The Bitcoin “bull-bear” indicator from the on-chain analytics agency CryptoQuant has just lately flagged the cryptocurrency’s worth to be “overheated.”

Bitcoin Could Be Overheated In accordance To This Indicator

As identified by CryptoQuant Head of Analysis Julio Moreno in a put up on X, the BTC worth has elevated so quick that some on-chain indicators have began to sign a possible part of overheating.

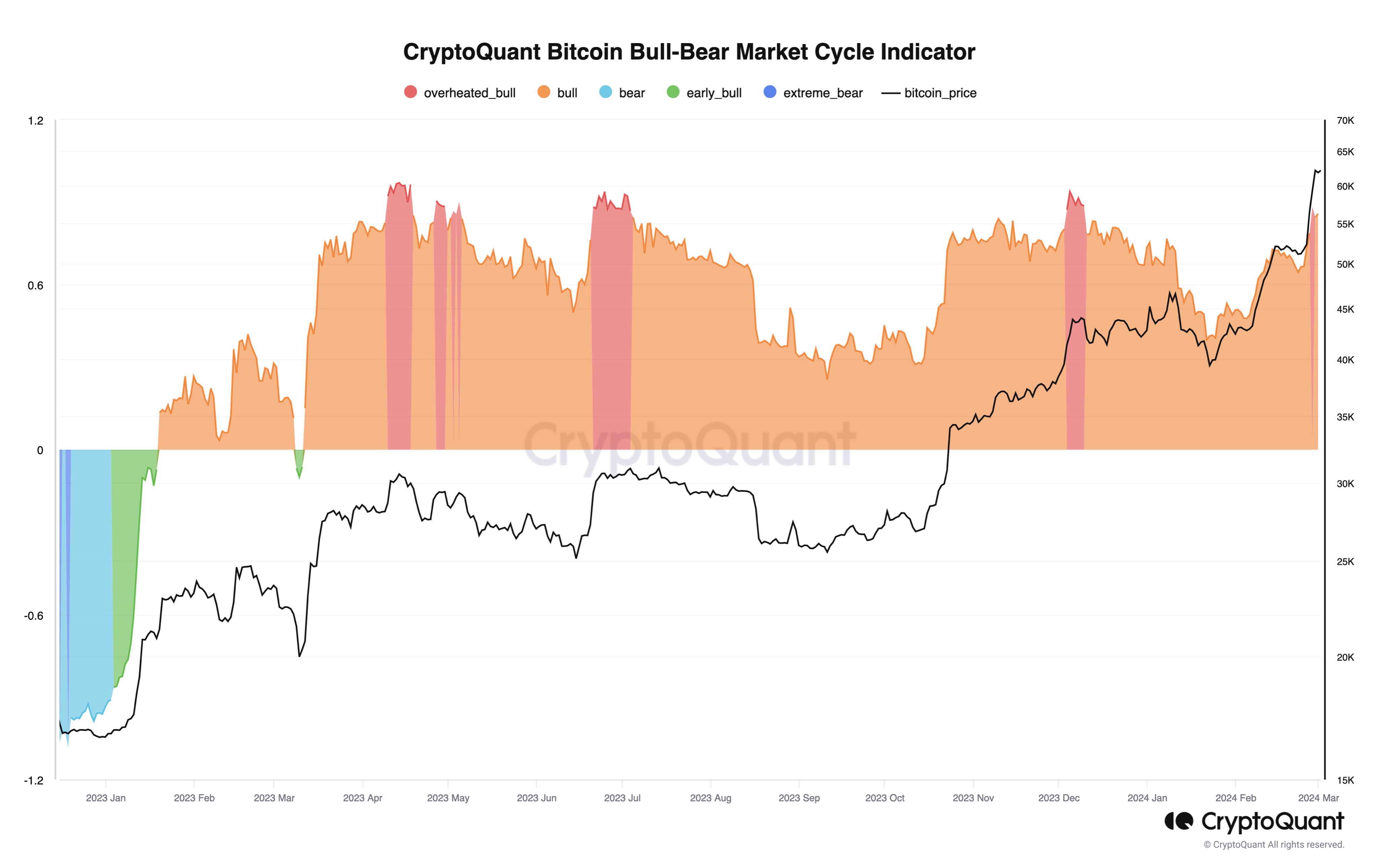

The primary metric of curiosity right here is the Bitcoin Bull-Bear Market Cycle Indicator made by the analytics agency that tracks the varied phases of bull and bear markets.

Right here is how the indicator has appeared like over the previous 12 months:

The pattern within the bull-bear indicator for the cryptocurrency | Supply: @jjcmoreno on X

As displayed within the above graph, Bitcoin has been contained in the “bull” territory because the early a part of 2023 and over the course of this run, the metric has hit “overheated bull” ranges throughout a couple of totally different cases.

From the chart, it’s seen that such values of the indicator have beforehand coincided with some form of high within the cryptocurrency’s worth. With the newest rally within the asset, it might seem that the market has as soon as once more entered into this territory of overheating.

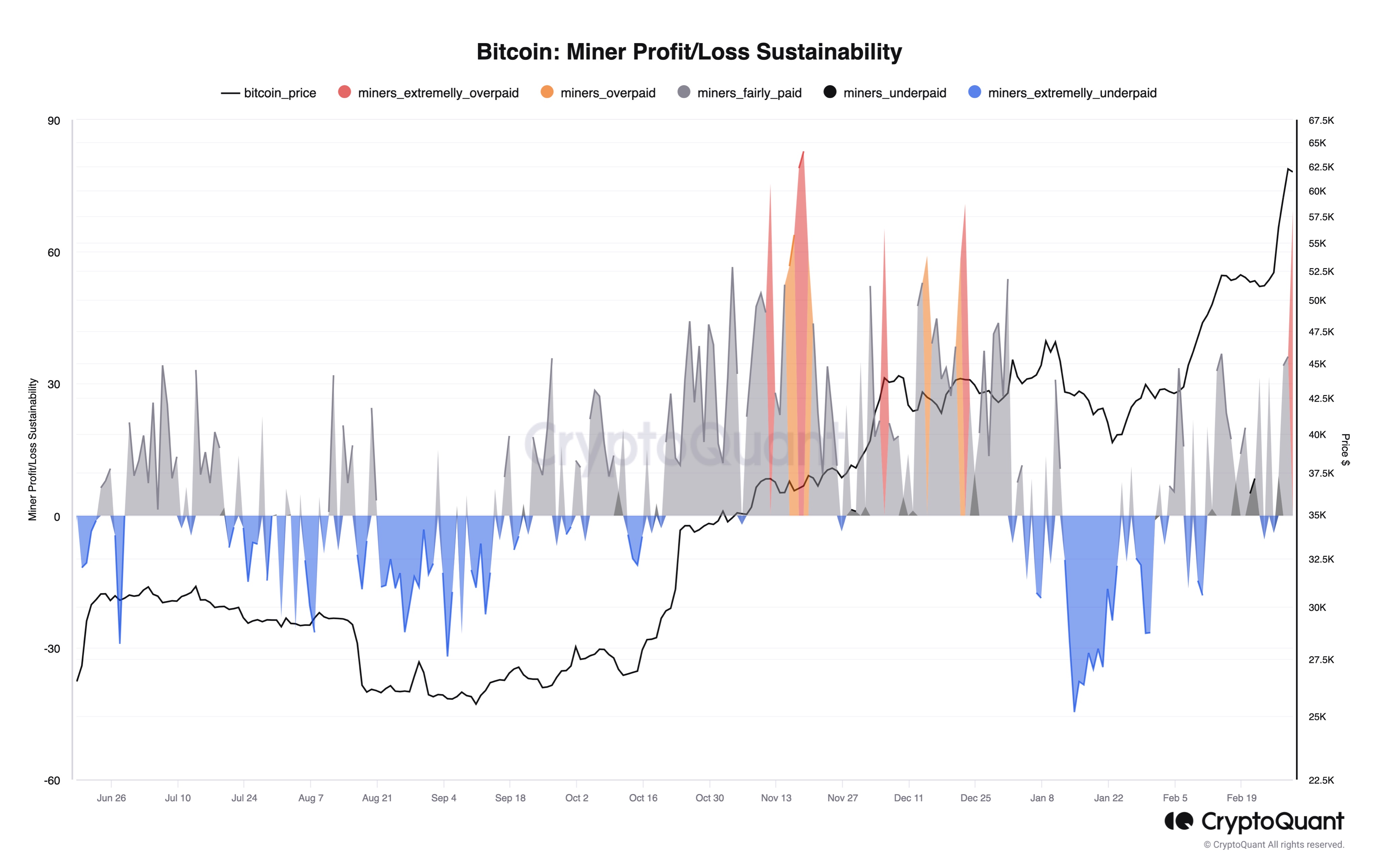

One other metric, the BTC “Miner Revenue/Loss Sustainability,” can also be suggesting an overheated market, in keeping with Moreno. This indicator mainly retains monitor of whether or not the miners are being overpaid or underpaid in comparison with the truthful worth baseline.

The worth of the metric seems to have spiked just lately | Supply: @jjcmoreno on X

As displayed within the chart, the Bitcoin Miner Revenue/Loss Sustainability has entered into the “extraordinarily overpaid” zone after the worth surge, implying {that a} cool off may maybe be due.

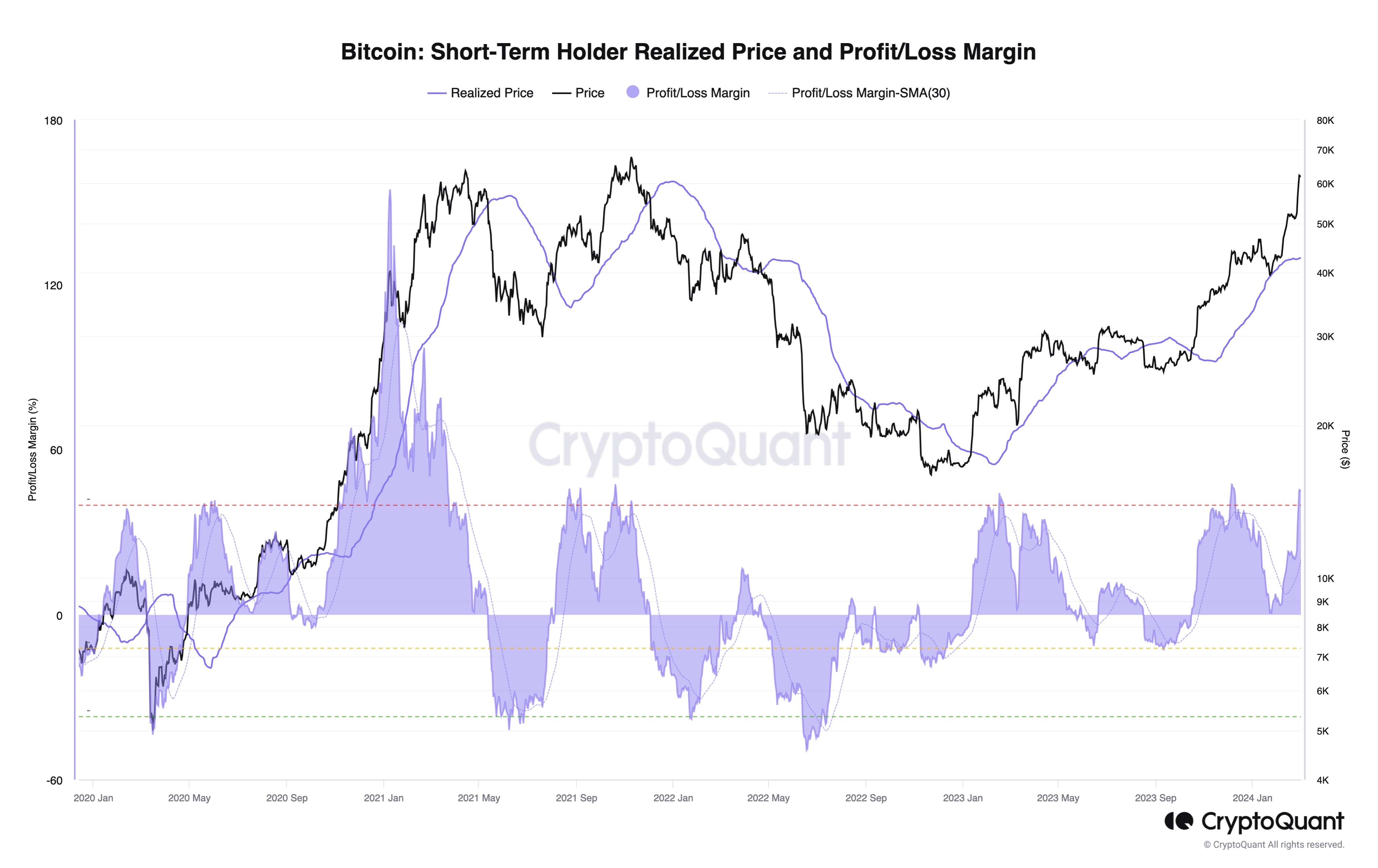

Lastly, the Bitcoin short-term holders (STHs) are additionally sitting on giant earnings in the meanwhile, which may be one other signal that issues have began to warmth up.

Seems like the worth of the metric has been fairly excessive in latest days | Supply: @jjcmoreno on X

The STHs check with the Bitcoin buyers who purchased their cash throughout the previous 155 days. These holders are thought-about the weak palms of the sector, who could simply promote on the sight of FUD or FOMO.

Because the above chart exhibits, this cohort’s unrealized earnings have swelled up because the Bitcoin worth has loved its rally. Lately, they’ve achieved revenue margins upward of 45%.

At any level, holders in earnings usually tend to promote their cash. As these earnings rise, the chance of the investor buckling into the attract of profit-taking additionally will increase.

