For the brand new yr, we’ve given you an intensive 3-pronged have a look at the markets.

First, we’ve the overall outlook for the economic system and markets by means of the Outlook 2024. That is the overall outlook for 2024, together with the recap of 2023 and the way the predictions I made then performed out. It features a comparability in inflation and disinflation patterns of the Nineteen Seventies and now. It additionally contains all of the indices and the overall outlook for key sectors and the bonds, greenback, metals, and so forth.

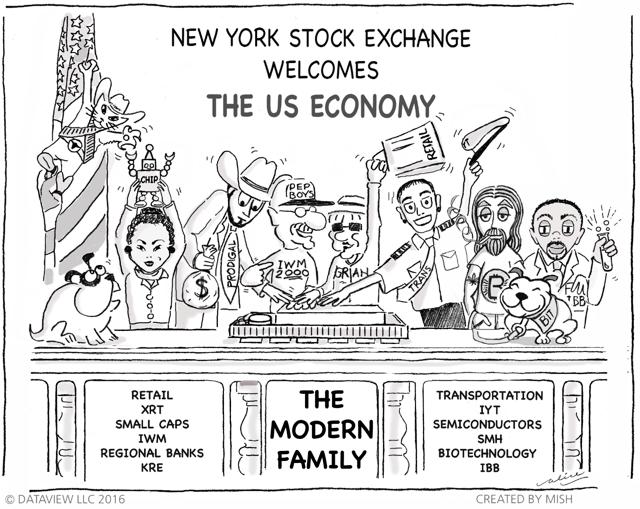

Furthermore, we have a look at the Financial Trendy Household and their outliers by means of charts and evaluation. Additionally included are general traits to observe, plus picks.

One different space I cowl within the Outlook 2024 is the teachings of Raymond Lo and the way he sees the upcoming 12 months of the Dragon. A part of my feedback on his evaluation is predicated on this assertion by Lo:

“Many has the misunderstanding that the Dragon is glamorous auspicious animal and can all the time deliver good luck. On the contrary, Dragon and Canine within the 12-animal system is known as the “Gate to Heaven and Hell” or the “Web of Heaven and Hell”.

Normal Ideas

2024 might see good points; nevertheless, we’re agnostic and positively trying to charts. SPY wants to carry 4600 as our line within the sand, and small caps want to carry over 2000. Plus, in January, we may have a 6-month calendar reset this yr with the election; devices that fail the calendar vary lows might set the stage for a broader selloff, whereas devices that rally above the calendar vary highs could be the larger winners, at the very least for the primary half of the yr. Nonetheless, we’ve eager eyes on junk bonds, which, regardless of rallying, have effectively underperformed the indices. In the event that they maintain, nice; if not, we take that as a warning.

With the anticipation of Fed decreasing charges a number of occasions, we additionally wish to see Fed Fund charges stabilize and never fall too dramatically, as these may very well be the indicators of recession that we seemingly prevented in 2023. Moreover, we expounded with Every day newsletters.

From Gold and Silver

For final yr’s Outlook, I wrote:

Maybe our greatest callout for a serious rally in 2023 is in gold.

Right here we’re over $2000 and, though gold has not doubled in value, it did rise by 25%.

For 2024, we stick with our name for larger gold costs. I’m in search of a transfer to $2400, offered gold continues to carry $1980.

That assertion was from December 1st. So as to add to that assertion:

Tendencies for 2024 — Gold and Silver begin their Final Hurrah.

From 17 Predictions

With sure areas of inflation coming down, though nonetheless larger than what numbers counsel, the dialogue of the speed hike cycle on the finish is controversial. Statistically, there was a serious monetary failure on the finish of every fee hike cycle since 1965.

At the moment, the catalyst for monetary stress may very well be the rising debt, rising spending, geopolitical points impacting provide chain and a contentious election yr. And something that gooses inflation will cease the Fed from reducing.

January 2024 will see a brand new 6-month calendar vary reset — will probably be crucial this time, with many predicting the top of the primary quarter with a selloff. Though the stats are on the facet of a better market, this yr of the dragon suggests some irritation that might flip the market on its facet with extra volatility.

To be ready try our predictions.

From The Vainness Commerce 2024: All About Me!

Based on Wikipedia, “Self-help or self-improvement is a self-directed enchancment of oneself—economically, bodily, intellectually, or emotionally—usually with a considerable psychological foundation.”

Within the Outlook 2024, I quote Raymond Lo but once more,

“The Dragon is taken into account a ‘Star of Arts.’ The industries that may carry out higher within the 12 months of the Dragon will probably be associated to the Metallic and Wooden components. Metallic industries are magnificence and skincare; wooden industries are media, vogue….”

This obtained me eager about the buyer and the habits of 2023 and the way they might proceed or change in 2024.

With disposable revenue nonetheless fairly excessive, customers who spent the final half of 2023 in YOLO or revenge spending go into vainness mode in 2024.

Style, magnificence, skincare, elective surgical procedures, self-help, weight-reduction plan medication, and possibly relationship shares do effectively.

This each day contains plenty of picks to place in your radar.

Click on this hyperlink to get your free copy of the Outlook 2024 and keep within the loop!

Thanks, all my loyal readers, followers, shoppers and colleagues, for making 2023 so profitable. Right here is to a VERY HEALTHY, HAPPY and PROSPEROUS NEW YEAR!!!

That is for instructional functions solely. Buying and selling comes with threat.

In the event you discover it tough to execute the MarketGauge methods or want to discover how we will do it for you, please electronic mail Ben Scheibe at Benny@MGAMLLC.com, our Head of Institutional Gross sales. Cell: 612-518-2482.

For extra detailed buying and selling details about our blended fashions, instruments and dealer training programs, contact Rob Quinn, our Chief Technique Marketing consultant, to be taught extra.

Merchants World Fintech Awards

Get your copy of Plant Your Cash Tree: A Information to Rising Your Wealth.

Develop your wealth in the present day and plant your cash tree!

“I grew my cash tree and so are you able to!” – Mish Schneider

“I grew my cash tree and so are you able to!” – Mish Schneider

Comply with Mish on X @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for each day morning movies. To see up to date media clips, click on right here.

Mish and group have a look at 2023 and make a number of predictions on commodities and traits for 2024 and vainness shares in Benzinga Pre Market Prep.

Mish discusses gold, silver and why self care and “all about me” can development in 2024 in this video from Yahoo! Finance.

Coming Up:

January 2: The Remaining Bar with David Keller, StockCharts TV & Making Cash with Charles Payne, Fox Enterprise & BNN Bloomberg

January 3: Actual Imaginative and prescient IP Group Particular Presentation

January 5: Every day Briefing, Actual Imaginative and prescient

January 22: Your Every day 5, StockCharts TV

January 24: Yahoo! Finance

Weekly: Enterprise First AM, CMC Markets

- S&P 500 (SPY): 480 all-time highs, 460 underlying help.

- Russell 2000 (IWM): 200 pivotal.

- Dow (DIA): Wants to carry 370.

- Nasdaq (QQQ): 410 pivotal.

- Regional Banks (KRE): 47 help, 55 resistance.

- Semiconductors (SMH): 174 pivotal help to carry this month.

- Transportation (IYT): Wants to carry 250.

- Biotechnology (IBB): 130 pivotal help.

- Retail (XRT): The longer this stays over 70.00 the higher!

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Schooling