degree. Instance: If this chosen as “YES”, and if grid distance is ready to 200 factors, but value went past, to the candle closed at a distance of 350 factors from the earlier commerce, TGP will add the top-up worth on the shut of the candle, and never on the 200 factors mark.

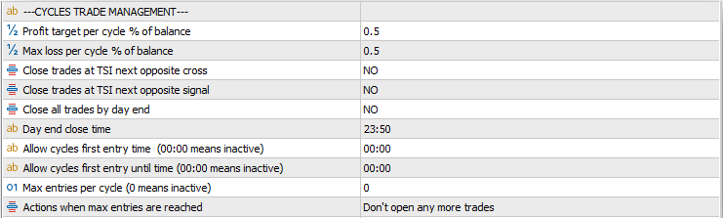

Cycles Administration Settings

This part will empower you to regulate your cycles commerce administration parameters.

Revenue goal per cycle % of steadiness: This determines the specified revenue (realised and floating) for every buying and selling cycle as a share of the account steadiness.

Max loss per cycle % of steadiness: This setting caps the utmost allowable loss (realized and floating) for every cycle as a share of the account steadiness.

Shut trades at TSI subsequent reverse cross: If set to “YES,” TGP will shut all trades inside a cycle when the Pattern Starter Indicator (TSI) produces an reverse cross to the present trades. This serves as a security mechanism primarily based on market path.

Shut trades at TSI subsequent reverse sign: Just like the above, however this setting relies on the TSI’s subsequent reverse sign slightly than a cross.

Shut all trades by day finish: When set to “YES,” the TGP will shut all lively trades by the tip of the buying and selling day, no matter their revenue or loss standing.

Day finish shut time: Specifies the precise time at which all trades must be closed if the “Shut All Trades by Day Finish” is ready to “YES”.

Permit cycles first entry time: This determines when TGP is allowed to provoke the primary commerce in a cycle. A “00:00” setting, signifies that no time restriction is utilized.

Permit cycles first entry till time: This setting specifies till what time TGP is allowed to provoke the primary commerce of a cycle. A “00:00” setting, signifies that no time restriction is utilized.

Max entries per cycle: This cover the variety of trades TGP can execute inside a single cycle. A setting of “0” means this function is inactive, and there is not any restrict on the variety of trades.

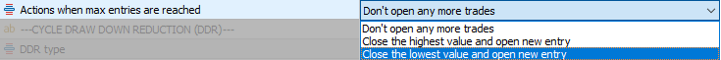

Actions when max entries are reached: When most variety of trades per cycle is reached, and a brand new top-up commerce is signaled, You could have three decisions from a drop-down checklist.

Don’t open any extra trades: TGP won’t open any extra top-up trades for the cycle.

Shut the very best worth and open a brand new entry: TGP will shut the very best worth commerce inside the open trades and can open the brand new top-trade.

Shut the bottom worth and open a brand new entry: TGP will shut the bottom worth commerce inside the open trades and can open the brand new top-trade.

Cycle Draw Down Discount (DDR)

TGP introduces a novel Drawdown Discount (DDR) mechanism, permitting customers to handle drawdowns positively or negatively. Relying in your DDR alternative, the system both makes use of a portion of earnings to offset losses or strategically closes trades to restrict losses. Outline particular thresholds to activate or deactivate this progressive function.

DDR Kind: TGP comes with two choices for DDR, you’ll be able to choose from a drop-down checklist.

No DDR: Merely opt-out of any DDR technique.

Damaging DDR: When your cycle’s drawdown hits an outlined share of the steadiness, TGP will begin to restrict this loss. It’s going to accomplish that by partially closing trades equal to a set share of the overall drawdown.

Optimistic DDR: Right here, TGP faucets into the features. It waits for trades to hit a constructive share mark, after which makes use of part of these earnings to mitigate ongoing losses within the cycle.

Cycle floating loss to START DDR: In the event you opted in for DDR (whether or not destructive or constructive DDR), it is advisable outline the draw down worth (as a % of steadiness), of which the DDR algorithm can be activated.

Cycle floating loss to STOP DDR: That is the draw down worth (as a % of steadiness) when reached, the DDR algorithm can be deactivated.

Damaging DDR loss cut up %: Below the Damaging DDR setting, when drawdown reaches the activation threshold, specify how a lot of the drawdown you’d prefer to deal with. As an illustration, if set at 25% for a $400 drawdown, TGP will alter trades, successfully lowering the drawdown to $300, realizing a $100 loss.

Optimistic DDR min revenue %: With Optimistic DDR lively and as soon as the cycle floating loss to begin DDR is reached, TGP appears to be like out for any trades that has a constructive float to realize this share revenue to make use of it to shut partial quantity from the dropping trades.

Optimistic DDR banked revenue cut up %: As soon as the earlier parameter is reached, TGP will shut the constructive float commerce, in opposition to partial quantity from the dropping trades, and financial institution this % from the constructive float.

