As a Foreign exchange dealer, you may select from dozens of forex pairs to commerce from, however which is the suitable selection and what are some widespread pitfalls when selecting the improper Foreign exchange pairs to your buying and selling? Selecting the improper Foreign exchange pairs can lead to suboptimal buying and selling circumstances, elevated danger, and decreased profitability. The most effective Foreign exchange pairs typically depend upon market volatility, financial occasions, liquidity, and your private danger tolerance.

It is necessary to think about elements just like the pair’s common day by day vary, buying and selling occasions, and prices. By understanding these parts, you may establish pairs that supply the most effective alternatives to your buying and selling type. Whether or not you are a day dealer, swing dealer, or long-term investor, specializing in the suitable Foreign exchange pairs can improve your buying and selling success and enable you keep away from pointless dangers.

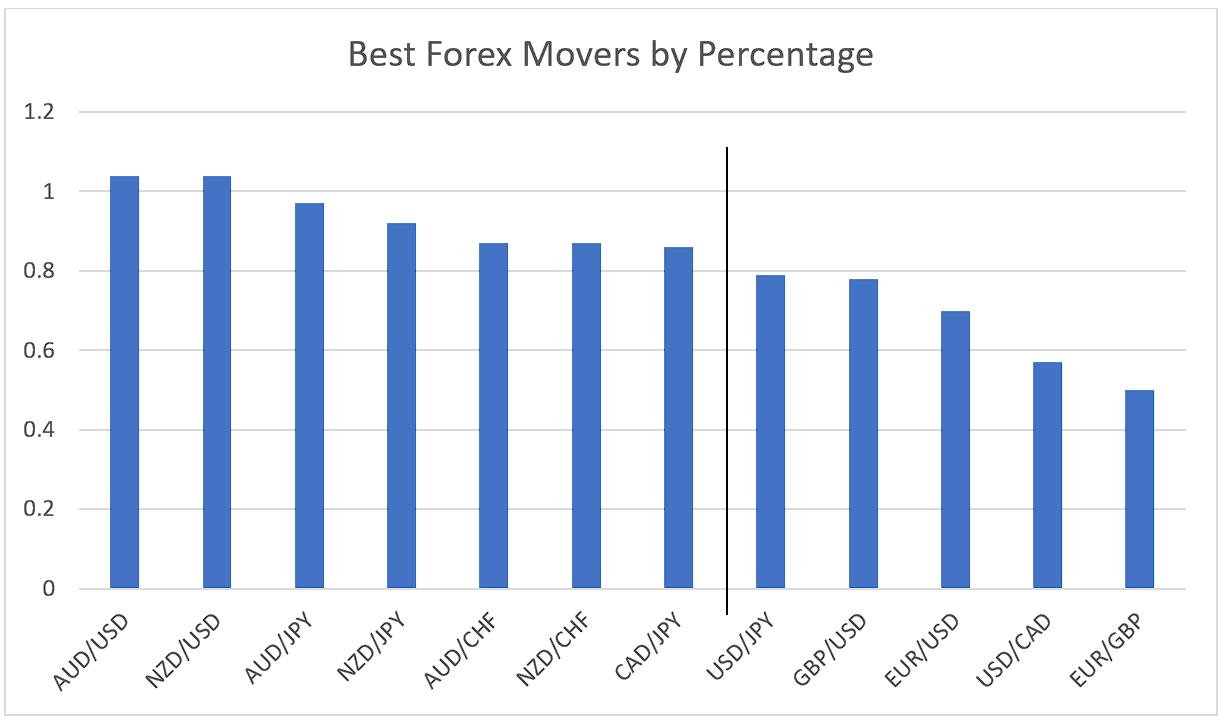

Foreign exchange Pairs Finest Movers

Step one when selecting a Foreign exchange pair to your buying and selling is ensuring that it reveals enough volatility. That is necessary as a result of solely when the worth of your chosen Foreign exchange pair is transferring sufficient, it is possible for you to to appreciate successful trades with a big dimension. When the worth just isn’t transferring, it could be tougher to search out worthwhile alternatives, and enormous trending strikes are much less probably. Particularly for trend-following merchants, or merchants who attempt to catch prolonged worth strikes, excessive ranges of volatility are an necessary issue relating to pair choice. On the decrease timeframes, this may not play such a big function as a result of merchants intention at a lot smaller worth actions.

The graphic beneath reveals that the AUD/USD and the NZD/USD have been the most effective movers on common over the past 40 weeks when their proportion vary. Different AUD and NZD crosses such because the AUD/JPY, NZD/JPY, or the AUD/CHF additionally present excessive ranges of volatility.

Some generally traded Foreign exchange majors such because the USD/JPY and the GBP/USD additionally present excessive ranges of volatility however fall behind the AUD and NZD crosses. Different Foreign exchange majors corresponding to probably the most traded Foreign exchange pair, the EUR/USD, present a lot decrease ranges of volatility. Many new merchants are mechanically drawn to the EUR/USD, USD/CAD, or EUR/GBP however trying on the proportion strikes, they won’t be the optimum selection.

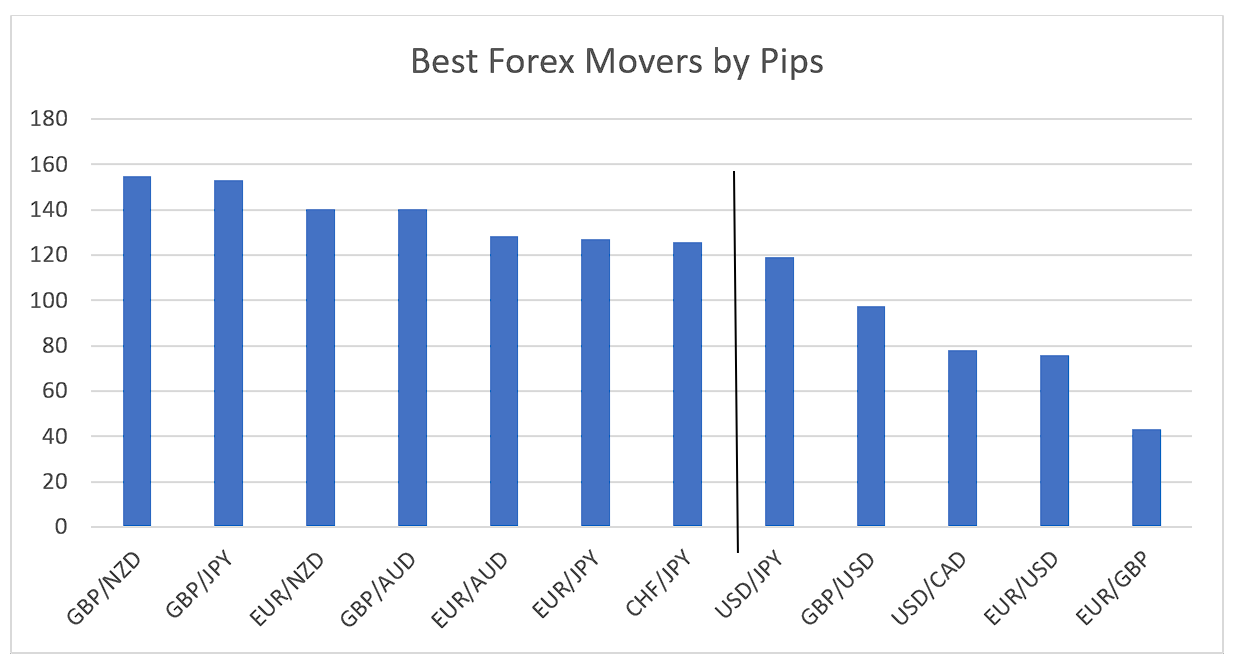

Finest Movers by Pips

When simply trying on the pure pip vary, we now additionally discover some GBP pairs apart from the beforehand talked about AUD and NZD Foreign exchange crosses among the many greatest movers. Nonetheless, the Foreign exchange majors EUR/USD, USD/CAD, and EUR/GBP fall effectively behind the highest movers; EUR/USD and USD/CAD Foreign exchange majors are transferring, on common, solely half of the pip vary, in comparison with GBP/NZD or GBP/JPY.

You will need to be aware right here, that these traits can change over time, and you may also discover cases throughout which the normally much less unstable EUR/USD or USD/CAD can exhibit excessive ranges of volatility. Particularly when geopolitical or macroeconomic (learn extra: most necessary Foreign exchange information occasions) conditions bear adjustments, this will immediately affect volatility. Due to this fact, it is very important pay shut consideration to volatility and the typical worth actions so that you could spot pattern adjustments early on and regulate your market choice.

Supply: Foreign exchange Volatility – Mataf (40-week common)

Supply: Foreign exchange Volatility – Mataf (40-week common)

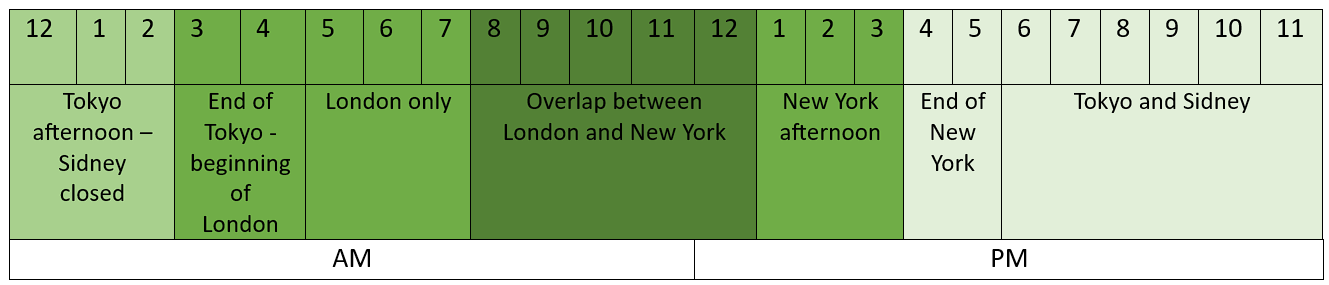

Most Energetic Buying and selling Periods

Apart from discovering Foreign exchange pairs that present enough ranges of volatility, it’s equally necessary to establish the Foreign exchange pairs that transfer throughout your energetic buying and selling hours. It doesn’t assist if you wish to commerce a particular Foreign exchange pair as a result of the graphics above confirmed that it’s a important mover, however then probably the most energetic occasions fall exterior of your energetic buying and selling hours if you find yourself busy at work or sleeping. That is very true for day buying and selling methods and merchants on the decrease timeframes.

The 24-hour buying and selling day is usually divided into 4 buying and selling classes: the primary markets to open on Sunday evening (when contemplating New York time) are Australia and Tokyo, adopted by London and at last New York.

When visualizing the worth exercise of the completely different classes, we get the next. We use New York (UTC-5) as a reference time for the next analyses.

The darker the inexperienced shade, the extra energetic a buying and selling interval; the lighter, the much less energetic:

A fantastic instrument to research the completely different Foreign exchange classes might be discovered on Babypips.

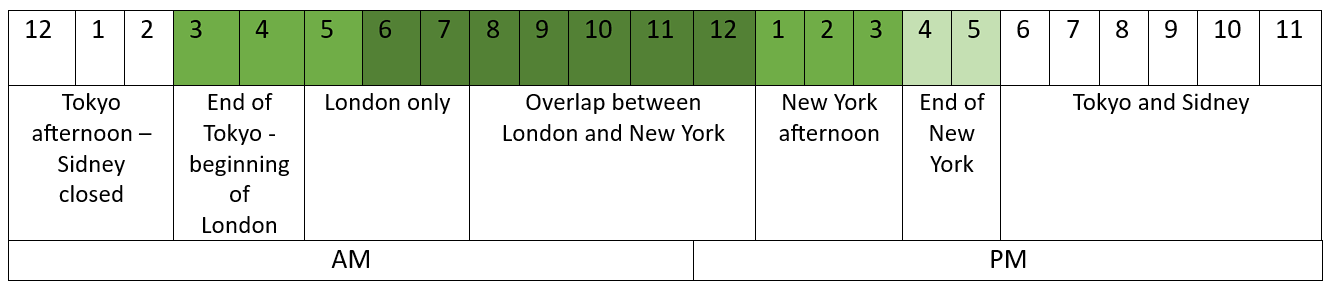

Though it is very important know when probably the most energetic buying and selling hours are, completely different forex pairs reply otherwise to the market hours. Usually, you may say {that a} particular forex is probably the most energetic when its home inventory market is open as effectively. Which means that EUR crosses are most energetic through the London session, whereas the USD is most energetic through the New York Session.

After we are trying on the EUR/USD, because of this this Foreign exchange main is most energetic through the overlap between the London and the New York classes when each inventory markets are open. The EUR/USD additionally reveals greater ranges of exercise through the London open (when New York continues to be closed) and through the New York afternoon session (when London is closed).

Supply: EUR USD Volatility Chart: Euro vs US Greenback Volatility (myfxbook.com)

Buying and selling exercise and the day by day buying and selling cycle present necessary implications for merchants. Provided that your energetic buying and selling time falls into probably the most energetic hours for the EUR/USD, you must think about buying and selling this Foreign exchange pair. In case you are residing in London and have a demanding day job throughout which you can not have a look at the charts, the EUR/USD, and most different EUR crosses, are most likely not a very good match to your buying and selling as a result of you may solely commerce through the much less energetic buying and selling hours, and discovering trending trades is much less probably.

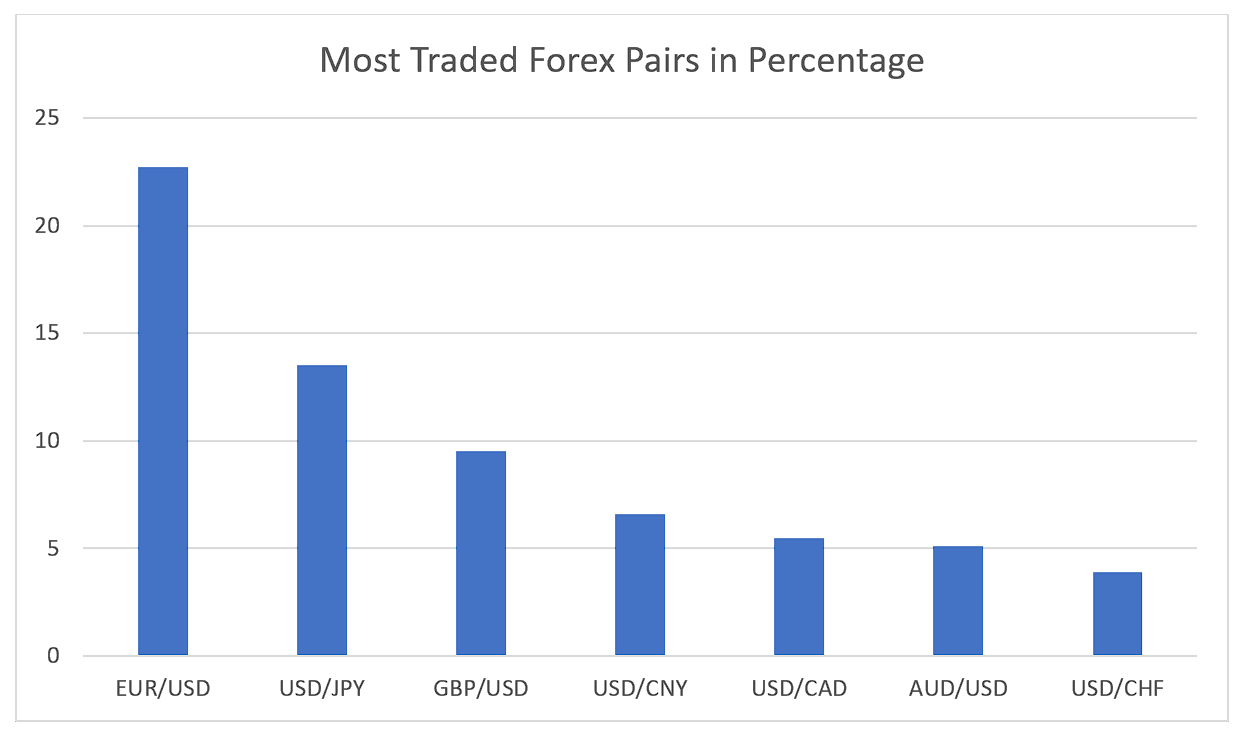

Most Traded Pairs

After we have a look at probably the most traded Foreign exchange pairs, we will see instantly that a lot of the hottest Foreign exchange pairs are usually not among the many greatest movers. EUR/USD and USD/CAD rank decrease on the volatility scale however are the primary and third most traded Foreign exchange pair.

New merchants typically simply seek for the preferred Foreign exchange pairs after which begin buying and selling them with out making any additional inquiries. The most well-liked Foreign exchange pairs are usually not essentially going to be the most effective match for all merchants. As we now have seen, the general volatility and the extent of exercise throughout one’s buying and selling hours are important elements relating to market choice.

Supply: Most traded forex pairs in foreign exchange 2022 | Statista

Buying and selling prices, commissions, and spreads don´t play an enormous function in in the present day´s world of aggressive and low-cost brokerage affords. Foreign exchange majors are the least costly markets, however Foreign exchange minors are normally nonetheless tradable, and their unfold just isn’t important. Nevertheless, Foreign exchange unique pairs could be too expensive, particularly when buying and selling on the decrease timeframes the place unfold and fee can rapidly make up a big a part of your total buying and selling vary.

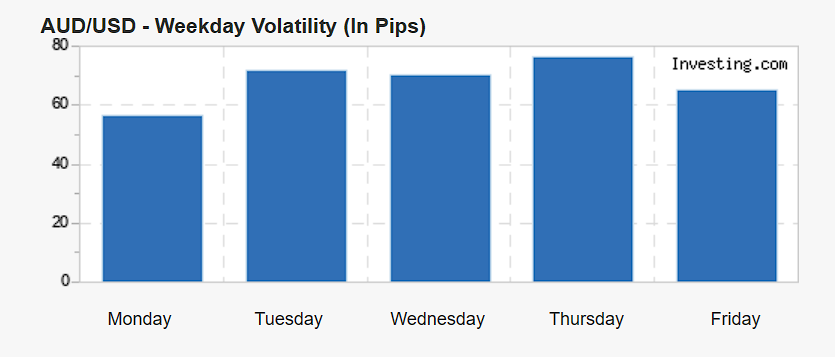

Finest Weekday to Commerce

Relating to inspecting the volatility by weekday, we will use the useful Investing.com volatility instrument. For many Foreign exchange pairs, there is no such thing as a important distinction within the volatility ranges by weekday. For some, as within the instance of the AUD/USD beneath, Mondays will probably be barely much less energetic buying and selling days. The reason being that the weekend break is affecting the whole buying and selling time. That is additionally the explanation why some pairs may present decrease volatility ranges on Fridays. Some merchants due to this fact select to keep away from buying and selling early Monday earlier than the London open and cease their buying and selling on Friday after the London shut.

Supply: Foreign exchange Volatility Calculator – Investing.com

Supply: Foreign exchange Volatility Calculator – Investing.com

Remaining Phrases

The optimum selection relating to market choice and discovering the most effective Foreign exchange pairs doesn’t need to be too difficult. In case you are a day dealer on the decrease timeframes, a very powerful elements are your energetic buying and selling occasions and discovering a Foreign exchange pair that aligns together with your time availability. Keep away from buying and selling Foreign exchange pairs which are most energetic exterior of your buying and selling occasions.

If you end up a dealer on greater timeframes, choosing Foreign exchange pairs that present a excessive stage of volatility could be the suitable strategy as a result of it means that you can commerce markets which have a better probability of displaying trending actions. Keep away from low volatility Foreign exchange pairs as a result of realizing excessive Reward:Threat ratio trades just isn’t as probably.