Does silver have a spot in your funding portfolio? Very like its first cousin, gold, silver has many detractors within the mainstream monetary universe. The usual arguments are that it’s topic to broad value swings, doesn’t pay curiosity or dividends, and so there are higher locations to take a position your cash.

Whereas the arguments in opposition to silver are legitimate, there are occasions when silver is usually a stable funding – perhaps even higher than gold.

That’s why it’s good to know the best way to put money into silver, particularly when the dear metallic is rising in worth. Which may be the case proper now, as you’ll perceive higher after studying this text.

Desk of Contents

- Why Spend money on Silver?

- 1. Silver as an Inflation Hedge

- 2. The Silver Provide Deficit

- 3. Purchase Silver for Funding Diversification

- 4. The Gold/Silver Ratio

- Components that Have an effect on the Value of Silver

- Spend money on Silver

- The place to Maintain Your Silver Investments

- Professionals and Cons of Investing in Silver

- Is Silver a Good Funding?

Why Spend money on Silver?

Silver has a protracted historical past of getting used as a financial metallic, even courting again to biblical occasions. It’s typically been known as “the poor man’s gold” as a result of it served an analogous goal among the many decrease courses that gold did for the rich.

That historical past doesn’t essentially imply silver is an effective funding at this time. However there are 4 substantial the reason why holding some silver in your portfolio could also be a good suggestion.

1. Silver as an Inflation Hedge

As a commodity, silver tends to rise in value throughout occasions of inflation, just like the previous few years.

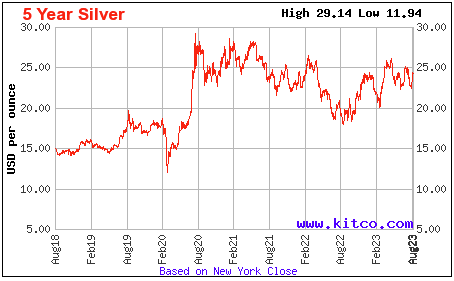

The screenshot beneath (from Kitco.com) reveals the historic value of silver going again to August 2018. Discover that the value hovered round $18 early in 2020, simply earlier than the COVID-19 pandemic. It bounced up and down since however is at the moment sitting at about $24 – roughly 33% greater than it was early in 2020 when the present wave of inflation started.

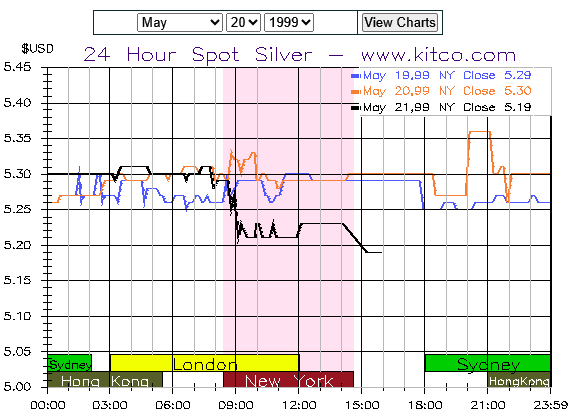

The longer-term chart beneath (additionally from Kitco.com) reveals that the value of silver was hovering simply above $5 an oz in Might of 1999. Meaning the present value of silver has elevated by about 480% over the previous 24 years.

It’s clear from the value motion that silver has confirmed itself to be an efficient hedge in opposition to inflation.

2. The Silver Provide Deficit

Along with its desirability as a financial asset, silver additionally has broad industrial functions. Silver is used to fabricate electronics and photo voltaic panels, so we’ve seen a rise in demand because the world step by step strikes away from fossil fuels. Silver can be used within the manufacturing of knickknack, in addition to held in coin and bar type for financial functions.

In response to The Silver Institute, 2022 and 2023 have seen a scarcity of silver manufacturing relative to world demand. World manufacturing of silver in 2022 totaled 1,004.7 million ounces in opposition to a requirement of 1,242.4 ounces.

The scenario has been repeated so far in 2023, with year-to-date manufacturing of 1024.9 million ounces of silver, versus demand of 1,167 million ounces. The provision deficit is anticipated to proceed as industrial demand continues to develop.

3. Purchase Silver for Funding Diversification

Silver represents a “laborious asset” and provides diversification away from a portfolio comprised solely of paper property, like shares and bonds. Even if you happen to don’t put money into bodily silver, holding the metallic in an exchange-traded fund will improve your portfolio’s variety.

4. The Gold/Silver Ratio

This may increasingly or will not be a related issue sooner or later path of the value of silver, however silver advocates have lengthy pointed to the change within the ratio of the value of gold to silver.

Till 1933, when gold was banned as a medium of alternate within the US, an oz of gold was set at $20, whereas silver was valued at $1. That gave a gold/silver ratio of 20:1. By 1971, that ratio was reset at 35:1.

However primarily based on at this time’s costs, with gold buying and selling above $1,900 and silver at nearly $24, the ratio has now expanded to roughly 80:1.

The idea is that if the ratio ever goes again to its historic norm of 20:1, the value of silver will quadruple even when gold goes nowhere.

After all, that reversion to the historic norm may play out in a really completely different method. The value of gold may fall till it reaches a degree the place it returns to the 20:1 ratio with out the value of silver transferring in any respect.

That’s what makes this issue the least compelling of the 4.

Components that Have an effect on the Value of Silver

Like each commodity or funding, there are big-picture forces that have an effect on the value of silver.

Rates of interest. “Protected property,” like bonds, certificates of deposit, and U.S. Treasury securities, compete with investments that rely totally on value progress. When rates of interest rise, property like silver have a tendency to say no in worth as buyers search predictable returns. Usually, declining rates of interest will assist rising silver costs, whereas rising charges may decrease costs.

The state of the worldwide financial system. Silver is a world commodity, and its value might be intently correlated with the state of the worldwide financial system, and never simply that of the U.S. If world financial progress is accelerating, demand for silver will rise. But when the worldwide financial system is declining, demand for silver will fall, taking the value down with it.

Industrial demand. Silver is a vital commodity within the manufacturing of batteries for electrical vehicles. Provided that the manufacturing of electrical automobiles is a progress business, that creates higher demand for silver.

Geopolitical points. Many of the world’s silver is produced in non-western/non-industrialized international locations. China and Russia are two of the most important suppliers. Worldwide conflicts, commerce wars, civil unrest, and even pure disasters could cause not less than a short lived scarcity of silver.

Pure provide. The value of silver will be affected by adjustments on this planet’s estimated quantity of silver reserves. For instance, discovering a big new supply may decrease the value. Conversely, the exhaustion of a big at the moment producing mine may elevate the value of silver.

Spend money on Silver

In case you imagine silver is price investing in, you might want to determine on one of the simplest ways to take action. Silver will be held both in bullion type (bodily bars or cash) or by paper property, like shares, ETFs, and futures contracts.

Silver Bullion

Bullion is a traditional solution to put money into silver because you’ll really take possession of the metallic. That may be achieved with both silver bars or silver cash. Both will be bought by standard metals sellers, like Blanchard & Firm, Goldline, or Kitco. You’ll have the choice to retailer your silver with the corporate you buy it from or to take possession of it your self.

Various kinds of silver cash can be found, however the preferred are formally minted cash, just like the one-ounce American Eagle or the Canadian Maple Leaf. Every will be bought for the value of a single ounce of silver plus a small markup for the vendor.

Alternatively, you should purchase bullion in bar type. These will be in denominations of between 10- and 100-ounce silver bars. They may also be out there for the value of their silver content material plus a markup. However the markup might be lower than it’s for particular person cash.

Numismatic cash. These are cash valued primarily due to their rarity reasonably than the bullion content material. They’re sometimes older cash, particularly these minted earlier than 1933 within the U.S. However they’re valued due to their situation and rarity and don’t characterize true investments in silver.

Benefits:

- Bullion is a pure play on silver investing.

- Silver cash will be purchased and offered domestically with different people.

- Silver bullion has related qualities to gold bullion, however at a fraction of the value – just about anybody can afford to purchase some silver.

- Like gold, silver is without doubt one of the few property that isn’t concurrently another person’s legal responsibility (like bonds and even shares)

Disadvantages:

- Supplier markups on particular person cash will be as excessive as 8% to 10%

- There are extra prices for storage, whether or not you retailer it by the vendor or at dwelling. In both case, it’s going to should be insured.

- Whereas there’s something of a personal marketplace for silver cash, they’re considerably illiquid.

- Silver bullion bars are even much less liquid.

Silver Shares

Siver shares are a extra oblique solution to put money into silver. That’s since you’re shopping for shares of corporations that produce silver however sometimes personal little or no.

Regardless of the significance of silver as an industrial commodity, there are comparatively few corporations concentrated in silver manufacturing alone. Many additionally mine and/or refine gold and different metals. To search out silver shares, do an online search utilizing one thing much like “finest silver shares” for the reason that lineup of potential corporations does change over time (and we’re not within the enterprise of recommending particular person inventory investments on this web site).

In case you do put money into silver shares, bear in mind that they contain all of the dangers of proudly owning silver, along with the standard market threat related to inventory investing. A kind of dangers is that the value of the inventory can collapse even whereas the value of silver rises.

However that stated, silver shares could carry out even higher than silver throughout a bull run within the metallic itself.

Benefits:

- Silver shares can outperform silver, producing greater returns throughout silver bull markets or decrease losses throughout silver bear markets.

- You’ll be able to diversify between numerous silver corporations.

Disadvantages:

- Silver shares should not a direct method of proudly owning silver itself.

- A silver firm’s inventory can collapse even whereas silver costs are rising.

- Extra speculative silver shares are corporations engaged in exploration, which may result in unsuccessful searches

Silver Bullion Change Traded Funds (ETFs)

As a substitute of holding silver bullion bodily, you may put money into it by an ETF. Such ETFs maintain silver bullion at a central location, enabling you to buy shares in these holdings.

Silver ETFs observe the value of silver bullion and have the benefit of being extra liquid than the metallic itself. And since they’re ETF shares, they will often be bought and offered by standard funding brokers commission-free.

Examples of silver bullion ETFs embrace abrdn Bodily Silver Shares ETF (SIVR) and the iShares Silver Belief (SLV) (Creator disclosure: I’ve invested in shares of SLV up to now).

Benefits:

- You’ll maintain an funding in an equal quantity of silver without having to take possession of the metallic itself.

- Shares in an ETF will be simply purchased and offered.

- ETF shares are often traded commission-free.

Disadvantages:

- Although you can be holding shares in a silver ETF, it’s not the identical as holding the bodily metallic.

- ETFs have been recognized to liquidate. The Invesco DB Silver Fund (DBS) was liquidated on March 10, 2023.

Silver Futures

Silver futures are a method of betting on the value of silver with out placing up a considerable amount of capital. Since futures contain a considerable amount of leverage, you may put up a small amount of cash to buy an possibility on the value of silver. You’ll be able to both guess on a value improve or decline and nonetheless make cash.

However the leverage concerned in choices additionally means you may lose more cash than if you happen to’re placing up a money place. If the value of silver strikes in opposition to your possibility, your whole place might be worn out. Silver futures are extra of a play on silver value motion than on the metallic itself.

Benefits:

- A chance to leverage a small amount of cash for important good points in case your possibility place goes in your favor.

Disadvantages:

- Probably not a play on silver itself, however on its value actions.

- Futures should not a long-term play.

- Your entire place will be worn out if the choice goes in opposition to you.

The place to Maintain Your Silver Investments

We’ve already lined bodily silver bullion cash and bars, which will be held both with the metals vendor the place they’re bought or in your possession if that’s what you select.

However if you happen to’re going to put money into silver shares, silver futures, or silver ETFs, you are able to do that by an funding brokerage account.

Examples embrace M1 Finance (which may also handle your investments for you), Ally Make investments, and SoFi Make investments. Every will allow you to open an account with no cash, commerce shares and ETFs commission-free, and have interaction in self-directed buying and selling.

Professionals and Cons of Investing in Silver

Professionals:

- Sturdy industrial demand signifies future stable value motion.

- Represents a diversification away from a portfolio of paper property.

- The value of silver typically rises in response to inflation.

- Silver has a protracted historical past as a financial metallic, which is unlikely to vanish sooner or later.

- It’s inexpensive than gold, making it appropriate for small buyers.

Cons:

- Usually puffed up with predictions of dramatic value will increase

- Silver bullion must be insured and guarded, which will be expensive.

- Silver doesn’t generate money circulate, like curiosity or dividends.

- Costs can swing wildly in just some days, making utilizing leverage (margin) much more dangerous.

- The value of silver is closely influenced by adjustments within the value of gold, which might distort the silver value both greater or decrease.

Is Silver a Good Funding?

It’s not attainable to know if silver, or every other funding, might be a good selection at this second. There have been occasions up to now when silver has confirmed to be a extremely worthwhile funding and others when it has both languished and even declined.

Due to the uncertainty surrounding this asset class, it is best to put money into it solely with a small slice of your portfolio. Silver, like different commodities, is infamous for broad value swings. This has to do with all of the forces that have an effect on the value of silver, but it surely’s protected to say none of these will disappear sooner or later, regardless of the promising progress in industrial demand for the metallic.