KEY

TAKEAWAYS

- The WillTrend indicator helps determine inventory traits and optimum entry and exit factors

- The WillTrend indicator offers clear alerts in weekly and every day charts that assist decide actionable buying and selling situations

- It is necessary to take every sign throughout the context of the inventory’s present technical and elementary setting

Profitable market timing depends on choosing the proper market to time. Within the StockChartsACP suite of Larry Williams plug-in indicators, three of them—Williams True Seasonal, Williams Cash Circulation Index, and Williams Sentiment Index—have been designed with that function in thoughts. So now comes the timing half for entries and exits.

Earlier than getting into a market, probably the most primary questions you must ask are:

- Is the market in an uptrend or downtrend?

- The place do you have to purchase or promote (or promote brief)?

- The place do you have to place your cease loss?

Offering a visible reply to those questions is what Larry Williams’ WillTrend indicator is designed to do. Developed in 1988, WillTrend reveals you whether or not a inventory is trending and, in that case, the place, precisely, to enter a purchase or promote.

How the WillTrend Indicator Works

This indicator is designed to work on weekly and every day charts solely (sorry, intraday merchants!). The alerts and development identification instruments are remarkably clear and straightforward to know. Check out the chart beneath.

CHART 1: DAILY CHART OF PROSHARES ULTRA BLOOMBERG CRUDE OIL ETF (UCO) AND WILLTREND INDICATOR. The WillTrend indicator clearly outlines the trending exercise in UCO.Chart supply: StockChartsACP. For instructional functions.

Wanting on the every day chart of UCO, the image is fairly clear. UCO broke out of a congestive space and commenced trending up. The WillTrend indicator accurately recognized the development motion, though anybody who might need shorted UCO when costs fell beneath the WillTrend line might need gotten burned. However no indicator is ideal, and it’s a must to take into account the general technical and elementary context when partaking in any commerce.

How one can Apply the WillTrend Indicator in StockChartsACP

- From Your Dashboard, click on on the StockChartsACP button.

- Add an emblem within the image field and hit return.

- Beneath Chart Settings, scroll all the way down to the Larry Williams Plug-Ins.

- Choose Williams WillTrend.

How To Use the WillTrend Indicator

Wanting on the description alone, you may most likely guess put this indicator to make use of. Let’s take a look at the weekly chart for Intel Corp (INTC).

CHART 2: INTEL CORP. AND WILLTREND INDICATOR. Watch the patterns and breakouts as they unfold in relation to the WillTrend indicator.Chart supply: StockChartsACP. For instructional functions.

Try the next:

A— WillTrend was spot-on in figuring out the start of INTC’s 15-month downtrend (a worthwhile experience for anybody who took that sign early on). When costs fell beneath the WillTrend line, the crossover signaled to go brief INTC (after all, you do that with discretion). You’ll additionally place a cease loss above the WillTrend line, which served as an efficient trailing cease.

B— INTC noticed six months of congestion; in the event you had a cease loss above the WillTrend line, you’d have remained within the commerce. Nonetheless, INTC was basing and now not trending downward.

C— Costs crossed above the WillTrend line, triggering a purchase sign and a trailing cease loss order beneath the WillTrend line.

This illustrates a commerce the place you may have remained available in the market, first brief after which lengthy. Nonetheless, not all buying and selling situations will probably be this “accommodative” to the indicator.

As efficient an indicator as WillTrend could be in lots of instances, you continue to have to make use of your noggin when making buying and selling choices, comparable to within the every day chart of Apple, Inc. (AAPL) beneath.

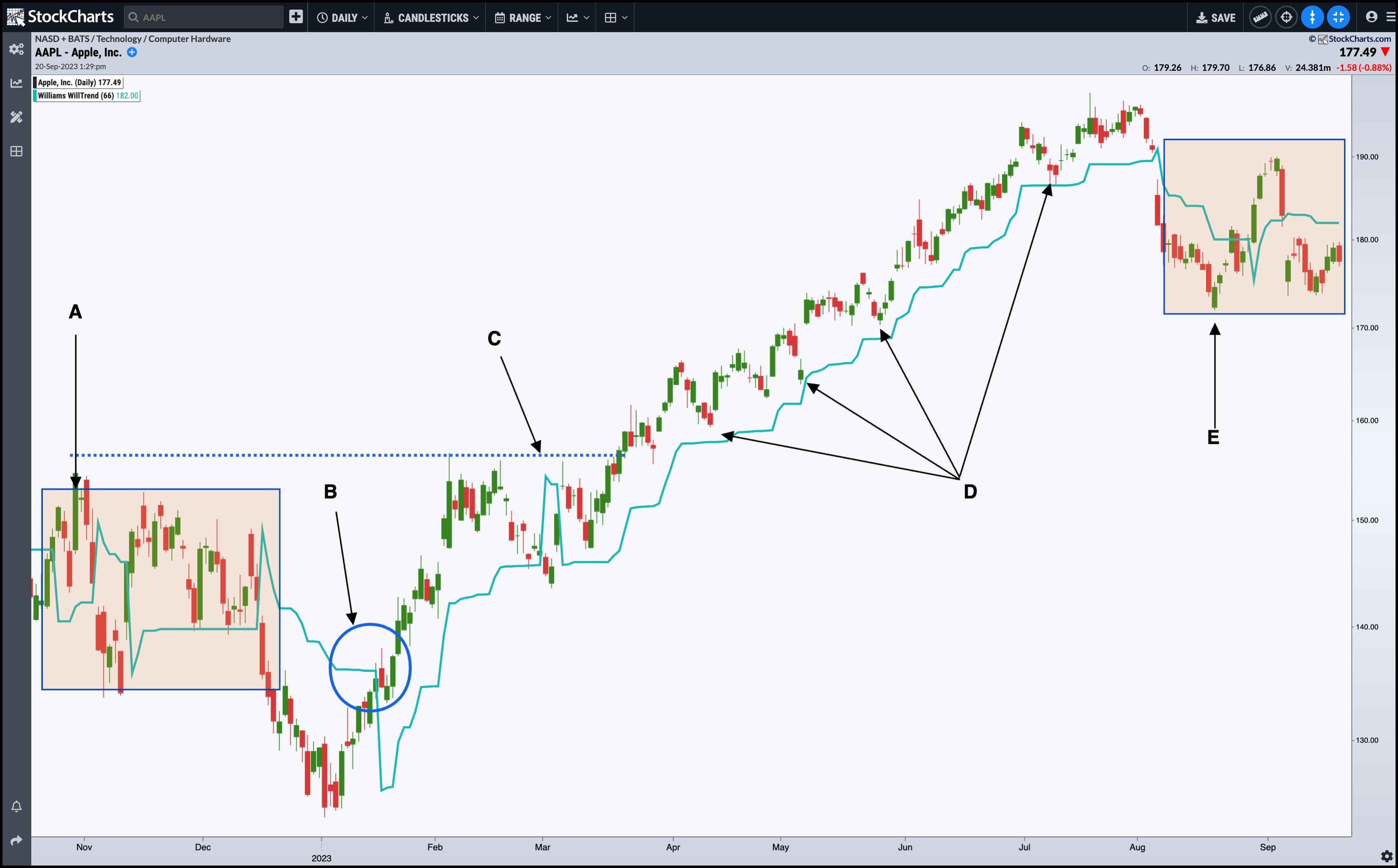

CHART 3: AAPLE STOCK AND THE WILLTREND INDICATOR. The chart reveals an uptrend punctuated by congestion intervals. Buying and selling throughout congestion intervals could be tough.Chart supply: StockChartsACP. For instructional functions.

There are many alternatives peppered with problematic pitfalls.

A— Congestion! Taking a buying and selling sign inside a congestion vary will virtually at all times spell bother except you may have a compelling cause. On this case, you’d have been whipsawed, and fairly badly.

B— However, an early entry sign off a dangerous V-bottom occurred shortly after congestion led costs downward. What might need made some merchants nervous getting into at this level have been the layers of resistance up forward.

C— The market response to this resistance induced merchants to unload their positions (or sellers to enter theirs) as costs fell beneath the WillTrend line for 3 days. Would you may have closed your lengthy place or gone brief at this stage?

D— The uptrend resumes, and you’ll see a number of extra purchase factors or alternatives to scale up your place as you rode the uptrend for a number of months. For sure, the market motion that adopted the March dip illustrates probably the most accommodating situation for the WillTrend indicator.

E—Much like A, the realm designated as E marks one other zone of congestion, a lot of it in response to the bigger financial circumstances surrounding the broader market. Do you go lengthy, brief, or maintain off? When uncertainty strikes, or when consumers and sellers are in a brief occasion of equilibrium or settlement (with regard to valuations), you may wish to maintain off till additional elementary information or technical indications give a compelling case to take one place or one other.

The WillTrend indicator could be efficient in varied market situations, however you have to take a nuanced method when analyzing your market and managing your trades. No indicator is ideal, however some are higher than others particularly situations.

The Backside Line

Larry Williams’ WillTrend indicator is usually a precious instrument for figuring out market traits and pinpointing entry and exit factors. It is designed to reply the fundamental (but most actionable) questions: Is the market in an uptrend or downtrend? The place do you have to purchase or promote or promote brief? The place do you have to place your cease loss? Nonetheless, as proven by way of varied examples, whereas the WillTrend could be remarkably exact, it is not infallible. No indicator is. But when used properly, the WillTrend may give you an edge specific to its design.

Karl Montevirgen is knowledgeable freelance author who makes a speciality of finance, crypto markets, content material technique, and the humanities. Karl works with a number of organizations within the equities, futures, bodily metals, and blockchain industries. He holds FINRA Collection 3 and Collection 34 licenses along with a twin MFA in essential research/writing and music composition from the California Institute of the Arts.

Study Extra