Weekly technical and elementary evaluation of gold:

Right this moment is Sunday, December twenty fourth, 2023. If you happen to check out the each day chart of the world gold ounce proper now, you’ll discover that the worldwide gold has elevated to a vital stage of $1970 on its final working day. Gold has had a development charge of 12.58% within the yr 2023 and has additionally managed to achieve its historic peak of $2148 .

Now, the world gold ounce is dealing with two main challenges because it enters the brand new yr of 2024. The primary problem is the change within the Federal Reserve’s financial insurance policies, and the second problem is the geopolitical points and their affect on the worldwide economic system.

In reviewing gold in 2023, it confronted sticky banking crises and inflation:

The monetary markets had been happy and optimistic when the Federal Reserve lastly lifted its foot off the pedal of contractionary insurance policies or rising rates of interest on the finish of 2022.

As quickly because the yield on ten-year Treasury notes fell on the eve of the New Yr 2023, gold reacted positively and rose greater than 6% in January 2023. Nonetheless, as inflation started to rise once more, gold entered a stagnant part as a result of buyers began to rethink the central financial institution’s insurance policies.

Then, because the banking crises and turmoil in the US started in March, gold additionally made up its thoughts and rose to above the vital stage of $2000. This area was the best worth of gold within the first quarter of 2023.

It was such that inside 5 days, three small to medium-sized banks in the US named Silicon Valley, Silvergate Financial institution, and Signature Financial institution went bankrupt, which was a elementary issue that brought about capital flight in the direction of a secure asset.

For the reason that Federal Reserve and main market regulators rapidly responded by making a banking liquidity provision program (BTFP) to scale back tensions in monetary markets, a part of the month-to-month upward pattern of gold was halted, and this valuable metallic confirmed a slight development in April.

In the meantime, the market realized that inflation in the US within the second quarter of 2023 was stickier than anticipated, and the market can be extremely aggressive for job seekers.

In response to this situation, the Federal Reserve raised its rates of interest once more.

In the meantime, because of the lower in fears and considerations concerning the banking disaster and its unfold to different banks and different elements of the monetary markets, in addition to the rise within the yield of ten-year Treasury notes, international gold ended the months of Could and June in a purple zone with a downward pattern.

Then, after the Federal Reserve stopped its contractionary insurance policies in June, it elevated its rates of interest by one other 25 foundation factors in July and raised them to five.25% to five.5%.

Lastly, gold additionally got here beneath downward strain in the summertime and fell about 6% in a two-month interval from August to September.

Geopolitical points and the dovish tone of the Federal Reserve:

Within the third quarter of 2023, when indicators of a decent labor market (which means low job however excessive labor pressure) and a lower in inflationary pressures had been noticed in the US, this led the Federal Reserve to loosen its contractionary insurance policies.

It’s true that central financial institution policymakers didn’t point out any shift or change of their financial insurance policies, however international gold revived once more.

On the similar time, after saying readiness for struggle and beginning anti-invasion operations within the Gaza Strip in response to Hamas’ shock assault on southern Israel on October 7, which led to the killing of civilians and hostage-taking, safe asset flows dominated monetary markets, and merchants rushed to purchase secure property.

World gold, which is taken into account a secure asset, additionally elevated by greater than 7% in the identical month of October.

This was such that gold once more managed not solely to cross the vital technical and psychological stage of $2000 but additionally to consolidate itself above this vital stage.

In the meantime, information of the Houthi rebels’ assault on three business ships within the Crimson Sea on Sunday and the US Navy’s response, which led to the downing of three unmanned plane on December 10, led to a different enhance in gold at the start of the week.

This vital issue sparked considerations concerning the escalation of the Israel-Hamas battle right into a widespread disaster within the Center East, and gold reached its historic excessive of $2149 on December 11 within the Asian buying and selling session.

It’s true that after this short-lived struggle, gold once more fell to the vital stage of $2000, however the adoption of a brand new dovish tone (which means expansionary insurance policies and rate of interest cuts) by the Federal Reserve brought about the US greenback to fall and international gold to strengthen once more.

The outlook for international gold in 2024:

After the final coverage assembly of 2023, the US Federal Reserve saved its rates of interest unchanged within the vary of 5.25% to five.5% and referred to the continual enchancment within the inflation outlook.

Powell additionally introduced that we’re strongly centered on guaranteeing {that a} main mistake doesn’t happen and that charges do not stay excessive for a very long time.

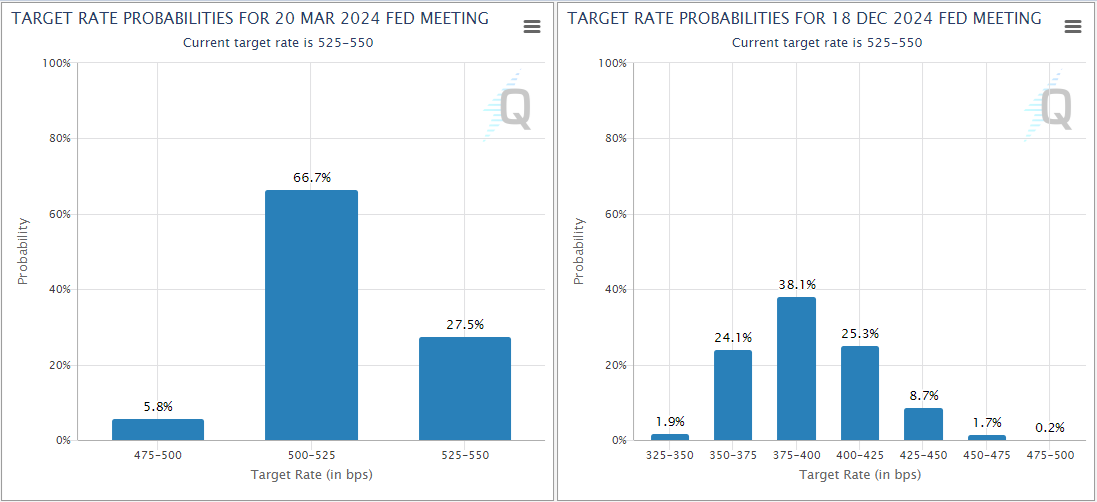

Till December 2024, nearly 60% of the market offers the chance that Federal Reserve rates of interest will attain 3.75% to 4% and even decrease.

The present market scenario exhibits that there’s presently a comparatively important decline in rates of interest priced into the marketplace for subsequent yr, and if macroeconomic information goes towards this expectation, there’s room for a greenback enhance.

It’s noteworthy that the Federal Reserve is assured concerning the absence of a recession in the US. If you happen to keep in mind, the US Gross Home Product (GDP) had a major development (annualized 5.2%) within the third quarter.

After all, don’t forget that since stock accumulation was the primary driver of GDP development throughout that interval, seeing a pointy decline in US development charges within the first half of 2024 won’t be stunning in any respect.

Three Doable Situations for Gold Costs within the First Half of 2024:

1. Because the job market strikes out of steadiness and comparatively wholesome financial exercise stays, inflation will proceed to say no steadily. Moreover, the GDP for the primary and second quarters shall be between 1.5% and a couple of%.

On this state of affairs, gold can nonetheless proceed its upward pattern, however earlier than finishing its long-term pattern, the continuation of this upward motion shall be restricted.

A powerful job market with a robust economic system permits the Federal Reserve to undertake a cautious strategy to altering its financial insurance policies, limiting the decline of the greenback and bond yields.

On this state of affairs, gold can be on an upward pattern and even has the potential for better earnings for this costly metallic. Nonetheless, if the US economic system weakens, it’s going to have a adverse affect on different economies akin to China, which may restrict demand for gold.

3. In our third state of affairs, gold may have a adverse reflection. The precedence of the Federal Reserve is to return inflation to its 2% goal, and policymakers are more likely to chorus from early rate of interest cuts even when the job market or economic system is sweet.

On this case, with a rise in US greenback bond yields, the US greenback turns into stronger, inflicting gold to begin falling.

Geopolitical Unrest and Uncertainty

The Russia-Ukraine struggle in 2022 and the Israel-Hamas battle in 2023 confirmed that gold continues to be a secure and acceptable asset for buyers throughout occasions of uncertainty.

Additional escalation and growth of conflicts within the Center East can push gold costs larger. As well as, renewed escalation of the Russia-Ukraine struggle can have an analogous affect on XAU/USD.

US Presidential Election

It’s tough to say how the outcomes of the presidential election and all associated developments can have an effect on monetary markets.

Nonetheless, in response to a Actual Clear Politics ballot performed on December 15, there’s nearly a 50% probability that Donald Trump, the previous US president, may very well be re-elected.

If elected, Trump is searching for to impose a ten% tariff on most international items and steadily eradicate imports of important items from China throughout a four-year plan.

Whereas worsening relations with China can have a adverse affect on the outlook for gold demand, larger tariffs can even make the Federal Reserve’s job of lowering inflation to its 2% goal harder.

As it’s possible you’ll know, China is the most important shopper of gold on the earth. Because of post-COVID reopening, China’s economic system renewed its upward pattern in 2023.

Gross home product (GDP) grew by 4.9% within the third quarter after annual development of 6.3% within the earlier quarter.

Chinese language authorities advisers have mentioned in an unique interview with Reuters that their development targets for 2024 had been between 4.5% and 5.5%.

In the meantime, Moody’s score company warned of a downgrade in China’s credit standing because of rising dangers associated to medium-term structural decline and financial development, and continued decline in the true property sector.

Weekly Technical Evaluation of Gold:

The weekly chart of world gold confirms the continuation of the upward pattern of gold on the verge of getting into 2024.

If you happen to have a look at the each day gold chart, you will notice that final week’s worth ground was $2016 and its ceiling was $2070.

The worldwide gold ounce rose about 1.67% positively final week, making market bulls joyful.

If you happen to have a look at the gold chart, you’ll discover that the value of gold closed at $2053.

The RSI indicator on the each day timeframe is rising and exhibiting quite a few 60. This means that gold has maintained its upward momentum and additional will increase should not surprising.

Essential Help Ranges for Gold:

If gold begins to say no, the primary vital assist stage shall be $2040. If market bears go beneath this space, the subsequent vital stage shall be $2030. Lastly, if gold falls beneath this space, the subsequent vital stage shall be a vital space of $2020.

Essential Resistance Ranges for Gold:

If gold will increase, the primary vital resistance stage shall be $2060. If market bulls go larger than this space, the subsequent vital stage shall be $2070. Lastly, if gold crosses this space as effectively, the subsequent vital stage shall be $2080.

I hope this evaluation and evaluation shall be helpful and efficient together with your individual technique and experience.