The Value Motion Finder Multi indicator is an indicator of entry factors that searches for and shows Value Motion system patterns on dozens of buying and selling devices and on all customary time frames: (m1, m5, m15, m30, H1, H4, D1, Wk, Mn). The indicator locations the discovered patterns in a desk on the backside of the display screen. By clicking on the sample names within the desk, you may transfer to the chart the place this sample is situated.

Value Motion. Sample Checklist

- Pin Bar (Pin)

- Outdoors bar (OB)

- Inside bar (IB)

- PPR

- Pressure bar

- The hanged man (HM)

- Inverted hammer (HR)

Patterns which can be enabled by default are proven in crimson. They’ve confirmed themselves to be probably the most dependable. In exterior parameters you may allow different patterns of the system.

Logic of the indicator. Chart

As soon as positioned on the chart, the indicator will mechanically start trying to find Value Motion patterns. When a sample is discovered, the indicator will instantly show it on the value chart. The indicator shows ascending patterns in inexperienced, and descending patterns in orange.

Variety of patterns. Chart

By default, the indicator shows patterns solely on the final 15 candles. The parameter “ShowLastBarsChart” = 15 is liable for this. In essence, the patterns of the Value Motion system are a mixture of 2-3 candles. Subsequently, if you wish to obtain solely present patterns, you may change the “ShowLastBarsChart” parameter to five. See the instance under:

If you wish to see how the system works on historical past, you may improve the “ShowLastBars” parameter, for instance, by 1500.

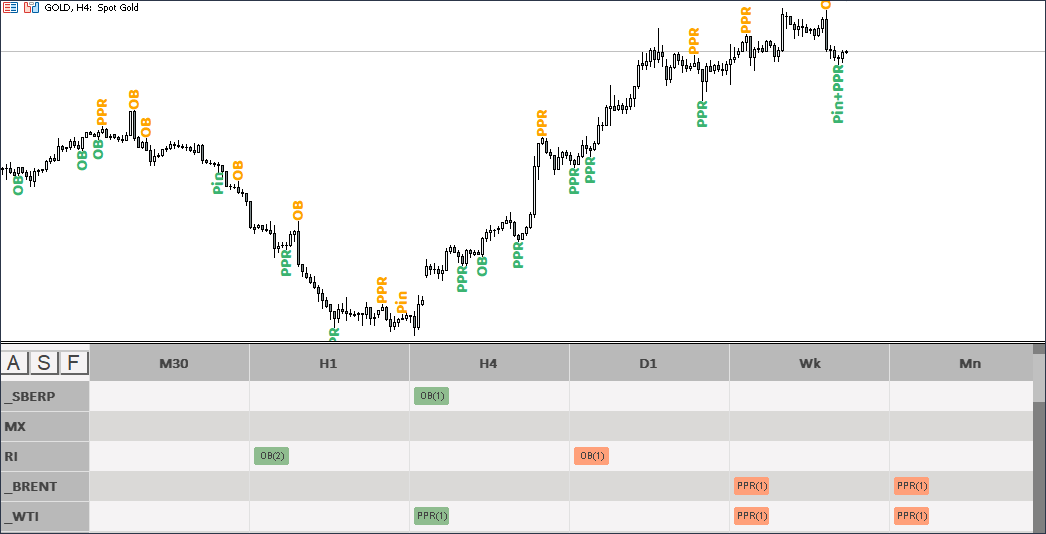

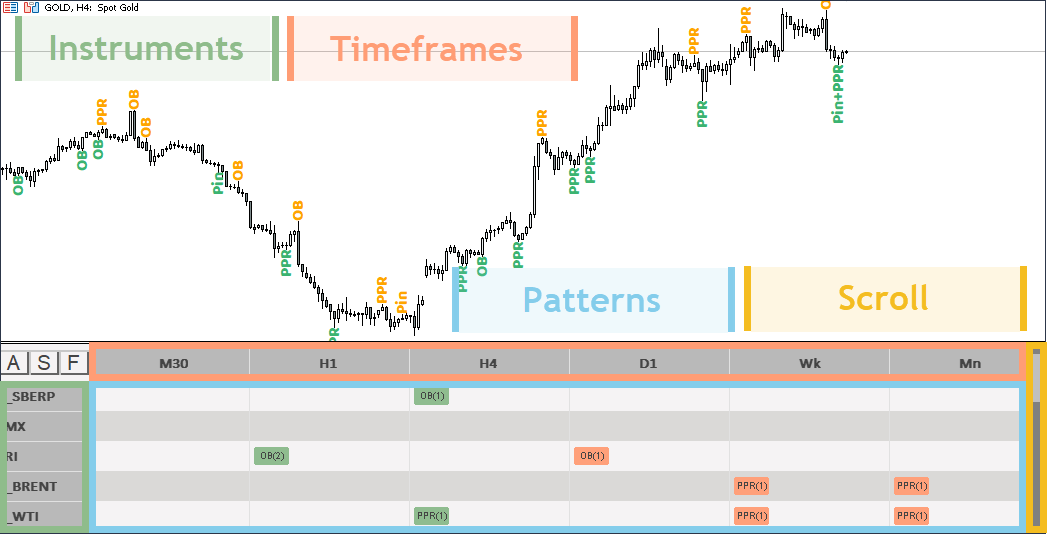

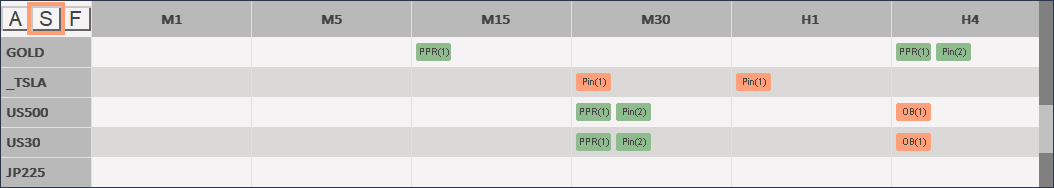

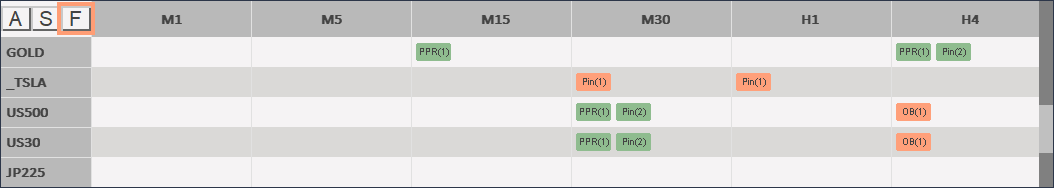

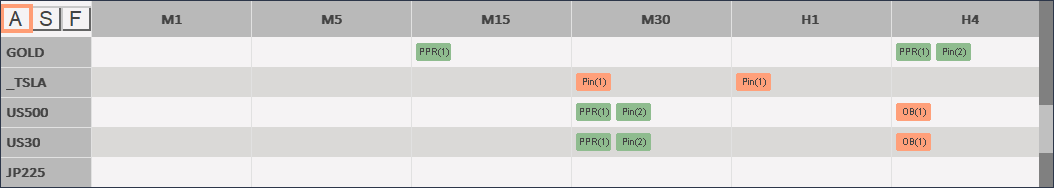

Logic of the indicator. Desk

The primary activity of “Value Motion Finder Multi” is to seek for patterns in all potential markets and all potential timeframes. To implement this concept, we made a desk that comprises data on all discovered patterns. The image under schematically exhibits its (desk) construction:

Devices

You should utilize any devices that your dealer permits. For instance, these could possibly be forex pairs, shares, indices, metals, oil and fuel, cryptocurrency, and so forth. To be able to customise the record of displayed devices, go to the exterior parameters of the indicator and double-click on the sector with a listing of devices reverse “Symbols“.

![]()

After double-clicking, the sector with the instruments will turn into lively and you’ll enter those you want. Please notice that it should be written separated by commas and precisely as it’s indicated in your dealer’s market evaluate.

Timeframes

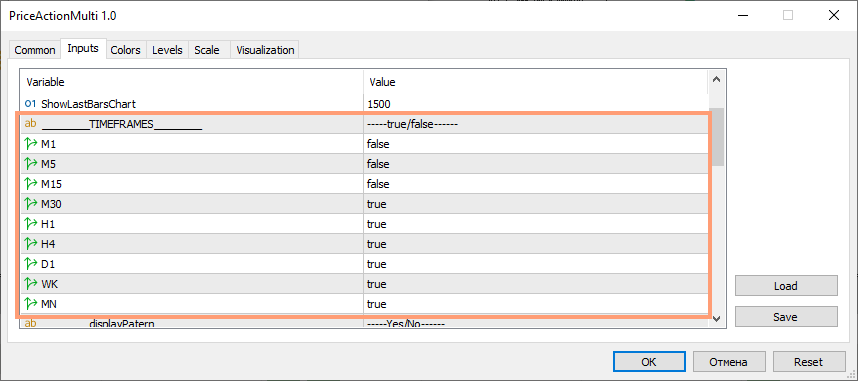

The indicator comprises solely basic timeframes: m1, m5, m15, m30, H1, H4, D1, Wk, Mn. All of it may be turned on and off within the exterior parameters of the indicator. See instance under:

Patterns

All discovered patterns fall into the cells of the indicator desk. Promote patterns are displayed with crimson squares, and purchase patterns are displayed with inexperienced squares. To the best of the sample title is its age in bars or candles. While you click on on a sample, the instrument we’d like on the timeframe we’d like opens on the chart above the desk. See instance under:

Transition pace

Please notice that with fundamental settings, when switching from sample to sample in each variations of the terminal, it takes about 1 second. Fundamental settings assume the next timeframes: m30, H1, H4, D1, Wk, Mn. When including smaller timeframes, equivalent to m1, m5, m15, the transition pace could lower, and the transition itself will take a median of 2-3 seconds.

Handbook scanning

In a scenario the place many of the markets are closed (for instance, on the weekend), computerized scanning, which often works by default, won’t work. You’ll be able to scan charts manually by clicking on the “S” button situated within the higher left a part of the indicator panel.

Scrolling a desk

In several variations of the terminal, scrolling the desk is completed in a different way.

Within the model for MT5, the indicator works in probably the most handy manner – scrolling is completed utilizing the mouse wheel:

Within the model for MT4, scrolling is completed manually by dragging the slider on the best with the mouse.

First launch of the indicator

Earlier than launching the indicator, make it possible for there’s sufficient free house on the disk the place you have got put in the buying and selling terminal. A minimal of 20 gigabytes is required. This is because of the truth that the indicator wants quotes to seek for patterns. For instance, if the indicator analyzes 20 devices on 8 customary timeframes, then it requires quotes from 240 charts per unit of time. And it take up free house.

I additionally draw your consideration to the truth that the smaller the analyzed timeframe is, the extra quotes it requires. Subsequently, by abandoning the m1, m5 and m15 timeframes, you’ll considerably scale back the prices of the indicator. These quotes take up many of the free house. The indicator will work sooner and can obtain much less data.

Additionally, when the indicator is launched for the primary time, rectangles with patterns within the desk could blink. That is defined by the truth that the indicator tries to seek out patterns on charts whose quotes are within the strategy of downloading. As quickly as this course of is accomplished, the desk will cease blinking and the indicator will return to regular.

Filter system. Buying and selling with the pattern

The Value Motion system is beneficial for use to a larger extent in pattern buying and selling. For this function, we now have carried out a filter system within the indicator that filters out countertrend alerts and leaves solely pattern ones.

Development motion might be outlined in several methods. For instance, utilizing the Alligator indicator or the shifting common. For our filter, we selected an exponential shifting common with a interval of 13. This filter is utilized by Alexander Elder in his “Three Screens” system.

Within the “Three Screens” system, the pattern is filtered one time-frame above the working timeframe. For instance, if we open a commerce on H4, then we decide the pattern by D1. If we open a commerce on H1, then the pattern is filtered by H4.

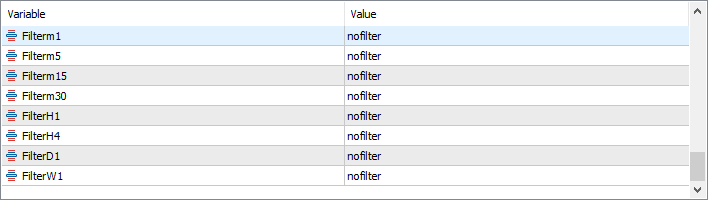

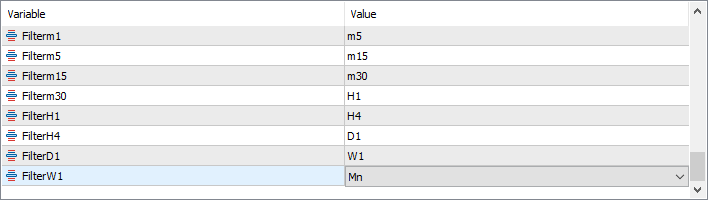

Within the exterior parameters of the indicator, you may choose a pattern timeframe for every present timeframe.

To be able to do that, double-click on “nofilter” subsequent to every timeframe and choose the timeframe on which the pattern filter will work. For instance, within the image under, for every timeframe, I chosen a filter one timeframe older:

If you want, you may experiment with the filter system and select, for instance, filtering by the present timeframe, however it is suggested to make use of the settings above.

After organising your filters, do not forget to show them on. To do that, press the “F” button on the indicator panel.

Filter enabled. Instance on the chart

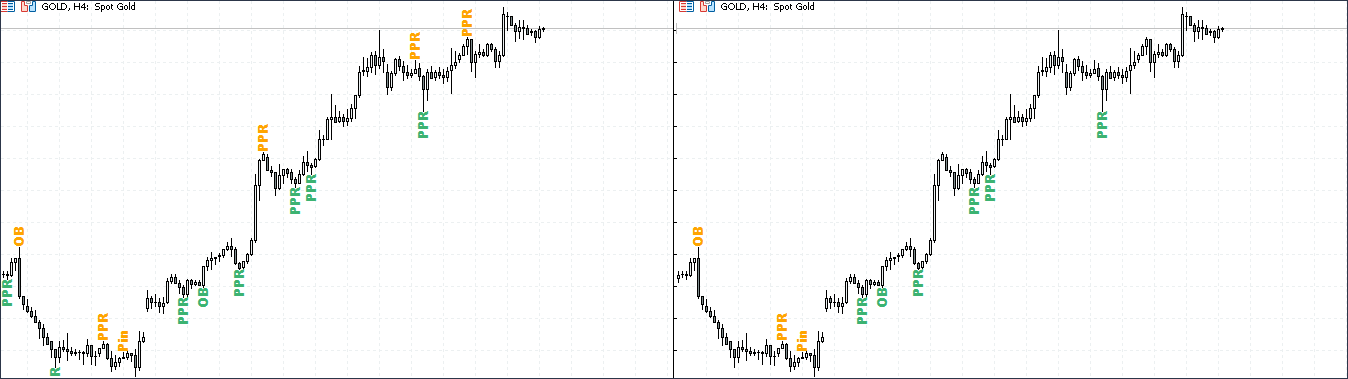

Within the image under you may see the distinction between the filter being on and off. Within the chart on the left, the filter is turned off, and within the chart on the best, it’s on.

Please notice that within the chart on the best, the place the present timeframe is H4 and the filter is turned on, the indicator shows patterns solely on that a part of the chart that’s above the shifting common on the day by day timeframe.

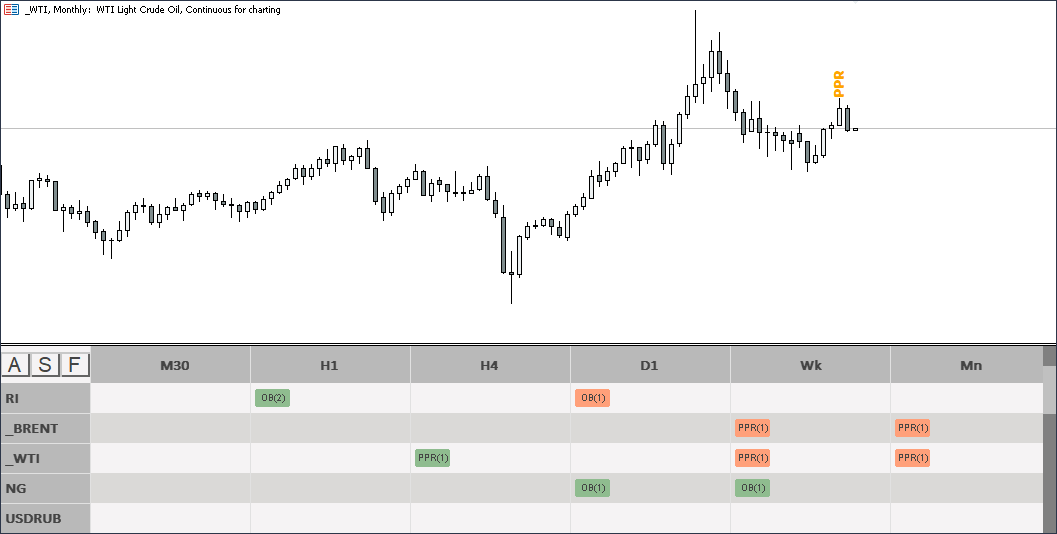

Filter enabled. Instance within the desk

Within the instance under you may see how the scenario within the desk modifications once you click on on the filter button. All counter-trend patterns are instantly deleted and solely pattern ones stay.

The filter system could be very appropriate for novice merchants who don’t but know learn how to decide a pattern manually. For extra skilled ones, I like to recommend not utilizing the filter system in any respect, in order to not miss countertrend alerts, which might generally even be very helpful.

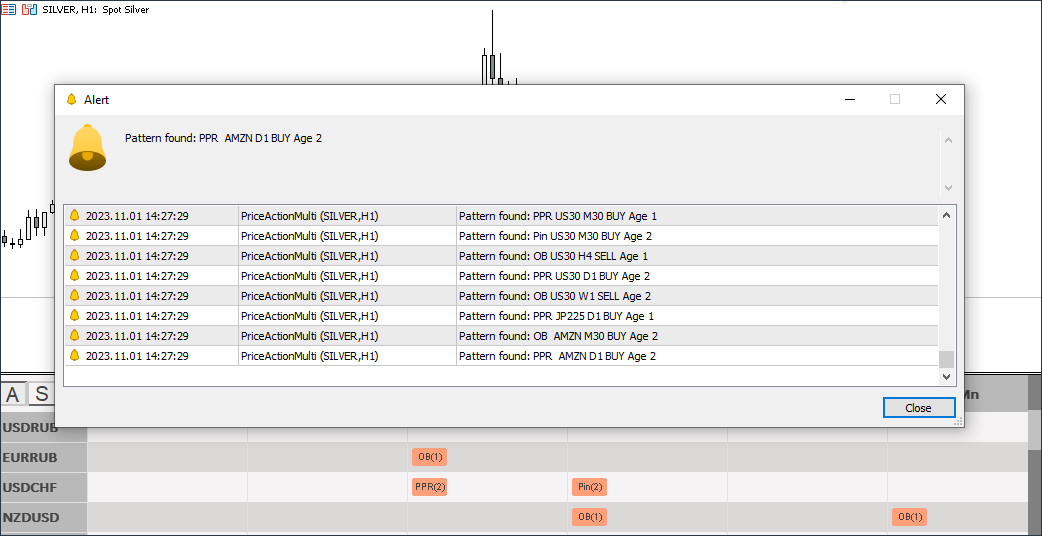

Alert system. Description

We’ve carried out a system of Alerts and Push notifications within the indicator. Alerts are activated by urgent the “A” button on the indicator panel. Push notifications are enabled within the exterior parameters of the indicator. “UsePushWithAlert” parameter.

When a sample seems on the value chart, the indicator will notify you about it. He’ll present the next data:

- Sample title

- Sample route

- The instrument on which the sample appeared

- Timeframe on which the sample appeared

- Sample age

Alert system. First activation

The primary time you press the “A” button, the indicator will notify you of all potential patterns that presently exist on the devices it analyzes. You will notice roughly the identical factor as proven within the image above. After this, the indicator will bear in mind all these patterns and you’ll now not obtain repeated alerts for them. All additional alerts will seem regularly on the time of their formation.

Exterior parameters

- Symbols – Checklist of forex pairs and different devices analyzed by the indicator. Accomplished with a comma.

- usePushWithAlert – Allow push notifications.

- ShowLastBarsTable – Inside what number of final bars to put in writing the sample to the desk.

- ShowLastBarsChart – Inside what number of final bars to show the sample on the chart.

- Timeframes – Activate and off time frames for show within the sample desk.

- displayPattern – Choose patterns to trace.

- PinFractional – during which a part of the bar the physique of the candle is situated (for a Pin bar).

- HM_HR_Fractional – In what a part of the bar the physique of the candle is situated (for the Hammer and the Hanging Man).

- HM_HR_Confirm – Add an up or down bar to verify Hammer or Hanging Man patterns.

- Fontsize – Font dimension.

- FontName – The title of the font.

- colorTextBuy – Lengthy sample title colour.

- colorTextSell – Colour of sample names in shorts.

- Interval – MA interval for the filter.

- Shift – MA smoothing for the filter.

- Technique – The MA methodology for the filter.

- Filter – Flip filters on and off for various time frames.

Creator: Siarhei Vashchylka. For any questions, write to me in personal messages. I additionally suggest subscribing to my updates. To do that, observe the hyperlink to my profile and click on “Add to associates”.