What do teen peer strain, wearable gross sales tendencies, and hybrid work must do with SMBs and value-added companies for Group & Voluntary advantages? Properly, let’s discover out.

Teen peer strain offers Apple a brand new platform for rising wearable use in Gen Z.

At the moment, 87% of Gen Z teenagers who personal a smartphone, personal an iPhone, versus an Android or different smartphone.[i] Apple opponents blame peer strain for the regular progress (a significant bone of competition is the inexperienced textual content bubble that iPhone customers obtain from non-Apple units). It doesn’t matter what the reason being, nonetheless, with practically 90% model penetration into an essential group, these iPhone purchases are ushering Gen Z teenagers into the world of Apple. From right here on, they proceed to purchase different Apple merchandise, such because the Apple Watch, and they’re going to persistently make the most of Apple companies similar to ApplePay.

The Apple Watch is extra essential to the way forward for Group & Voluntary advantages than insurers might imagine. The reason being that wearables stand to influence total worker populations by being able to enhance well being and wellness outcomes. And, that is the important thing, total worker populations are part of the rising market of wearables. Wearables are getting extra common amongst a broad spectrum of sub-groups, together with:

- Extraordinarily-health-conscious folks who’re fascinated about all of their well being information for coaching causes.

- On a regular basis customers who’re merely fascinated about keeping track of their well being whereas pursuing average well being targets.

- “Linked” know-how lovers who wish to periodically untether from their telephones whereas staying tethered to their data (monetary, social, — not simply well being information.)

- Folks with continual circumstances who want to observe a few of their numbers for medical functions.

Even when a Group or Voluntary advantages supplier doesn’t presently see a have to make the most of wearables, wearable information, or linked experiences, they need to severely start contemplating how and the place employers may profit from services that may be tied to wearables. Because the market grows, SMB expectations proceed to evolve as nicely. HR groups can be asking for linked services. It’s a development that’s too huge to disregard. Staff themselves can be searching for methods they will use their wearables to enhance their work and private lives.

Wearable gross sales tendencies are robust and never slowing down. SMBs have to know that well being monitoring is on the rise.

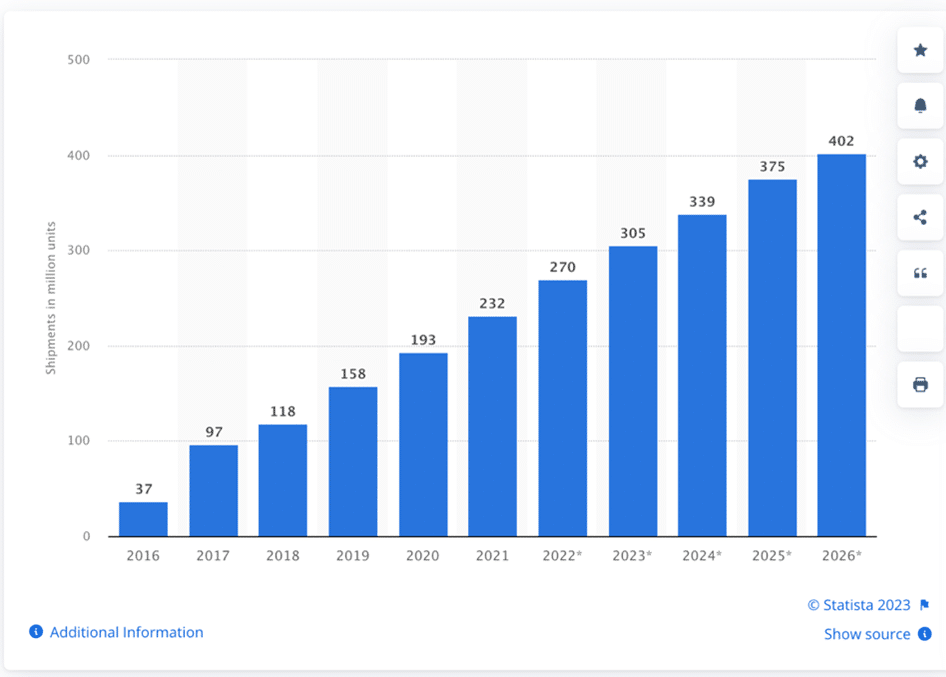

Wearable progress will even proceed to be on the rise amongst practically all ages group, not simply Gen Z. In truth, 34% of all customers already personal a smartwatch, but by 2026, wearable cargo tendencies will proceed to develop simply as quick as they’ve for the final 10 years. Because of this the marketplace for wearables isn’t displaying indicators of saturation.[ii] It’s solely displaying indicators of larger adoption and integration.

Determine 1: Sensible wearable shipments worldwide from 2016-2026. Statista

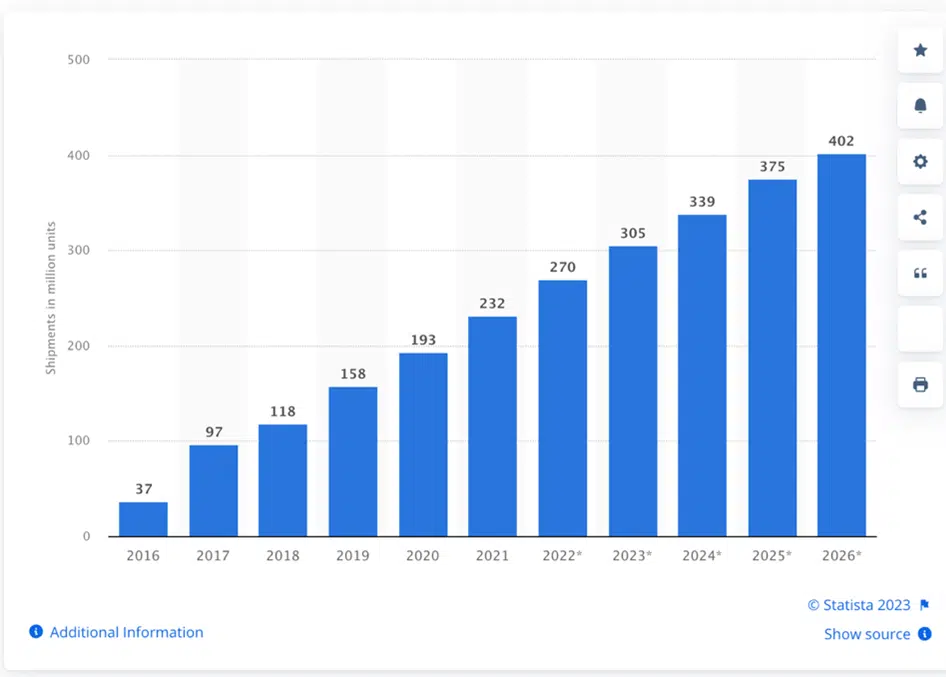

The result’s that, typically, worker populations are paying extra consideration to their well being they usually could also be getting more healthy. Pundits may say that the wearable market progress doesn’t essentially predict wearable utilization for health-related functions, however well being apps are additionally in fast progress mode. In 2022, well being apps introduced in $8.2 billion and by 2030, they’re predicted to usher in $35.7 billion.[iii] For Group & Voluntary advantages suppliers, this can be a golden alternative for improvement — both creating wearable apps that hyperlink to new merchandise or value-added companies — or partnering with one of many many new well being apps to hyperlink app and information utilization.

Determine 2: Complete Annual Income within the Well being App Trade

Hybrid workforce getting more healthy, commuting much less, and utilizing their time extra properly.

Quickly after the pandemic, companies small and huge started to contemplate the way forward for distant work. “What are we going to do about distant work? Is hybrid work going to assist us or damage us?” It didn’t take monetary groups lengthy to determine that hybrid and distant work may lower down on workspace bills, assist construct loyalty amongst workers, and even contribute to the rising expertise challenge by permitting SMBs to rent for some roles exterior of their geography.

What they didn’t know was that hybrid and distant work may enhance worker well being. A current research by IWG decided that in a sampling of two,000 hybrid employees, hybrid employees are exercising extra (virtually 90 minutes extra per week on common). They’re commuting much less, which contributes to environmental targets and has “led to an additional 71 hours of sleep per yr.” And, practically 1 / 4 of hybrid employees have misplaced weight — 20 lbs. or extra. As well as, hybrid employees are consuming more healthy.[iv]

What’s the potential influence of those tendencies from a Group & Voluntary advantages perspective?

- Life, supplemental life, CI, most cancers, and hospital indemnity insurance policies might even see a gentle enchancment in claims ratios.

- Conventional well being plans may see a marked enchancment in SMB protection for SMBs who make the most of hybrid workers.

- Train could also be prepared for its personal sort of insurance coverage or value-added service merchandise that transcend voluntary accident insurance coverage.

- Reductions for wearable customers might enhance gross sales of these merchandise as wearable use rises.

- Hybrid and distant employees are driving much less. Group & Voluntary Auto/House insurance policies might be created particularly for the no-commute/low-commute worker.

- Profit incentives might be created for SMBs that select to make use of hybrid employees for a sure proportion of their workforce.

- Group & Voluntary advantages suppliers can now have a look at the entire realm of product and repair alternatives in a special gentle than they’ve prior to now.

- Most Group & Voluntary core methods aren’t but ready to satisfy at the moment’s SMB alternatives.

Dozens or lots of of potential services will turn into rather more viable in gentle of those three tendencies. The actual query is: are SMBs prepared for these new services proper now or will it take time for them to understand the potential of latest choices? Majesco discovered the reply in our surveys of SMB decision-makers — was a powerful sure!

SMBs and Staff are Prepared for Extra Than Insurers Can At the moment Present

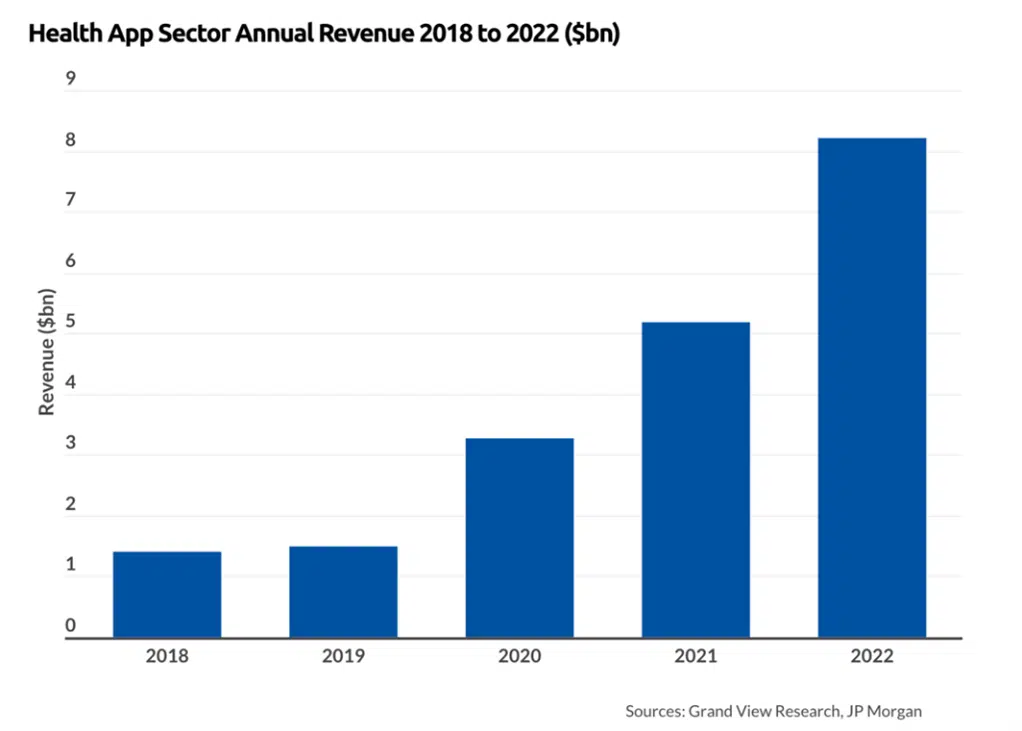

Throughout the board, there’s a vital buyer expectation hole between what clients need – no matter generational group – and what insurers are delivering, as represented in Determine 3. These value-added companies present tangible worth and improve general wellness with alerts and extra.

As well as, these choices may collect extra customized information to reinforce their pricing in addition to their general expertise. Many are “low hanging fruit” that may not take a number of effort, however will create large worth and begin insurers down the highway to a extra holistic, valued providing and expertise for patrons.

Determine 3: SMB-Insurer gaps in value-added companies for group/voluntary advantages

A key technique for insurers to deal with buyer expectations is to extend the worth of the merchandise they provide. To take action, insurers ought to bundle, or provide for a worth, value-added companies that reach the worth of the chance product/coverage, similar to incomes factors for wellness that can be utilized to purchase issues, annual monetary planning evaluation, roadside help, and extra.

Worth-added companies can create new income alternatives whereas additionally strengthening the shopper relationship, loyalty, belief, and worth.

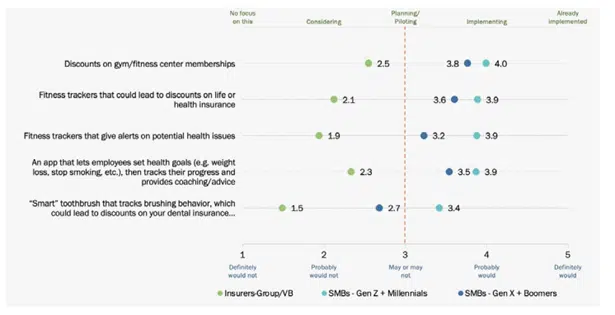

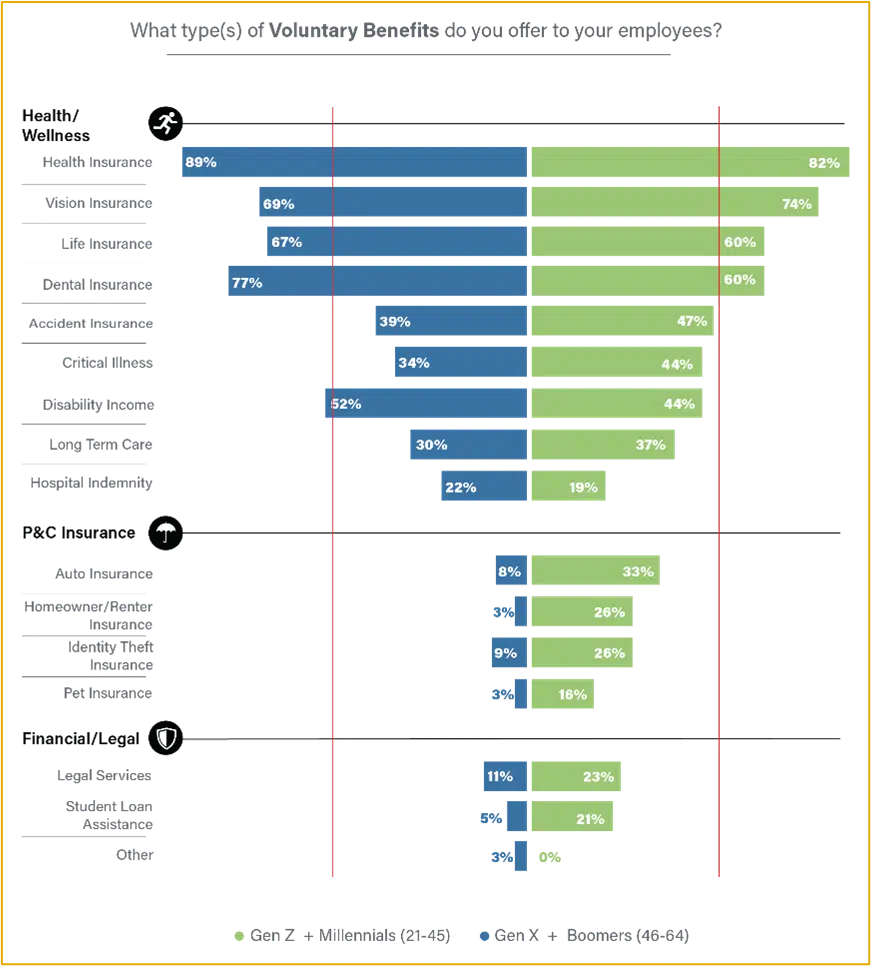

As SMB firms are rising their advantages choices for workers, it’s clear that they’re eager about holistic safety for his or her workers that can embody well being, wellness, monetary stability, social and emotional assist, and every kind of safety. When Majesco checked out what varieties of advantages SMBs had been providing, there was a pointy distinction between Gen Z/Millennials and Gen X/Boomers. (See Determine 4.) These variations spotlight the path of SMB advantages choices. To satisfy the wants of SMBs, insurers should put together, not only for new merchandise, however for completely new methods to soak up and handle information.

Determine 4: Voluntary Advantages provided

Innovating to Meet the SMB Market Calls for

The necessity for innovation round worker advantages and coverages for a youthful era who’ve completely different way of life wants and for an older era that need to port insurance coverage after retirement or may fit as an on-demand/Gig employee are collectively a dominant a part of the workforce. Progressive new plans and insurance coverage choices and portability are more and more essential to draw and retain workers in addition to preserve them as clients as they modify jobs.

Insurers should strike the proper stability when it comes to the product, value-added companies, and expertise to assist the breadth of generations inside the workforce. With the emergence of a extra diversified office throughout all generations, workers, and subsequently, employers, count on a broader portfolio of group and voluntary advantages merchandise that can meet their private wants, life stage, and way of life. Whereas many employers proceed to supply the normal merchandise of well being, dental, imaginative and prescient, STD, LTD, and life, there may be an rising demand for brand spanking new, revolutionary merchandise in addition to monetary wellness choices.

To retain and develop their enterprise, insurers should rethink their scope to a broader way of life expertise throughout well being, wealth, and wellness.

The alternatives are nonetheless rising, however capturing them requires applied sciences that aren’t presently utilized by most Group & Voluntary advantages suppliers — as a result of most are on decades-old legacy methods! Sure legacy methods are usually not a roadblock to the longer term.

Majesco has created core options for group and voluntary advantages and value-added companies that won’t solely deliver insurers into the digital age however will even put together to provide the information and analytic suggestions insurers and employers have to optimize their choices. That is essential! With out the power to adequately deal with information, insurers gained’t get probably the most out of their buyer relationships, both with the employer or with the worker. Majesco is working with various insurers who’re bringing revolutionary group advantages merchandise to market, together with value-added companies to satisfy the calls for of a quickly altering employer and worker market.

Discover out extra about Majesco’s market-leading options that deliver what you want for the longer term at the moment together with L&AH Clever Core Suite, Majesco IDAM, Clever Gross sales & Underwriting Workbench, and Digital 360 options which are serving to Group and Voluntary insurers meet the rising calls for of employers and their workers.

For an in-depth have a look at the outcomes of Majesco’s SMB buyer surveys, you may obtain, Bridging the Buyer Expectation Hole for Group and Voluntary Advantages.

[i] Mok, Aaron, Apple has a surprising stranglehold over GenZ — and it’ll repay for many years to come back, Enterprise Insider, October 2023.

[ii] Laricchia, Federica, “Sensible wearable shipments forecast worldwide from 2016 to 2026,” Sept. 12, 2023, Statista

[iii] Wylie, Louise, Well being App Income and Utilization Statistics (2023), August 16, 2023, Enterprise of Apps

[iv] Tsipursky, Gleb, “Does Hybrid Work Result in a More healthy Workforce?,” Forbes, March 30, 2023