Pattern Reversals are market situations whereby the market reverses in opposition to a previous opposing pattern. It may very well be a bearish reversal creating after an uptrend market or a bullish reversal creating after a downtrend market.

Pattern Reversals may be wonderful buying and selling alternatives as a result of it permit merchants to maximise their earnings if they’ll open their trades close to the start of the pattern and shut their trades on the finish of the pattern.

The buying and selling technique we’re about to debate is an instance of how we will use the confluences between two trend-following technical indicators to determine potential pattern reversals and revenue from the market.

Zero Lag MACD

The Zero Lag MACD Indicator is an oscillator sort of technical indicator that was developed to assist merchants determine the path of the market’s momentum and visually observe and determine doable oversold and overbought markets that will lead to a market reversal.

As its identify suggests, the Zero Lag MACD Indicator is predicated on the MACD or the Shifting Common Convergence and Divergence indicator. It is rather much like the basic MACD oscillator however with a slight distinction. Not like the basic MACD, which tends to be lagging when in comparison with worth motion, the Zero Lag MACD produces momentum indications and market reversal alerts with considerably much less lag.

The Zero Lag MACD calculates for the distinction between two Exponential Shifting Common (EMA) values. These underlying EMA strains are sometimes preset as 12-period and 26-period EMA strains. Nevertheless, merchants can also modify these variables for it to suit their buying and selling technique. It then makes use of the distinction between the 2 underlying EMA strains as a foundation for plotting its MACD histogram bars.

The subsequent worth it calculates for is its Sign Line. The Zero Lag MACD calculates the Exponential Shifting Common of its MACD histogram bars and makes use of the ensuing values to plot its Sign Line.

The MACD histogram bars and its Sign Line can be utilized collectively to objectively determine potential momentum reversals based mostly on the crossing over of the 2. Crossovers, whereby the MACD histogram bars would cross above the Sign Line, point out a bullish momentum reversal. Alternatively, crossovers, whereby the MACD histogram bars would cross under the Sign Line, point out a bearish momentum reversal.

Along with this, bullish crossovers that happen whereas the MACD histogram is extraordinarily detrimental could also be a excessive likelihood bullish imply reversal sign, whereas bearish crossovers that develop whereas the MACD is extraordinarily optimistic point out a excessive likelihood bearish imply reversal.

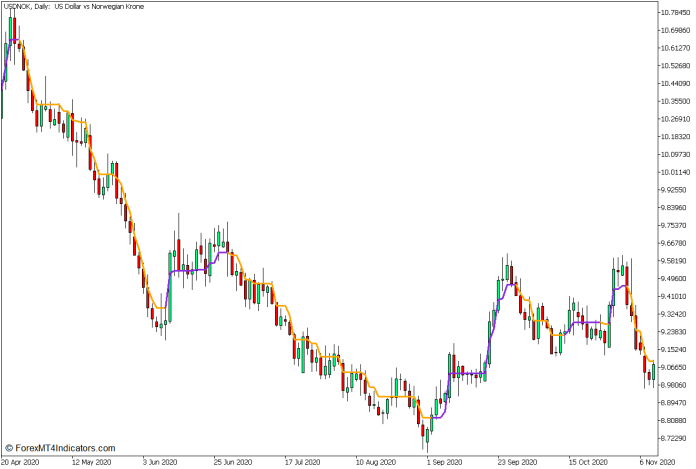

Share Crossover Indicator

The Share Crossover Indicator is a trend-following technical indicator that’s used to assist merchants determine the path of the market’s momentum based mostly on the Day by day timeframe.

This technical indicator plots a line that follows the actions of worth motion based mostly on a posh algorithm. This line shifts up each time worth motion is in a bullish market momentum and shifts down each time worth motion is in bearish momentum.

The road that the Share Crossover Indicator plots additionally change coloration each time its slope shifts. It plots a blue-violet line each time its line begins to slope up. Inversely, it additionally plots an orange line each time its line begins to slope down.

This altering of the colour of its line signifies a momentum reversal which merchants might use as a momentum reversal entry sign in confluence with different momentum reversal alerts and indications.

Buying and selling Technique Idea

This pattern reversal buying and selling technique trades on a confluence of confirmed pattern reversal alerts coming from two extremely dependable technical indicators, the Zero Lag MACD, and the Share Crossover indicator.

It is very important notice that this technique works solely on the Day by day Timeframe because the Share Crossover Indicator is optimized for the Day by day Timeframe.

The Share Crossover Indicator is used as one of many momentum reversal sign indicators. That is recognized by a robust momentum candle crossing over its line adopted by the shifting of the slope of its line and a altering of the colour of its line inside just a few bars. This means a doable pattern reversal proper after a robust momentum transferring in opposition to a previous pattern.

The Zero Lag MACD is then used to verify the doable pattern reversal. That is based mostly on the shifting of its bar from optimistic to detrimental or vice versa relying on the path of the doable pattern reversal.

These pattern reversal alerts must be in confluence with each other and may develop inside just a few candles from one another. If doable, these alerts must be aligned indicating a robust confluence between the pattern reversal alerts.

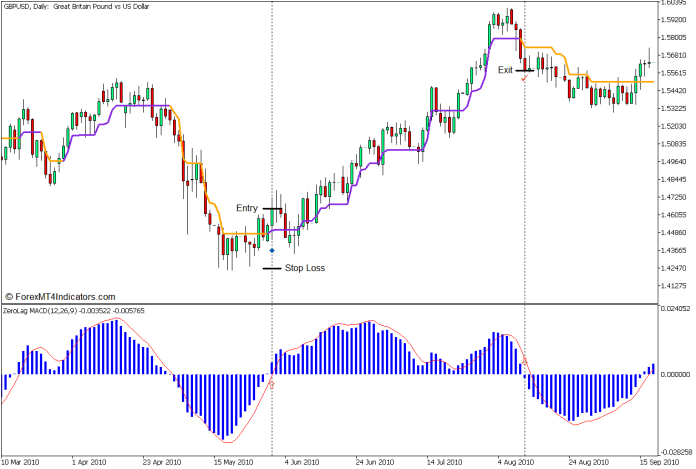

Purchase Commerce Setup

Entry

- Coming from a downtrend market, a robust bullish momentum candle ought to shut above the Share Crossover line.

- The Share Crossover line ought to begin to slope up and alter to the colour blue-violet.

- The Zero Lag MACD histogram bars ought to cross above zero.

- Open a purchase order on the confluence of those bullish pattern reversal alerts.

Cease Loss

- Set the cease loss on the fractal under the entry candle.

Exit

- Shut the commerce if the Share Crossover line slopes down and adjustments to orange.

- Shut the commerce if the Zero Lag MACD histogram bar shifts under zero.

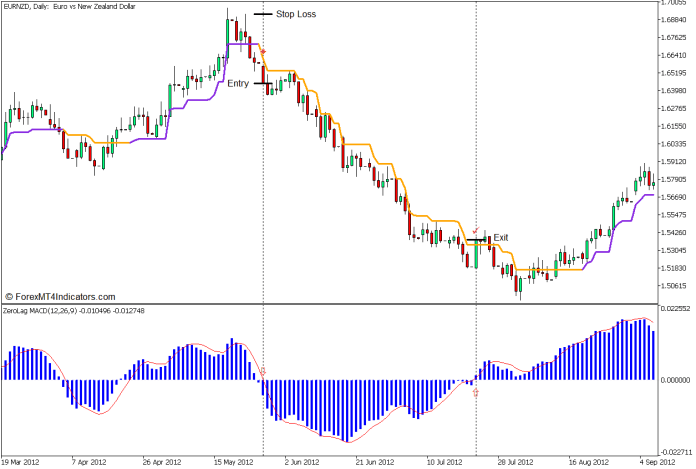

Promote Commerce Setup

Entry

- Coming from an uptrend market, a robust bearish momentum candle ought to shut under the Share Crossover line.

- The Share Crossover line ought to begin to slope down and alter to the colour orange.

- The Zero Lag MACD histogram bars ought to cross under zero.

- Open a promote order on the confluence of those bearish pattern reversal alerts.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Shut the commerce if the Share Crossover line slopes up and adjustments to blue-violet.

- Shut the commerce if the Zero Lag MACD histogram bar shifts above zero.

Conclusion

This buying and selling technique may be very efficient if used appropriately. This implies merchants ought to use it in the appropriate market context, a pattern reversal sign creating proper after a previous opposing pattern or momentum. Merchants must also be disciplined when utilizing this technique as its alerts ought to solely be traded each time the alerts are in confluence and are carefully aligned.

Though this buying and selling technique may be very efficient, the alerts that it produces may be only a few as a result of it’s based mostly on the day by day timeframe. Merchants want persistence and self-discipline to implement this buying and selling technique appropriately.

Foreign exchange Buying and selling Methods Set up Directions

This MT5 Technique is a mixture of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the accrued historical past knowledge and buying and selling alerts.

This MT5 technique offers a chance to detect numerous peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional worth motion and regulate this technique accordingly.

Advisable Foreign exchange MetaTrader 5 Buying and selling Platforms

XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

How you can set up This MT5 Technique?

- Obtain the Zip file under

- *Copy mq5 and ex5 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out the MT5 technique

- You will note technique setup is out there in your Chart

*Observe: Not all foreign exchange methods include mq5/ex5 information. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here under to obtain: