KEY

TAKEAWAYS

- Sturdy September jobs report brought about an preliminary shock however buyers overcame it and the broader inventory market indexes all closed increased

- Volatility remained beneath 20 in the course of the buying and selling day

- Along with Expertise and Communication Companies, Financials could also be exhibiting bullish energy

September’s sturdy labor market—336,000 jobs added—initially shocked buyers. Treasury yields and the US Greenback Index ($USD) spiked increased, whereas fairness futures dropped.

However a comeback try was in play. Throughout the buying and selling day, Treasury yields got here off their highs, and the inventory market got here off its lows, closing positively. Traders weren’t panicked, as is clear within the CBOE Volatility Index ($VIX), which remained beneath 20.

Does a robust shut within the main indexes imply the market has circled? Someday does not make a pattern, so we’re not out of the woods but. But it surely’s an encouraging signal.

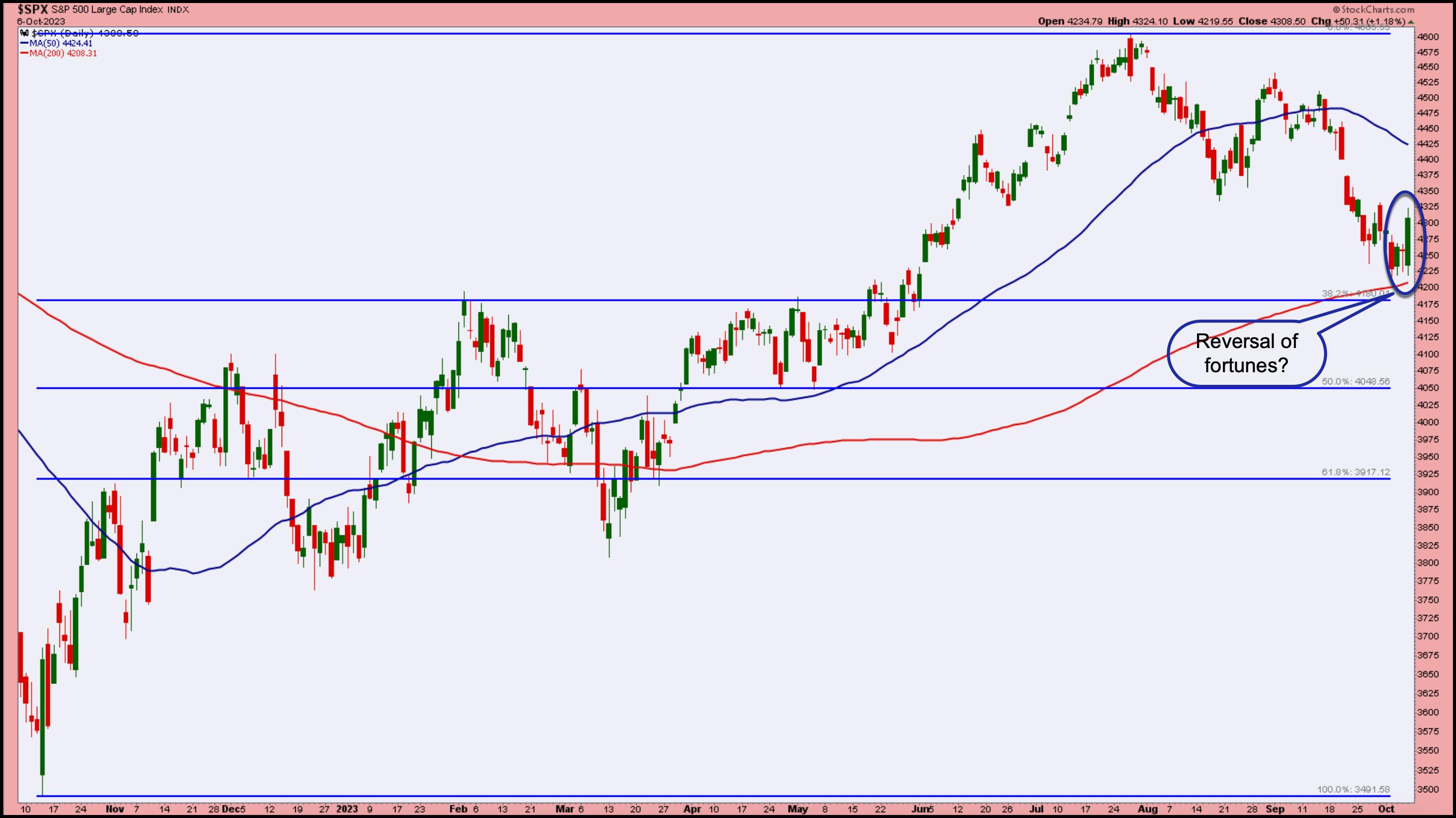

S&P 500 Near Key Help

Keep watch over the 4200 degree within the S&P 500 index ($SPX). Earlier than as we speak, there was an apparent sideways motion occurring simply above the help of the 200-day transferring common. The S&P 500 was additionally near the primary Fibonacci retracement degree (from October 2022 lows to July 2023 highs).