As such, a considerable amount of these fickle-minded Bitcoin buyers holding important earnings means that there’s a excessive danger of a possible selloff happening out there.

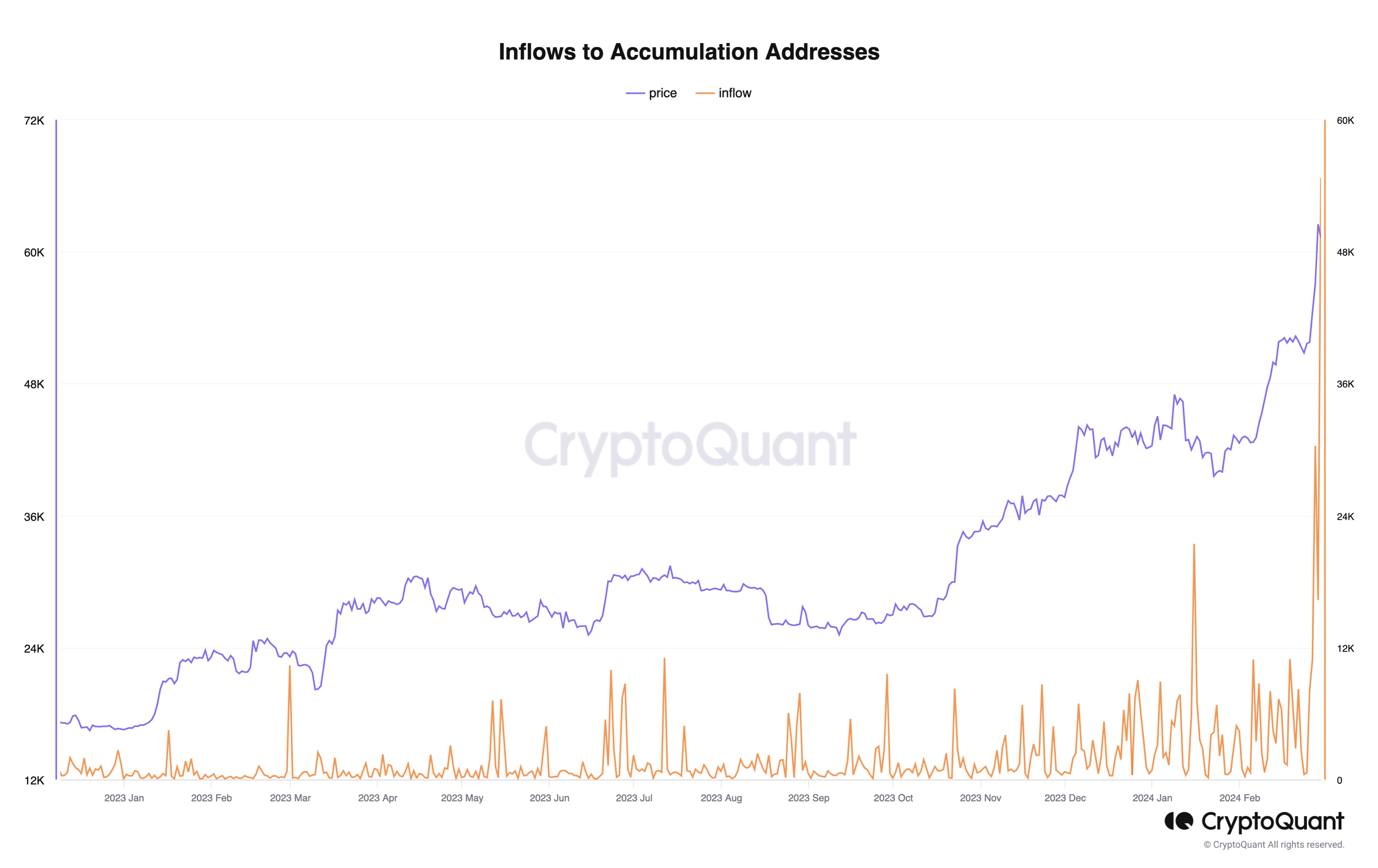

Whereas all these indicators are pointing to the cryptocurrency maybe being overvalued, there has nonetheless been a optimistic improvement in an indicator. This metric is the “Inflows to Accumulation Addresses.”

The indicator seems to have spiked | Supply: @jjcmoreno on X

Accumulation addresses are outlined as those who have a historical past of solely shopping for Bitcoin and by no means of promoting. At current, these HODLers are observing an all-time excessive quantity of inflows, which may undoubtedly be a bullish signal.

BTC Worth

Bitcoin has seen the newest continuation to its run up to now 24 hours as its worth has now damaged previous the $65,100 barrier.

BTC has noticed a pointy surge just lately | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site solely at your individual danger.