Picture supply: Getty Photos

Synthetic intelligence (AI) has been on a meteoric rise in 2023, experiencing an enormous bull run that appears unstoppable.

This surge has been catalyzed by a number of components: the discharge of revolutionary AI applied sciences like ChatGPT, record-breaking income from U.S. chipmakers who energy these AI techniques, and substantial investments into AI by tech juggernauts.

Nevertheless, whereas it could simply be my interior pessimist talking, I’m all the time cautious of getting swept away by market euphoria and the most recent “new paradigm!” being extolled by trade pundits and analysts.

Historical past has proven that speculative bubbles type when an asset’s value far exceeds its intrinsic worth, typically pushed by a collective enthusiasm that obscures the dangers concerned.

At the moment, I’ll clarify why I personally have reservations about leaping headfirst into AI shares proper now, even amid the compelling progress narratives.

I’ll additionally define an alternate funding possibility that gives a steadiness between danger and reward, offering what I contemplate a safer pathway within the unstable panorama of rising applied sciences.

Why I don’t spend money on AI

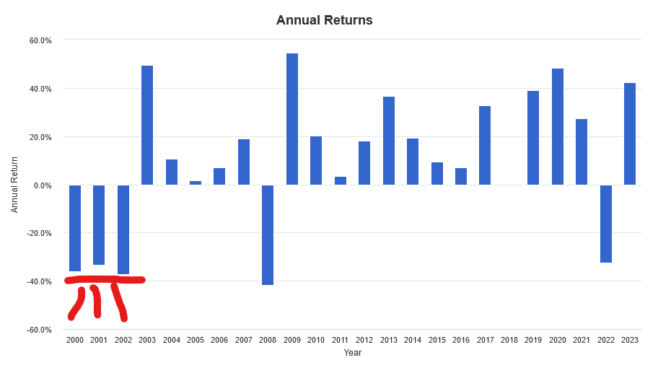

The phrase “historical past doesn’t repeat itself, nevertheless it typically rhymes” involves thoughts when considering the seemingly unstoppable rise of AI shares. One needn’t look far again to discover a cautionary story; contemplate the 2000 dot-com bubble.

The optimism surrounding rising web corporations on the time led to inflated valuations, solely for a lot of of those budding companies to break down. In consequence, the Nasdaq-100 index skilled three consecutive years losses after the bubble burst.

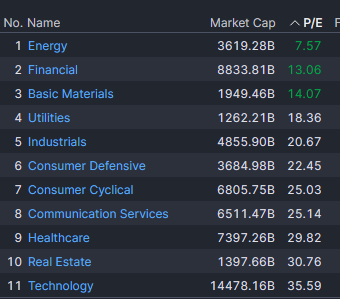

One other essential level to contemplate is the matter of valuations. As of now, in keeping with Finviz, the know-how sector within the U.S., the place most AI corporations reside, is buying and selling at a hefty price-to-earnings (P/E) ratio of 35.6. To place this into perspective, evaluate it to the vitality sector, which at the moment trades at a way more modest P/E of seven.57.

Excessive valuations, whereas indicative of investor optimism, additionally suggest increased expectations for future progress and efficiency. Primarily, while you spend money on a sector with a excessive P/E, you’re paying a premium for future earnings, thereby limiting your potential upside. On the flip facet, sectors with decrease valuations usually supply extra room for progress and fewer draw back danger.

So, even when the know-how and AI sectors proceed to develop, the lofty valuations in the present day might imply extra modest returns sooner or later, significantly when in comparison with different sectors which might be buying and selling at extra cheap multiples.

What I might purchase as an alternative of AI shares

In my humble opinion, in the present day’s fervour round AI applied sciences is eerily paying homage to previous market frenzies. There’s a normal sense of irrational exuberance, with buyers typically overlooking conventional valuation metrics in favour of nebulous potential.

Whereas AI is undoubtedly transformative, not each firm leveraging the know-how will emerge as a winner. Due to this fact, I might moderately make a extra diversified funding by betting on the general U.S. market.

Figuring out the profitable AI shares of tomorrow is almost unimaginable, however by shopping for the broad U.S. inventory market, I’m assured to learn from their outperformance. I’ll additionally get a extra even steadiness of sectors.

For a diversified wager on the U.S. inventory market, I like BMO S&P 500 Index ETF (TSX:ZSP). This no-frills exchange-traded fund prices a low expense ratio of 0.09%, or round $9 in charges yearly on a $10,000 funding.