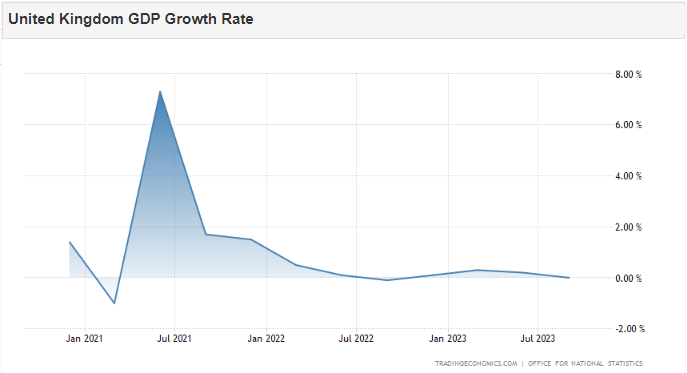

Sterling remained comparatively secure, buying and selling above the $1.22 stage final week, as UK financial progress levelled off in Q3 2023, surpassing expectations of a contraction and doubtlessly averting a recession this 12 months. Q3 GDP was unchanged at 0% q/q, higher than the -0.1% forecast, leading to progress of 0.6% y/y in Q3, greater than the 0.5% determine anticipated by the market. In keeping with the ONS, progress in September was 0.2% m/m, greater than the projected flat end result.

Sterling didn’t obtain a lot help and is prone to stay below strain within the coming days, as markets proceed to strengthen their expectations of a BOE price hike in 2024. The BOE lately saved rates of interest at their highest stage in 15 years, reaffirming its dedication to tackling inflation. UK Finance Minister Jeremy Hunt emphasised sticking to the financial plan to fight inflation for sustainable progress.

UK inflation information shall be launched on Wednesday [15/11]. The headline CPI price is predicted to fall to 4.9% y/y from 6.7%, and the core price to fall to five.6% y/y from 6.1%. Nonetheless, in accordance with the PMI, costs charged by corporations elevated to the best stage in three months in October. The employment report for September on Tuesday [14/11] may be essential, as common weekly earnings may present a glimpse into the path of inflation within the coming months. As well as, on the finish of the week, information from retail gross sales m/m shall be launched.

CPI information displaying higher-than-expected inflation may improve the share of price hikes, and even when it doesn’t occur, it may nonetheless encourage traders to scale back the few foundation factors of price cuts anticipated for subsequent 12 months; not due to a brighter financial outlook however due to considerations that huge cuts to help the financial system may end in inflation getting uncontrolled, which in flip may result in extra extreme financial losses afterward. Nonetheless, if there are not any large upside surprises within the providers and wage figures, then the Financial institution will really feel snug holding charges unchanged in December.

Sterling’s decline, following this better-than-expected GDP determine, means that markets need to see a major upside shock within the information earlier than bidding.

Sterling has been below strain since August, as markets minimize expectations for UK rates of interest, lowering the chance of additional hikes from the present 5.2% and quickly growing bets of a price minimize in 2024. Messages coming from the Financial institution of England counsel, nevertheless, that the latest tightening cycle is certainly over, partially as a result of coverage makers have now saved rates of interest on maintain for 2 consecutive conferences.

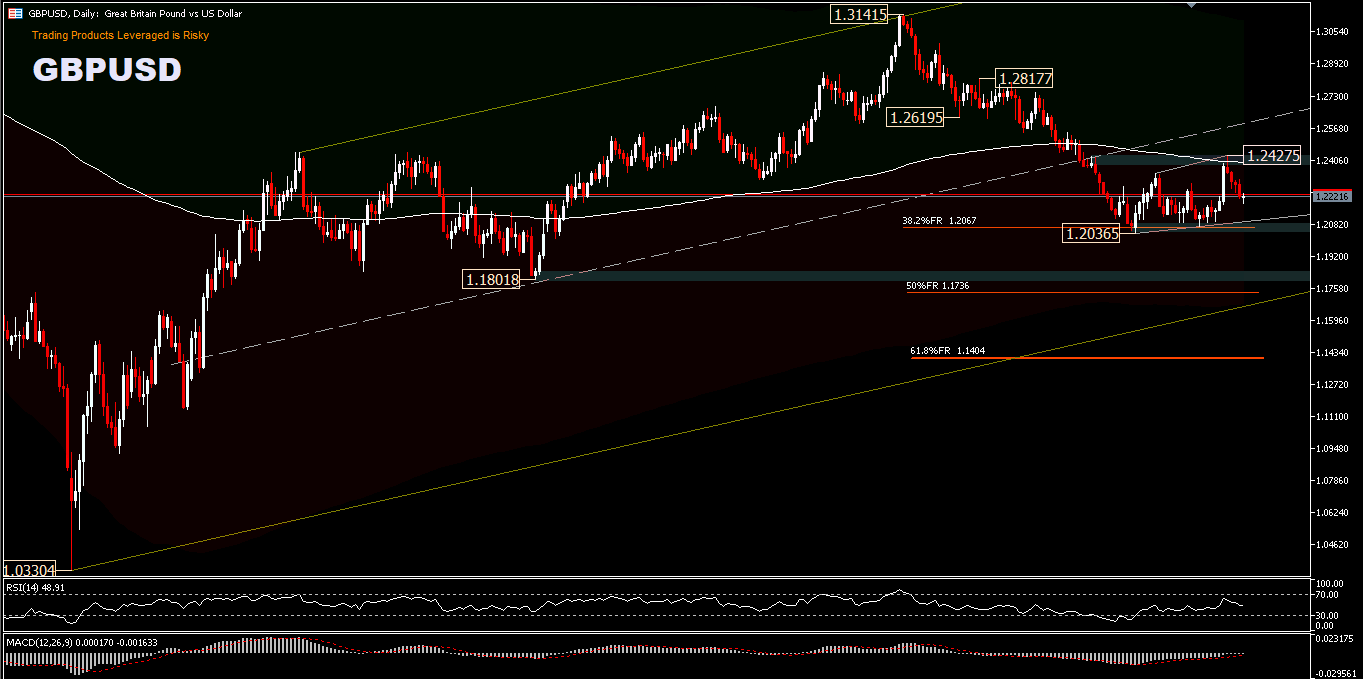

Technical Assessment

GBPUSD within the huge image: The value motion from the medium-term peak of 1.3141 is seen as a correction to the uptrend from the 2022 low [1.0330]. A robust rebound from the 38.2percentFR retracement of 1.2067 [from 1.0330-1.3141 pullback] would counsel that it’s only a sideways sample under the 200-day EMA. Nonetheless, a sustained break of 1.2036 would counsel {that a} deeper correction may take a look at the 50percentFR and 61.8percentFR ranges at 1.1736 and 1.1404, respectively.

Intraday bias [H8] continues to be on the draw back for the time being. The corrective rebound from 1.2036 may have completed at 1.2427 just under the 38.2percentFR pullback stage of 1.3141-1.2036. A deeper drop could be seen again to retest the 1.2036 help zone first. Nonetheless, on the upside, a break of the minor resistance at 1.2307 will scale back the bearish chance and switch the intraday bias to impartial first. Presently, the value stays under the 200 EMA, the RSI is trending detrimental and the MACD is approaching the centre line with its the slope flattening.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Academic Workplace – Indonesia

Disclaimer: This materials is supplied as a common advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.