Momentum buying and selling methods are viable buying and selling methods that many seasoned merchants use. Worth normally continues after a robust worth motion due to momentum. This presents a buying and selling alternative that many momentum merchants benefit from. This technique reveals us how we will commerce with the momentum in confluence with the route of the pattern.

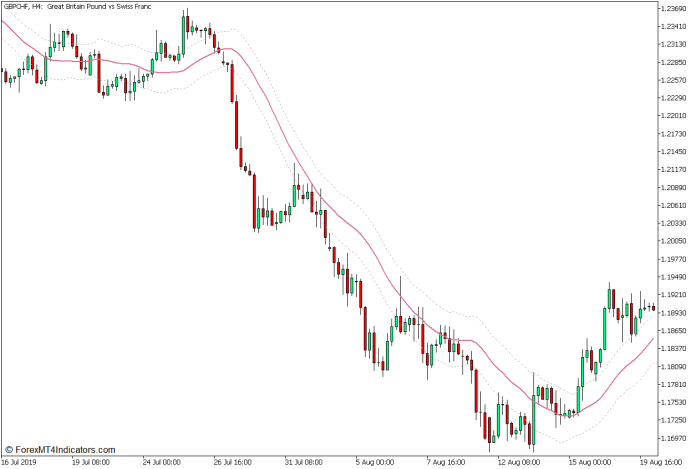

Adaptive ATR Keltner Channel

The Adaptive ATR Keltner Channel is a technical indicator primarily based on the Keltner Channel indicator, which was first launched by Chester Keltner within the Sixties. It’s a pattern following technical indicator that pulls a band or channel-like construction that follows the actions of worth motion.

The Keltner Channel is similar to the extensively used Bollinger Bands. The distinction is that whereas the Bollinger Bands makes use of commonplace deviations to find out the space of the outer traces from the center line, the Keltner Channel makes use of a a number of of the Common True Vary (ATR) to measure the space of the outer traces from the center line.

There are two generally used variations of the Keltner Channel. One variation makes use of a Easy Shifting Common (SMA) to find out its center line, whereas the opposite makes use of an Exponential Shifting Common (EMA) to attract its center line. This variation of the Keltner Channel nevertheless makes use of an Adaptive Easy Shifting Common to calculate for its center line. This incorporates the usage of the Effectivity Ratio which Perry Kauffman utilized in growing the Kauffman Adaptive Shifting Common (KAMA).

This model of the Keltner Channel is preset to make use of the Typical Worth to calculate its center line as an alternative of the standard Shut Worth. That is represented by the stable pale violet-red line. The outer traces are drawn as a dashed darkish grey line. The gap of the outer traces is preset at 1x the ATR from the center line. Nevertheless, these presets could also be modified inside the indicator settings.

For the reason that center line is a shifting common line, merchants can use this indicator as a pattern route indicator. That is primarily based on the overall location of worth motion concerning the center line, in addition to the slope of the road.

It will also be successfully used as a momentum indicator. Merchants could observe robust momentum candles closing outdoors the channel after a bounce from the world round its center line.

Superior Oscillator

The Superior Oscillator (AO) is a technical indicator used to objectively measure and assess the route of the market’s momentum. It does this utilizing a pair of Easy Shifting Common (SMA) traces, that are normally preset because the 5-bar SMA and the 34-bar SMA. The indicator calculates the distinction between the 5 SMA and 34 SMA values after which makes use of the ensuing values to plot histogram bars making an oscillator.

Development and momentum route is indicated by whether or not the bars are usually constructive or damaging. Development energy then again is indicated by the rise or lower of the values of the bars. This model of the Superior Oscillator conveniently plots inexperienced bars to point rising bar values and crimson bars to point lowering bar values. Optimistic inexperienced bars point out a strengthening bullish pattern route, whereas constructive crimson bars point out a weakening bullish pattern route. Inversely, damaging crimson bars point out a strengthening bearish pattern route, whereas damaging inexperienced bars point out a weakening bearish pattern route.

Merchants typically use the values of the bars to establish the route of the pattern and filter trades primarily based on the pattern route. Some merchants additionally use the altering of the colour of the bars to substantiate a commerce entry within the route of the pattern. As an oscillator, the AO will also be used to establish divergences, that are high-probability pattern reversal indications.

Buying and selling Technique Idea

This buying and selling technique is a pattern continuation technique that trades on momentum alerts primarily based on the confluence of the Superior Oscillator and the Adaptive ATR Keltner Channel indicator.

The Superior Oscillator is primarily used to establish the route of the pattern. That is primarily based on whether or not the AO is usually plotting constructive or damaging bars. Merchants ought to then isolate their trades solely within the route of the pattern as indicated by the AO.

After figuring out the route of the pattern, merchants could then use the Adaptive ATR Keltner Channel indicator to establish shallow pullbacks in the direction of its center line. Worth motion ought to then bounce off the center line and type a momentum candle that will shut outdoors the Adaptive ATR Keltner Channel. Merchants could then use this momentum sign as an entry sign for the commerce.

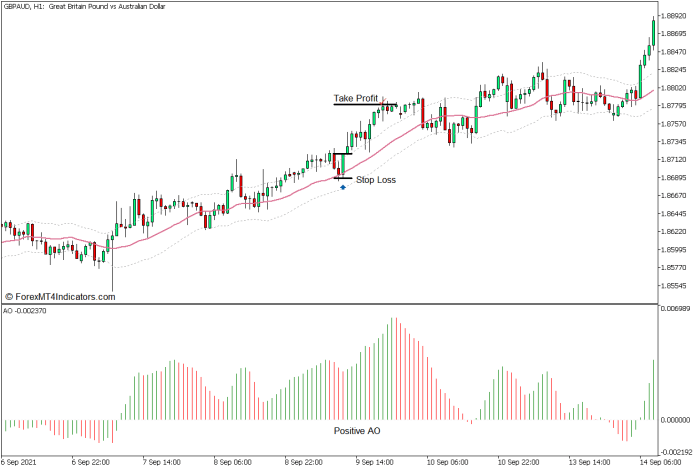

Purchase Commerce Setup

Entry

- The Superior Oscillator bars ought to usually be constructive.

- Worth motion ought to pull again in the direction of the center line of the Adaptive ATR Keltner Channel indicator.

- Open a purchase order as quickly as worth motion reveals indicators of worth rejection on the world of the center line and a bullish momentum candle closes above the higher line of the Adaptive ATR Keltner Channel.

Cease Loss

- Set the cease loss beneath the bullish momentum candle.

Exit

- Set the take revenue goal at 2x the scale of the cease loss in pips and permit the value to succeed in the goal.

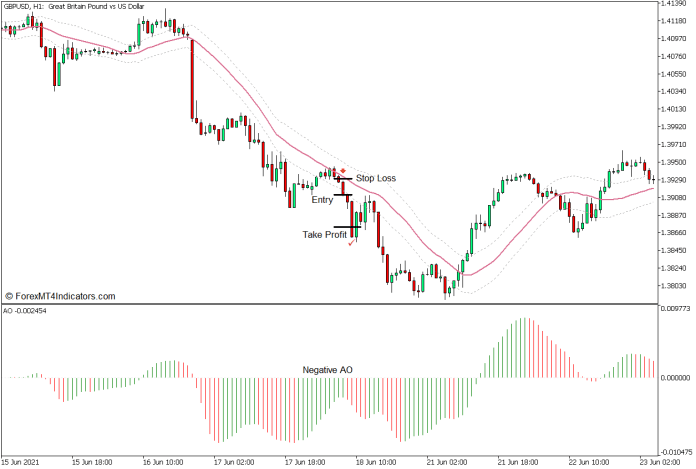

Promote Commerce Setup

Entry

- The Superior Oscillator bars ought to usually be damaging.

- Worth motion ought to pull again in the direction of the center line of the Adaptive ATR Keltner Channel indicator.

- Open a promote order as quickly as worth motion reveals indicators of worth rejection on the world of the center line and a bearish momentum candle closes beneath the decrease line of the Adaptive ATR Keltner Channel.

Cease Loss

- Set the cease loss above the bearish momentum candle.

Exit

- Set the take revenue goal at 2x the scale of the cease loss in pips and permit the value to succeed in the goal.

Conclusion

This buying and selling technique is a viable momentum buying and selling technique that merchants can use. It permits merchants to objectively filter out trades that aren’t viable primarily based on the algorithm used. Nevertheless, there are additionally conditions whereby the succeeding worth motion isn’t robust sufficient to succeed in the goal. There are additionally conditions whereby commerce alternatives type on the finish of the pattern, which merchants ought to keep away from. Merchants ought to nonetheless use sound judgment when deciding whether or not to take a legitimate commerce or not.

Foreign exchange Buying and selling Methods Set up Directions

This MT5 Technique is a mixture of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to rework the accrued historical past knowledge and buying and selling alerts.

This MT5 technique supplies a chance to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional worth motion and modify this technique accordingly.

Beneficial Foreign exchange MetaTrader 5 Buying and selling Platforms

XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

The right way to set up This MT5 Technique?

- Obtain the Zip file beneath

- *Copy mq5 and ex5 recordsdata to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick the MT5 technique

- You will note technique setup is on the market in your Chart

*Observe: Not all foreign exchange methods include mq5/ex5 recordsdata. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain: