Pattern continuation methods typically present new merchants the best option to commerce the foreign exchange market. It is because development continuation methods indicate that you’re buying and selling with the path of the development. That is typically performed by buying and selling on the confluence of the long-term development path and the short-term development reversal. This technique exhibits us an instance of how we may objectively commerce development continuation methods utilizing the ALMA line and the Kumo.

Arnaud Legoux Transferring Common

The Arnaud Legoux Transferring Common (ALMA) is a transferring common kind of trend-following indicator. It’s a customized transferring common indicator that was developed with the first goal of decreasing market noise, theoretically leading to a transferring common line that gives development reversal indicators which might be extra dependable compared in opposition to primary transferring common line calculations.

The ALMA has an algorithm that smoothens its transferring common line utilizing the zero-phase digital filtering idea. It calculates its transferring common line by calculating the transferring common line twice. One transferring common calculates a weighted transferring common from the oldest information to the newest information, whereas the opposite transferring common calculates a weighted transferring common from the newest information to the oldest information. It then combines the 2 calculations utilizing the Gaussian Offset calculation primarily based on customary deviations. In principle, this could create a transferring common line which reduces market noise considerably.

For those who observe the ALMA line, it does plot a transferring common line which is considerably smoother when in comparison with different transferring common strains and can be very responsive to cost motion.

This model of the ALMA indicator offers development reversal indicators primarily based on the shifting of the slope and trajectory of its line. It plots a deep sky blue line each time the ALMA line begins to slope up indicating an upward market momentum. Inversely, it additionally plots a sandy brown line each time its line begins to slope down indicating a downward market momentum. Merchants could use the altering of the colour of its line as an entry sign primarily based on a possible development or momentum reversal.

Ichimoku Kinko Hyo – Kumo

The Ichimoku Kinko Hyo indicator is a trend-following technical indicator that’s considered an indicator that gives an entire development path indication. It offers development path and reversal indications from the short-term to the long-term time horizons. That is potential as a result of the Ichimoku Kinko Hyo indicator is a group of strains primarily based on the median of worth motion throughout a number of time home windows. These strains are the Chikou Span, Tenkan-sen, Kijun-sen, Senkou Span A, and Senkou Span B strains.

The Tenkan-sen and Kijun-sen strains are thought-about because the short-term development strains whereas the Senkou Span A and Senkou Span B strains, which kind the Kumo, are thought-about because the long-term development strains.

The Senkou Span A, or Main Span A line, is principally the typical of the Tenkan-sen and Kijun-sen strains shifted 26 bars forward. It’s calculated by including the corresponding Tenkan-sen and Kijun-sen values, dividing the sum by two, and plotting the ensuing worth 26 bars ahead.

The Senkou Span B, or Main Span B line, however, is the median of worth inside a 52-bar interval, additionally shifted 26 durations ahead. It’s calculated by including the very best excessive and lowest low inside a 52-bar window, dividing the sum by two, and once more plotting the ensuing worth 26 bars forward.

Collectively, the Senkou Span A and Senkou Span B strains kind the Kumo or “Cloud”. The realm between the 2 strains is shaded to point the path of the long-term development. It’s shaded sandy brown each time the Senkou Span A line is above the Senkou Span B line indicating an upward long-term development. Alternatively, additionally it is shaded thistle each time the Senkou Span A line is under the Senkou Span B line indicating a downward long-term development. Merchants typically use the long-term development path indicated by the Kumo as a development path filter.

Buying and selling Technique Idea

This buying and selling technique is a straightforward development continuation buying and selling technique that trades solely within the path of the long-term development whereas utilizing the pullbacks or market contraction phases as a commerce entry alternative.

The long-term development is objectively recognized utilizing the Kumo. This may be clearly recognized primarily based on whether or not the Kumo is sandy brown or thistle. Merchants ought to then isolate their commerce path primarily based on this long-term development indication.

As quickly because the long-term development and commerce path are recognized, we may then anticipate buying and selling alternatives on market pullbacks.

The ALMA line usually reverses briefly in opposition to the path of the long-term development throughout pullbacks, which would offer us with buying and selling alternatives. The commerce entries are recognized as quickly as the colour of the ALMA line reverts again to the colour that’s in confluence with the long-term development path.

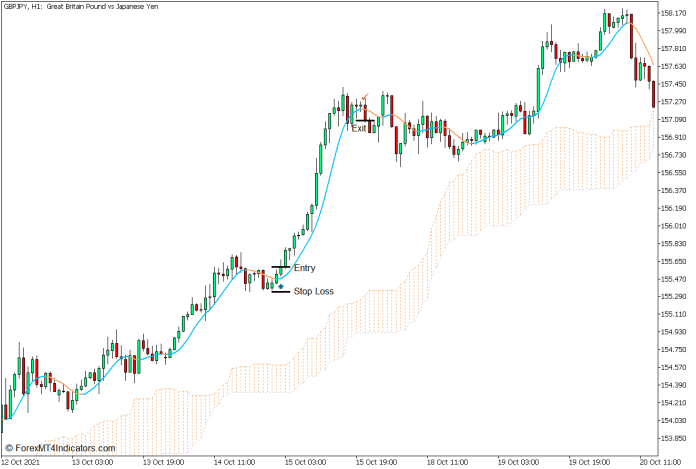

Purchase Commerce Setup

Entry

- The Kumo ought to be sandy brown indicating a long-term uptrend.

- Worth motion ought to pull again inflicting the ALMA line to briefly change to sandy brown.

- Open a purchase order as quickly because the ALMA line reverts again to deep sky blue.

Cease Loss

- Set the cease loss on the fractal under the entry candle.

Exit

- Shut the commerce as quickly because the ALMA line modifications again to sandy brown.

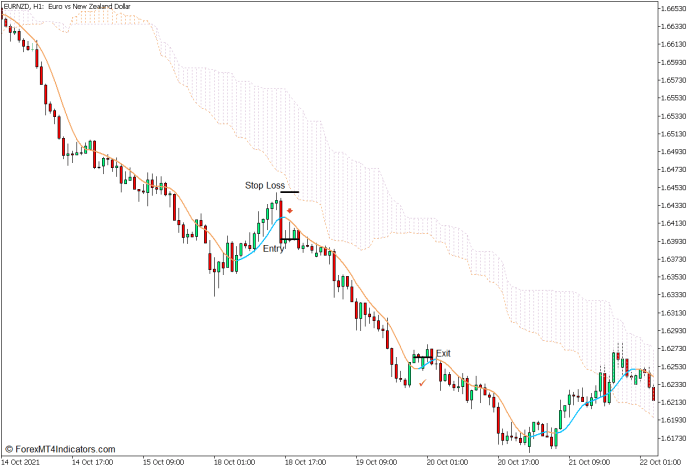

Promote Commerce Setup

Entry

- The Kumo ought to be thistle indicating a long-term downtrend.

- Worth motion ought to pull again inflicting the ALMA line to briefly change to deep sky blue.

- Open a promote order as quickly because the ALMA line reverts again to sandy brown.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Shut the commerce as quickly because the ALMA line modifications again to deep sky blue.

Conclusion

As a development continuation technique, this technique does present first rate commerce setups that can provide good risk-reward ratios, offered that it’s utilized in the appropriate market context. It ought to be used solely in markets which have a transparent long-term development with vast and clearly outlined market swings. It must also be used in the beginning or in the midst of the development, and never close to the tip of the development the place reversals could be abrupt. If used accurately, this buying and selling technique is usually a first rate technique that merchants can use.

Foreign exchange Buying and selling Methods Set up Directions

This MT5 Technique is a mix of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to rework the amassed historical past information and buying and selling indicators.

This MT5 technique offers a possibility to detect numerous peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional worth motion and modify this technique accordingly.

Beneficial Foreign exchange MetaTrader 5 Buying and selling Platforms

XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Learn how to set up This MT5 Technique?

- Obtain the Zip file under

- *Copy mq5 and ex5 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out the MT5 technique

- You will note technique setup is accessible in your Chart

*Word: Not all foreign exchange methods include mq5/ex5 information. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here under to obtain: