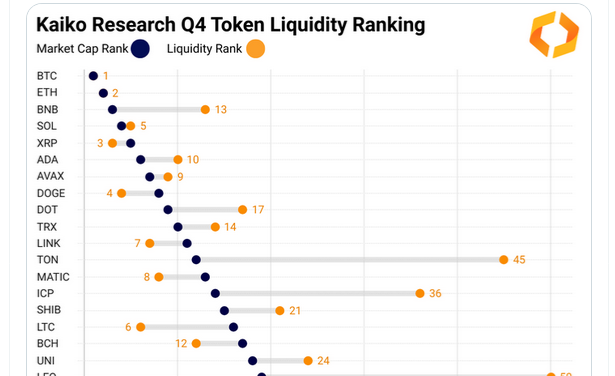

Amidst regulatory scrutiny and management modifications, Binance Coin (BNB) misplaced its footing within the liquidity race, slipping to thirteenth place in This autumn 2023, based on Kaiko knowledge on January 11. This shocking growth contrasts BNB’s place because the third-largest cryptocurrency by market capitalization, elevating questions on its normal liquidity.

Dogecoin Flips BNB In Liquidity Rankings

Kaiko’s findings, primarily based on spot buying and selling knowledge from a number of exchanges, revealed that Bitcoin (BTC), Ethereum (ETH), XRP, and Dogecoin (DOGE) emerged as the highest 4 most liquid cryptocurrencies in This autumn 2023.

Liquidity is a metric that exhibits how simply a given asset will be traded with out vital worth impacts. One of many greatest assumptions is {that a} crypto asset greater up the market cap rating is extra liquid. Nevertheless, as Kaiko knowledge exhibits, this isn’t often the case, as elements similar to alternate itemizing play an enormous function.

DOGE flipping BNB in liquidity dynamics could also be attributed to a mixture of things, together with regulatory issues surrounding Binance, management modifications inside the firm, and the standing of Dogecoin. DOGE is the primary meme coin, and through the years, it has continued to cement its place because the world’s largest meme coin by market cap regardless of heavy competitors. As an example, regardless of the recognition of alternate options like PepeCoin (PEPE) or Bonk coin (BONK), none has managed to flip DOGE.

Binance Authorized Battles, Value Recovers Steadily

In 2023, Binance grappled with authorized battles and inside restructuring. In early June 2023, the Securities and Alternate Fee (SEC) filed fees in opposition to the alternate, alleging that it had violated securities legal guidelines by promoting unregistered securities. Moreover, Binance founder and CEO Changpeng Zhao stepped down from his government function in late This autumn 2023, additional including to the alternate’s uncertainty.

Regardless of its authorized troubles, Binance agreed to pay a $4.3 billion settlement with the SEC and different US companies in late 2023. Whereas this settlement might have eased some regulatory issues, it’s unclear whether or not will probably be sufficient to revive BNB’s liquidity place.

Associated Studying: Ethereum Basic (ETC) Explodes Over 50% In Large Value Soar – Right here’s Why

Up to now, trying on the each day chart, BNB has been trending greater, rapidly shaking off the weak spot of late November 2023. After Changpeng Zhao, the founder, exited because the CEO, BNB costs sharply fell. Nevertheless, with out follow-through and the group remaining optimistic concerning the platform’s prospects, costs recovered because the broader crypto scene rose, hoping the SEC would approve the primary spot Bitcoin ETF.

BNB is up 37% from November 2023 lows and is steady, trying on the efficiency within the each day chart. As a bull flag varieties, it’s unclear whether or not the coin will break greater above $340, establishing new 2024 highs or contract following Bitcoin.

Characteristic picture from Canva, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site totally at your personal danger.