CHART 1: S&P 500 INDEX BOUNCING OFF 200-DAY MOVING AVERAGE? Someday does not make a pattern however the indicators are encouraging. Chart supply: StockCharts.com. For academic functions.

At the moment’s worth motion was surprising however reveals how rapidly the market can react. The S&P 500 moved away from its 200-day transferring common and closed increased by over 1%. However that is only a single day, and we nonetheless must see increased highs and better lows to be assured that the market has reversed. So, to guard your portfolio, it is a good suggestion to investigate what might occur if the S&P 500 rapidly strikes decrease within the subsequent few buying and selling days.

If the S&P 500 breaks beneath the 4200 degree, it might fall a lot decrease. That is as a result of, total, the index is in a downtrend. Be aware the sequence of decrease highs and decrease lows. On the flip facet, if the 4200 degree holds and the index reverses and resumes its uptrend, there’s an opportunity it might hit its 50-day transferring common and probably hit the 4600 degree it reached in July. But it surely’s nonetheless a manner away from hitting that degree. The index is way nearer to its 4200 degree help, and that is the place your focus needs to be. Because the total pattern is bearish, you are higher off being cautious.

Market Breadth: A Extra Correct Barometer

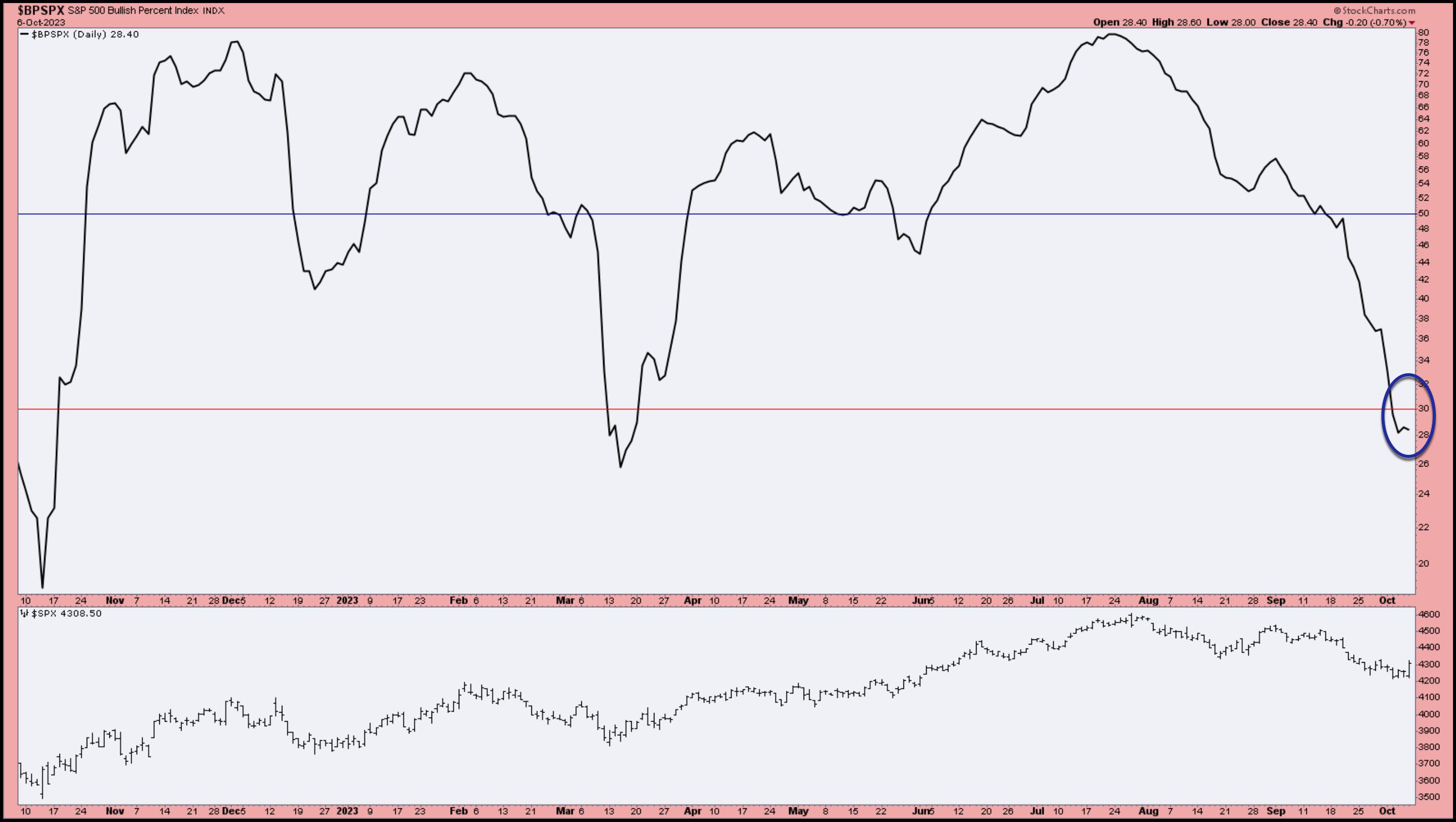

Figuring out market reversals might be difficult. When situations are bearish, it is best to undertake a wait-and-see strategy. There are a number of indicators you should use to establish if the inventory market has bottomed. One that may be efficient is the Bullish % Index (BPI), which provides you some concept of the interior well being of an index, sector, or business group.

Beginning with the S&P 500 BPI, you’ll be able to see from the chart beneath that the indicator is beneath the 30 degree, usually thought-about oversold. Up to now 12 months, there have been two different occasions when the indicator dipped beneath 30—October 2022 and March 2023. Each these occasions, the S&P 500 fell to important lows. Discover that the Bullish % Index turned comparatively rapidly, and when the indicator crossed above the 30 degree, the S&P 500 went via a bullish rally.

S&P 500 BULLISH PERCENT INDEX IS STILL SHOWING A BEARISH SIGNAL. When the S&P 500 BPI turns and closes above the 30 degree there’s a greater likelihood {that a} reversal is in play. Chart supply: StockCharts.com. For academic functions.

It is also value wanting on the BPI for a few of the most important indexes and sectors. Happily, StockCharts consists of predefined CandleGlance charts, which can assist you establish areas of the market which can be gaining energy. Trying on the charts, Expertise and Communication Companies are the stronger sectors. And for those who have a look at the Nasdaq BPI and the Nasdaq 100 BPI, you will see that they have not crossed beneath 30. So, assuming situations do not change drastically, these areas of the market are prone to lead the rally. That is not shocking, provided that’s been the narrative for the reason that AI growth began.

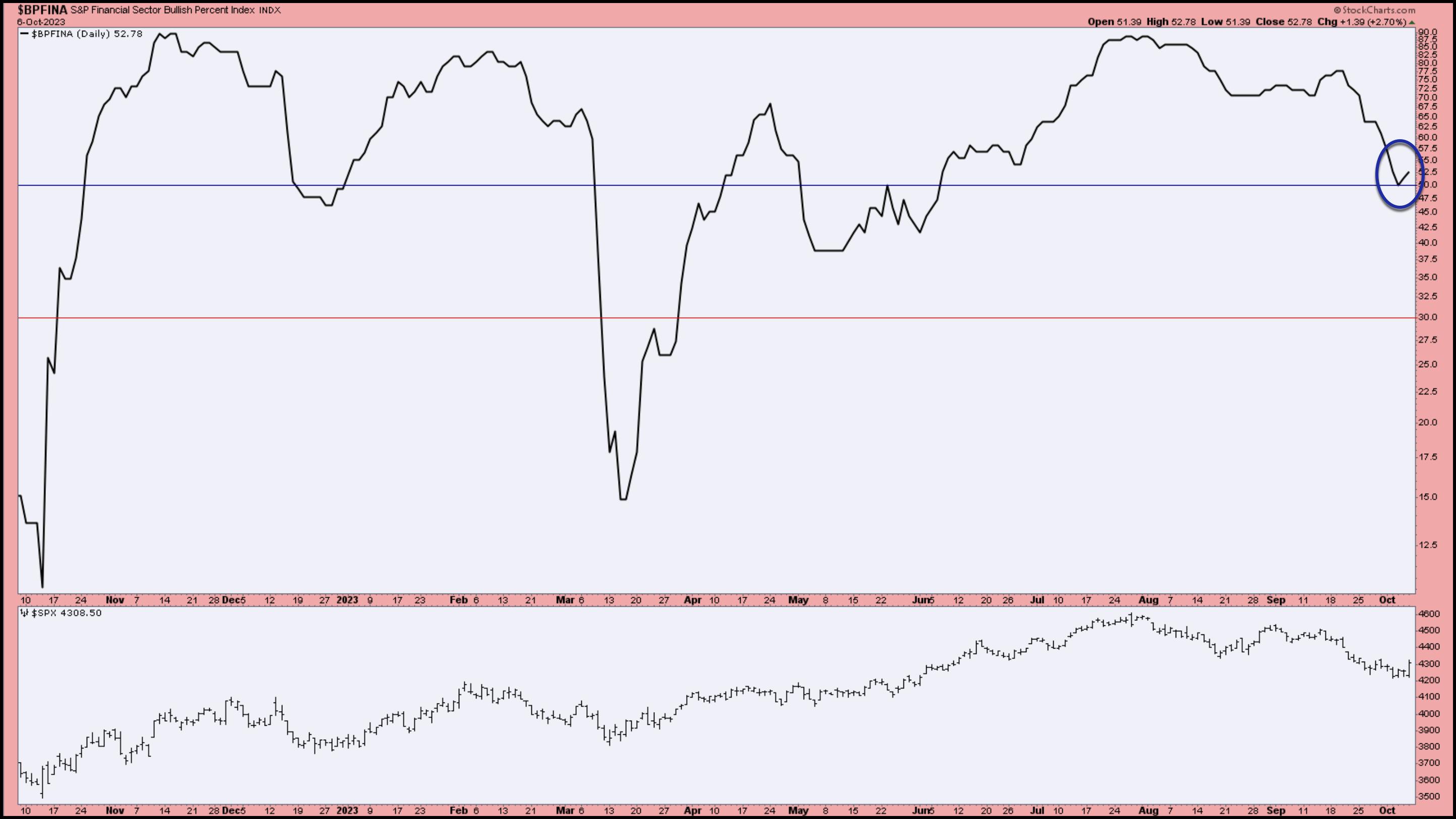

A Stunning Sector Discover

One level to bear in mind is the variety of shares that comprise the index or sector can influence how a lot the BPI strikes. For instance, the Dow Jones Industrial Common ($INDU) is made up of 30 shares, whereas the S&P 500 has 500 shares. So the DJIA BPI will go to oversold and overbought ranges much less often than the SPX BPI, and also you would possibly discover some surprises.

For instance, the motion within the Monetary BPI (see chart beneath) will make you are taking a re-assessment. For a sector that acquired hit laborious, it was shocking to seek out the indicator bouncing off its 50 degree. It might be value citing a chart of the Monetary Choose Sector SPDR Fund (XLF). The ETF is in a downtrend, is properly beneath its 200-day transferring common, and is underperforming the S&P 500. However there’s one encouraging signal: its StockCharts Technical Rank (SCTR) rating is crossing 70.

CHART 3: S&P FINANCIAL SECTOR BULLISH PERCENT INDEX. The monetary sector seems to be prefer it’s bouncing off its 50 degree. Does this imply it is a good time to load up on beaten-down monetary shares? Someday’s spike is not convincing sufficient however control this indicator. A follow-through to the upside might imply monetary shares could rally quickly. Chart supply: StockCharts.com. For academic functions.

Closing Ideas

So, with a BPI bouncing off 50 and a SCTR rating crossing 70, is it attainable that one thing is brewing within the Monetary sector? Nicely, the large banks kick off earnings season subsequent week. And Q3 earnings stories might be the catalyst that brings life to the fairness market.

A number of issues that might be vital are occurring subsequent week within the inventory market. Do not stray too removed from what is going on on.

Inventory Market Wrap-Up

US fairness indexes up; volatility down

- $SPX up 1.18% at 4308.50, $INDU up 0.87% at 33407.58; $COMPQ up 1.6% at 13431.34

- $VIX down 5.62% at 17.45

- Finest performing sector for the week: Expertise

- Worst performing sector for the week: Power

- High 5 Giant Cap SCTR shares: Vertiv Holdings, LLC (VRT); Tremendous Micro Laptop, Inc. (SMCI); Applovin Corp. (APP); Palantir Applied sciences (PLTR); Splunk Inc. (SPLK)

On the Radar Subsequent Week

- Earnings Season kicks off with PepsiCo Inc. (PEP), Delta Airways Inc. (DAL), Citigroup Inc. (C), and J.P. Morgan Chase & Co. (JPM), Wells Fargo & Co. (WFC)

- September PPI

- September CPI

- Fed speeches

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Website Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to teach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising and marketing company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra