Choose your stress. In case your group needed to have a ache level, would you relatively have…

- Increased than regular common declare prices on account of inflation and provide chain challenges?

- Rising expense construction on account of rising expertise and core working system prices?

- Higher danger and underwriting losses as a direct results of unpredictable climate?

- Lack of knowledge insights to enhance A. B. or C.?

Sadly for at present’s P&C insurers, the enterprise local weather has been chosen for them.

E. All the Above

P&C insurers are in a very tight spot. Title a stress and it’s occurring proper now to them. It might be momentary. It is probably not as dangerous because it has ever been. However, it’s difficult sufficient that insurers should take steps to alleviate their pains and pressures and create alternatives.

In response to A.M. Finest’s Q1-2023 report, the P&C mixed ratio worsened by 6.1 proportion factors to 102.0 in Q123 (when in comparison with the prior 12 months’s quarter.)[i] In 2022, The US property-casualty insurance coverage market skilled a $26.5 billion web underwriting loss, a decline of $21.5 billion from the prior 12 months’s underwriting loss, in keeping with A.M. Finest.

Whereas environmental climate and pure disasters similar to wildfires, hurricanes, or different catastrophic occasions, are high of thoughts, there’s a rising set of latest dangers together with societal and technological. And most not too long ago we’ve got as soon as once more seen the affect of monetary danger with the latest failure of Silicon Valley Financial institution and the continued fallout. As famous in an article in Insurance coverage Journal, the failure was an absence of efficient danger administration.

All of those traits point out P&C insurers should rethink danger administration methods from merchandise and pricing to claims and prevention. As an alternative of taking part in protection, insurers should go on offense. However that requires a distinct operational and know-how technique and method.

At a latest Majesco and Capgemini roundtable, business specialists mentioned the altering danger atmosphere and which modifications insurers could make to show E. All the Above into Not one of the Above. You’ll be able to learn extra about this in our standpoint report, The Altering World of Danger: Insurers and Brokers on the Heart of Danger. In at present’s weblog, we glance particularly at pressures that may be mitigated via improved applied sciences.

A correct evaluation of danger contains…

Previously, we could have checked out a selected coverage danger for solutions to loss chance and profitability. In the present day’s danger requires a wider lens, together with:

- How a coverage danger impacts the general portfolio danger (and portfolio profitability).

- What different layers of danger needs to be thought of together with environmental, societal, and technological dangers?

- How can loss management be used to evaluate each danger cost-effectively to handle the portfolio, reinsurance wants, and assist prospects mitigate danger?

- How does customized knowledge shift underwriting and danger?

- How do insurers higher perceive new dangers?

Digital Autos (EVs) make a superb case research for a broad method to understanding danger.

- As EV utilization grows, we are actually seeing the affect on claims on account of accidents. We now have a number of incidents involving EV fires. Responders don’t essentially know easy methods to put these fires out. There have been cases of automobile doorways being “too digital” to open. When batteries are punctured, new dangers seem.

- Restore prices of EVs are costly. One instance is Rivian R1T pickup truck, which was rear-ended by a Lexus in February 2023 at a stoplight in Columbus, Ohio. The injury was initially deemed comparatively minor, and the opposite driver’s insurer provided him $1,600. The precise price to repair the bumper at a enterprise licensed to restore Rivian automobiles — certainly one of simply three in Ohio — was $42,000, roughly half the truck’s promoting value[DG1] .

- Due to the complexities of EVs, many are totaled as a result of substitute of the battery is troublesome or not possible to do, rising the danger and value.

- Legal responsibility isn’t straightforward to type out, particularly when the “driver” is probably not driving. Wouldn’t it be the proprietor? The auto producer? For insurers, it turns into attempting to unravel a Rubik’s dice of understanding all the probabilities and dimensions of danger.

Residence and Enterprise sensible property methods have some comparable points, solely in some cases, new applied sciences could also be offering new protections.

- The sensible residence has the flexibility to maintain observe of dangers inside water provide, drainage, safety, and electrical methods.

- As sensible residence/sensible enterprise networks develop more and more tied to electrical methods, some methods could also be discovered to be outdated and overly-taxed — dangerous to policyholders and insurers.

- Are insurers ready to seize and assess the precise varieties of knowledge that can shield policyholders, stop fires, water injury, and theft, and likewise cut back claims?

- Are insurers actively utilizing AI and knowledge personalization to speak shortly about coming dangers, similar to hail, fires, and storms?

The excellent news is that for essentially the most half, change and danger are accelerating change with insurers to adapt extra shortly operationally. It could be fearful in tempo, however definitely not within the alternative and outcomes that create new worth and advantages prospects can count on:

- Higher protection — extra folks and extra companies could discover themselves coated via extra related or newer choices and fewer steps to utilization, together with embedded protection, lowering the insurance coverage protection hole.

- Higher predictive safety — insurance coverage could enhance underwriting profitability, cut back its prices and prospects’ prices via a dramatic uptick in loss management data-driven danger assessments for underwriting that additionally offers perception and suggestions for danger avoidance or mitigation via proactive options.

- Higher effectivity and effectiveness — insurers are proper now grappling with operational challenges together with expertise shortages and tech debt that can give them the “excuse” to revamp their working fashions and introduce higher options and ecosystems to enhance operational outcomes.

- Higher resiliency — a rapidly-growing set of dangers is more likely to spark off two ancillary traits: new product improvement and higher danger information and response.

Mitigated danger is an improved expertise

Buyer expectations are one more very important stress level for insurers. These expectations are linked to all the different pressures (e.g. — prevention improves buyer satisfaction AND earnings) however they deserve their very own consideration. Prospects reside completely different life and exhibit way more strong digital proficiency. They demand completely different experiences, and so they have completely different expectations about worth. In response to a latest AM Finest innovation evaluation report, “the rise of digital platforms and ecosystems will make relationships with prospects much more necessary.”

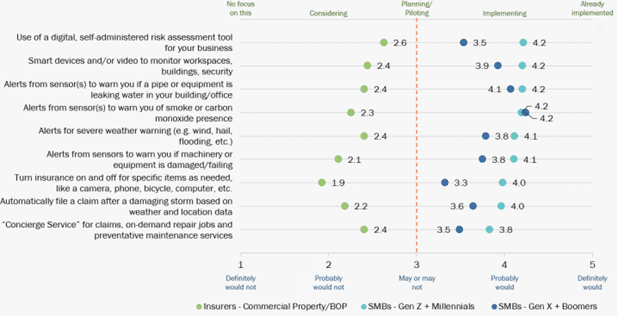

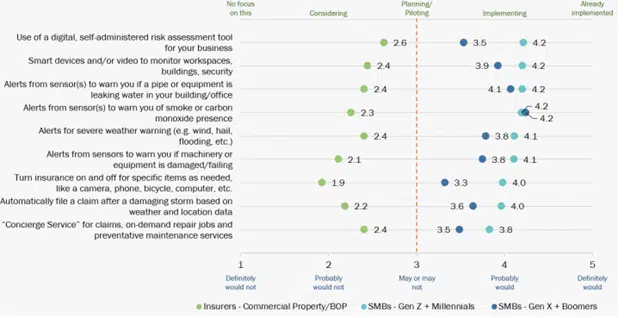

These altering expectations and desires are making a disconnect between what they need and what insurers supply. The disconnect contains buyer altering priorities and merchandise wanted, demand for danger mitigation and avoidance, customized pricing and score primarily based on their particular danger profile and a necessity for value-added companies that reach buyer worth and loyalty as seen in Determine 1.

Determine 1

The gaps between buyer expectations and what insurers are providing are almost twofold for each generational teams of SMBs and comparable for shoppers, primarily based on Majesco analysis! Prospects need and count on extra. To satisfy the elevated expectations, we have to determine priorities that can bridge the hole for insurers similar to digitalization, knowledge, and danger resilience — new methods of coping with each the brand new buyer and the brand new dangers we’re seeing in at present’s period.

Prospects need customized underwriting primarily based on their particular knowledge or steady evaluation of danger. The normal danger fashions or once-per-year, conventional method doesn’t work for the brand new dangers which are introduced. Knowledge and analytics and the way it impacts our danger perspective on a micro stage are extra consumable in methods that don’t pressure our know-how and our underwriting groups.

This is the reason there’s elevated curiosity in usage-based or telematics-based insurance coverage. In at present’s macroeconomic atmosphere, prospects are attempting to handle their prices, together with insurance coverage premiums, therefore the elevated demand for telematics-based insurance coverage.

An amazing instance of the worth is within the latest earnings name from Progressive Insurance coverage Group and a view from Mike Zaremski, Sr. P&C insurance coverage fairness analysis analyst, and MD at BMO Capital Markets:

“Progressive is constructing upon its materials first-mover aggressive telematics benefit by providing a brand new crash-detection/security service to its prospects. We estimate PGR’s aggressive benefit in telematics can also be structural in that buyer adoption charges of telematics-based insurance policies by way of D-2-C distribution are multiples larger than by way of a dealer, that means PGR is constructing upon its aggressive benefit vs. its common peer each day (word, most of its friends distribute by way of insurance coverage brokers).”

Worth-added companies contribute to danger resilience

We live in a world that has rising danger. Insurance coverage can now not be about simply underwriting after which ready for the declare to occur, however insurance coverage additionally should assist keep away from or decrease the danger, creating better buyer worth.

Whereas most insurers are targeted on how they’ll higher assess danger, many extra are increasing to additionally give attention to the prevention of losses and creating danger resilience for purchasers. The adage of “management what you may management” is now entrance and middle for insurers as they take a look at new danger administration methods as an important element of their underwriting and customer support technique.

Main insurers are leveraging know-how similar to IoT gadgets, sensible watches, loss management assessments, and value-added companies to not solely assess and monitor danger however to proactively reply to it with mitigation companies and actions. From concierge companies to monitoring water hazards and the protection of staff, to serving to to stay wholesome life, main insurers are shifting to danger resilience methods that not solely drive higher enterprise outcomes but in addition produce nice buyer loyalty.

This creates danger resilience.

New applied sciences, paired with knowledge & analytics

One of many essential areas for insurers to satisfy the altering world of danger is with know-how and knowledge and analytics. They have to create a brand new basis that allows operational optimization and innovation via the substitute of legacy methods, adoption of latest applied sciences, and embracing the strategic function of knowledge and analytics.

Expertise is the essential basis to adapt, innovate and ship at pace to execute on technique and market shifts. The rising significance and adoption of platform applied sciences, APIs, microservices, digital capabilities, new/non-traditional knowledge sources, and superior analytics capabilities – together with generative AI — are actually essential to progress, profitability, buyer engagement, channel attain, and workforce change.

From the entrance workplace to the again workplace, SaaS platforms are reshaping the enterprise focus from coverage to buyer, from course of to expertise, from static to dynamic pricing, from point-in-time underwriting to steady underwriting, from a historic view of knowledge to predictive and prescriptive knowledge, from conventional merchandise to new, progressive merchandise, and a lot extra. Insurers’ skill to create an interconnected tech basis will ship each progress and buyer relationship alternatives.

Superior analytics capabilities are poised to be a game-changer for insurance coverage. When new and real-time knowledge, superior analytics, AI and machine studying, and generative AI are successfully embedded into the operation and core methods, insurers can have a big operational affect throughout your entire insurance coverage worth chain. Knowledge is changing into extra available and cheaper, changing into a commodity that enables it to unfold throughout your entire worth chain. And superior analytics with AI, ML, and NLP are rising as highly effective instruments to boost underwriting, determine and forestall danger, and drive extra efficiencies, main to higher profitability and loss ratios.

Knowledge overload and diminishing pace to insights

The swelling quantity of knowledge is creating issue for underwriters to handle and use it successfully. The market is seeing large knowledge will increase in IoT machine knowledge, telematics knowledge, and risk-specific knowledge.

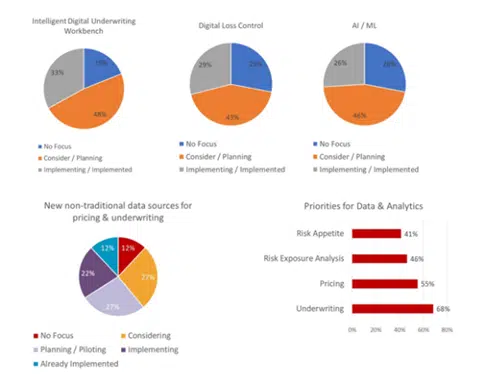

Underwriters and actuaries can’t validate and devise their understandings shortly sufficient, resulting in the need of automated strategies needing to be utilized to the info to attract perception to create higher and expedited enterprise choices. With the usage of extra correct knowledge, insurers can leverage predictive modeling to offer custom-made protection and higher pricing. However it’s greater than anybody coverage. The mixture of clever underwriting, loss management and superior analytics like AI/ML are more and more essential to assess the precise danger, but in addition its affect when it comes to danger urge for food and danger publicity evaluation for the portfolio as seen in Determine 2.

Determine 2

Because the competitors tightens within the business, each a part of the insurance coverage group have to be dedicated to the usage of next-generation know-how and knowledge and analytics to face out from their opponents and to satisfy buyer expectations.

These caught on legacy core methods are boxed in and are restricted of their potential. Shifting their enterprise to next-gen cloud platforms is essential, not only for single strains of enterprise, however for your entire enterprise to attain actual optimization and value discount. Extra importantly, it frees up assets to fund tomorrow’s enterprise.

Tomorrow’s enterprise have to be digital, enabling the flexibility to quickly introduce new merchandise that seize new market segments, meet new dangers, buyer wants and expectations, and new distribution channels. It should embed insurance coverage into different services to make it simpler to grasp and buy.

For insurers, enterprise processes finally must be seen otherwise than in earlier occasions. It’s about being aggressive in prevention and giving your underwriters (and different crew members) the instruments they should obtain the very best outcomes. A renewed core and upgraded know-how will play a considerable function and assist insurers obtain a complicated loss management technique. Inside that know-how platform, insurers should additionally not be afraid to make the most of cloud capabilities that may assist enhance knowledge utilization and quicken the time that underwriters can produce protection choices.

Expertise is the essential basis for coping with the present and future pressures of a high-pressure P&C atmosphere. It should assist insurers to adapt, innovate, and ship at pace to execute on technique and market shifts. The rising significance and adoption of platform applied sciences, APIs, microservices, digital capabilities, new/non-traditional knowledge sources, and superior analytics capabilities are actually important to progress, profitability, buyer engagement, channel attain, and workforce change.

For a deeper take a look at how rising ecosystem participation and efficient management are concerned in the identical risk-mitigation equation, be sure you obtain the Majesco/Capgemini standpoint report, The Altering World of Danger: Insurers and Brokers on the Heart of Danger.

In the present day’s weblog is co-authored by Denise Garth, Chief Technique Officer at Majesco, and Kelly Reisling, Senior Director, Capgemini

[i] Willard, Jack, US P&C business sees $8.2bn web underwriting loss in Q1: AM Finest, June 16, 2023

[DG1]https://www.nytimes.com/2023/07/03/enterprise/car-repairs-electric-vehicles.html#:~:textual content=Datapercent20frompercent20Mitchellpercent20showspercent20that,requirepercent20workpercent20bypercent20specialistpercent20mechanics.