The CPI figures for Canada will probably be intently watched at present, as predictions level to a rise. Headline inflation is forecast at 3.8% y/y, up from 3.3% y/y in July. If this occurs, will probably be the third consecutive month that the inflation charge has elevated, reaching the very best stage since April and much exceeding the Financial institution of Canada’s goal of two%. The rise in month-to-month CPI is predicted to sluggish from the 0.6% recorded in July to 0.2%.

The interplay of base results and rising power costs is considered the reason for the surge in inflation in August. Nonetheless, numerous service prices pose the obvious constructive threat. Core inflation indicators will in fact take centre stage. Furthermore, a three-month soar within the inflation charge would logically improve the chance of one other charge hike by the BOC, maybe as early as October.

In a speech within the first week of September, Governor Tiff Macklem clarified the financial institution’s place, saying that whereas “financial coverage could also be fairly restrictive”, the financial institution expects to see “much less generalised value will increase” along with a decline in common value will increase. If the financial institution fails to note this sample, it could be pressured to contemplate elevating the coverage charge as soon as once more, particularly if inflationary developments proceed.

Within the FX Markets, the Canadian Greenback has proven power this month, fuelled by a surge in oil costs. Fellow commodity currencies the Australian Greenback and New Zealand Greenback look closely weighted by China’s financial development. This may be seen from the AUDCAD and NZDCAD pairs persevering with to point out weak spot within the -1% vary simply this month. From the January 2023 peak, AUDCAD and NZDCAD have weakened by greater than -9%.

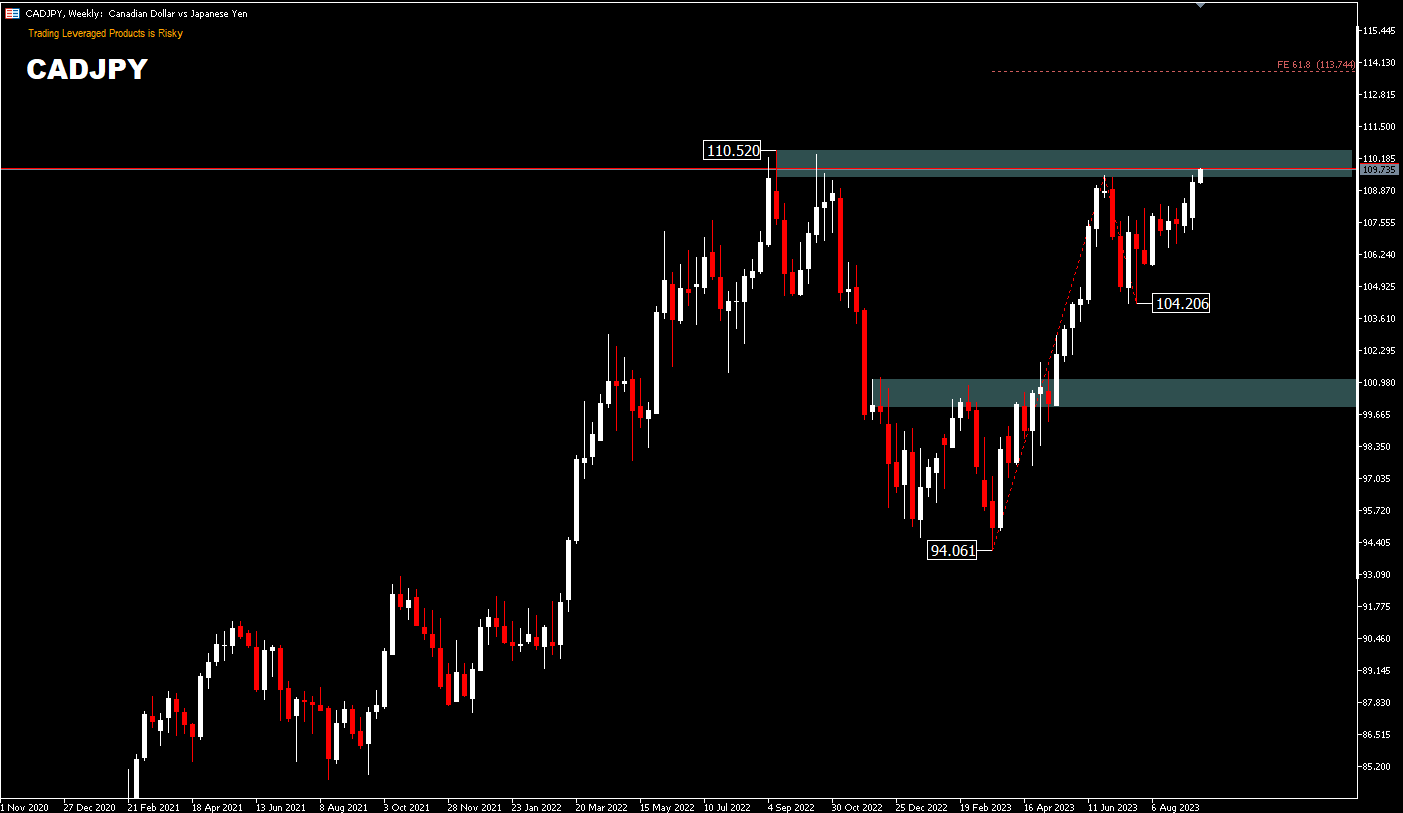

In the meantime towards the Yen, with its tremendous unfastened financial coverage, the CADJPY pair continues to speed up previous the 109.49 resistance mark recorded in late June. This continued rally could quickly strategy the 2022 peak at 110.52. A powerful breakout there would affirm the resumption of a bigger uptrend with a projection of FE61.8% [from 94.06-109.49 drawdown and 104.20 at 113.74]. Nonetheless, the near-term outlook will stay bullish so long as there isn’t any coverage change at this week’s BOJ assembly.

For now, the hurdle on the 110.52 resistance zone would be the essential stage between a continued breakout or a big reversal within the triple prime sample.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is offered as a basic advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

![45446202 - HFMarketsGlobal-Live1 - Hedge - HF Markets (SV) Ltd. - [AUDUSD,Daily] 9_19_2023 2_31_07 PM (2)](https://analysis.hfm.com/wp-content/uploads/2023/09/45446202-HFMarketsGlobal-Live1-Hedge-HF-Markets-SV-Ltd.-AUDUSDDaily-9_19_2023-2_31_07-PM-2-696x403.png)