KEY

TAKEAWAYS

- The StockCharts Technical Rank is indicating that AMD’s inventory value is strengthening

- A bull flag sample and potential resistance ranges may also help to make a projection on AMD’s inventory value

- AMD inventory’s relative efficiency and momentum are enhancing, which suggests the inventory has room to run

A inventory market pullback usually makes traders query what they need to be doing with their investments. Throw in geopolitical tensions, and the uncertainty grows exponentially. However when a pullback ends, it opens up the chance to select up shares, exchange-traded funds (ETFs), or some other securities for a lower cost. And there is additionally the potential to experience an honest rally.

However not all shares are created equal. You possibly can’t simply purchase any inventory and count on it to maneuver excessive sufficient for an honest return. You will need to nonetheless do your due diligence and determine shares with the momentum to rally sufficient to make it price your money and time.

Semiconductors are one of many sub-sectors which have pushed the rally from the October 2022 low to the July 2023 excessive. Deliver up a chart of the semiconductor sub-industry, such because the Philadelphia Semiconductor Index ($SOX), and you will discover that the index is battling with the downward-sloping trendline. A break above that trendline could be a optimistic for semiconductor shares.

CHART 1: PHILADELPHIA SEMICONDUCTOR INDEX ($SOX) COULD BREAK OUT ABOVE ITS DOWNWARD-SLOPING TRENDLINE. A breakout could be optimistic for semiconductor shares.Chart supply: StockCharts.com. For academic functions.A number of semiconductor shares are displaying indicators of rotation, and one which should not be ignored is Superior Micro Units (ticker image: AMD).

Analyzing AMD Inventory

The month-to-month chart of AMD reveals a transparent uptrend within the inventory since 2016. In the course of the October 2022 low, value dipped under its 50-month easy shifting common (SMA), however since then, AMD inventory has managed to carry above it. It is now holding on to the help of its 21-month exponential shifting common (EMA). So, general, the pattern is upward sure.

CHART 2: MONTHLY CHART OF AMD STOCK. Over the long run, AMD has been trending larger. It pulled again on the finish of 2022, however the downtrend has reversed.Chart supply: StockCharts.com. For academic functions.

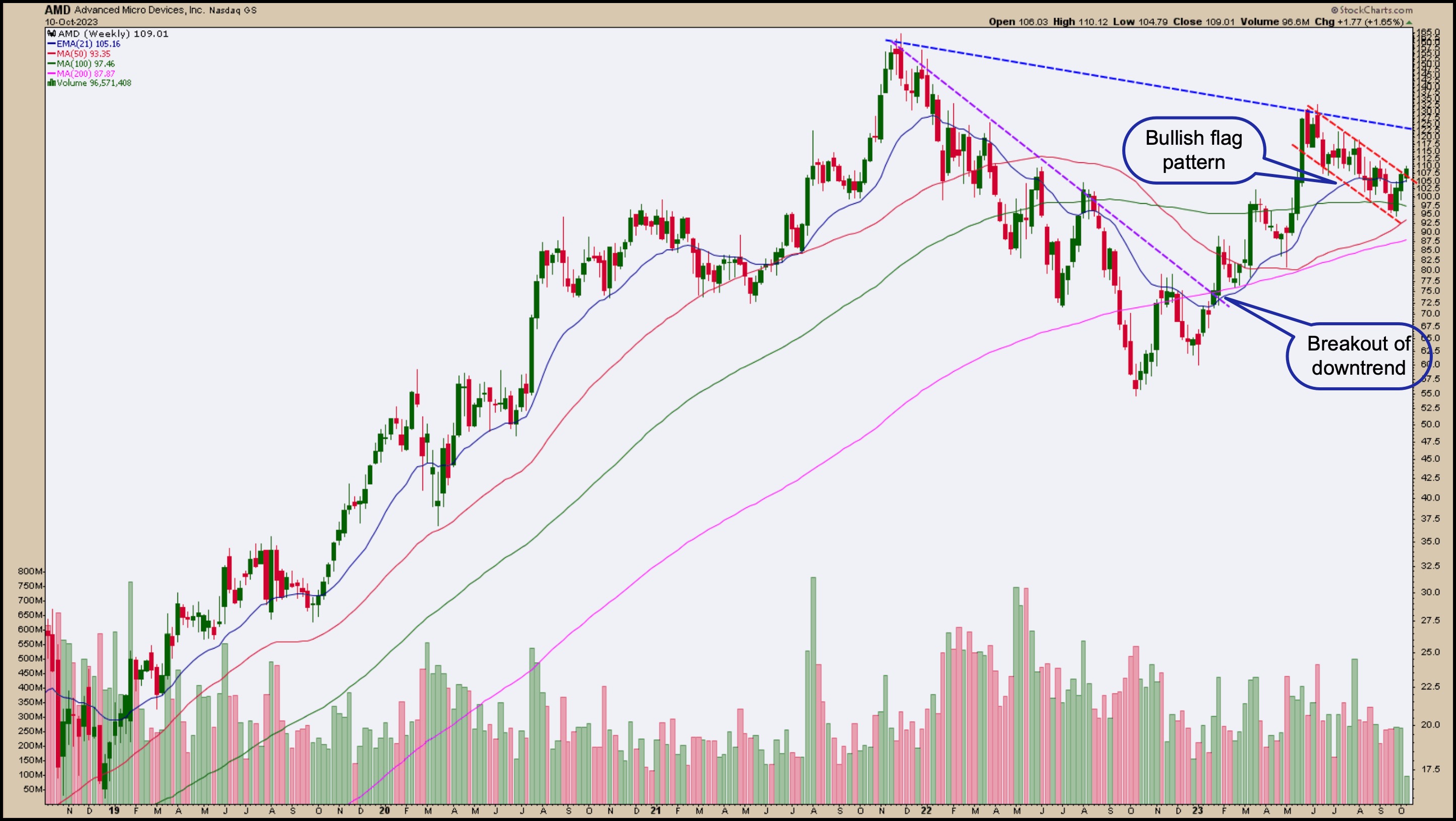

The weekly chart reveals an fascinating image. Whereas the general pattern is decrease, the worth motion is displaying the formation of a bullish flag sample. Worth is breaking above this flag, which suggests there’s an opportunity the inventory might come near its November 2021 excessive. However earlier than getting there, it has to interrupt above the trendline that connects the November 2021 excessive and the excessive at first of the flag sample.

CHART 3: WEEKLY CHART OF AMD. The bullish flag sample is useful in projecting a value goal for AMD after a breakout.Chart supply: StockCharts.com. For academic functions.

Let’s shift to the each day chart and see if it aligns with the longer-term charts.

CHART 4: CALCULATING PRICE TARGET FROM FLAG BREAKOUT. AMD’s inventory value might go as excessive as round $162, near its all-time excessive of $164.Chart supply: StockCharts.com. For academic functions.

The bull flag is clearer within the each day AMD inventory chart, and value has damaged out of the flag sample. The sample can be utilized to challenge how far AMD inventory might rise. To estimate a value goal after a flag breakout, calculate the gap between when the inventory broke out of its final downtrend and the excessive of the flag sample.

Returning to the weekly chart of AMD, the breakout from the final downtrend (purple dashed line on the weekly chart) occurred in January 2023 at round $75. So the gap from there to the excessive of the flag, which is round $130, is about $55. Add 55 to the worth on the flag breakout—round $107—bringing you to a value goal of round $162.

It is also price noting that the StockCharts Technical Rating (SCTR) rating has crossed above 70, which signifies the inventory is displaying power and has room to run earlier than it hits the 90+ ranges of different semiconductor shares, similar to NVIDIA Corp. (ticker image: NVDA). The Relative Energy Index (RSI) is at round 60, indicating that momentum is robust however hasn’t reached ranges that make it excessively sturdy. And relative power can also be enhancing. All indicators recommend the inventory has room to run.

The primary resistance AMD’s inventory value might hit could be the 100-day shifting common, which is not far off. A break above this shifting common would carry it to the trendline within the month-to-month chart of round $120. Past that, the inventory might attain the November excessive of round $164, which coincides with the flag sample breakout value goal.

Last Ideas

Should you get in comparatively quickly, AMD’s inventory value might offer you a return of over 50%. However that does not imply it will be clean crusing. Nothing is assured within the inventory market, particularly since extra geopolitical tensions have surfaced.

As at all times, watch general market situations, particularly within the semiconductor {industry}. It is an excellent indicator of the general efficiency of the inventory market. As well as, regulate AMD’s SCTR rating, the general pattern of AMD, and its efficiency in opposition to a benchmark such because the S&P 500.

Should you purchase shares of AMD at present ranges and the inventory strikes in your favor, look ahead to extreme momentum. Should you suppose the momentum is simply too excessive, sellers might dominate and produce the worth down. If indicators of power weaken, you have to diligently tighten your stops.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Website Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to coach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising and marketing company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra