Lunch Cash

Strengths

- Straightforward-to-use budgeting instruments and web value calculator

- Can sync accounts or add handbook accounts

- Customizable transaction guidelines and report

- Multicurrency assist

- 14-day free trial

Weaknesses

- Much less aggressive finances than zero-based budgeting apps

- No cellular app

- No free plan

The greatest budgeting apps can assist you craft a perfect finances and observe different monetary metrics equivalent to your web value, financial savings charge, and spending patterns. One such app, Lunch Cash, affords many options to assist make budgeting simpler with computerized account syncing, including handbook accounts, and customizing the information.

Lunch Cash affords a number of perks that some rivals are much less possible to offer, equivalent to multicurrency assist and community-developed plugins to personalize the budgeting expertise.

Our Lunch Cash evaluation digs into the varied options that may assist you make and keep on with a finances.

Desk of Contents

- What Is Lunch Cash?

- How Lunch Cash Works

- Lunch Cash Pricing

- Finest Lunch Cash Options

- Account Syncing

- Budgeting

- Calendar

- Multicurrency Tracker

- Web Value Calculator

- Transaction Guidelines

- Developments

- Lunch Cash vs. YNAB

- Lunch Cash vs Tiller Cash

- Is Lunch Cash Protected?

- Lunch Cash Professionals and Cons

- FAQs

- Who Ought to Use Lunch Cash?

What Is Lunch Cash?

Launched in 2019, Lunch Cash is a private finance app that permits you to finances and observe your web value, amongst different issues. ts founder is a solopreneur who describes it as “a multicurrency private finance device for the modern-day spender.”

However you don’t should be a world traveler or conduct enterprise with shoppers from a number of international locations to get essentially the most out of Lunch Cash. Its budgeting instruments swimsuit strange households needing to trace each day spending.

Among the core options embody:

- Budgeting

- Cryptocurrency pockets monitoring

- Web value tracker

- Recurring bills

- Guidelines and transactions utilities

- Stats and traits

Lunch Cash is appropriate for various budgeting methods, particularly if you’d like entry to the customizable instruments, automation options, and colourful shows that elevate Lunch Cash above budgeting spreadsheets and pen-and-paper budgets.

Nevertheless, Lunch Cash isn’t for everyone, because it solely affords an online model – there is no such thing as a cellular app. Whereas that may deter some, an online browser permits the platform to provide extra highly effective instruments plus further display visibility.

Be taught Extra About Lunch Cash

How Lunch Cash Works

After you create your account, you’ll be able to auto-connect your varied banking accounts and embody the worth of different tangible property. The setup course of takes a little bit little bit of time as you will want to categorize a handful of transactions and designate category-based spending targets.

How a lot time it takes depends upon the variety of accounts you wish to observe and the complexity of your budgeting targets. The setup course of took me about so long as different paid apps, nevertheless it’s not as overwhelming as some data-heavy finances software program.

Tech-savvy customers may make the most of the developer API to construct personalized plugins that often require a spreadsheet finances app. Suppose you’re like me and desire a primary budgeting app. In that case, you’ll be able to simply add transaction guidelines and auto-categorization instruments to reduce ongoing upkeep.

I’ve used many budgeting instruments and located Lunch Cash to be among the many higher ones. My first impression is that connecting banking accounts utilizing Plaid and calculating the bills is simple. I’m in a position so as to add handbook accounts and property by importing CSV information or coming into transaction particulars by hand. And I can simply evaluate my spending by month and think about itemized transactions.

For my part, Lunch Cash is simpler to make use of and has extra performance than most free budgeting apps, such because the now-defunct Mint. It additionally has a unique really feel than deluxe paid budgeting apps like YNAB or Tiller, mixing the most effective options and performance from each.

Lunch Cash Pricing

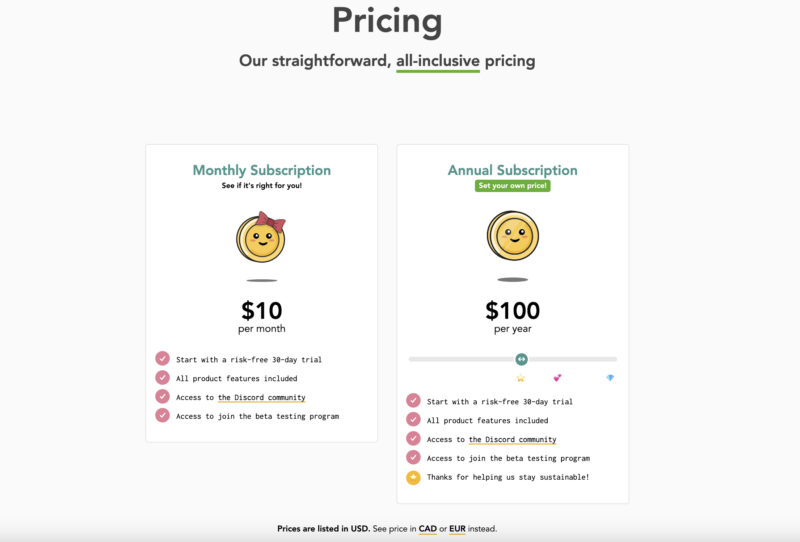

You possibly can check out Lunch Cash with a 14-day free trial that doesn’t require offering your bank card particulars. After that, it’s $10 month-to-month, or you should purchase an annual subscription that prices between $40 and $150 every year, relying on which options and additional perks you need included.

This pricing is aggressive with different premium budgeting apps. The 14-day trial interval is adequate time to arrange your funds and check out the software program to see if it suits your budgeting and monetary planning targets.

Be taught Extra About Lunch Cash

Finest Lunch Cash Options

Listed here are among the most beneficial monetary instruments to trace spending, make monetary targets, and monitor your web value.

Account Syncing

Lunch Cash routinely syncs to most banks and on-line brokerages to add your newest transactions from these account sorts:

- Checking accounts

- Bank cards

- Cryptocurrency wallets

- Worker compensation

- Funding accounts

- Loans

- Actual property

- Financial savings accounts

- Autos

It’s also possible to manually add accounts in case you don’t wish to join accounts or have non-linkable accounts and property. For instance, you might have a household mortgage you want to observe or the market worth of various investments.

Budgeting

The Lunch Cash finances technique has you set spending limits for a month-to-month finances. You possibly can simply evaluate your precise spending to your deliberate bills and your common month-to-month spending.

It’s simple so as to add single classes and class teams to trace spending with out experiencing knowledge overload. You possibly can deal with classes as revenue and exclude them from the finances totals, like bank card funds, to stop skewing your numbers.

You possibly can view the transactions by class with graphs and line objects to see a high-level overview or an in-depth look on the identical display. As an illustration, chances are you’ll wish to observe spending by service provider.

This method is just not as aggressive as a zero-based finances that requires a function for each earned greenback. Zero-based budgets require a extra intensive dedication however could make your spending and saving habits extra environment friendly than an informal, self-directed finances like Lunch Cash.

Lunch Cash’s flexibility is good if you’d like a extra informal budgeting method that requires much less oversight. Moreover, a category-based finances is extra of a standard budgeting technique that may suit your wants, whether or not you’re new to budgeting or have already developed cash administration expertise and don’t want a lot hands-on assist.

Calendar

The finances calendar is a comparatively new characteristic that gives one other approach to observe your funds. Every date consists of the revenue and bills in month-to-month or two-week increments.

Multicurrency Tracker

Many private finance apps solely provide assist within the native foreign money. Nevertheless, a small subset of the world’s inhabitants works with a number of currencies, and this app can precisely log cross-border transactions in over 90 currencies.

Early adopters of cryptocurrency transactions may profit from this platform perk.

Web Value Calculator

The online value tracker can assist visualize your exhausting work of lowering bills, saving the distinction, and incomes funding revenue. It’s simple to calculate your liquid web value.

The characteristic is a wonderful addition because it affords further worth in your paid subscription. Examine Lunch Cash to Empower (previously Private Capital) and different high web value calculators.

Be taught Extra About Lunch Cash

Transaction Guidelines

By automating your funds, you’ll be able to spend much less time categorizing transactions and cut back the likelihood of giving up when budgeting takes an excessive amount of time. Lunch Cash suggests guidelines you can apply to transaction imports. You’ve the power to create customized guidelines too.

Guidelines can be found for these subjects:

- Funds class

- Payee

- Recurring transactions

- Tags

Every rule adopts an “if…then…lastly” order move so you’ll be able to add circumstances, determine particular labels, and resolve how lengthy to run a rule or delete present ones. Not all finances software program affords this stage of customization.

Developments

One of many largest benefits of utilizing a budgeting app is viewing your spending habits and financial savings charge with colourful charts and knowledge bins utilizing customizable search filters. These statistics make it simpler to foretell your most costly months and finances classes. It could undertaking how a lot it can save you every month and obtain future targets.

I respect monitoring my web value and spending patterns in real-time to remove the potential of destructive monetary surprises. There have been occasions once you suppose you’ll have extra money within the financial institution to pay an costly invoice however don’t and may’t shortly work out why. These insights present the data to keep away from monetary errors.

Lunch Cash vs. YNAB

You Want a Funds (YNAB) has an online and cellular platform utilizing the zero-based finances technique. This platform is good in case you’re dwelling paycheck-to-paycheck or want hands-on assist with making a spending plan, because it has one of the crucial intensive setup walkthroughs.

There are additionally reside workshops that may assist you create a YNAB finances and make the most of the platform options. It’s also possible to benefit from the 34-day free trial.

Be taught extra with our YNAB evaluation.

Lunch Cash vs Tiller Cash

Tiller is likely one of the greatest finances spreadsheet software program apps obtainable, with Google Sheets and Microsoft Excel compatibility. It syncs along with your monetary accounts for real-time updates. You possibly can add customized templates to pursue a number of finances methods and observe revenue and bills by means of a spreadsheet.

Be taught extra in our Tiller evaluation.

Is Lunch Cash Protected?

Lunch Cash makes use of bank-level safety and two-factor authentication (2FA) to guard your private knowledge. Moreover, it received’t promote your info and solely has read-only entry. You may additionally resolve to add CSV information as a substitute of linking your accounts by means of Plaid to stop ongoing entry in case your account will get compromised.

Lunch Cash Professionals and Cons

There’s a lot to love about Lunch Cash, nevertheless it’s not for everybody. Here’s a checklist of Lunch Cash professionals and cons:

Professionals

- Straightforward-to-use budgeting instruments and web value calculator

- Can sync accounts or add handbook accounts

- Customizable transaction guidelines and report

- Multicurrency assist

- 14-day free trial

Cons

- Much less aggressive finances than zero-based budgeting apps

- No cellular app

- No free plan

FAQs

Lunch Cash has a web-based library with an in depth catalog of useful articles. Help can also be obtainable by electronic mail or in a Discord group.

Lunch Cash’s commonplace setup is a month-to-month finances the place customers checklist their month-to-month spending restrict for limitless finances classes. The app routinely syncs with banking accounts and auto-categorizes transactions to match precise spending to deliberate bills simply.

No. Lunch Cash is a web-first finances platform accessible solely from an online browser. It’s greatest to entry this service from a pc or pill, which has an even bigger display to show its in-depth private finance instruments.

Be taught Extra About Lunch Cash

Who Ought to Use Lunch Cash?

Whereas another apps provide a extra in-depth budgeting expertise, individuals love Lunch Cash for its extremely purposeful budgeting app that permits you to join your accounts, make a customizable month-to-month finances, and observe your bills in actual time.

Lunch Cash makes it simple to make sure you’re not overspending with out the rigidity or intensive repairs that extra detailed finances apps typically require. Its web value calculator and handbook account monitoring are beneficial secondary advantages.

See if Lunch Cash suits your monetary wants with a risk-free 14-day trial interval.