KEY

TAKEAWAYS

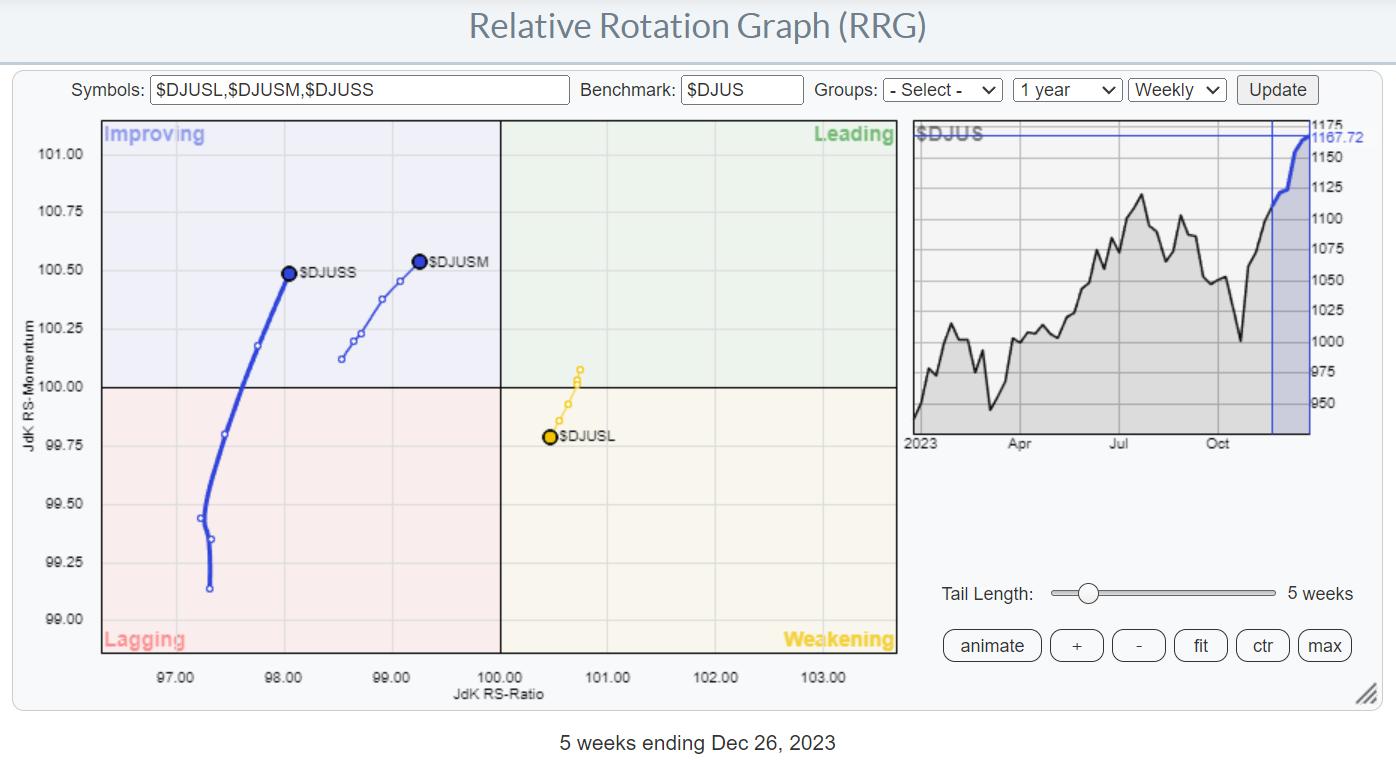

- Cash rotating away from large-cap shares

- Re-distribution and new influx to mid- and small-caps

- Majority of sectors present choice for equal weight ETFs over Cap-Weighted counterparts

I’ve used this Relative Rotation Graph commonly up to now few weeks to point the continuing rotation out of large-cap shares into the mid-and small-cap segments.

That is taking place whereas the market as an entire, on this case, the Dow Jones US index ($DJUS), continued to maneuver greater.

What this implies is that buyers are pulling cash out of large-cap shares and re-distributing it to the mid- and small-cap segments. Whereas additionally including contemporary cash into the market (in any other case, we’d not be going greater).

On this final written RRG article for this 12 months, I would prefer to evaluation a Relative Rotation Graph that I launched in Sector Highlight a couple of weeks in the past.

Sector Highlight 11/7/23

This explicit RRG makes use of ratio symbols to visualise the distinction in rotation between cap-weighted and equal-weighted sectors.

It’s possible you’ll want a couple of seconds to regulate and perceive what we’re taking a look at right here.

The 11 tails every symbolize the comparability between the cap-weighted sector divided by the equal-weight sector. So for expertise, that’s XLK:RSPT.

When that ratio strikes greater, cw is outperforming ew and vice versa. So, we have an interest within the absolute route of that tail. Due to this fact, we use $ONE because the benchmark.

*If you end up a StockCharts.com subscriber, clicking on the picture will take you to this RRG, which you’ll then save as a bookmark in your browser for later retrieval

Now, have a look at that RRG once more.

What instantly stands out, at the very least to me and I hope to you as properly, is the big group of tails contained in the weakening quadrant and heading in the direction of lagging. We are able to embody XLI:RSPN in that group as properly, as it’s near crossing into weakening and likewise touring at a detrimental heading. XLF:RSPF is already properly contained in the lagging quadrant and heading deeper into it at a detrimental heading.

For all these sectors :

- Financials

- Industrials

- Supplies

- Expertise

- Client Staples

- Client Discretionary

- Well being Care

- Communication Companies

the conclusion is that the equal-weight variations ought to be most popular over their cap-weighted counterparts.

That leaves solely three sectors the place the cap-weighted model has a greater outlook for the approaching weeks. These are

- Actual-Property contained in the main quadrant

- Utilities contained in the enhancing quadrant

- Power shifting again from lagging to enhancing

It’s a clear rotation away from cap-weighted, i.e., large-cap names, to the second and perhaps third-tier market capitalizations at first of the brand new 12 months.

I’m going to go away you to consider this remark. I want you a really glad New Yr, and I’m wanting ahead to seeing you again in 2024 with extra written RRG weblog articles and Sector Highlight movies.

Thanks for 2023, –Julius.

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels underneath the Bio under.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to answer every message, however I’ll actually learn them and, the place fairly potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered emblems of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive technique to visualise relative power inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Regulation (now a part of AXA Funding Managers).

Be taught Extra