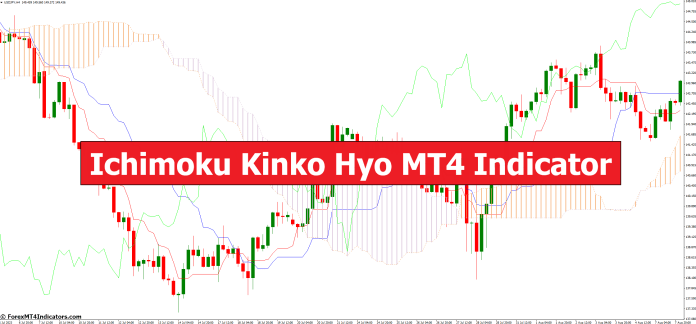

On the earth of foreign currency trading, making knowledgeable choices is paramount to success. Merchants are always looking for instruments and indicators to assist them analyze the markets successfully. One such highly effective device is the Ichimoku Kinko Hyo MT4 Indicator. On this article, we’ll delve into the intricacies of this indicator, exploring its options, advantages, and the way it may be a game-changer for merchants.

Understanding Ichimoku Kinko Hyo

Ichimoku Kinko Hyo, also known as simply “Ichimoku,” is a flexible technical evaluation device developed by Japanese journalist Goichi Hosoda within the late Nineteen Sixties. It supplies a complete view of value motion, serving to merchants establish developments, assist and resistance ranges, and potential reversals.

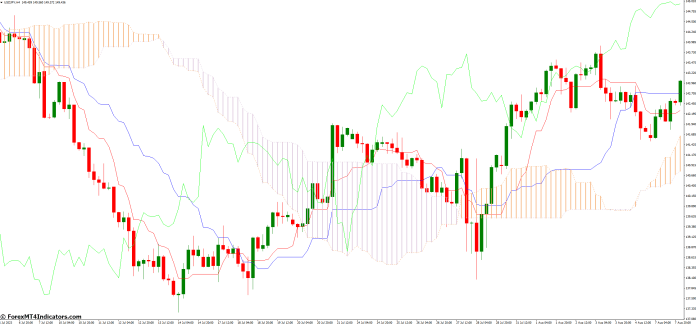

Elements of the Indicator

Tenkan-sen (Conversion Line)

The Tenkan-sen, or Conversion Line, represents the typical of the best excessive and lowest low over a particular interval, often 9 intervals. It presents insights into short-term value momentum.

Kijun-sen (Base Line)

The Kijun-sen, or Base Line, calculates the typical of the best excessive and lowest low over an extended interval, usually 26 intervals. This line supplies a view of medium-term value momentum.

Senkou Span A and B

These are two key elements that type the “cloud” or “Kumo.” Senkou Span A is the midpoint between the Tenkan-sen and Kijun-sen, projected ahead 26 intervals. Senkou Span B calculates the typical of the best excessive and lowest low over the previous 52 intervals, projected ahead 26 intervals.

Chikou Span (Lagging Span)

The Chikou Span is the closing value of the present candle, shifted again 26 intervals. It helps merchants perceive potential assist and resistance ranges.

Methods to Interpret Ichimoku Alerts

Ichimoku supplies varied alerts, together with the Tenkan-Kijun crossover, Kumo breakout, and Chikou affirmation. These alerts are essential for merchants in making purchase or promote choices.

Utilizing Ichimoku in Development Identification

Bullish Traits

Ichimoku identifies a bullish pattern when the value is above the Kumo, and the Tenkan-sen is above the Kijun-sen. This means a powerful upward momentum.

Bearish Traits

Conversely, a bearish pattern is recognized when the value is under the Kumo, and the Tenkan-sen crosses under the Kijun-sen. This means a powerful downward momentum.

Help and Resistance Ranges with Ichimoku

The Kumo, fashioned by Senkou Span A and B, serves as a dynamic assist and resistance zone. Merchants use it to establish potential entry and exit factors.

Combining Ichimoku with Different Indicators

Many merchants mix Ichimoku with different technical indicators just like the Relative Energy Index (RSI) or Shifting Averages to reinforce their buying and selling methods.

Ichimoku Methods for Merchants

The Kumo Breakout Technique

The Kumo breakout technique includes getting into a commerce when the value breaks above or under the Kumo. It’s a well-liked technique for figuring out pattern reversals.

The Tenkan-Kijun Crossover Technique

This technique relies on the crossover of the Tenkan-sen and Kijun-sen. Merchants use it to establish potential entry and exit factors.

Benefits of Ichimoku Kinko Hyo

Ichimoku presents a number of benefits, together with its versatility, capability to establish developments, and its visible simplicity, making it accessible even to novice merchants.

Potential Drawbacks

Whereas highly effective, Ichimoku might not be appropriate for all buying and selling kinds or market situations. It’s important to grasp its limitations.

Actual-Life Examples of Ichimoku Evaluation

Inspecting real-life examples of Ichimoku evaluation can present worthwhile insights into how this indicator is utilized in precise buying and selling situations.

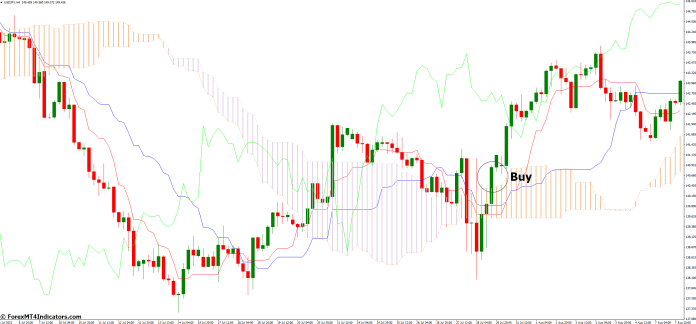

Methods to Commerce with Ichimoku Kinko Hyo MT4 Indicator

Purchase Entry

- Search for the value to be above the cloud (Senkou Span A > Senkou Span B).

- Tenkan-Sen (Conversion Line) crosses above the Kijun-Sen (Base Line).

- Chikou Span (Lagging Span) is above the value from 26 intervals in the past.

Promote Entry

- Search for the value to be under the cloud (Senkou Span A < Senkou Span B).

- Tenkan-Sen (Conversion Line) crosses under the Kijun-Sen (Base Line).

- Chikou Span (Lagging Span) is under the value from 26 intervals in the past.

Ichimoku Kinko Hyo MT4 Indicator Settings

Conclusion

In conclusion, the Ichimoku Kinko Hyo MT4 Indicator is a potent device for foreign exchange merchants. Its complete evaluation capabilities, mixed with strategic insights, make it a worthwhile addition to any dealer’s toolbox. By mastering the artwork of Ichimoku, you’ll be able to elevate your buying and selling recreation and make extra knowledgeable choices within the dynamic world of foreign exchange.

FAQs

- Is Ichimoku appropriate for day buying and selling?

Ichimoku may be tailored for day buying and selling, but it surely’s important to make use of shorter timeframes and modify parameters accordingly. - Can Ichimoku be utilized in different monetary markets in addition to foreign exchange?

Sure, Ichimoku may be utilized to shares, commodities, and different monetary markets. - What’s the significance of the Kumo within the Ichimoku evaluation?

The Kumo acts as a dynamic assist and resistance zone, serving to merchants establish potential value reversals.

MT4 Indicators – Obtain Directions

It is a Metatrader 4 (MT4) indicator and the essence of this technical indicator is to remodel the gathered historical past information.

This MT4 Indicator supplies for a chance to detect varied peculiarities and patterns in value dynamics that are invisible to the bare eye.

Primarily based on this data, merchants can assume additional value motion and modify their technique accordingly. Click on right here for MT4 Methods

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Methods to set up MT4 Indicator?

- Obtain the mq4 file.

- Copy mq4 file to your Metatrader Listing / consultants / indicators /

- Begin or restart your Metatrader 4 Consumer

- Choose Chart and Timeframe the place you wish to check your MT4 indicators

- Search “Customized Indicators” in your Navigator principally left in your Metatrader 4 Consumer

- Proper click on on the mq4 file

- Connect to a chart

- Modify settings or press okay

- And Indicator might be obtainable in your Chart

Methods to take away MT4 Indicator out of your Metatrader Chart?

- Choose the Chart the place is the Indicator working in your Metatrader 4 Consumer

- Proper click on into the Chart

- “Indicators listing”

- Choose the Indicator and delete

(Free Obtain)

Click on right here under to obtain: