What number of of you have got heard me say that commodities are inherently risky?

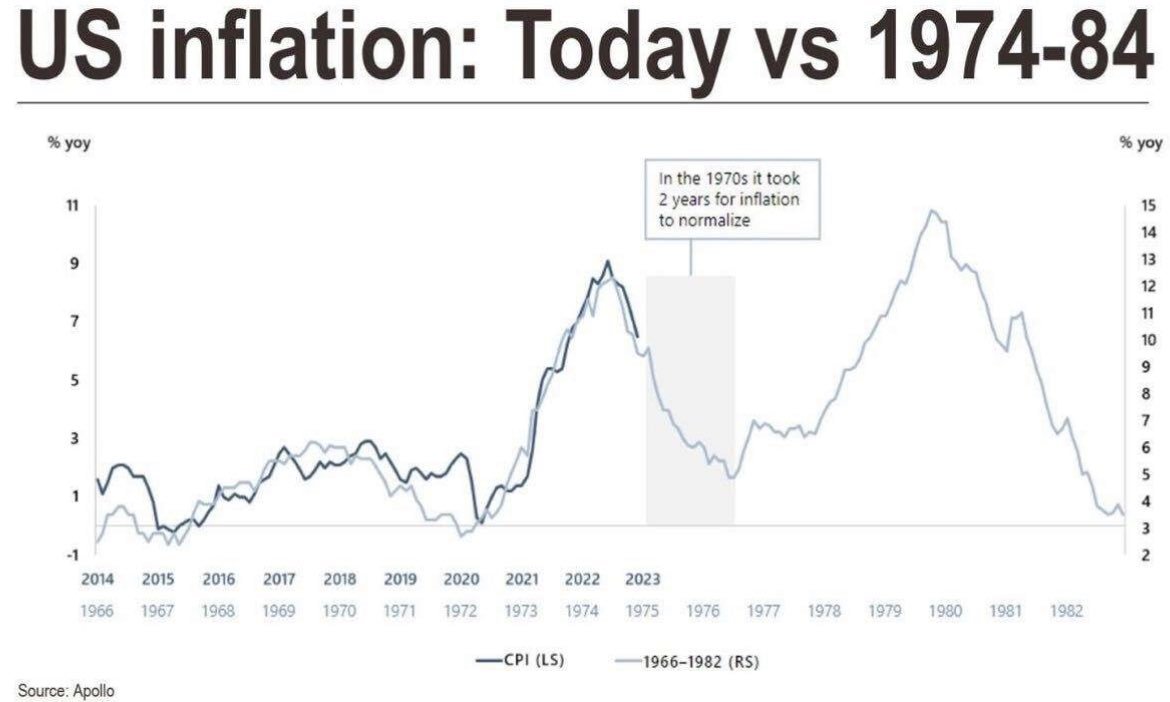

Clearly, from this chart, you may see that after the oil rally within the mid Seventies, the CPI went from almost 9% in 1974 right down to 2% in 1976. Sugar, my favourite barometer of inflation, ran to $.66 a pound in 1974, after which right down to round $.08 cents a pound in 1976. Big. As sugar peaked, inflation, as measured by CPI, had a stupendous drop inside 2 years.

Equally, the CPI peaked in June 2022 at round 9%, and right here we’re with CPI presently at 3.6%. If the timeline matches, we may see inflation decline additional into 2024. Nevertheless, every part strikes quite a bit sooner now.

So, let’s assume that historical past rhymes quite than repeats. If that’s the case, inflation is due for an additional run, even when oil calms down from present ranges.

After the trough in inflation in 1976, it took 4 years for the following peak to hit. In 1980, CPI reached almost 15%. Sugar ran from $.08 again as much as round $.45 a pound by 1980.

At current, if we scale back the timeframes, after 1.5 years of declining inflation, perhaps we see one other 2-3 years of climbing inflation.

Does inflation peak in 2024-2025? It might be a bit horrifying, worrying about a lot larger inflation. Nonetheless, we search for alternatives to make cash.

Final week we wrote about gold miners. Right this moment, September 18th, GDX the ETF for gold miners cleared the 50-DMA for a second consecutive time and went right into a confirmed recuperation section. And that is earlier than the Fed assembly.

We additionally talked about that miners typically lead the valuable metals markets. And all heading larger means extra inflation considerations.

3 technical indicators to notice, and all inline with the IBD interview featured over the weekend.

Calendar Ranges: GDX held the July 6-month calendar vary low (pink line). We think about {that a} reversal. There may be nonetheless fairly a distance to the July 6-month calendar vary excessive (inexperienced line).

Phases: GDX has 2 closes over the 50-DMA, which has a barely destructive slope. Nevertheless, the section has improved to Recuperation. Moreover, Actual Movement (momentum) reveals some resistance on the 50-DMA (blue line). Therefore, we want extra momentum.

Management: GDX now convincingly outperforms the SPY. That too, nevertheless, wants a lift over the dotted Bollinger Band resistance.

Hold your eyes on the August thirtieth excessive at 30.00.

That is for academic functions solely. Buying and selling comes with danger.

For extra detailed buying and selling details about our blended fashions, instruments and dealer schooling programs, contact Rob Quinn, our Chief Technique Guide, to study extra.

Should you discover it tough to execute the MarketGauge methods or wish to discover how we are able to do it for you, please e-mail Ben Scheibe at Benny@MGAMLLC.com.

“I grew my cash tree and so are you able to!” – Mish Schneider

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for each day morning movies. To see up to date media clips, click on right here.

In this look on Enterprise First AM, Mish explains why she’s recommending TEVA, an Israeli pharmaceutical firm outperforming the market-action plan.

Because the inventory market tries to shake off a sluggish summer season, Mish joins Investing with IBD to elucidate how she avoids evaluation paralysis utilizing the six market phases and the financial fashionable household. This version of the podcast takes a take a look at the warnings, the pockets of power, and learn how to see the larger image.

Mish was the particular visitor in this version of Merchants Edge, hosted by Jim Iuorio and Bobby Iaccino!

On this Q3 version of StockCharts TV’s Charting Ahead 2023, Mish joins a panel run by David Keller and that includes Julius de Kempenaer (RRG Analysis & StockCharts.com) and Tom Bowley (EarningsBeats). On this unstructured dialog, the group shares notes and charts to focus on what they see as necessary concerns in right this moment’s market setting.

Mish discusses AAPL within the wake of the iPhone 15 announcement on Enterprise First AM.

Mish explains learn how to observe the numbers in oil, fuel, gold, indices, and the greenback daytrading the CPI in this video from CMC Markets.

Mish talks commodities, and the way progress may fall whereas uncooked supplies may run after CPI, on this look on BNN Bloomberg.

On this look on Fox Enterprise’ Making Cash with Charles Payne, Mish and Charles talk about the normalization of charges and the profit, plus shares/ETFs to purchase.

Mish chats about sugar, geopolitics, social unrest and inflation in this video from CNBC Asia.

Mish talks inflation that might result in recession on Singapore Breakfast Radio.

Coming Up:

September 19: Jared Blikre, Yahoo Finance

September 20: Your Day by day 5, StockCharts TV

September 22: Benzinga Prep Present

October 29-31: The Cash Present

- S&P 500 (SPY): 440 assist, 458 resistance.

- Russell 2000 (IWM): 185 pivotal, 180 assist.

- Dow (DIA): 347 pivotal.

- Nasdaq (QQQ): 363 assist, over 375 appears higher.

- Regional Banks (KRE): 44 pivotal.

- Semiconductors (SMH): 150 pivotal.

- Transportation (IYT): Must get again over 247 to look more healthy.

- Biotechnology (IBB): Compression between 124-130.

- Retail (XRT): Weak, however noisy until this breaks down beneath 57, the 80-month shifting common.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Training

Mish Schneider serves as Director of Buying and selling Training at MarketGauge.com. For almost 20 years, MarketGauge.com has supplied monetary data and schooling to 1000’s of people, in addition to to giant monetary establishments and publications comparable to Barron’s, Constancy, ILX Methods, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many high 50 monetary folks to observe on Twitter. In 2018, Mish was the winner of the Prime Inventory Decide of the 12 months for RealVision.