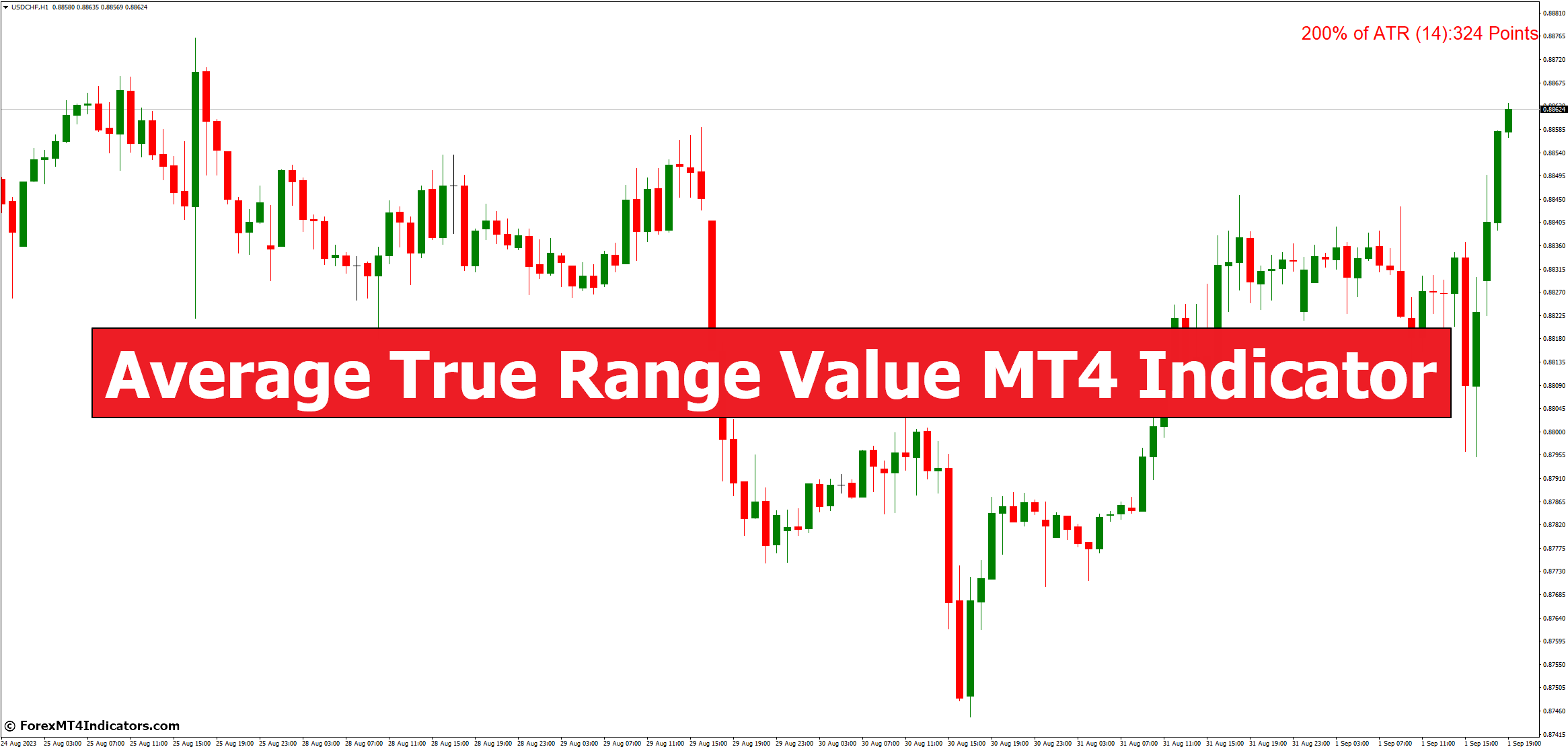

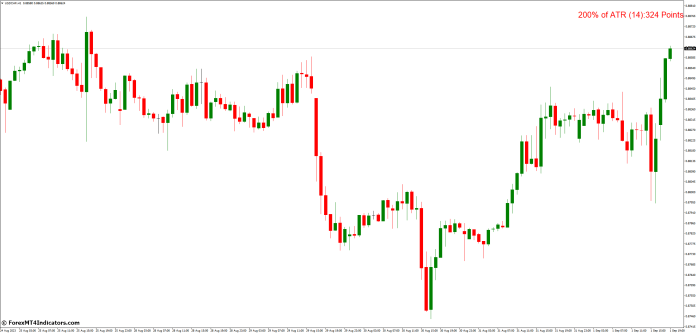

Within the dynamic world of foreign currency trading, having the proper instruments at your disposal could make all of the distinction. Among the many quite a few indicators out there to merchants, the Common True Vary (ATR) MT4 indicator stands out as a precious device for assessing market volatility and making knowledgeable buying and selling selections. On this complete information, we are going to delve into the intricacies of the ATR indicator, its significance in technical evaluation, and the way it can improve your buying and selling technique.

Understanding the Common True Vary

What’s ATR?

The ATR, quick for Common True Vary, is a technical indicator designed to measure market volatility. Developed by J. Welles Wilder Jr., it calculates the common vary between the best and lowest costs over a specified interval, usually 14 durations. This worth is represented in pips or factors and displays the present market’s degree of volatility.

How ATR is Calculated

To calculate the ATR, comply with these steps:

- Decide the True Vary (TR) for every day.

- Calculate the common True Vary over the desired interval (often 14 days).

Significance of ATR in Foreign exchange Buying and selling

Assessing Market Volatility

The ATR offers merchants with a transparent image of market volatility. Excessive ATR values point out better volatility, whereas low values recommend calmer market situations. Understanding volatility is essential for danger administration and setting applicable stop-loss and take-profit ranges.

Setting Cease-Loss Orders

Merchants usually use the ATR to set stop-loss orders. By inserting stop-loss ranges at a a number of of the ATR away from the entry level, merchants can account for market fluctuations whereas defending their positions.

Figuring out Breakout Alternatives

The ATR generally is a highly effective device for figuring out potential breakout alternatives. When the ATR is trending upward, it alerts a rise in volatility, which can precede a major worth motion. Merchants can use this data to identify potential entry factors.

Incorporating ATR into Your Buying and selling Technique

ATR as a Filter

Integrating the ATR into your buying and selling technique can act as a filter, serving to you choose trades that align with present market situations. For example, in case you choose buying and selling in risky markets, you would possibly select to provoke trades when the ATR is excessive.

ATR for Place Sizing

Place sizing is a crucial facet of danger administration. The ATR can help in figuring out the suitable place dimension primarily based on the extent of danger you’re keen to take. The next ATR would possibly result in smaller place sizes to mitigate potential losses.

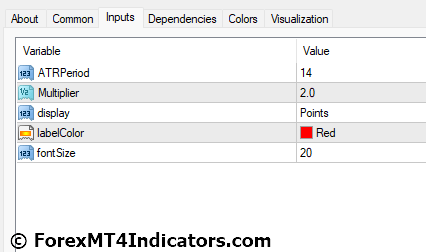

Common True Vary Worth MT4 Indicator Settings

Conclusion

On this planet of foreign currency trading, data is energy. The Common True Vary MT4 indicator empowers merchants by offering precious insights into market volatility. By incorporating the ATR into your buying and selling technique, you can also make extra knowledgeable selections, handle danger successfully, and seize alternatives as they come up.

FAQs

- What’s the optimum interval setting for the ATR indicator?

The default interval for the ATR is 14 days, which is extensively used. Nonetheless, merchants can alter the interval to go well with their buying and selling fashion and preferences. - Can the ATR be used for buying and selling different monetary markets apart from foreign exchange?

Sure, the ATR is a flexible indicator that may be utilized to varied monetary markets, together with shares and commodities. - How can I interpret the ATR worth in sensible buying and selling phrases?

The next ATR worth suggests better volatility and wider worth swings, whereas a decrease ATR signifies calmer market situations. - Is the ATR indicator appropriate for each newbie and skilled merchants?

Completely. The ATR is a precious device for merchants of all ranges, from inexperienced persons trying to handle danger to skilled merchants searching for to fine-tune their methods.

MT4 Indicators – Obtain Directions

Common True Vary Worth MT4 Indicator is a Metatrader 4 (MT4) indicator and the essence of this technical indicator is to remodel the gathered historical past knowledge.

Common True Vary Worth MT4 Indicator offers for a chance to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional worth motion and alter their technique accordingly. Click on right here for MT4 Methods

Really useful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

The best way to set up Common True Vary Worth MT4 Indicator.mq4?

- Obtain Common True Vary Worth MT4 Indicator.mq4

- Copy Common True Vary Worth MT4 Indicator.mq4 to your Metatrader Listing / specialists / indicators /

- Begin or restart your Metatrader 4 Consumer

- Choose Chart and Timeframe the place you wish to take a look at your MT4 indicators

- Search “Customized Indicators” in your Navigator largely left in your Metatrader 4 Consumer

- Proper click on on Common True Vary Worth MT4 Indicator.mq4

- Connect to a chart

- Modify settings or press okay

- Indicator Common True Vary Worth MT4 Indicator.mq4 is obtainable in your Chart

The best way to take away Common True Vary Worth MT4 Indicator.mq4 out of your Metatrader Chart?

- Choose the Chart the place is the Indicator operating in your Metatrader 4 Consumer

- Proper click on into the Chart

- “Indicators record”

- Choose the Indicator and delete

Common True Vary Worth MT4 Indicator (Free Obtain)

Click on right here under to obtain: