Value spikes and unusually robust market runs are market situations that may present wonderful buying and selling alternatives for the discerning dealer. Nevertheless, most merchants see it as a really robust momentum and would usually commerce it incorrectly by chasing value. Others properly attempt to keep away from buying and selling such market situations realizing that chasing value is rarely a good suggestion.

Nevertheless, some revenue from the market by buying and selling the reversals that come after such value spikes. It is because costs do are usually overbought or oversold after such a value spike. This in flip causes the market to appropriate itself by making an attempt to rebalance value.

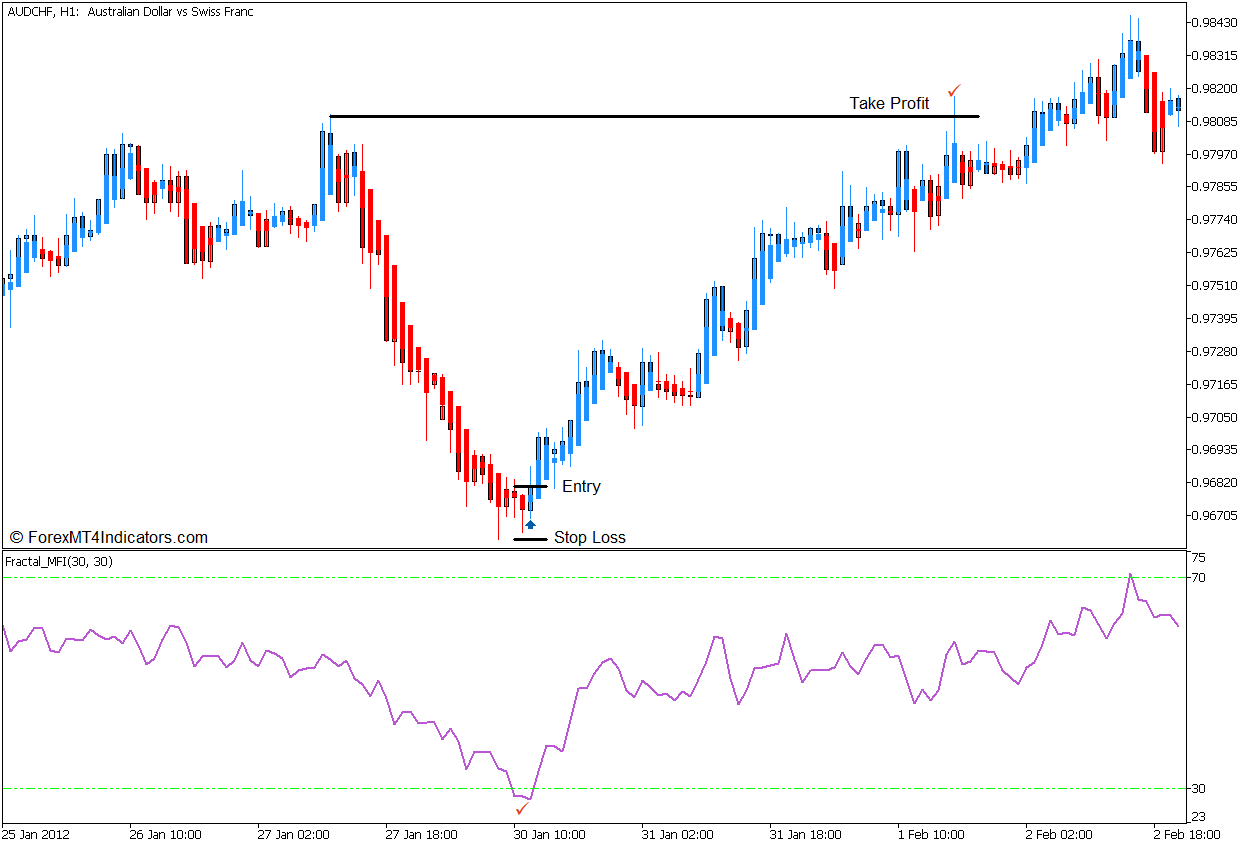

This buying and selling technique exhibits us how we are able to commerce a market reversal setup proper after a powerful value spike utilizing the Fractal MFI Indicator and the Heiken Ashi Candlesticks.

Heiken Ashi Indicator

The phrase Heiken Ashi means “common bars” when translated from Japanese, and the Heiken Ashi Indicator is aptly named as such.

The Heiken Ashi Indicator or Heiken Ashi Candlesticks is a technical indicator that modifies how the fundamental value candle is shaped to assist merchants simply determine the path of the pattern. The open and shut ranges of every value candle is modified primarily based on common value actions in order that the worth candle would reverse and alter coloration solely when the indicator detects a momentum reversal.

This indicator modifies the opening of the candle in order that it turns into the common of the particular Open and Shut Value of the earlier value candle.

Open = (Open of Earlier Bar + Shut of Earlier Bar) / 2

It additionally modifies the Shut of the candle making it the common of the particular Open, Excessive, Low, and Shut of the present value candle.

Shut = (Open + Excessive + Low + Shut) / 4

The Highs and Lows of its bars sometimes stay the identical.

Excessive = Max [High, Open, Close]

Low = Min [Low, Open, Close]

These modifications lead to a value chart whereby the candles solely change coloration at any time when the common of every candle has shifted instructions. This then permits merchants to simply decipher the path of the market momentum and detect attainable momentum reversals.

Merchants could use the Heiken Ashi Indicator together with an precise Japanese Candlestick Chart. This might enable merchants to simply determine the market construction, in addition to the traits of value motion.

Many merchants use the Heiken Ashi Candlesticks as a momentum reversal entry sign primarily based on the altering of the colour of its bars. That is usually used inside the context of confluences between commerce alerts.

Fractal Cash Circulation Index (MFI) Indicator

The Fractal MFI Indicator or Fractal Cash Circulation Index Indicator is a momentum technical indicator that makes use of value and quantity knowledge to create an oscillator. This oscillator line can be utilized to objectively determine oversold and overbought markets, which could be excessive chance imply reversal alternatives and successfully observe the path of the market momentum.

The Fractal MFI Indicator has some similarities with the Relative Energy Index (RSI) indicator as a result of it additionally plots an oscillator line that oscillates inside a hard and fast vary of 0 to 100. Their distinction lies in the truth that the Fractal MFI Indicator makes use of quantity and value when calculating momentum.

The Cash Circulation Index (MFI) calculation begins by calculating the Cash Circulation Ratio. It’s a ratio between the Constructive Cash Circulation and Unfavorable Cash Circulation over a given interval.

Cash Circulation Ratio = n-Interval Constructive Cash Circulation / n-Interval Unfavorable Cash Circulation.

It additionally calculates for the Uncooked Cash Circulation, which is the product of the Typical Value and Quantity.

Typical Value = (Excessive + Low + Shut) / 3

Uncooked Cash Circulation = Typical Value x Quantity

Utilizing these variables, it then calculates the Cash Circulation Index.

Cash Circulation Index = 100 – [100 / (1 + Money Flow Ratio)]

The Fractal MFI Indicator has markers at ranges 30 and 70, which function thresholds for its regular vary. Fractal MFI values dropping beneath 30 point out an oversold market, whereas values breaching above 70 point out an overbought market. Each market situations are prime circumstances for a possible imply reversal particularly when in confluence with value motion.

Buying and selling Technique Idea

This buying and selling technique is a Reversal Buying and selling Technique which trades primarily based on a confluence of an oversold or overbought market situation and a momentum reversal sign coming from such market circumstances.

The Fractal MFI Indicator is used to determine the oversold or overbought market circumstances. This may be objectively recognized at any time when the Fractal MFI line drops beneath 30 or breaches above 70.

As quickly as these circumstances are met, we may then observe the momentum reversal sign indicating that the worth may begin to reverse in the other way to rebalance an oversold or overbought value degree.

The Heiken Ashi Candlesticks is the software that we’ll use to objectively determine the momentum reversals. These momentum reversal alerts are primarily based on the altering of the colour of the bars that it plots.

Purchase Commerce Setup

Entry

- The Fractal MFI line ought to drop beneath 30 indicating an oversold market.

- Open a purchase order as quickly because the Heiken Ashi Candlesticks change to dodger blue indicating a bullish momentum reversal.

Cease Loss

- Set the cease loss on the fractal beneath the entry candle.

Exit

- Set the take revenue on the following logical swing excessive which value may doubtlessly attain.

Promote Commerce Setup

Entry

- The Fractal MFI line ought to breach above 70 indicating an overbought market.

- Open a promote order as quickly because the Heiken Ashi Candlesticks change to purple indicating a bearish momentum reversal.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Set the take revenue on the following logical swing low which value may doubtlessly attain for.

Conclusion

This buying and selling technique is a reversal buying and selling technique that works greatest as a way to commerce on the reversal that happens proper after a powerful market spike. These market circumstances are greatest recognized by observing value motion. The technical indicators used on this technique are simply instruments that assist make figuring out such market circumstances simpler. The indications could present oversold or overbought alerts, however it will nonetheless be greatest to substantiate the commerce state of affairs primarily based on what you see on the worth chart. Merchants who may use these alerts in tandem with value motion have a very good likelihood of benefiting from the market throughout such market reversals.

Foreign exchange Buying and selling Methods Set up Directions

This MT5 Technique is a mixture of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to rework the gathered historical past knowledge and buying and selling alerts.

This MT5 technique supplies a chance to detect varied peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional value motion and alter this technique accordingly.

Advisable Foreign exchange MetaTrader 5 Buying and selling Platforms

XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

How you can set up This MT5 Technique?

- Obtain the Zip file beneath

- *Copy mq5 and ex5 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick the MT5 technique

- You will notice technique setup is out there in your Chart

*Observe: Not all foreign exchange methods include mq5/ex5 information. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain: