No one might argue that 2022 was something however a bear market. After Bitcoin reached an ATH in November of 2021 we noticed the bear market develop in traditional trend by dropping help at key technical ranges. Whereas the bear was taking part in out in considerably predictable trend, the market was caught off guard by the occasions that led to the FTX crash in November 2022. As a result of the contagion from FTX had a devastating ripple impact that was felt by the most important establishments with crypto publicity in addition to banks, I really anticipated costs to fall even decrease.

On the time, worry and preventing amongst institutional gamers like Galaxy, Gemini and Grayscale (beneath DCG) who have been amongst SBF’s largest institutional victims added to the priority that value would grind down in direction of the decrease teenagers, but considerably remarkably and maybe not so coincidentally on January 1, 2023 Bitcoin began to rally. What was first thought of weekend whale video games developed gone the weekend, and actually, by means of Q1/2023 I recognized an entity on FireCharts which I nicknamed “Infamous B.I.D.” that was double stacking massive blocks of bid liquidity to push value greater. There was a sample to the conduct that made it considerably predictable and tradable. These strikes have been nicely documented in my X feed throughout that time frame. As soon as value reached $25k that entity disappeared. Even with out the assistance of that manipulation pushing value up, and although the macroeconomic scenario was horrible, the geopolitical scenario went from unhealthy to worse and the US political scenario developed from a dysfunctional sh*t present to a full blown circus, the market continued to rally.

Now, almost 12 months and > 150% from the day the rally started, the controversy between bulls and bears over whether or not this can be a confirmed bull market or a sequence of bear market distribution rallies actually continues as we speak. Whereas it’s comprehensible that somebody might have a look at 150% and instantly assume bull market, it does require a deeper understanding of what distribution and accumulation seem like. From my view, that also isn’t as clear as one would anticipate. Traditionally, the Purple Class of Whales with orders within the $100k – $1M vary have had probably the most affect over BTC value route. The order movement knowledge I’ve been monitoring on Binance reveals that by means of a lot of the yr they (together with bigger MegaWhales) have been shopping for dips and distributing considerably greater than they purchased on these dips on the uptrends that adopted.

Solely just lately have we seen an uptick that could possibly be a sign that the pattern is shifting. Parallel to that, some on-chain knowledge suppliers are exhibiting a rise within the variety of wallets holding BTC which can be a sign that we could possibly be transitioning from a distribution part to an accumulation part and I’m searching for extra clear proof of that. One of many issues I search for to get a way of that’s bid liquidity. I consider that “Liquidity = Sentiment,” and it’s no secret that order books have been skinny on either side of value by means of a lot of the yr, nevertheless within the final 3 weeks or so, we’ve began seeing extra institutional sized bid ladders coming into the order ebook and that reality helps a bullish thesis, so long as they don’t dump by means of the following pump.

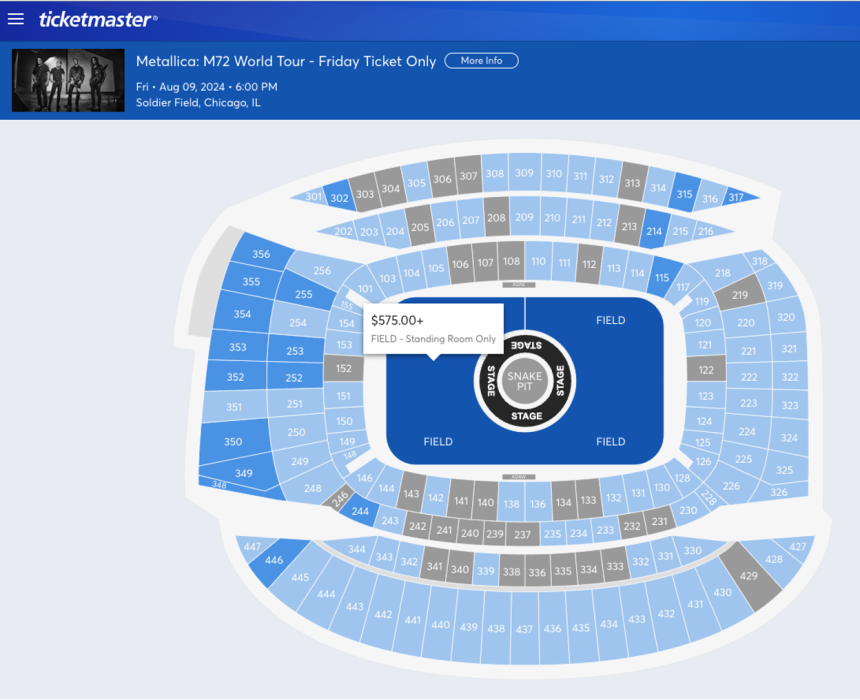

With the entire above in thoughts, there are most actually turns and twists that buyers ought to look out for. Certain we’re beginning to see some enhancements on the U.S. inflation and unemployment numbers, however one thing in these studies doesn’t jive with actuality. For many center and decrease revenue People, bank card debt is climbing to new highs, rents have soared, dwelling possession is unattainable, grocery costs are excessive and a Metallica “Standing Room Solely” Area ticket is $575. So in my thoughts, we nonetheless have a percolating macroeconomic drawback and the geopolitical and U.S. political points appear to worsen by the day.

Apart from that, the RSI has been over cooked for an prolonged time frame and we simply had 8 consecutive inexperienced weekly candles. Each of these elements have traditionally led to corrections. I might provide the “Historical past doesn’t must repeat itself…” spiel or I can present you what traditionally occurs after strikes like this and allow you to resolve.

One other potential twist to contemplate is that the present PA has a hanging resemblance to the primary leg of the 2019 rally that turned out to be a Fib retracement, that finally bought rejected from the highest of the Golden Pocket at .618 Fib. That led to a 53% correction earlier than the Covid Crash took it down greater than 70% from the .618 Fib.

At this stage, I’d be shocked to see a draw back transfer that deep with out the help of a Black Swan, however we’re at present having some interplay with the Golden Pocket that appears acquainted. Whereas it’s cheap to anticipate some resistance getting into and exiting the Golden Pocket, there’s one very bizarre twist to what we’re seeing and that may be a unusual sample I’ve observed occurring on or round December seventeenth. Yearly since 2017 there was a transfer on December seventeenth that had Macro implications. The one exception to that’s final yr when it occurred on December twentieth. On every event the worth motion led to a macro breakout or breakdown. It’s too quickly to inform if this transfer will validate the sample on the day of writing (Dec nineteenth), however on the seventeenth we noticed BTC get rejected from the decrease finish of the Golden Pocket and in addition lose the 21-Day transferring common. Worth has been flirting with each of these ranges ever since so we’ll have to attend to see the way it performs out over time. Apart from these issues I’m watching the upcoming ETF window very carefully. I believe that the market is numb to SEC delays on these selections, however there’s a lot anticipation that this time we’ll see an approval, {that a} flat out rejection has the potential to be the catalyst that triggers a correction.

No matter the place you aspect on whether or not we’re or should not in a confirmed bull market, we’re seeing a number of proof that if we’re not in it, we’re near it. Should you’re a long run investor and also you haven’t already began constructing a place, it’s a superb time to determine some targets to begin scaling into one. This after all relies on your time horizon and danger urge for food, however you probably have a long run outlook and 6 determine targets for BTC it’s nonetheless early sufficient to get in, but it surely’s additionally a good suggestion to avoid wasting dry powder for a correction as a result of for my part, it’s not a matter of if it should come, however when.

Q: Proper now, we’re seeing Bitcoin attain new highs. Do you suppose we’re within the early days of a full bull run? What has modified available in the market that enabled the present value motion; is it the Bitcoin spot ETF or the US Fed hinting at a loser coverage or the upcoming Halving? What’s the large narrative that may go on in 2024?

Regardless of the continuing debate between bulls and bears over whether or not or not we’ve been in a bull market, I can say that regardless of the uptrend, there was no clear affirmation that we’ve been in a bull market by means of a lot of the yr. Nonetheless, the truth that we’ve just lately began to see extra institutional sized bid ladders coming into the order ebook together with the on-chain knowledge that signifies extra wallets holding for longer and the latest shopping for after the R/S flip at $40k are indications that we could also be on the verge of a breakout.

There’s little doubt in my thoughts that a number of the momentum we’ve been seeing is expounded to the following ETF choice window opening January 5-10 and the April 2024 Halving. The FED’s latest choice to pause fee hikes and trace at a pivot to cuts in 2024 actually added gas to that momentum that pushed value above $40k. In typical crypto kind, we additionally had some assist in late October by means of early December after I observed some acquainted patterns within the order ebook. I can’t affirm with absolute certainty if it was the Infamous B.I.D. spoofer we noticed in Q1 returned, but it surely was the identical sport I recognized by means of Q1 being executed and there’s no query that it helped push value up by means of the $35k – $40k vary earlier than it disappeared.

(…) As a lot as I’d wish to see a correction come earlier than we get there (the Bitcoin spot ETF choice), the market doesn’t care what I need. I might anticipate it to return earlier than the Halving. Whether or not it comes earlier than or after the ETF choice window closes stays to be seen. Within the meantime, I’ll proceed to look at order ebook and order movement knowledge and commerce what’s in entrance of me.

Q: Final yr, we spoke about probably the most resilient sectors throughout the Crypto Winter. Which sectors and cash will doubtless profit from a brand new Bull Run? We’re seeing the Solana ecosystem bloom together with the NFT market; what traits may benefit within the coming months?