Quickly Zerodha Mutual Fund will launch two schemes the place the benchmark is the Nifty LargeMidcap 250 Index. Do you really need this index in your portfolio?

As of now, there is just one index fund that replicates this index (Edelweiss Nifty LargeMidCap 250 Index Fund). As Index Funds are gaining reputation amongst traders and just one fund is at present obtainable for this index, traders at the moment are wanting to search for Zerodha Mutual Fund firm’s choices of the 2 funds.

What’s the NIFTY LargeMidcap 250 Index?

The NIFTY LargeMidcap 250 displays the efficiency of a portfolio of 100 large-cap and 150 mid-cap firms listed on the NSE, represented by way of the NIFTY 100 and the NIFTY Midcap 150 index respectively. The mixture weight of large-cap shares and mid-cap shares is 50% every and is reset on a quarterly foundation.

Highlights

- The index has a base date of April 01, 2005, and a base worth of 1000.

- The index consists of all Shares forming a part of the NIFTY 100 and NIFTY Midcap 150 index.

- The mixture weight of large-cap shares and Midcap shares are capped at 50% every.

- The index shall be reconstituted on a semi-annual foundation together with the NIFTY 100 and NIFTY Midcap 150 index.

- Weights of large-cap and mid-cap shares are rebalanced on a quarterly foundation.

The highest holdings primarily based on weightage as of now are as beneath.

| Firm’s Identify | Weight(%) |

| HDFC Financial institution Ltd. | 5.64 |

| Reliance Industries Ltd. | 3.92 |

| ICICI Financial institution Ltd. | 3.23 |

| Infosys Ltd. | 2.47 |

| ITC Ltd. | 1.87 |

| Tata Consultancy Companies Ltd. | 1.65 |

| Larsen & Toubro Ltd. | 1.57 |

| Axis Financial institution Ltd. | 1.28 |

| Kotak Mahindra Financial institution Ltd. | 1.24 |

| Shriram Finance Ltd. | 1.22 |

The highest 5 sectors on this index are as beneath.

| Sector | Weight(%) |

| Monetary Companies | 28.35 |

| Data Expertise | 8.67 |

| Capital Items | 7.8 |

| Healthcare | 7.76 |

| Car and Auto Parts | 7.4 |

In whole these 5 sectors represent round 60% of the index. This can be a transient data in regards to the NIFTY LargeMidcap 250 Index.

NIFTY LargeMidcap 250 Index – Must you make investments?

Do you as an investor want this NIFTY LargeMidcap 250 Index fund in your portfolio? What the historical past this index truly exhibits us. Allow us to attempt to discover it out.

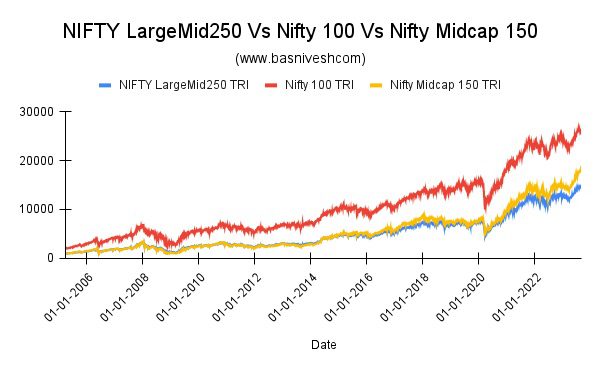

For my comparability function, I’ve chosen the Nifty 100 TRI Index, Nifty Midcap 150 TRI Index, and NIFTY LargeMidcap 250 Index. Because the NIFTY LargeMidcap 250 Index began on 1st April 2005, I’ve thought-about the identical date for all three indexes for comparability. Therefore, it’s nearly round 18 years of information with round 4,500 each day information factors for our analysis.

How do all three indexes look plainly?

This won’t give us a transparent image primarily as a result of Nifty 100 TRI began lengthy again and on 1st April 2005, the worth was 2,158. Nonetheless, for each the NIFTY LargeMidcap 250 Index and Nifty Midcap 150 it was 1,000. Therefore, clearly, Nifty 100 TRI seems finest performing. However it’s a half-truth.

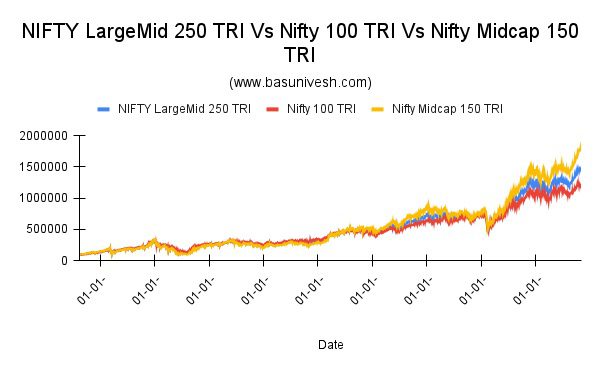

As an alternative, allow us to attempt to perceive with an instance of what if somebody invested Rs.1,00,000 in these three indexes on 1st April 2005 and what are the ultimate worth as of now.

The ultimate values are Rs.14,99,193, Rs.12,11,806, and Rs.18,75,746 for the NIFTY LargeMid 250 TRI, Nifty 100 TRI, and Nifty Midcap 150 TRI indexes respectively. Clearly, this results in the conclusion that Nifty Midcap 150 TRI carried out higher and we should blindly bounce into investing on this index. Once more this can be a half-truth. It won’t give us the entire image. As an alternative, allow us to look into the drawdown of this journey.

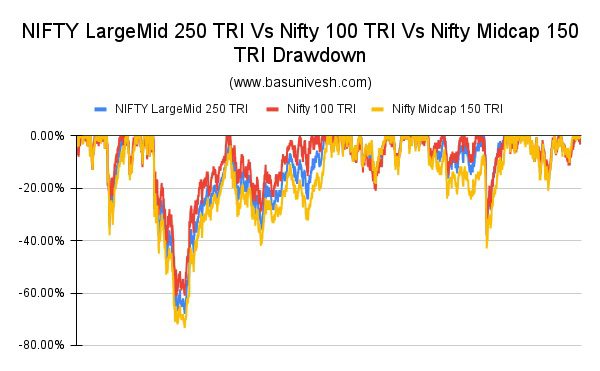

The drawdown is one solution to measure danger. This exhibits how a lot funding has fallen from its peak and for a way lengthy it continued.

Right here it’s!! You observed that the Nifty Midcap 150 TRI drawdown was nearly greater than 70%. It means the worth of what you invested went down by nearly 70%. Therefore, assuming the Nifty Midcap 150 TRI is finest by point-to-point returns of across the final 18 years isn’t the precise approach. As an alternative, we’ve to search for the danger in investing.

Clearly, the above drawdown picture exhibits that NIFTY LargeMid 250 TRI and Nifty 100 TRI are safer than Nifty Midcap 150 TRI. Nonetheless, as a consequence of midcap publicity in NIFTY LargeMid 250 TRI, it seems extra dangerous than Nifty 100 TRI.

Now allow us to transfer on and attempt to perceive the volatility and attempt to perceive whether or not it’s actually price investing in NIFTY LargeMid 250 TRI by rolling returns.

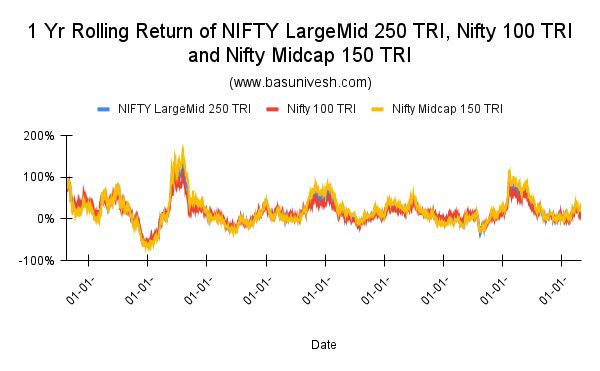

1-12 months Rolling Returns of NIFTY LargeMid 250 TRI, Nifty 100 TRI, and Nifty Midcap 150 TRI

Appears related with no such deviation in returns. Nonetheless, in case you look into the information, the utmost return is 138%, the minimal is -62% and the typical is eighteen% for NIFTY LargeMid 250 TRI.

Equally, the utmost return is 112%, the minimal is -57%, and the typical is 16% for Nifty 100 TRI.

The utmost is 169%, the minimal is -67%, and the typical is 20% for Nifty Midcap 150 TRI.

You observed that by having publicity of fifty% of the midcap index in NIFTY LargeMid 250 TRI, you’re growing the danger to a portfolio with no such better benefit as the typical returns between the 2 indexes NIFTY LargeMid 250 TRI and Nifty 100 TRI is simply round 2% for one yr rolling returns.

Nonetheless, 1-year rolling returns clearly not a greater information to guage.

3-Years Rolling Returns of NIFTY LargeMid 250 TRI, Nifty 100 TRI, and Nifty Midcap 150 TRI

You observed that the Nifty Midcap 150 TRI exhibits excessive returns with excessive danger in comparison with the NIFTY LargeMid 250 TRI and Nifty 100 TRI.

Nonetheless, in case you look into the information, the utmost return is 38%, the minimal is -12% and the typical is 13% for NIFTY LargeMid 250 TRI.

Equally, the utmost return is 41%, the minimal is -7%, and the typical is 12% for Nifty 100 TRI.

The utmost is 41%, the minimal is -17%, and the typical is 15% for Nifty Midcap 150 TRI.

This proves that for 3 years of rolling returns, investing in NIFTY LargeMid 250 TRI isn’t price in comparison with even Nifty 100 TRI!!

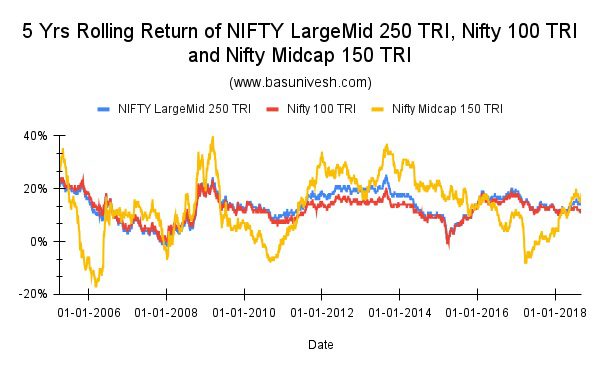

5-Years Rolling Returns of NIFTY LargeMid 250 TRI, Nifty 100 TRI, and Nifty Midcap 150 TRI

The outcomes of the 5-year rolling return of NIFTY LargeMid 250 TRI, Nifty 100 TRI, and Nifty Midcap 150 TRI are much like 3-year rolling returns.

The utmost return is 25%, the minimal return is -2%, and the typical is 13% for NIFTY LargeMid 250 TRI.

The utmost return is 24%, the minimal return is -1%, and the typical is 12% for NIFTY 100 TRI.

The utmost return is 40%, the minimal return is -17%, and the typical is 13% for NIFTY Midcap 150 TRI.

This once more exhibits that by including round 50% to your portfolio by way of NIFTY LargeMid 250 TRI, there isn’t a nice benefit in comparison with Nifty 100 TRI traders. You might be merely growing the danger with no such nice reward.

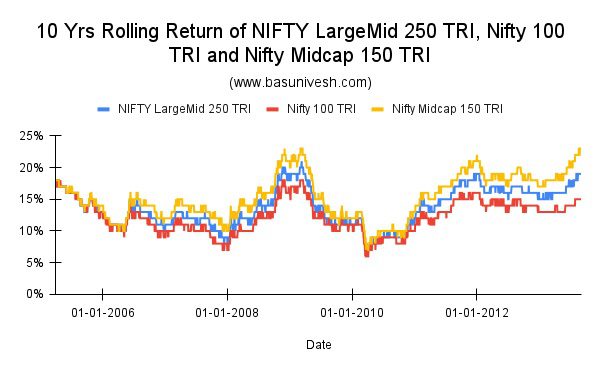

10-Years Rolling Returns of NIFTY LargeMid 250 TRI, Nifty 100 TRI, and Nifty Midcap 150 TRI

The outcomes are the identical even within the case of 10 years of rolling returns.

The utmost return is 21%, the minimal return is 6%, and the typical is 14% for NIFTY LargeMid 250 TRI.

The utmost return is eighteen%, the minimal return is 6%, and the typical is 12% for NIFTY 100 TRI.

The utmost return is 23%, the minimal return is 7%, and the typical is 15% for NIFTY Midcap 150 TRI.

Conclusion – By wanting on the above information, you may conclude that by investing within the Nifty LargeMid 250 index, you aren’t getting any better benefit over the Nifty 100. As an alternative, by including the Nifty LargeMid 250 index, you’re taking a excessive danger of investing 50% within the Nifty Midcap 150 Index.

Nifty 100 is sufficient so that you can add Nifty LargeMid 250 to your portfolio. Yet another factor I want to convey to your discover is that in Nifty 100, the key portion is Nifty 50 in comparison with Nifty Subsequent 50. Therefore, in case you divide this Nifty 100 between Nifty 50 and Nifty Subsequent 50 with numerous combos, then in my opinion, you’ll cut back the danger and may have higher risk-adjusted returns than including Nifty LargeMid 250. Do do not forget that Nifty Subsequent 50 acts like a typical Nifty Midcap. I wrote a put up on this lengthy again and you may seek advice from the identical (as that is the previous put up, it’s a must to be sure the comparability as per at this time’s worth) “Nifty Subsequent 50 Vs Nifty Midcap 150 – Which is finest?“.

As Nifty Midcap 150 is a part of Nifty LargeMid 250, generally it’s possible you’ll face liquidity points and therefore the massive monitoring error. Take, for instance, the prevailing Edelweiss Nifty LargeMidCap 250 Index Fund displaying the monitoring distinction as -1.18% for 1 one-year interval and -1.3% for since inception interval. For an index fund, such an enormous monitoring distinction is unacceptable. Nonetheless, allow us to see how these new entrants carry out sooner or later. (Discuss with my earlier put up to know what’s monitoring distinction “Monitoring Distinction Vs Monitoring Error of ETF and Index Funds“.

As of now, fairly than simply leaping into any new index fund, attempt to perceive the necessities at first. If you might want to, then go forward. In any other case, no want so as to add all index funds to your kitty simply because index funds are finest in comparison with energetic funds.