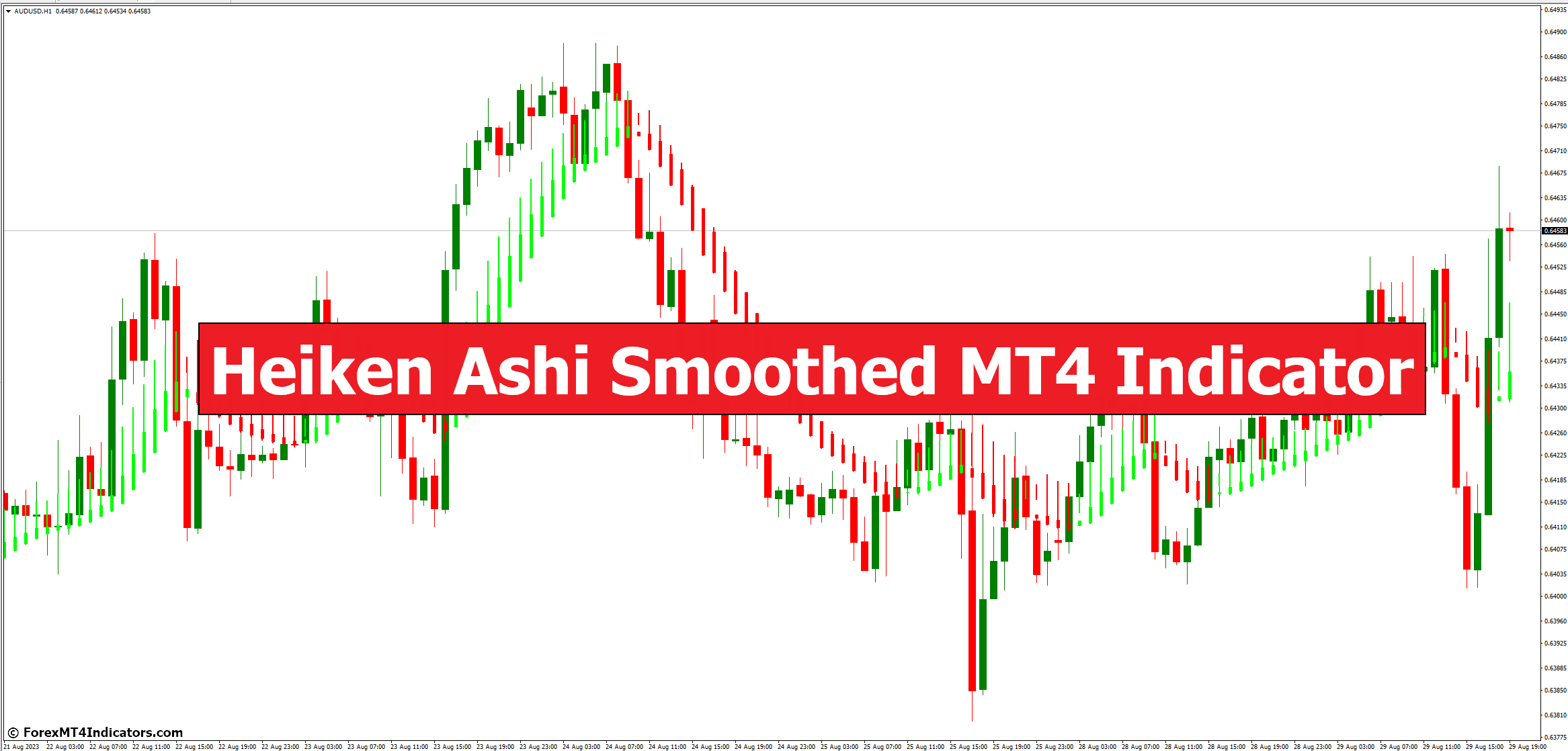

Are you a dealer looking for an edge within the fast-paced world of economic markets? In that case, you’re in luck as a result of at this time, we’re diving into a strong instrument that may probably revolutionize your buying and selling technique – the Heiken Ashi Smoothed MT4 Indicator. On this article, we’ll discover what the Heiken Ashi Smoothed MT4 Indicator is, the way it works, and why it’s grow to be a favourite amongst merchants. So, let’s get began and uncover how this indicator can give you priceless insights for extra knowledgeable buying and selling selections.

Understanding Conventional Candlestick vs Heiken Ashi Smoothed

Conventional candlestick charts show open, excessive, low, and shut costs for every time interval, making them priceless for detailed evaluation. Nonetheless, they will typically be noisy, particularly in risky markets. Heiken Ashi Smoothed charts, however, substitute commonplace candlestick parts with calculated values that present a smoothed illustration of worth motion. This smoothing impact can reveal traits extra distinctly, aiding merchants in making extra correct predictions.

The Mechanics of Heiken Ashi Smoothed MT4 Indicator

The Heiken Ashi Smoothed Indicator makes use of a mixture of previous worth knowledge to calculate its values, together with the open, excessive, low, and shut costs. These values are then adjusted to generate a modified model of the candlesticks. The “Smoothed” side comes from the appliance of an averaging method, which reduces the affect of short-term fluctuations. This leads to smoother, extra steady worth bars that may reveal the underlying development with better readability.

Using Heiken Ashi Smoothed for Pattern Identification

One of many key strengths of the Heiken Ashi Smoothed Indicator is its capability to establish traits with enhanced accuracy. By presenting traits in a smoother method, merchants can rapidly establish whether or not an asset is in an uptrend, downtrend, or a sideways consolidation part. This data is invaluable for merchants who depend on trend-following methods because it permits for higher decision-making relating to entries, exits, and stop-loss placements.

Incorporating Heiken Ashi Smoothed in Your Buying and selling Technique

Integrating the Heiken Ashi Smoothed Indicator into your buying and selling technique can provide a strategic benefit. As an illustration, utilizing it at the side of different technical indicators resembling Transferring Averages or the Relative Power Index (RSI) can present affirmation of development indicators. This layered method may also help you filter out false indicators and improve the general accuracy of your buying and selling selections.

Making use of Heiken Ashi Smoothed in Totally different Timeframes

One of many beauties of the Heiken Ashi Smoothed Indicator is its adaptability throughout numerous timeframes. Whether or not you’re a short-term day dealer or a long-term swing dealer, this indicator will be tailor-made to fit your most well-liked buying and selling fashion. It’s essential, nevertheless, to regulate the parameters primarily based on the timeframe you’re buying and selling in, as it will affect the sensitivity of the indicator.

Combining Heiken Ashi with Different Indicators for Enhanced Alerts

Whereas the Heiken Ashi Smoothed Indicator is usually a highly effective standalone instrument, combining it with different technical indicators can provide a extra complete evaluation. As an illustration, pairing it with an oscillator just like the Stochastic may also help pinpoint potential reversal factors available in the market. Bear in mind, the purpose is to make use of these indicators synergistically to create a well-rounded buying and selling technique.

Backtesting and Validating Heiken Ashi Smoothed Alerts

Earlier than absolutely integrating any new buying and selling instrument, it’s essential to conduct thorough backtesting. This includes making use of the Heiken Ashi Smoothed Indicator to historic knowledge and analyzing its efficiency in numerous market situations. Backtesting permits you to gauge its effectiveness and perceive its strengths and limitations. It’s additionally a method to validate its indicators in opposition to precise worth actions.

Ideas for Optimum Utilization and Frequent Pitfalls to Keep away from

To take advantage of the Heiken Ashi Smoothed Indicator, maintain the following pointers in thoughts:

- Mix with Different Indicators: Improve your technique through the use of it alongside different indicators.

- Follow Persistence: Look ahead to affirmation earlier than appearing on indicators to keep away from false trades.

- Perceive Market Context: Contemplate the broader market context earlier than making selections.

- Commonly Evaluate Parameters: Regulate indicator settings as market situations evolve.

As for pitfalls, keep away from:

- Overlooking Fundamentals: Technical instruments are priceless, however don’t neglect basic evaluation.

- Relying Solely on Indicators: Use indicators as a instrument, not an infallible prediction methodology.

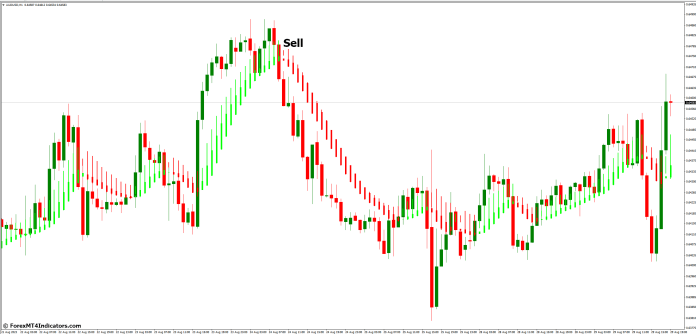

Find out how to Commerce with Heiken Ashi Smoothed MT4 Indicator

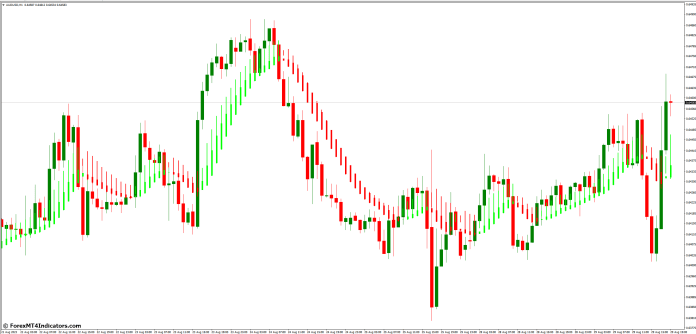

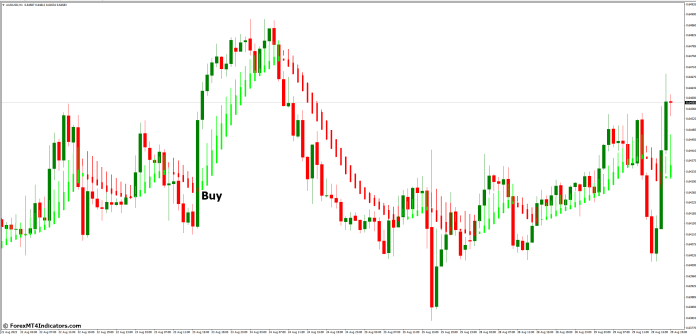

Purchase Entry

- Search for a sequence of bullish (inexperienced) Heiken Ashi Smoothed candles.

- The candle our bodies must be predominantly inexperienced, indicating a powerful bullish development.

- Look ahead to a pullback or a small retracement indicated by just a few consecutive purple candles.

- As soon as the purple candles begin turning again to inexperienced, take into account getting into a purchase commerce.

- Verify with different technical indicators or worth motion indicators for added confidence.

Promote Entry

- Establish a sequence of bearish (purple) Heiken Ashi Smoothed candles.

- The candle our bodies must be principally purple, signaling a powerful bearish development.

- Look ahead to a short pullback, marked by just a few consecutive inexperienced candles.

- When the inexperienced candles begin transitioning again to purple, it might be a chance to enter a promote commerce.

- All the time double-check with complementary indicators or worth patterns.

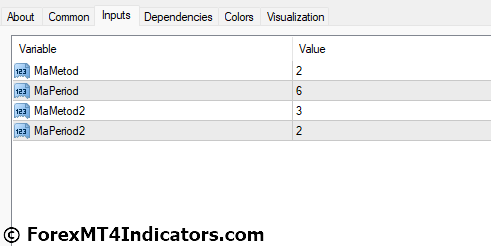

Heiken Ashi Smoothed MT4 Indicator Settings

Conclusion

In conclusion, the Heiken Ashi Smoothed MT4 Indicator presents merchants a novel perspective on worth traits and market momentum. By smoothing out worth fluctuations, it supplies a clearer view of traits, aiding in additional knowledgeable buying and selling selections. Do not forget that no instrument ensures success in buying and selling, however the Heiken Ashi Smoothed Indicator can actually be a priceless addition to your evaluation toolkit.

FAQs

1. Can the Heiken Ashi Smoothed Indicator be used at the side of different indicators?

Completely. Combining the Heiken Ashi Smoothed Indicator with different technical indicators can improve your buying and selling technique.

2. Is the Heiken Ashi Smoothed Indicator appropriate for day buying and selling?

Sure, the indicator’s adaptability makes it appropriate for numerous buying and selling kinds, together with day buying and selling.

3. Can I solely depend on the Heiken Ashi Smoothed Indicator for buying and selling selections?

Whereas the indicator is highly effective, it’s advisable to make use of it at the side of different types of evaluation, resembling basic analysis.

4. How usually ought to I overview and modify the indicator’s parameters?

Commonly overview and modify parameters primarily based on altering market situations to make sure optimum efficiency.

MT4 Indicators – Obtain Directions

Heiken Ashi Smoothed MT4 Indicator is a Metatrader 4 (MT4) indicator and the essence of this technical indicator is to remodel the amassed historical past knowledge.

Heiken Ashi Smoothed MT4 Indicator supplies for a chance to detect numerous peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional worth motion and modify their technique accordingly. Click on right here for MT4 Methods

Really useful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Find out how to set up Heiken Ashi Smoothed MT4 Indicator.mq4?

- Obtain Heiken Ashi Smoothed MT4 Indicator.mq4

- Copy Heiken Ashi Smoothed MT4 Indicator.mq4 to your Metatrader Listing / consultants / indicators /

- Begin or restart your Metatrader 4 Consumer

- Choose Chart and Timeframe the place you wish to take a look at your MT4 indicators

- Search “Customized Indicators” in your Navigator principally left in your Metatrader 4 Consumer

- Proper click on on Heiken Ashi Smoothed MT4 Indicator.mq4

- Connect to a chart

- Modify settings or press okay

- Indicator Heiken Ashi Smoothed MT4 Indicator.mq4 is accessible in your Chart

Find out how to take away Heiken Ashi Smoothed MT4 Indicator.mq4 out of your Metatrader Chart?

- Choose the Chart the place is the Indicator operating in your Metatrader 4 Consumer

- Proper click on into the Chart

- “Indicators checklist”

- Choose the Indicator and delete

Heiken Ashi Smoothed MT4 Indicator (Free Obtain)

Click on right here beneath to obtain: