There’s a saying — “A bit data is a harmful factor.” Once you don’t know a lot a couple of topic, you stick with the tried-and-true as a result of there’s security within the mainstream. As you be taught extra in regards to the topic, you begin to discover off the overwhelmed path. That’s when the hazard begins. You suppose what to do however you don’t know what to keep away from. In the event you solely know sufficient to get into hassle, you’re higher off not realizing it.

We’ve got an instance of this in utilizing TreasuryDirect.

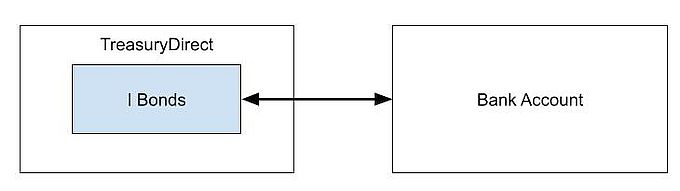

Many individuals purchased I Bonds final yr at TreasuryDirect. You hyperlink a checking account and put in an order to purchase. TreasuryDirect debits the checking account and offers you I Bonds within the account. Many readers of this weblog have performed that. It really works in reverse if you promote. TreasuryDirect credit the linked checking account. These are all routine transactions.

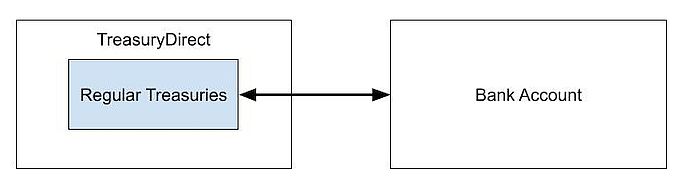

Some individuals uncover that you would be able to additionally purchase common Treasuries within the TreasuryDirect account. You should purchase in $100 increments versus in $1,000 increments in a brokerage account. You may place the order extra days upfront versus having to attend for the official announcement. TreasuryDirect helps “auto roll” whereas not all brokers help it. TreasuryDirect debits the identical linked checking account for purchases and credit it when the Treasuries mature. These are all routine too.

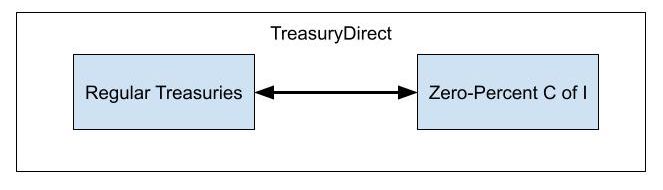

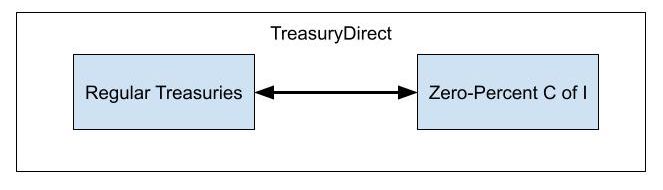

Then some individuals discover this peculiar factor referred to as a “Zero-P.c Certificates of Indebtedness” or briefly “Zero-P.c C of I” or just “C of I.” It’s principally TreasuryDirect’s model of uninvested money in a brokerage account. It doesn’t pay any curiosity, therefore “Zero-P.c.” Zero-P.c C of I will be designated because the vacation spot of the credit from matured Treasuries, for use because the supply of your debits for the following buy.

You’ll suppose this Zero-P.c C of I is ineffective as a result of drawing from and sending to the checking account works simply effective and you may not less than earn some curiosity whereas the cash is in your checking account, however some individuals resolve to make use of Zero-P.c C of I to carry money in TreasuryDirect.

That’s when the difficulty begins. I learn this report on the Bogleheads funding discussion board (I edited it barely for brevity):

Effectively, I moved all of my financial savings into the US Treasury, within the type of four-week T-Payments that redeeem to C of I.

Usually, that’s not a difficulty, works each time.

Till two days in the past once I received an e mail saying my account was flagged as having some issues and Threat Administration had positioned a tough lock on the account as a precautionary measure.

I used to be requested to fill out a FS Type 5444. I mailed the notarized type however the processing time for this way is “20 weeks minimal.”

I referred to as the Treasury and received transferred to the hardlock division. They mentioned they obtained my type however couldn’t act on it.

Additionally they mentioned, the explanation for the onerous lock was as a result of I purchased a $1,000 C of I with my checking account, intending to make use of it to purchase a T-Invoice, and this was a fraud threat.

So I will be unable to log into my account to get better any of my cash, nor will I be capable of reinvest it.

Over the following 20 weeks I’m going to lose out on maybe about $5,000 value of curiosity, yikes.

False positives in threat administration and account restrictions occur generally. Usually it wouldn’t be an enormous downside as a result of at worst you possibly can’t place new orders and cash from matured T-Payments will nonetheless come again to your checking account. On this case, the cash goes to Zero-P.c C of I, which earns no curiosity whereas it takes 20 weeks to resolve the account restriction.

This investor is clearly higher off not realizing that Zero-P.c C of I exists.

She or he can also be higher off not realizing that you should use TreasuryDirect to purchase T-Payments. If she or he purchased T-Payments in a business brokerage account, not less than the settlement fund or core place earns curiosity and it needs to be a lot faster to resolve the danger administration challenge than 20 weeks.

To be clear, I don’t blame this investor for utilizing Zero-P.c C of I or utilizing TreasuryDirect to purchase T-Payments. It nonetheless wouldn’t be an enormous downside if TreasuryDirect might evaluate the notarized type and take away the restriction in two days versus 20 weeks, however the actuality is that TreasuryDirect is understaffed. The pc system runs routine transactions effectively however something requiring human intervention takes a very long time.

Classes discovered: Deal with TreasuryDirect as a fragile object. Do as little as doable with it. Keep on the overwhelmed path. Purchase your I Bonds. Promote your I Bonds. Use your linked checking account to transact. Don’t use the browser’s again button. Bear in mind your password and your solutions to the safety questions. Be additional cautious to not get your account locked. Use your brokerage account if you purchase common Treasuries. Steer clear of Zero-P.c C of I in TreasuryDirect.

Say No To Administration Charges

In case you are paying an advisor a share of your belongings, you might be paying 5-10x an excessive amount of. Discover ways to discover an impartial advisor, pay for recommendation, and solely the recommendation.