Divergences are situations whereby an oscillator’s peaks and dips would deviate from the depth of the worth swings of value motion. These situations are telltale indicators of a presumably sturdy reversal value swing which could be wonderful buying and selling alternatives. Nevertheless, it’s typically tough to establish legitimate divergences as a result of most merchants haven’t any goal technique for figuring out legitimate value swings. This technique exhibits us how we will objectively spot divergences utilizing a few technical indicators.

Shifting Common of Oscillator

The Shifting Common of an Oscillator, also referred to as the Oscillator of a Shifting Common (OsMA), is a technical indicator that signifies the path of the momentum of value based mostly on the distinction between an oscillator worth and its corresponding transferring common line.

The MACD or Shifting Common Convergence and Divergence indicator is essentially the most generally used oscillator format for calculating the OsMA. Utilizing this indicator for instance, the OsMA indicator would calculate for an underlying MACD worth, which is the distinction between two Exponential Shifting Common (EMA) traces. It will then calculate for a transferring common of the MACD values. The OsMA indicator would then calculate for the distinction between the MACD values and its corresponding transferring common line. These values are then used to plot the OsMA histogram bars.

The OsMA indicator is a really versatile technical indicator. It’s typically used to establish momentum path. Merchants might objectively establish the path of the market’s momentum based mostly on whether or not the OsMA bars are optimistic or damaging. Optimistic bars point out a bullish momentum, whereas damaging bars point out a bearish momentum.

It can be used as a foundation for figuring out imply reversals. Merchants might observe oversold and overbought markets based mostly on histogram bars which are far prolonged away from zero. These eventualities are prime situations for imply reversals. Merchants might observe the imply reversal based mostly on the histogram bars beginning to revert again to zero and should swing to the alternative excessive.

As an oscillator, the OsMA also can establish attainable market reversals based mostly on divergences. Merchants might examine the oscillations between value motion and the OsMA histogram bars to identify divergences, which signifies a attainable market reversal.

Zigzag 2 R Colour

The Zigzag 2 R Colour is a customized technical indicator developed to assist merchants establish value swings. This indicator objectively identifies value swings utilizing an algorithm that compares current value actions with prior value swings.

This indicator units a proportion threshold that compares the current value actions in opposition to the prior value swing. If the current value transfer in opposition to the prior value swing exceeds the proportion threshold, the current value motion could be thought of a brand new value swing, and its apex or trough shall be thought of a swing excessive or swing low.

Zigzag indicators are sometimes set with a 5% proportion threshold. If the brand new value momentum strikes in opposition to the prior value swing and exceeds this threshold, the indicator identifies the worth excessive both as a swing excessive or a swing low. The indicator then connects the swing highs and swing lows with a line, forming a zigzag construction oscillating up and down the worth chart, thus the indicator is known as a “Zigzag” indicator.

This model of the Zigzag indicator plots coloured traces. It plots a medium sea inexperienced line to attach a swing low to a swing excessive, and a medium violet purple line to attach a swing excessive to a swing low.

This indicator has many makes use of. Merchants might use the recognized swing highs and swing lows to establish market construction, in addition to assist and resistance zones based mostly on swing highs and swing lows. It can be used to objectively establish pattern path based mostly on the trajectory of the worth swings. Provided that the indicator routinely identifies swing highs and swing lows, merchants may additionally use this indicator as a foundation for objectively recognizing divergences when evaluating value motion and oscillators.

Buying and selling Technique Idea

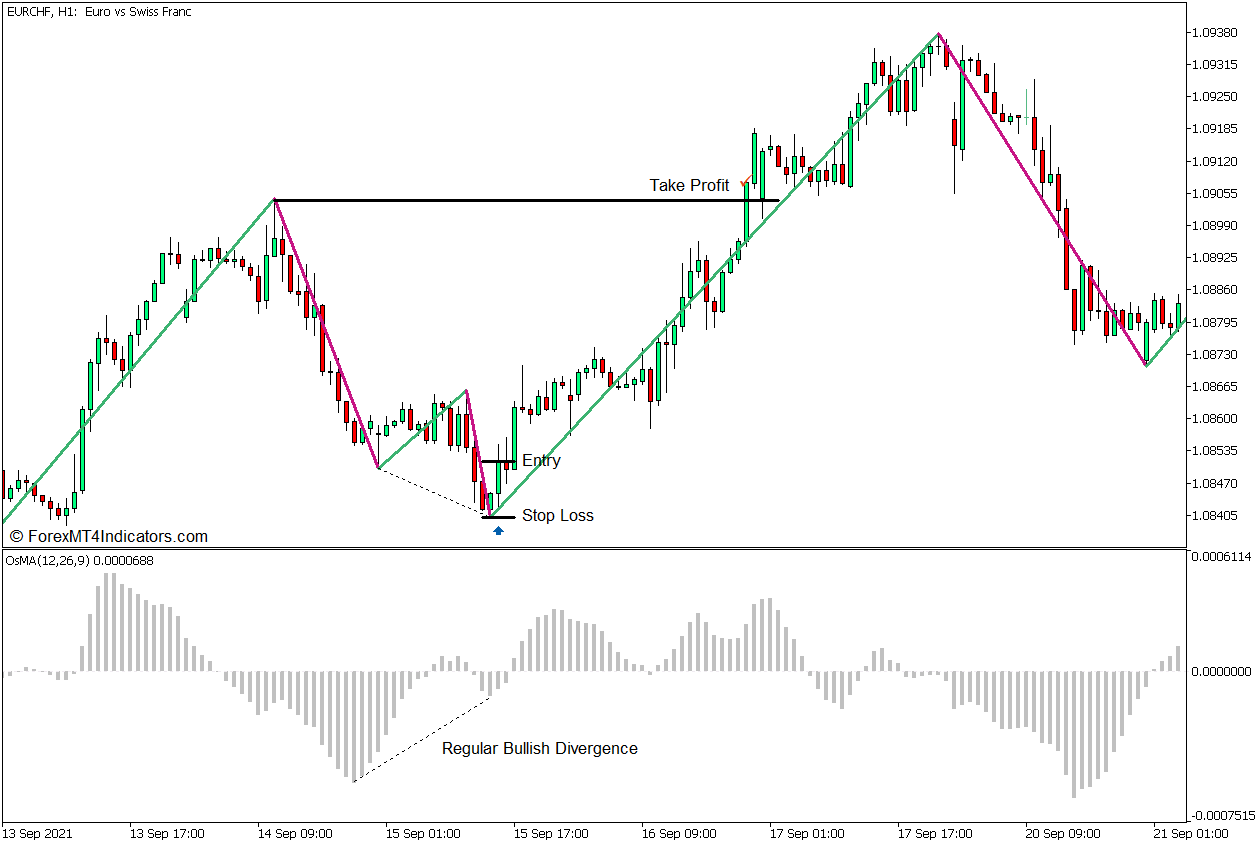

This buying and selling technique is a reversal buying and selling technique that makes use of divergences as a foundation for figuring out potential market reversals. It makes use of two technical indicators particularly supposed to assist merchants objectively establish divergences, notably the Zigzag 2 R Colour indicator and the OsMA indicator.

The Zigzag 2 R Colour is used to assist merchants objectively establish legitimate important value swings. These are the swing highs and swing lows which the indicator identifies and turns into the apex and troughs of its zigzag construction.

Merchants ought to then examine the recognized swing highs and swing lows with the peaks and dips on the OsMA oscillator. A reversal commerce setup might then be thought of if there may be an observable legitimate divergence between value motion and the OsMA histogram bars. Merchants might commerce this and set the following logical swing excessive or swing low because the take-profit goal.

Purchase Commerce Setup

Entry

- Determine a attainable bullish divergence by evaluating the swing lows of value motion as indicated by the Zigzag 2 R Colour indicator and the dips of the OsMA histogram bars.

- Open a purchase order if value motion exhibits indicators of a attainable bullish reversal based mostly on candlestick patterns.

Cease Loss

- Set the cease loss on the fractal beneath the entry candle.

Exit

- Set the take-profit goal on the following logical swing excessive, permitting for a good risk-reward ratio.

Promote Commerce Setup

Entry

- Determine a attainable bearish divergence by evaluating the swing highs of value motion as indicated by the Zigzag 2 R Colour indicator and the peaks of the OsMA histogram bars.

- Open a promote order if value motion exhibits indicators of a attainable bearish reversal based mostly on candlestick patterns.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Set the take-profit goal on the following logical swing low, permitting for a good risk-reward ratio.

Conclusion

This buying and selling technique could be a superb technique for buying and selling reversals based mostly on divergences. The peaks and dips between value motion and the oscillator is probably not precisely aligned attributable to lag. Nevertheless, merchants should still observe legitimate divergences way more simply when utilizing this technique. Merchants may additionally modify the settings inside the indicators to permit for commerce setups which are extra aligned. The important thing to this technique is in studying the way to correctly establish divergences and reversal value motion indications.

Foreign exchange Buying and selling Methods Set up Directions

This MT5 Technique is a mix of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the collected historical past information and buying and selling indicators.

This MT5 technique gives a possibility to detect varied peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional value motion and alter this technique accordingly.

Advisable Foreign exchange MetaTrader 5 Buying and selling Platforms

XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

The way to set up This MT5 Technique?

- Obtain the Zip file beneath

- *Copy mq5 and ex5 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you wish to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick the MT5 technique

- You will notice technique setup is obtainable in your Chart

*Observe: Not all foreign exchange methods include mq5/ex5 information. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain: