The markets have been handed a vacation present in the present day after the Commerce Division reported that underlying inflation pressures are persevering with to decelerate. This has left extra revenue on the disposal of households with elevated spending that can assist the general economic system. Information of declining inflation units the stage for rates of interest to proceed to say no, with charge cuts by the Fed anticipated as early as March. That is nice information for the broader markets in addition to for particular person areas, a number of of which might profit essentially the most from this backdrop.

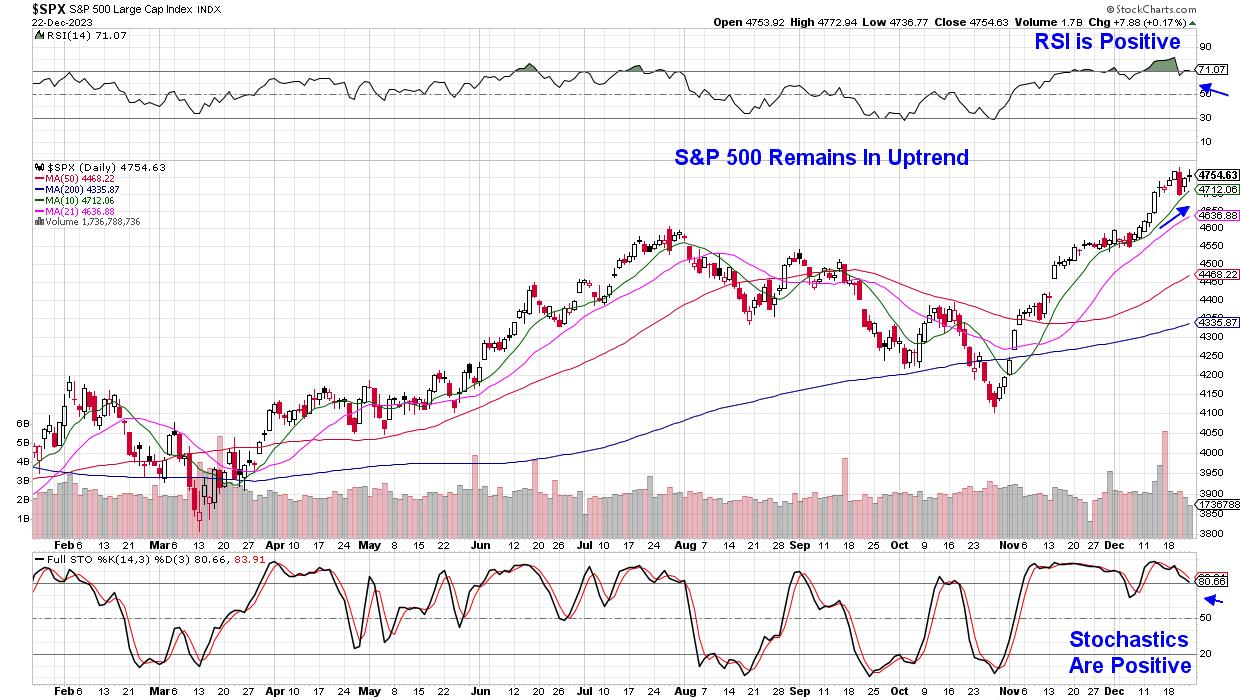

Each day Chart of S&P 500 Index ($SPX)

Each day Chart of S&P 500 Index ($SPX)

Amongst areas that can profit most from a rising inventory market amid a continued drop in rates of interest, the Monetary sector has a number of areas already seeing progress. Brokerage agency Charles Schwab (SCWB), which just lately reported that whole shopper belongings have been up 12% year-over-year for the month of November, is a main instance. The rise comes as investor confidence within the markets expands and people put cash to work.

Each day Chart of Charles Schwab Corp. (SCHW)

Each day Chart of Charles Schwab Corp. (SCHW)

The inventory gapped up right into a base breakout on heavy quantity following the information of a rise in purchasers. Since then, SCHW has pulled again to its upward trending 10-day shifting common, the place its discovered assist. With each the RSI and MACD in constructive territory, the inventory is poised to commerce increased.

Asset administration companies are additionally benefiting attributable to elevated AUM amid an increase in portfolio values because the markets hit year-to-date highs. Blackrock (BLK), among the many largest asset managers, is poised to interrupt out of a flag formation following a 5-month base breakout which passed off earlier this month. The corporate is shifting nearer to the approval of their new Bitcoin ETF, which has attracted constructive consideration to this 2.5%-yielder. A transfer above $820 on quantity can be fairly bullish for BLK.

Each day Chart of Blackrock (BLK)

Each day Chart of Blackrock (BLK)

Different monetary shares are on the transfer as properly, equivalent to financial institution shares that proceed to development increased. Subscribers to my MEM Edge Report have been alerted to the brand new uptrend in mid-November, after we added two Regional Banks to our prompt holdings listing. Each shares have posted double digit returns nonetheless, they’ve pulled again to key assist this week because the shares put together for one more leg increased. Use this hyperlink right here to entry these shares, in addition to different names poised to commerce increased within the at the moment bullish environement. Your 4-week trial to my twice weekly report additionally supplies broader market insights not discovered elsewhere in addition to detailed sector and inventory choice concepts. Intra-week shifts in sentiment relating to shares, in addition to the markets, may even be delivered on to your e mail.

Could you have got a improbable vacation weekend!

Warmly,

Mary Ellen McGonagle

MEM Funding Analysis

Mary Ellen McGonagle is knowledgeable investing guide and the president of MEM Funding Analysis. After eight years of engaged on Wall Avenue, Ms. McGonagle left to turn into a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with purchasers that span the globe, together with large names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Study Extra