Bonnie and Clyde, Ma Barker, Child Face Nelson and Willie Sutton robbed banks. When requested by a journalist requested why he did, Sutton famously replied “as a result of that’s the place the cash is.” If banks’ $3.1 trillion in money and invested belongings attracts criminals to steal from banks, the insurance coverage business’s $10 trillion in belongings arguably tempts fraudsters but extra. And it does.

Whereas banks’ annual losses from fraud are on the order of $2.7 billion, insurance coverage fraud measures a staggering $308.6 billion yearly. The FBI, which prosecutes vital insurance coverage fraud circumstances, affirms the insurance coverage business’s huge measurement “contributes considerably to the price of insurance coverage fraud by offering extra alternatives and greater incentives for committing unlawful actions.” And from the fraudster’s standpoint, insurance coverage fraud is a criminal offense not requiring a gun, a masks or a getaway automobile. In an period of congressional hearings on learn how to cut back the price of insurance coverage for shoppers, one answer is to assault insurance coverage fraud. Insurers’ fraud-related losses are handed onto all policyholders. If insurance coverage fraud had been worn out premiums could be 10 % decrease.

Insurance coverage fraud is the second-largest class of white-collar crime, following tax evasion. Insurers’ huge hemorrhaging from fraud makes theft in different industries pale by comparability. Retailer shrink (theft) price is 1.6 %. Wholesaler/stock shrink price is estimated at 4 %.

Insurance coverage fraudsters might justify dishonest an insurance coverage firm as a result of it’s regarded as a victimless crime. In a latest survey of attitudes surrounding insurance coverage fraud, virtually 9 % of respondents justified insurance coverage fraud as not being incorrect or prison based mostly on their perception that “insurance coverage corporations rip folks off, so it’s honest” and “I pay them sufficient, it’s my cash I’m getting again.” The survey revealed a excessive proportion of respondents (28.6% %) discovering insurance coverage fraud “not an actual crime” (8.5 %) or constituted a “enterprise observe with no actual sufferer” (20.1 %).

The Many Flavors of Insurance coverage Fraud

Insurance coverage fraud is available in many kinds and sizes. It ranges from registering vehicles in a state apart from the state of ones residence as a result of charges and insurance coverage there can “save” lots of of {dollars}, to a just lately uncovered scheme which scammed Medicare $2 billion.

A few of the foremost forms of insurance coverage fraud, in reducing order of fraud quantity, are:

| Insurance coverage Fraud Class | Description or Instance | Estimated Annual Fraud Quantity |

| Life Insurance coverage | Failure to report medical situation, shopping for a life insurance coverage coverage on another person’s life and murdering them, faking loss of life | $74.7 billion |

| Medicaid and Medicare | Offering pointless companies | $68.7 billion |

| Property & Casualty | Staged accidents, arson | $45.0 billion |

| Healthcare | Suppliers billing for companies not rendered | $36.3 billion |

| Premium Avoidance | Misclassification of staff or underreporting payroll | $35.1 billion |

| Employees’ Compensation | Employee claiming to have been injured on the job, however was not | $34.0 billion |

| Incapacity | Claiming to be on incapacity with no mobility whereas coaching for a 10k footrace not for the wheelchair-bound | $7.4 billion |

| Auto Theft | Perpetrated solo or operated as a revenue middle by prison gangs | $7.4 billion |

| Whole | $308.6 billion |

(Knowledge supply: The Impression of Insurance coverage Fraud on the U.S. Financial system. Coalition Towards Insurance coverage Fraud. 2022. https://insurancefraud.org/wp-content/uploads/The-Impression-of-Insurance coverage-Fraud-on-the-U.S.-Financial system-Report-2022-8.26.2022.pdf)

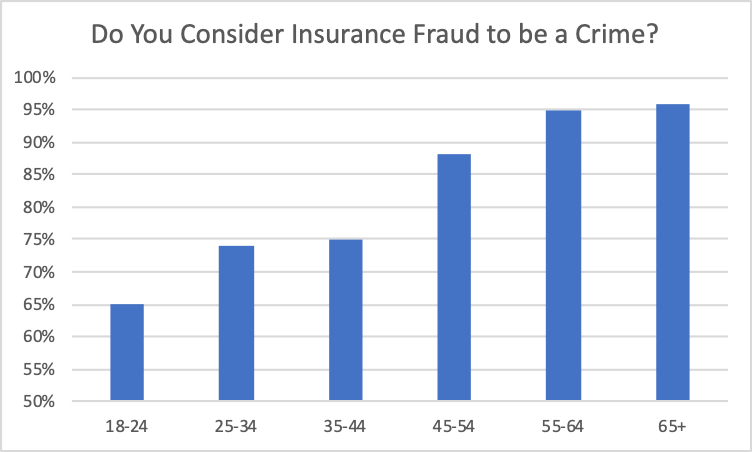

Troubling Generational Developments

Whether or not somebody considers insurance coverage fraud a criminal offense or not relies upon to some extent on their age. Within the report presenting findings of the “Who Me?” research, respondents 45 and older had been far more susceptible to think about insurance coverage fraud a criminal offense. For the youngest respondents, aged 18 to 24, slightly below 65 % did, whereas 96 % of respondents 65 and older did.

(Knowledge Supply: Who Me? Who Commits Insurance coverage Fraud and Why? Coalition Towards Insurance coverage Fraud and Verisk. 2023. Used with permission. https://insurancefraud.org/wp-content/uploads/WHO_ME_STUDY_REPORT.pdf)

The “Who Me?” survey additionally discovered respondents beneath the age of 45 reporting a considerably increased stage of dishonesty than these a technology older. The under-45 respondents had been discovered to be far more vulnerable to “Undoubtedly … Submit a Declare for a Automobile Brought about in a Prior Automobile Accident,” to submit a declare for a owners or insurance coverage coverage with injury from an earlier occasion, and would “positively would assist a medical supplier invoice an insurance coverage firm for remedy I didn’t obtain.”

Because the older technology ages out, insurance coverage corporations ought to be involved they are going to more and more be coping with respondents self-reporting as having fewer scruples about committing insurance coverage fraud

Tales from the Darkish Aspect

A few of the most chilling examples of insurance coverage fraud are grisly affairs revealing the darkest of humanity’s darkish aspect:

- John Gilbert Graham positioned a time-release bomb on a airplane by which his mom was touring, for the life insurance coverage cost. The bomb exploded. Along with Graham’s mom all 43 different passengers and crew perished.

- Utah doctor Farid Fata administered chemotherapy to lots of of girls who didn’t have most cancers. Fata submitted $34 million in fraudulent claims to Medicare and personal insurance coverage corporations.

- Ali Elmezayen staged a freak automobile accident which took the lives of his two autistic kids and almost drowned his spouse. He collected a $260,000 insurance coverage payout, however his crime was found. He was sentenced to 212 years in jail.

- A Chicago federal grand jury charged 23 defendants with collaborating in a fraud scheme swindling $26 million from ten life insurers. The scheme featured submission of fraudulent functions to acquire insurance policies, and misrepresenting the identification of the deceased.

There are literally thousands of different equally horrific insurance coverage fraud tales. The annual Soiled Dozen Corridor of Disgrace report describes a few of the most egregious, and contributes to an understanding of how far fraudsters will go to cheat insurance coverage corporations.

How is Insurance coverage Fraud Addressed?

There are a number of organizations combatting insurance coverage fraud. In 42 states the insurance coverage division has a fraud investigation unit. In different states, resembling Colorado, insurance coverage fraud investigations are the duty of the Lawyer Normal’s workplace. The fraud items are staffed with anti-fraud and prison investigators working with federal, state, and native legislation enforcement officers to prosecute insurance coverage fraud. When a number of states are concerned within the fraud or if it’s a massive case, the FBI might pursue the case on a prison foundation. Insurance coverage corporations even have inside Particular Investigation Models (SIUs).

New Developments – Synthetic Intelligence

Enhancements in predictive modeling and the introduction of synthetic intelligence (AI) have strengthened insurers talents to determine, and in the end examine, submitted claims that could be fraudulent. On the similar time, nonetheless, AI can be getting used as a weapon to penetrate insurers’ fraud detection techniques. Methods getting used embody AI-created faux pictures of automobiles of a specific make and mannequin exhibiting injury that isn’t actual, however used to extract a claims cost. Some insurers are now not accepting images as a result of they might be doctored, and are returning to adjustors bodily visiting the allegedly broken automobile. A nefarious life insurance coverage rip-off consists of AI-enabled manipulation of ones voice so {that a} prison third get together will get previous insurers’ voice recognition know-how, and initiates a coverage being surrendered to a non-policyholder, non-beneficiary. It appears that evidently for each further layer of safety insurers introduce, the criminals are maintaining, if not forging forward.

Motion Required

Insurers have to strengthen their inoculation in opposition to the insurance coverage fraud germ. They need to educate youthful generations to know that insurance coverage fraud is certainly a criminal offense, regardless in the event that they suppose in any other case. In at present’s populist political setting huge enterprise, together with insurers, is just too usually singled out as accountable for no matter ills there could also be. As we have now argued elsewhere, the mixed impact of plaintiff legal professional corporations vilifying insurers, and zealous shopper advocates denouncing insurers, is to offer the business a black eye. What’s extra, youthful generations’ picture of the insurance coverage business is coloured by billboard attorneys promising to stay it to the insurance coverage firm.

Insurers must also be part of forces with different events battling insurance coverage fraud – state insurance coverage division fraud items, native and federal legislation enforcement, and organizations such because the Coalition Towards Insurance coverage Fraud and the Nationwide Insurance coverage Crime Bureau. As insurance coverage fraudsters exploit new applied sciences, and because the youthful generations with unfavorable views on insurance coverage grow to be policyholders, the combat might get more durable, but it surely should be fought if combatting insurance coverage crime can ever be a driver of decrease insurance coverage charges.

Subjects

Fraud

Excited by Fraud?

Get automated alerts for this matter.