Be aware to the reader: Over the following couple of weeks and months, I shall be republishing the contents of my guide, “Investing with the Pattern,” in article kind right here on my weblog. I am calling this collection “The Hoax of Trendy Finance” for causes you’ll study beneath. Hopefully, you’ll find this content material helpful. As at all times, let me know what you suppose within the feedback space beneath the article. – Greg Morris, Nov. 2023

CHAPTER 1: Introduction

I’ve realized just a few issues through the years and doubtless retained even fewer. For instance, I do know that when coping with the unknown, reminiscent of it’s with the evaluation of the inventory market, you completely can’t communicate in absolutes. I additionally know that random guessing about what to do out there is a fast path to failure. One wants a course of for investing. Any course of is healthier than no course of or, even worse, a random or consistently altering course of. Hopefully, with this guide, you’ll find the trail to a profitable course of.

The noblest pleasure is the enjoyment of understanding. — Leonardo da Vinci

How are you going to even start to investigate the market if you’re not utilizing the proper instruments to find out its current state? If you don’t totally grasp the current state of the market, your evaluation, whether or not actual or anticipated, shall be off by an quantity equal to at the very least the error of your present evaluation. And your error shall be compounded primarily based on the timeframe of that evaluation. This highlights why most forecasts are a waste of time.

Plausible Misinformation

One ought to bear in mind issues are very often not what they appear. It’s completely superb to me what number of issues folks consider that aren’t true (talking with the voice of expertise right here). Beneath are some issues that many people realized in our youth from our lecturers and oldsters, most of which we simply accepted as reality as a result of we heard it from folks we believed.

Delusion: Water runs out of a tub sooner because it will get towards the tip.

Truth: Assuming the bathtub’s sides are cylindrical, the stress is fixed; it solely seems to empty sooner as a result of you’ll be able to observe it beginning to swirl towards the tip, one thing you can not observe when the bathtub was full. The swirling motion deceives one into pondering it’s draining sooner.

Delusion: George Washington lower down a cherry tree.

Truth: George Washington didn’t lower down a cherry tree. That was a narrative advised in order that adults may educate their kids that it was dangerous to inform lies—not even our founding fathers advised lies. Parson Mason Locke Weems, the creator who wrote about it shortly after Washington’s loss of life, was attempting to humanize Washington.

Delusion: Washington threw a silver greenback throughout the Potomac River.

Truth: The Potomac River is nearly a mile extensive at Mount Vernon, and silver {dollars} didn’t exist at the moment.

Delusion: The Battle of Bunker Hill was fought at Bunker Hill.

Truth: It was fought at Breed’s Hill in Charleston, Massachusetts.

Delusion: Canine sweat by means of their tongues.

Truth: Guess what? Canine do not sweat. Their tongues have giant salivary glands that hold them moist.

Okay, the next two examples of plausible misinformation are just for the hardy who’ve discovered this part fascinating. The remaining ought to skip them. They’re just for nerds like me.

Delusion: December 21 within the northern hemisphere is the shortest day of the 12 months.

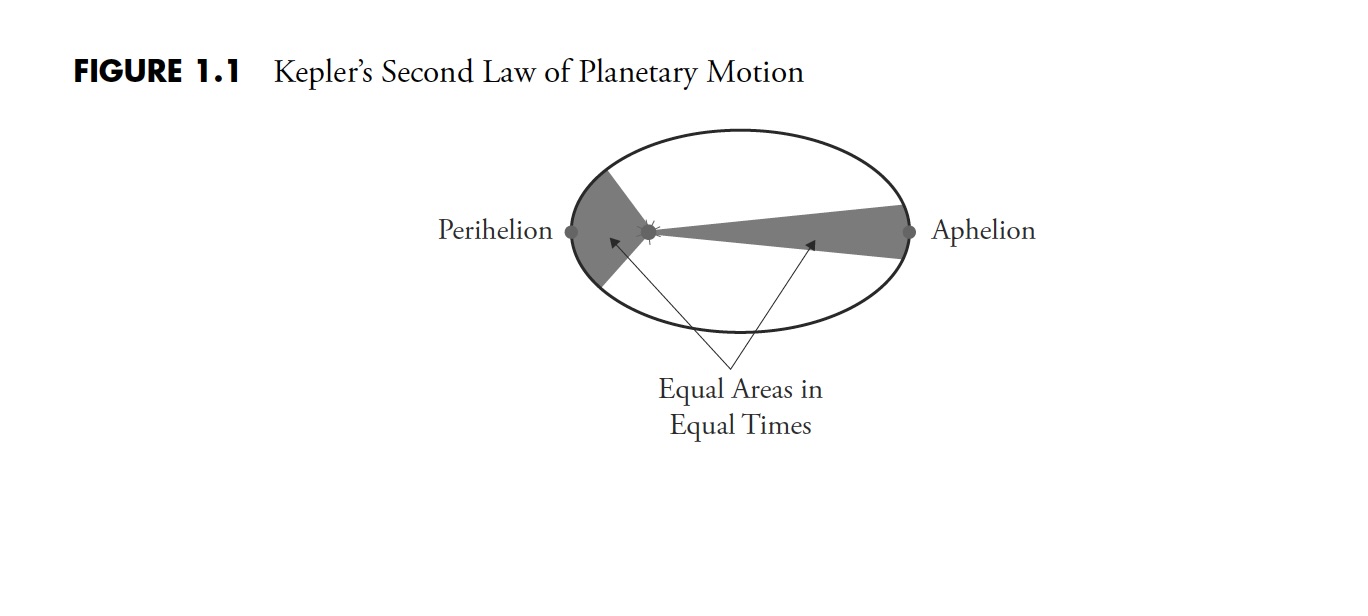

Truth: Most individuals most likely consider this. Nevertheless, it’s really the longest astronomical day primarily based on Kepler’s Second Regulation of Planetary Movement (planets, of their elliptical orbits, sweep out equal areas in equal time). When the Earth is closest to the solar, the northern hemisphere is tilted away, and a a lot better arc is swept in a day’s journey than when the Earth is the furthest distance from the solar. If the query have been posed as “What’s the day with the shortest interval of daylight?” then it will be right.

See Determine 1.1 for an illustration of Kepler’s Second Regulation of Planetary Movement.

A further remark on the lean of the Earth is that summers within the southern hemisphere are usually hotter than the summers within the northern hemisphere. This may be influenced by the truth that there may be considerably extra ocean within the southern hemisphere, but in addition, the southern hemisphere is tilted extra in the direction of the solar when the solar is closest to the Earth.

Determine 1.1 Kepler’s Second Regulation of Planetary Movement

Determine 1.1 Kepler’s Second Regulation of Planetary Movement

Delusion: Bathtub water drains counterclockwise within the northern hemisphere.

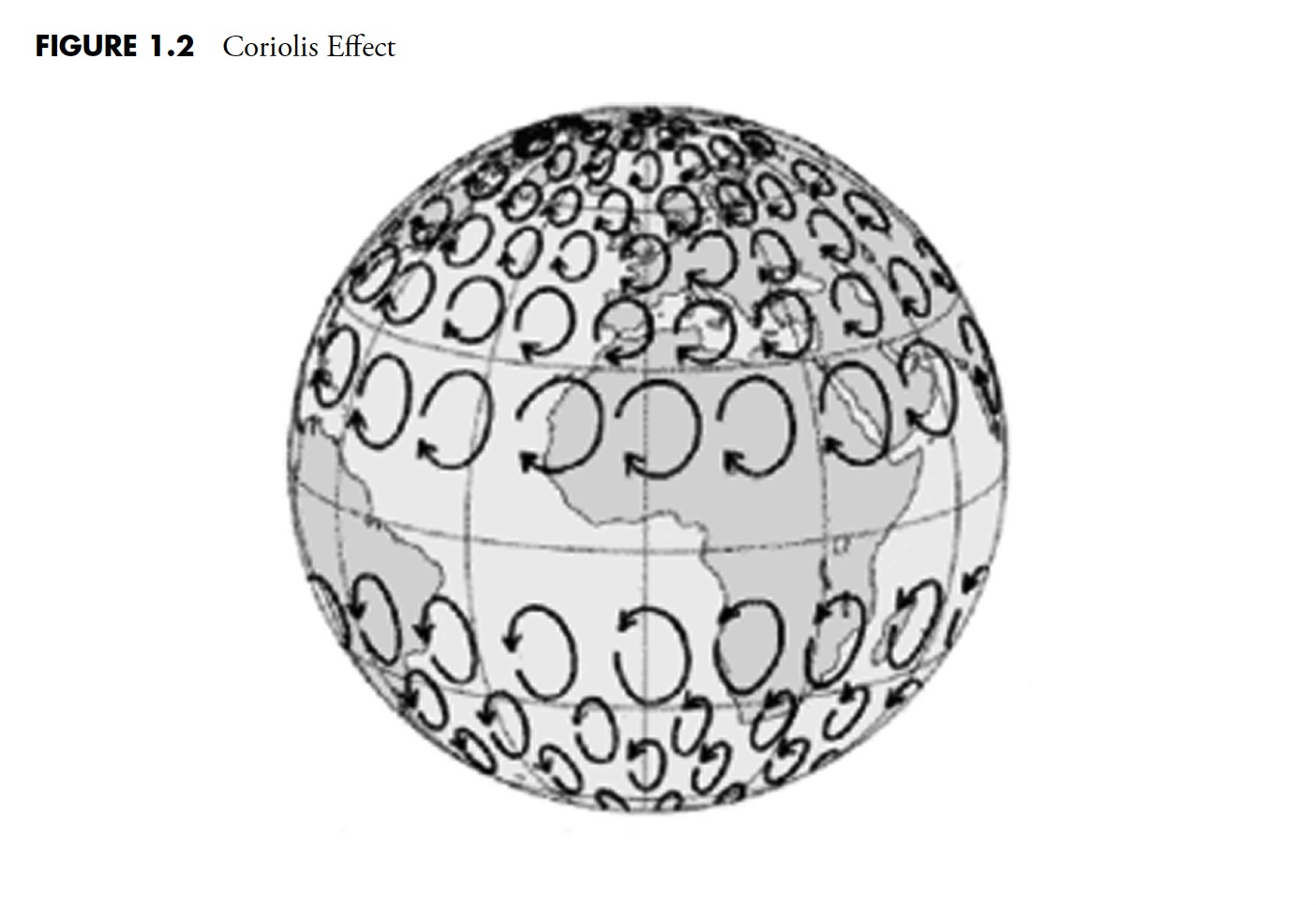

Truth: One other instance of how folks have believed issues which can be merely not true is that, within the northern hemisphere, many will say that water, when draining from a bathtub, will swirl counterclockwise. Though it very properly might achieve this, it’s not for the rationale they suppose it is going to. That is an instance of somewhat little bit of scientific information completely misapplied. The Coriolis Impact (see Determine 1.2) is brought on by the earth’s rotation and usually applies to giant, nearly frictionless our bodies, reminiscent of climate programs. For this reason, within the northern hemisphere, hurricanes rotate counterclockwise, and within the southern hemisphere, they rotate clockwise. The rotational impact is measured in arc seconds (a unit of angular measure equal to 1/60 of an arc minute or 1/3600 of a level), which is a particularly small measurement of angular rotation. Making use of this precept to the rotation of water draining from a bathtub is completely incorrect. Excessive-pressure and low-pressure climate patterns are additionally reversed—I’d like to see a climate reporter from Dallas transfer to Santiago and adapt to that.

Hopefully, you might be getting my level. Up to now few years, the Web has been the supply and exploitation of a lot hype and false data. What number of occasions have you ever acquired an e-mail from a good friend (who most likely didn’t originate it) and believed it to be true however didn’t hassle to test it out and forwarded it anyhow? You must begin verifying them as a result of a lot of them are hoaxes. Plausible misinformation thrives.

Determine 1.2 Coriolis Impact

Determine 1.2 Coriolis Impact

In the event you take pleasure in this sort of data, I’d suggest a guide by Samuel Arbesman, The Half-Lifetime of Information: Why Every thing We Know Has an Expiration Date. Arbesman is an skilled in scientometrics, which appears to be like at how details are made and remade within the fashionable world. Individuals usually cling to chose “details” as a method to justify their beliefs about how issues work. Arbesman notes, “We persist in solely including details to our private retailer of data that jibe with what we already know, somewhat than assimilate new details no matter how they match into our views.” (B4). This is named affirmation bias, which is handled in Chapter 6.

A basic theme all through this guide is one in all separating reality from fiction. Fiction, on this case, is commonly a well-accepted idea on finance, economics, or the market typically. In the event you have been caught believing a number of the issues talked about within the earlier paragraphs, then how a lot from the world of investing do you consider? Simply perhaps you have got accepted as reality some issues that merely are usually not true. I definitely know that I did.

On this chapter, a number of primary data is supplied to help you in understanding the rest of this guide. There are definitions, mathematical formulae, explanations of anomalies, historic occasions that have an effect on the info, differing strategies of calculation, and a bunch of different necessary data usually present in an appendix. It’s of such significance to grasp this materials that it belongs previous to the dialogue and never within the appendix, as is often the customized.

Thanks for studying this far. I intend to publish one article on this collection each week. Cannot wait? The guide is on the market right here. Subsequent up: A useful record of indicators and terminology that it’s essential know, adopted by a frank dialogue about monetary knowledge sources and their accuracy.