KEY

TAKEAWAYS

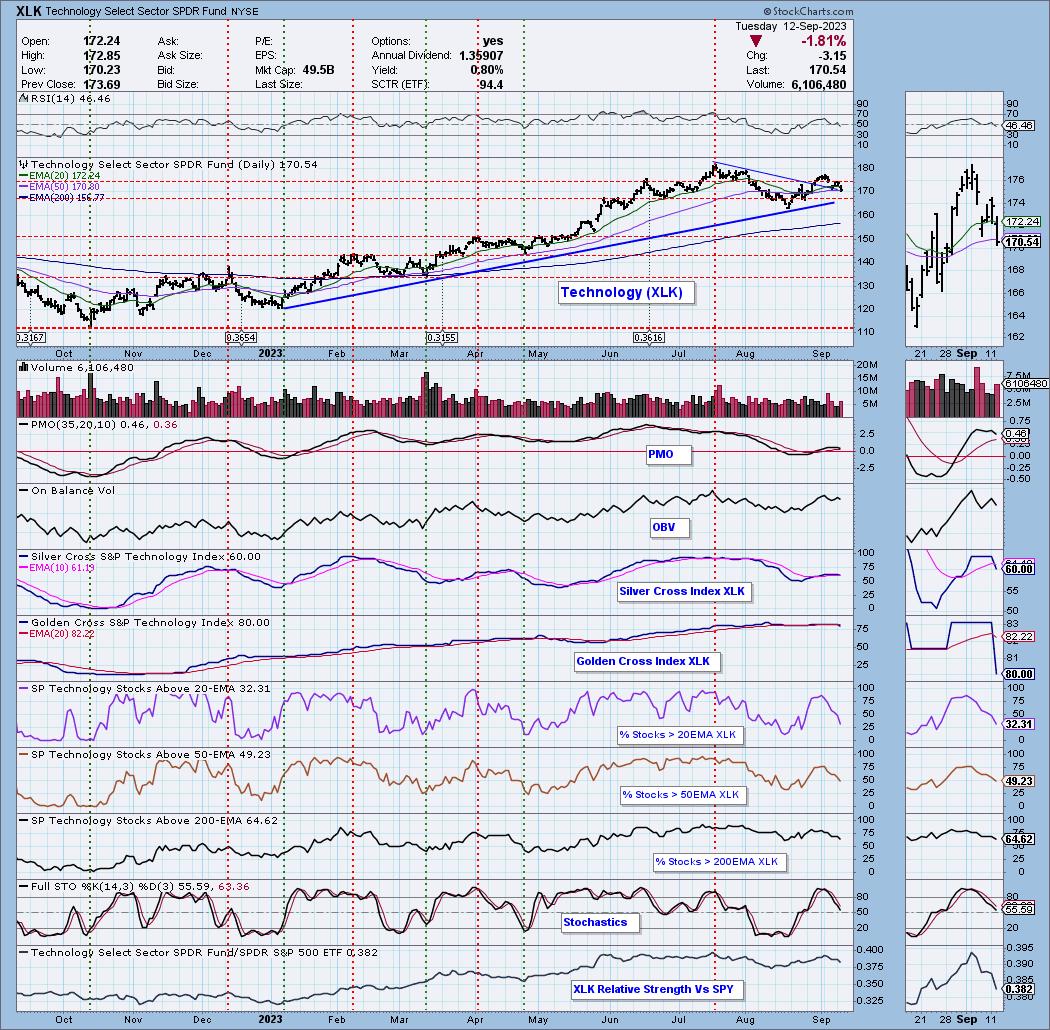

- XLK “Bearish Shifts” Transfer IT and LT Bias to BEARISH

- XLK PMO Nearing Crossover SELL Sign

In Monday’s DecisionPoint Buying and selling Room we mentioned that Expertise (XLK) was the final one standing on our Bias Scoreboard with a Bullish Bias in each the intermediate time period and long run. At this time that bullish bias was misplaced in each timeframes. When the Silver Cross Index drops under its sign line, it’s a “Bearish Shift” that strikes the IT Bias to “Bearish”. When the Golden Cross Index drops under its sign line, it strikes the LT Bias to “Bearish” on a Bearish Shift.

The Value Momentum Oscillator (PMO) is in decline once more and is headed for a Crossover SELL Sign. Most regarding is the entire lack of participation. %Shares > 20/50/200EMAs have seen declines for the reason that sector topped at first of September. We might simply learn the ST Bias as “Bearish” given %Shares > 20/50EMAs are under our bullish 50% threshold.

Including insult to harm are the RSI dipping under internet impartial (50) and Stochastics that are falling quick.

Conclusion: Expertise tends to steer the market and on this case it ought to lead the market decrease. Indicators are falling with the PMO nearing a SELL Sign. Relative energy has been failing and the lack of the Bullish Bias in each the IT and LT counsel this isn’t a sector to depend on in your portfolio.

Study extra about DecisionPoint.com:

Watch the most recent episode of DecisionPoint on StockCharts TV’s YouTube channel right here!

Attempt us out for 2 weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Evaluation is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled. Any opinions expressed herein are solely these of the creator, and don’t in any approach symbolize the views or opinions of another individual or entity.

DecisionPoint isn’t a registered funding advisor. Funding and buying and selling selections are solely your duty. DecisionPoint newsletters, blogs or web site supplies ought to NOT be interpreted as a advice or solicitation to purchase or promote any safety or to take any particular motion.

Useful DecisionPoint Hyperlinks:

DecisionPoint Alert Chart Checklist

DecisionPoint Golden Cross/Silver Cross Index Chart Checklist

DecisionPoint Sector Chart Checklist

Value Momentum Oscillator (PMO)

Swenlin Buying and selling Oscillators (STO-B and STO-V)

Erin Swenlin is a co-founder of the DecisionPoint.com web site alongside along with her father, Carl Swenlin. She launched the DecisionPoint every day weblog in 2009 alongside Carl and now serves as a consulting technical analyst and weblog contributor at StockCharts.com. Erin is an lively Member of the CMT Affiliation. She holds a Grasp’s diploma in Data Useful resource Administration from the Air Pressure Institute of Expertise in addition to a Bachelor’s diploma in Arithmetic from the College of Southern California.