Instance: On an account of 10K, the place constructive DDR is lively, and set to begin when the draw down (floating loss) reached 5%, constructive DDR min revenue set to 1%, and constructive DDR banked revenue cut up % set to 25%. Assume a commerce is positioned, and market moved in opposition to you, this the TGP constructed some top-up trades, now the TGP will await any pull again of those top-up trades to create some constructive floats. As soon as one of many constructive floats reaches 1% (100 USD), TGP will shut these constructive float trades, financial institution 25 USD, and use the 75 USD to shut as a lot as attainable partial quantity from the dropping trades.

Account Administration Settings

TGP has complete Account Administration options, designed primarily for sturdy account safety. This performance positions TGP as an indispensable instrument, particularly for proprietary companies’ merchants. The function incorporates quite a few mechanisms to meticulously handle threat, guaranteeing fairness stays inside designated every day loss limits. Furthermore, to optimize revenue retention, the TGP system integrates fairness trailing choices. Not like cycle administration settings, this part applies to all the account, whatever the magic quantity.

Most trades per day on the account: To guard you from over buying and selling, TGP gives you the choice to set most variety of trades per day on the account degree.

Floating loss restrict $: Set a most floating loss restrict in cash worth, when reached, all open trades on the account can be closed, and resume trades on the subsequent accessible sign.

Floating revenue restrict $: Set a most revenue restrict in cash worth, when reached, all open trades on the account can be closed, and resume trades on the subsequent accessible sign.

Each day loss restrict $: Set a most every day loss (realised and unrealized) restrict in cash worth, when reached, all open trades on the account can be closed, and resume trades the next day.

Each day revenue restrict $: Set a most every day revenue (realised and unrealized) restrict in cash worth, when reached, all open trades on the account can be closed, and resume trades the next day.

Account excessive to shut all trades $: Set the very best fairness worth for the TGP to shut all trades and disable buying and selling on the account.

Account low to shut all trades $: Set the bottom fairness worth for the TGP to shut all trades and disable buying and selling on the account.

Trailing revenue: Choose YES if you wish to allow fairness trailing on the account.

Trailing begin, cease and step: In the event you opt-in for trailing, right here it is advisable set the trailing begin, cease, and step values.

Common Settings

Symbols for again testing: TGP lets you again take a look at a number of property on the similar time, merely add the pair/asset you need to again take a look at on this subject.

Fee per lot: Often fee is calculated on the finish of the shopping for/promoting cycles. To accommodate the fee value within the TGP P&L calculation, it is advisable outline your dealer fee worth on this subject.

Most allowed unfold: Set your max allowed unfold in your trades.

Magic quantity: Enter the specified distinctive magic quantity. You possibly can’t have the identical magic quantity to completely different pairs, as it’ll confuse TGP whereas calculations associated to commerce administration.

Entries delay in seconds: This can be a particular function for prop companies’ merchants who may commerce the identical an identical units, with the identical entries. Setting few seconds delay earlier than executing the trades, will assist merchants to not have their accounts marked for an identical methods violations.

Rationalization of dynamic lot measurement calculation primarily based on ADR

1st: Calculate the Cease Distance utilizing Digital threat % of ADR: Assuming the Common Each day Vary (ADR) interval of the final 10 days was 100 pips and the Digital Danger % of ADR chosen is 50%, your digital cease distance is 50 pips

2nd: Decide the quantity of threat utilizing the Digital threat % of steadiness: Assuming account steadiness is, for example, $10,000 and your Digital Danger % of Steadiness is ready at 1%, the quantity you are prepared to threat on the commerce is $100

![]()

third: Calculate the lot measurement: To calculate the lot measurement, it is advisable know the pip worth for 1 customary lot of the pair you commerce. For EURUSD, pip worth for 1 customary lot is $10. The chance when it comes to distance is 50 pips (from step 1). Subsequently, the danger in financial phrases for 1 customary lot is 50 pips X $10 = $500. To threat solely $100 (from step 2), you’d must commerce 0.2 tons (1 tons X $500/$100).

Setfiles and Methods

Technique 1 – Sustainable EURUSD Technique

- EURUSD 15 min timeframe chart.

- Entry sign: TSI variables set to 10 and 14, with HL/LH filter set to YES

- MAs filter: Is lively for the cycle first entry (not the top-ups). 2 MAs, 50 and 150 @ the three hours timeframe, with the angle path mode.

- Buys, sells and hedging is allowed

- Prime-ups are lively for each win and lose path, with a a number of of two, and the grid distance is 100% ADR measurement

- Every cycle is ready to 1% revenue goal, therefore it is advisable be affected person.

- DDR just isn’t lively on this set, and no account administration (fairness safety) is utilized.

- Again testing interval: Jan 2021 until Oct 2023 – Turning 10,000 USD to 47,970 USD (Please learn the disclaimer beneath)

Disclaimer: Carry out correct again testing this set in your dealer information, then demo commerce for two weeks to 2 months earlier than you apply it on a dwell account. Creator again testing proven above was carried out between 2021 until Oct 2023, and would not assure any future earnings.