Costco is an American multinational company based in 1983, which engages within the operation of over 850 membership warehouses by way of wholly owned subsidiaries. It has been the world’s largest retailer of alternative and prime beef, natural meals, rotisserie rooster and wine since 2016, and ranked within the high 5 largest retailers on the planet since 2022. The corporate is scheduled to report its This fall 2023 earnings on 26th September (Tuesday), after market shut.

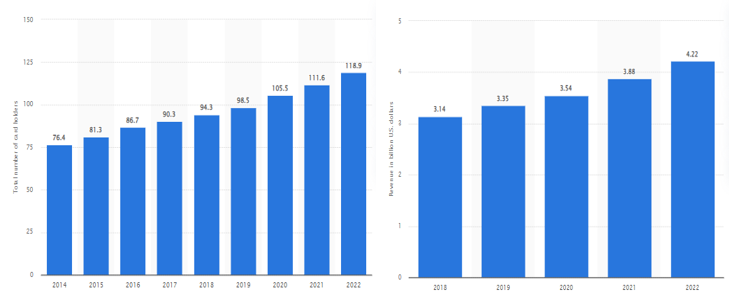

The success of Costco’s enterprise mannequin (which incorporates providing items in bulk at aggressive costs) for many years has actually elevated the variety of its loyal clients who’ve chosen to develop into cardholders. Final 12 months, energetic cardholders amassed to 118.9 million, up 6.5% from 2021. It was below 100 million earlier than 2020. Buyer retention price was excessive (practically 90% membership renewal every year) as nicely, contributed by the standard of the services that Costco presents. The corporate earned $4.22B in membership charge income final 12 months, up 8.76% from 2021 (observe that Costco’s competitor Walmart made solely $2.2B in its Sam’s Membership membership income).

In FY 2022, the corporate reported complete gross sales income at $227.0B, up 15.9% from the earlier 12 months. Along with the above talked about, some components which contributed to strong development of the corporate embrace diminished provide chain prices, elevated penetration of private-label manufacturers, and many others.

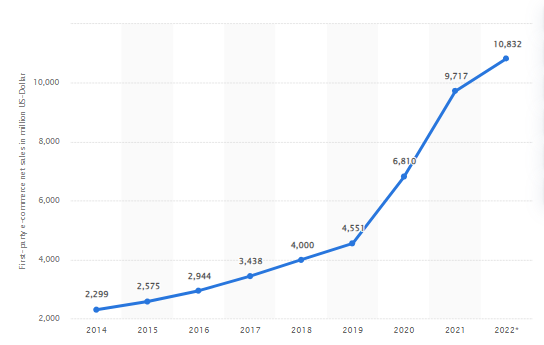

The corporate has additionally been engaged on reversing its shrinking digital gross sales lately (and anyway the share of e-commerce income of the corporate accounts for lower than 10% of the overall income). Some efforts embrace a two-year highway map for bettering and re-platforming the e-commerce web site, cellular apps and cellular web site, in addition to growing the variety of engineering capabilities.

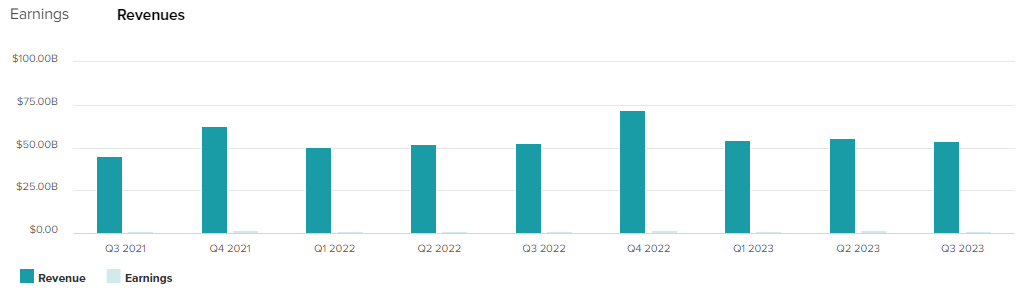

However, Costco’s income stays flat at a median of $54B all through FY 2023. Some headwinds that we must always not ignore on this case are inflationary pressures and the high-interest-rate surroundings. Final week, the Federal Reserve held rates of interest regular at a 22 12 months excessive (5.25%-5.50%), however on the identical time signaled “increased for longer” in close to future. Yet one more price hike is anticipated by the top of this 12 months, whereas there might be fewer cuts than beforehand indicated in 2024.

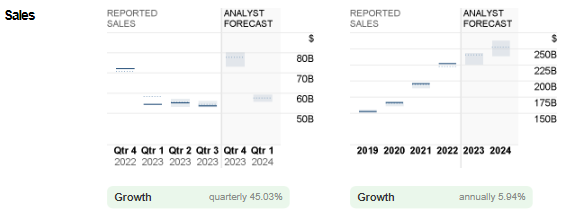

Consensus estimates for Costco’s gross sales income hit $77.8B, a reasonably optimistic outlook in comparison with earlier quarters. In the identical interval final 12 months, reported gross sales had been $72.1B. If the reported determine aligns with the forecast, complete gross sales income for FY 2023 could be $243.5B, up over 9% from FY 2022.

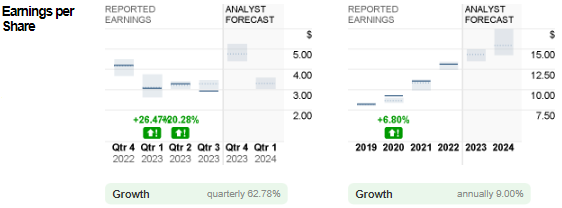

However, EPS is predicted to achieve $4.77, up over 62% from the earlier quarter, and up over 13% from the identical interval final 12 months. Forecast for closing EPS all through FY 2023 was $14.32, increased than in FY 2022 ($13.15).

Technical Evaluation:

The #Costco share worth closed final Friday at $558.73. The closest resistance is seen at $568, a stage that has been examined thrice. A bullish breakout above the stated resistance might put $589 (61.8% Fibonacci Growth) in focus, which can be a brand new excessive since April 2022. The psychological stage $600 and ATH $611.96 would function the subsequent resistance space. Quite the opposite, the 100-day SMA which coincides with FR 61.8% at $533 could be the subsequent goal after the minor help zone $550.50-$552.50. An in depth under this stage would encourage sellers to proceed testing the subsequent stage at $509 (FR 50.0%).

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.