The Bollinger Bands® indicator is among the many most dependable and highly effective buying and selling indicators merchants can select from. Bollinger Bands® can be utilized to learn the pattern power, to time commerce entries, trip trending markets, and discover potential market tops for reversal buying and selling. The Bollinger Band® indicator isn’t a lagging indicator as a result of it adjusts to cost motion in real-time and the indicator makes use of the value volatility to regulate to the present value conduct.

On this article, we present you tips on how to use the Bollinger Bands ® indicator to enhance your chart studying expertise and tips on how to determine high-probability commerce entries.

Bollinger Bands ® Indicator Defined

We don’t wish to get too technical on this article, however understanding the fundamental premise of the indicator will assist us use the indicator extra successfully. If you’re not within the underlying rules of the Bollinger Bands® indicator, you may skip forward to the subsequent part the place we cowl some widespread use instances.

Because the title implies, Bollinger Bands® are value channels (bands) which might be plotted above and beneath the value motion.

The outer Bollinger Bands® are primarily based on value volatility, which signifies that they increase when the value fluctuates and tendencies strongly. Conversely, the bands contract throughout sideways consolidations and low momentum tendencies. The longer the candles and the candlestick wicks, the upper the volatility is and, subsequently, the additional aside the Bollinger Bands® are going to be.

An essential element of the Bollinger Bands ® is the customary deviation. With out getting too technical, the usual deviation measures the value fluctuation and the deviation from the common candle measurement.

A small customary deviation signifies that the candle’s measurement was near the common candle measurement. A big customary deviation means the candles’ measurement was everywhere and deviated strongly from the same old common candle measurement.

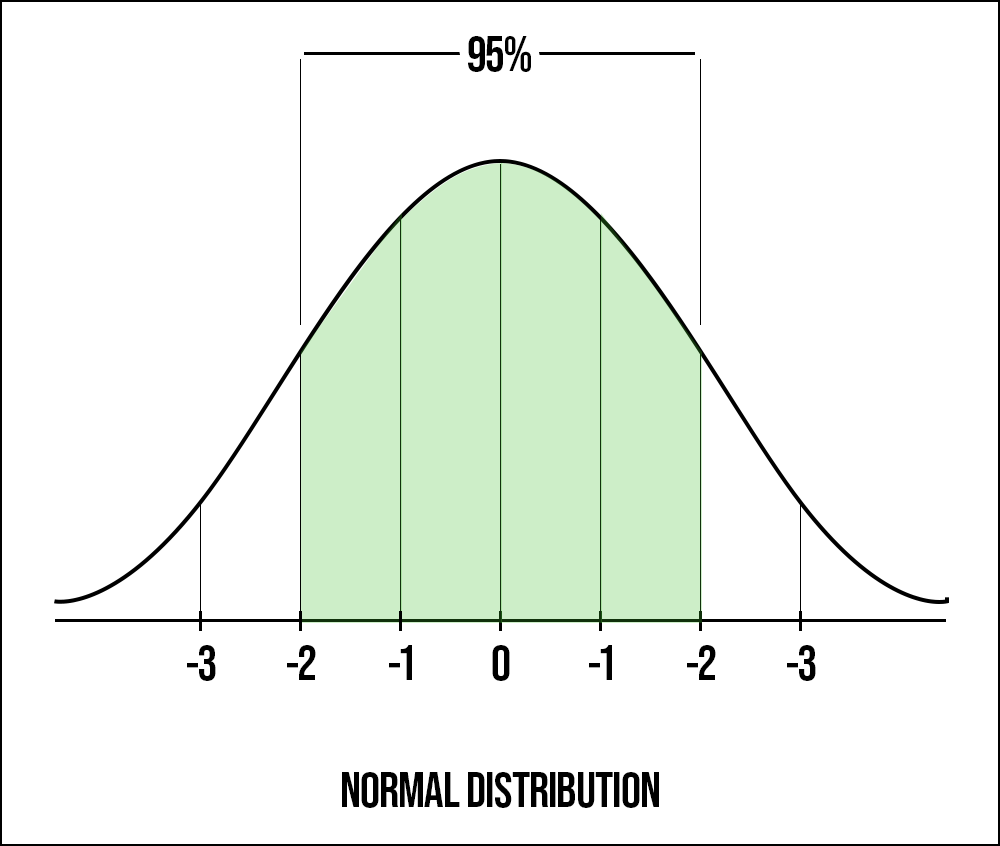

The Bollinger Bands ® indicator makes use of two ideas from statistics, the so-called confidence interval, and the regular distribution. By default, the Bollinger Bands ® are set to 2 customary deviations. With a typical deviation of two, we’d say that 95% of all noticed value factors ought to fall inside the Bollinger Bands®. The graph beneath reveals a traditional distribution graph with the usual deviations on the backside x-axis.

Once more, I don’t wish to get too technical, however a small tour is essential to grasp the method of the Bollinger Bands® indicator and why it’s so highly effective.

While you hear somebody say “95% confidence interval,” it means they’re fairly sure (95% positive, to be actual) that the common value candle will fall inside the vary of the Bollinger Bands ®. In case you’re 95% positive the value will keep inside the Bollinger Bands ®, you will be assured concerning the value prediction.

In easy phrases, we’d say that 95% of all the value motion occurs in between the Bollinger Bands®. A transfer exterior of the outer Bollinger Bands ® reveals a big value transfer and is a 5% outlier.

The middle of the Bollinger Bands ® is the 20-period shifting common and the proper addition to the volatility-based outer bands, particularly once we begin utilizing Bollinger Bands ® for trend-following buying and selling.

Pattern-Buying and selling with the Bollinger Bands ®

Bollinger Bands ® don’t lag (as a lot) as a result of they at all times change mechanically with the value motion.

We are able to use the Bollinger Bands ® to investigate the power of tendencies and get a variety of essential data this manner. There are only a few issues that you must take note of in relation to utilizing Bollinger Bands ® to investigate trending markets and value motion:

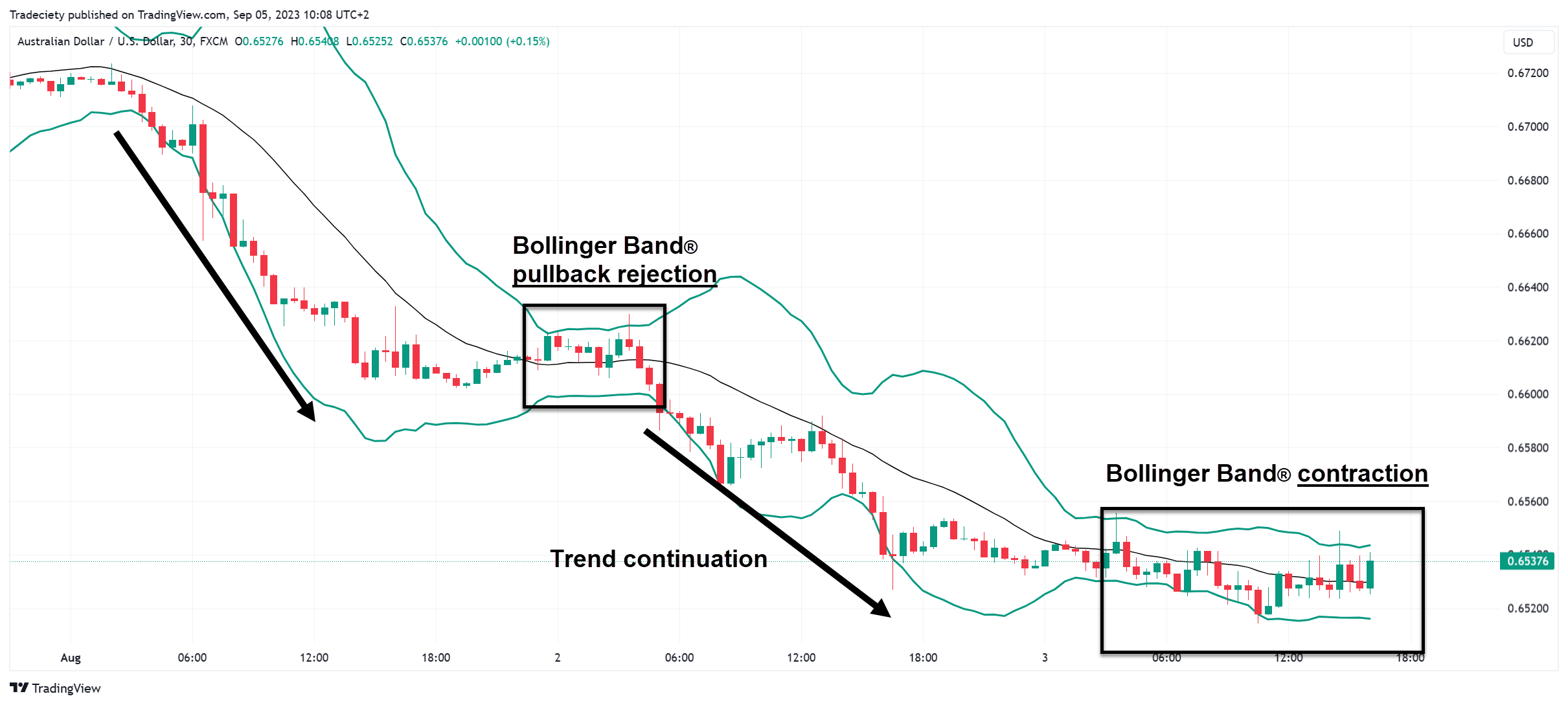

- Earlier than a brand new pattern emerges, we frequently see a Bollinger Bands ® contraction the place the 2 bands come collectively. This sometimes occurs throughout sideways consolidations earlier than a breakout happens.

- Throughout sturdy trending phases, the value stays near the outer band and the bands widen as bigger trending candles push the value larger.

- If the value fails to achieve the outer band and strikes again inside the middle, it reveals fading momentum. This is sort of a value divergence.

- Repeated pushes into the outer bands that don’t advance the pattern can usually be an indication of exhaustion and we check with them as Bollinger Bands ® spikes.

Within the following, we’ll look at every Bollinger Bands ® sign individually to get a greater understanding of tips on how to use the Bollinger Bands ® in our buying and selling.

Bollinger Bands ® Contraction

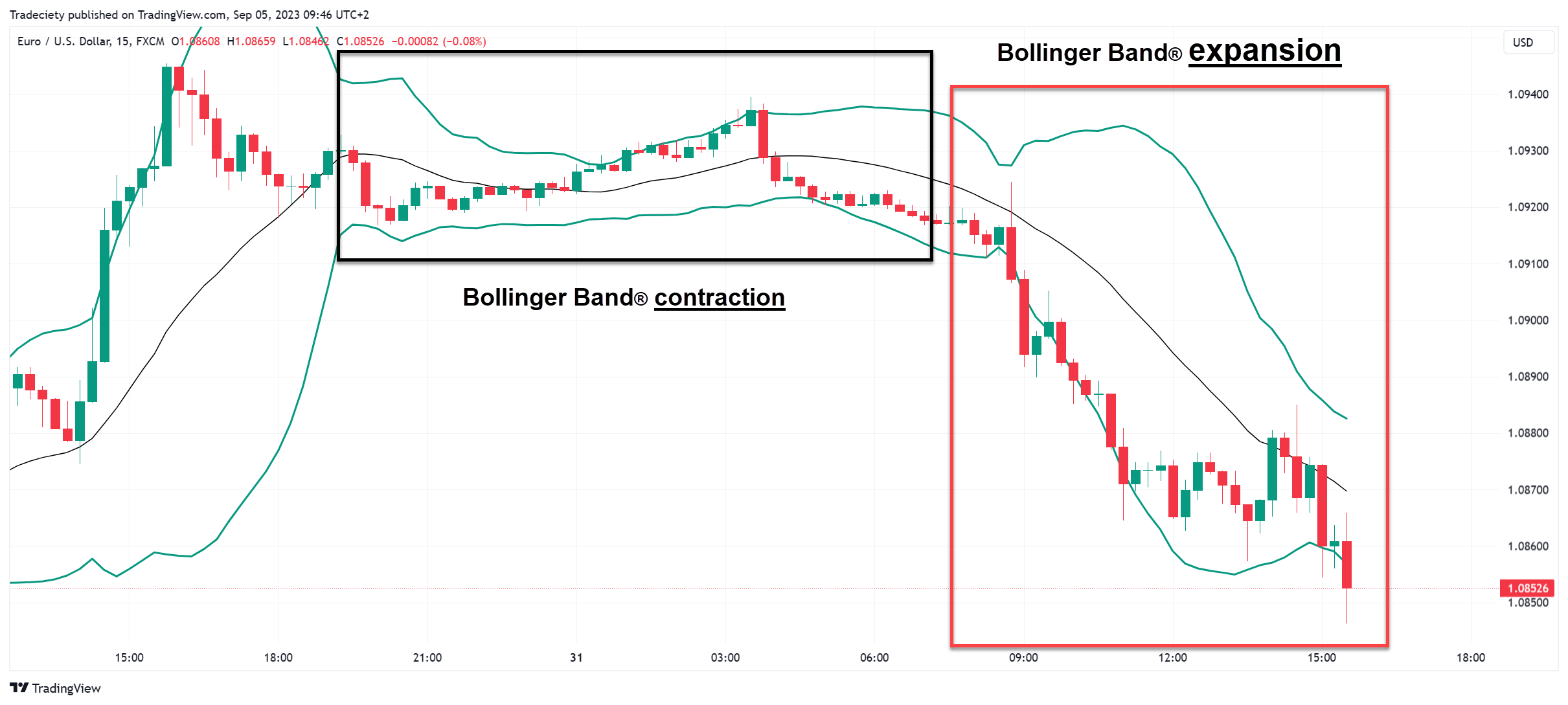

We’re beginning with the Bollinger Bands ® contraction as a result of a contraction usually foreshadows a pattern change or a pattern continuation and is, subsequently, the primary essential sign.

Within the screenshot beneath, we are able to see that the value was in an uptrend first after which began shifting sideways. In the course of the sideways interval, the candlesticks turned smaller and the Bollinger Bands ® began narrowing. Particularly lengthy contraction durations will be essential indicators.

After the sturdy breakout from the contraction, the Bollinger Bands ® began widening instantly, signaling the sturdy trending value motion. Throughout trending markets, when the value pushes into one route with lengthy candlesticks, the Bollinger Bands ® widen, confirming the excessive stage of volatility – a deviation from the conventional value conduct.

Bollinger Bands ® Pattern-Following

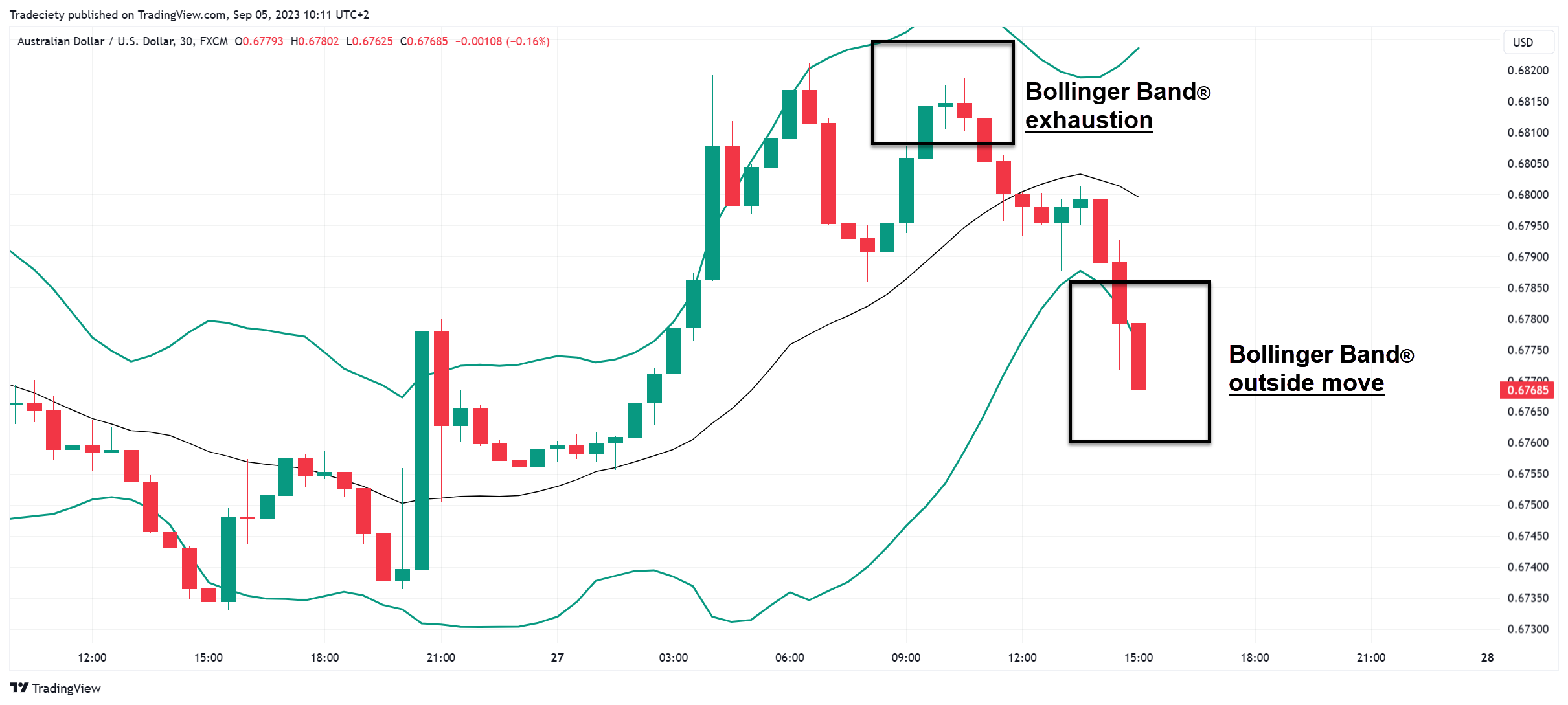

Within the screenshot beneath, the value first confirmed a Bollinger Bands ® exhaustion. The exhaustion is confirmed when the value fails to achieve the higher Bollinger Bands ® in an uptrend. Whereas beforehand within the uptrend, the value was capable of attain and commerce exterior the higher band, in the course of the exhaustion, the value couldn’t proceed the trending section. That is the primary signal of a pattern reversal.

Subsequent, the value moved all the way in which into the other Bollinger Bands ® and began buying and selling exterior the decrease band. The worth confirmed excessive power and the value was even capable of shut exterior the decrease band. As now we have discovered, a lot of the candlesticks will fall contained in the Bollinger Bands ®. A transfer exterior the bands reveals, subsequently, excessive pattern power.

After the push exterior the decrease Bollinger Bands ®, the pattern continued to the draw back and the value stayed very near the decrease band. Sturdy continuation pushes beneath the decrease band affirm the pattern route.

Lastly, the Bollinger Bands ® began contracting and the bands narrowed when the value began shifting sideways with smaller candlesticks. A bullish pattern change may now be underway when the value begins pushing into the higher Bollinger Bands ®.

Bollinger Bands ® Pullback Buying and selling

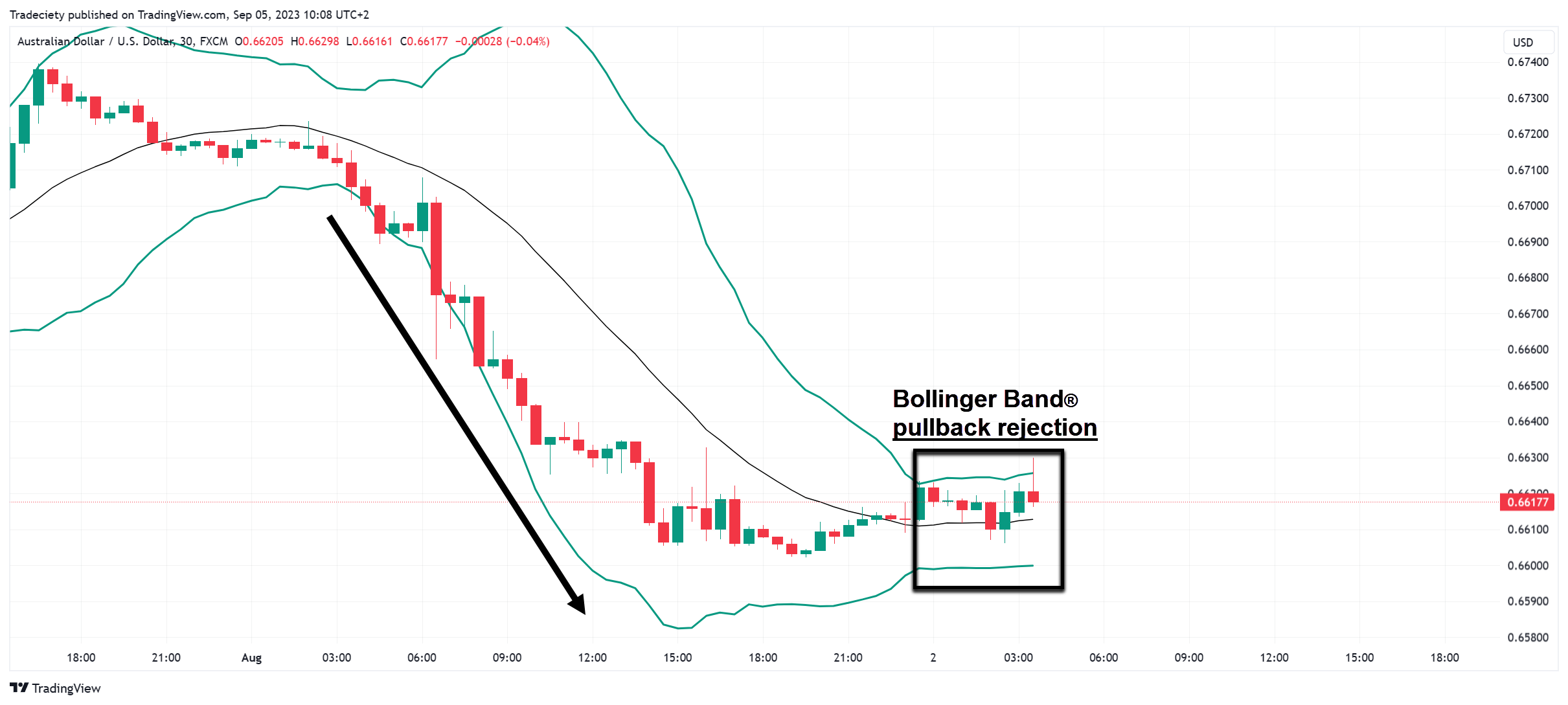

Thus far, now we have seen that breakouts from contractions can foreshadow new trending phases and a robust push exterior of the Bollinger Bands ® will be seen as a pattern affirmation. However the Bollinger Bands ® indicator will also be used for trend-following pullback buying and selling. As soon as a pattern is on its means, merchants sometimes await the value to indicate a pullback section. A pullback is a brief pause within the trending market the place the value strikes sideways or makes a brief transfer into the other pattern route. Evaluating the pullback phases can inform merchants rather a lot concerning the underlying trending dynamic.

The screenshot beneath reveals that the value is in an general down-trending market section as a result of the value stored pushing into the decrease bands. Now, the Bollinger Bands ® began narrowing and the value even reached the upper Bollinger Bands ®. The response across the larger band can inform us rather a lot concerning the market conduct. On this instance, the market simply briefly poked above the upper Bollinger Bands ® after which instantly was rejected. Such a fast rejection transfer will be seen as a rejection of the bullish shopping for try. If such a rejection is adopted by a robust bearish candle, this sequence could foreshadow extra promoting to return.

As we are able to see, after the Bollinger Bands ® rejection, the value began shifting again into the decrease bands instantly and the downtrend continued. The fast rejection, adopted by the sturdy bearish transfer was a perfect pattern continuation sign.

Bollinger Bands ® Spikes

Lastly, we are able to additionally use the Bollinger Bands ® for reversal buying and selling. For that, we’re going to look at the Bollinger Bands ® on the upper timeframe, the Day by day.

On the Day by day timeframe, we search for a value candle that spikes by way of the outer band however will get rejected instantly. The stronger the rejection, the higher the sign is.

Within the screenshot beneath, we additionally see that the spike happens with a fakeout, a failing breakout above the final highs.

Though you’ll use the Bollinger Bands ® sign from the upper timeframe to time your trades on the decrease timeframe away from the spike, we are able to see that the value did transfer decrease on the upper timeframe after the spike.

Bollinger Bands ® spikes could be a nice larger timeframe sign. Particularly when mixed with different confluence elements comparable to larger timeframe help and resistance ranges and different exhaustion indicators.

Closing Phrases

The Bollinger Bands ® indicator is a multi-purpose buying and selling device that can be utilized in some ways as now we have discovered all through the article. Though the Bollinger Bands ® are categorised as an indicator, using volatility and the idea of the usual deviation flip the Bollinger Bands ® indicator into an essential value motion buying and selling device.

The Bollinger Bands ® indicator is good for trend-following buying and selling, and trend-continuation buying and selling, and might even be utilized by reversal merchants.

As at all times, we advocate attempting the Bollinger Bands ® indicator in a backtest first earlier than shifting on to utilizing it in your demo buying and selling to guage its effectiveness and discover the completely different use instances of the indicator.