When Bulldozers Bust By means of Brick Partitions: Causes for Resistance Breaks in Foreign exchange

We have all been there: gazing a chart, worth hovering simply beneath a seemingly impenetrable resistance degree. Orders poised, adrenaline pumping, we anticipate the bounce, the affirmation of our evaluation. After which… CRACK! That cussed barrier shatters like a stale baguette, worth surging previous with the drive of a runaway bulldozer. What simply occurred? Why did resistance, as soon as so resolute, crumble like a sandcastle below a rogue wave?

Worry not, fellow dealer, for understanding these breakouts is the important thing to unlocking hidden alternatives and avoiding painful false dawns. So, seize your espresso and buckle up, as a result of we’re diving into the 5 fundamental causes why resistance ranges in foreign exchange get pulverized into buying and selling mud:

1. The Gathering Storm: Shifting Market Sentiment

Think about a battle between consumers and sellers. When resistance holds, it is like a stalemate – neither aspect can overpower the opposite. However generally, exterior forces tip the scales. A shock financial launch, a geopolitical earthquake, or perhaps a juicy rumor can shift market sentiment like a hurricane’s winds. Instantly, that cussed resistance line turns right into a flimsy seaside umbrella within the face of a tidal wave. Patrons surge in, fueled by newfound optimism, and increase! Resistance is historical past.

2. The Cavalry Arrives: Institutional Intervention

Image this: massive banks and hedge funds, the market’s heavy cavalry, have been quietly accumulating positions earlier than reaching a key resistance degree. They wait patiently, like wolves circling their prey. Then, on the opportune second, they cost in, unleashing a torrent of purchase orders that overwhelms the present promoting stress. Resistance crumples below the sheer weight of their mixed would possibly, paving the best way for a sustained uptrend.

3. The Energy of Technicals: Affirmation Candles and Breakouts

Typically, the rationale for a resistance break is so simple as pure technical validation. A collection of bullish affirmation candles, like engulfing patterns or breakaways, can ignite shopping for momentum, pushing worth by the barrier like a battering ram by a cardboard door. Conversely, bearish engulfing candles or failed breakouts on decrease timeframes can warn of impending weak point, triggering a wave of promoting that shatters resistance from beneath.

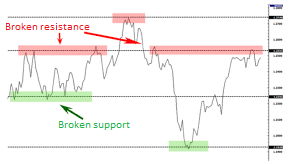

4. The Phantasm of Power: False Breaks and Retests

Not all resistance breaks are created equal. Typically, worth spikes by a degree solely to shortly reverse, leaving bewildered merchants scratching their heads. These “false breaks” may be attributable to fleeting bursts of shopping for or promoting stress that shortly evaporate. Bear in mind, true breakouts often have quantity affirmation and follow-through on increased timeframes. So, do not bounce the gun simply because worth pokes its head above resistance – anticipate the cavalry to reach earlier than charging in your self.

5. The Unseen Hand: Basic Shifts and Lengthy-Time period Tendencies

So, there you will have it, merchants. Bear in mind, resistance ranges are usually not ironclad fortresses, however relatively psychological traces within the sand. By understanding the forces that may trigger them to interrupt, you may flip these breakouts from buying and selling booby traps into profitable alternatives. Hold your eyes peeled for shifting sentiment, institutional maneuvering, technical confirmations, and remember the whispers of the basics. Armed with this data, you may be able to surf the waves of volatility and conquer even probably the most formidable resistance ranges. Now go forth and commerce with confidence, realizing that even the sturdiest partitions can crumble when the suitable forces collide.

Bonus Tip:

Bear in mind, context is essential. Analyse resistance breaks throughout the broader market atmosphere, contemplating timeframes, technical indicators, and elementary information. Do not chase each breakout blindly – anticipate affirmation and commerce with correct danger administration.

Joyful buying and selling!