Till this 12 months, copper appeared near being a positive factor, investment-wise. Demand for the steel had elevated steadily with the ramp-up within the manufacturing of electrical autos (EVs). However it appears that evidently, at the very least for the second, demand for the steel has stalled.

Contrarian buyers would say that makes 2023 the proper 12 months to spend money on copper. In any case, it’s higher to purchase any funding or commodity when the value is low. However how do you spend money on copper should you determine you need to make the leap this 12 months?

I share some methods to do this on this article and give you some background on copper and the forces which can be affecting its value right this moment.

Desk of Contents

- Tips on how to Spend money on Copper

- The place to Spend money on Copper

- Elements Affecting the Worth of Copper

- 1. Demand as an Industrial Steel

- 2. A Future Copper Provide Deficit?

- 3. Diversification from Shares and Bonds

- 4. Copper is a Financial Asset

- Different Elements that Have an effect on the Worth of Copper

- The Backside Line: Is Copper a Good Funding?

Tips on how to Spend money on Copper

You’ll be able to spend money on copper by buying copper bullion, inventory in firms that produce copper, copper exchange-traded funds (ETFs), or copper futures. Right here’s a more in-depth take a look at every of those choices.

Copper Bullion

Copper bullion may be bought in coin or bar kind by retail sellers. Examples embrace JM Bullion and Cash Metals.

Bullion may be bought as copper pennies, copper rounds, or commemorative cash. It’s even potential to purchase copper bullets. Bars may be bought in quantities starting from one ounce to as a lot as 10 kilos.

Copper bullion can both be saved with the vendor the place it’s bought, or you’ll be able to take supply of it. However a $1,000 order weighs round 250 kilos, making it an issue from each a delivery and storage standpoint. You’ll pay a vendor markup for copper over the bullion value, in addition to delivery prices should you take supply.

Benefits:

- Bullion is a bodily asset and never depending on a promise to pay, like paper belongings

- Don’t must be involved by the efficiency of copper firms

- Bullion is essentially the most direct play on copper investing

Disadvantages:

- Vendor markups will put you instantly behind the value curve and are charged upon each buy and sale

- Receiving massive quantities of copper is cumbersome, and storing it with the vendor can get costly

- May be difficult to discover a non-public purchaser for a considerable amount of copper bullion

Copper Shares

Should you don’t need to maintain copper bullion, you’ll be able to spend money on copper mining shares. Whilst you gained’t personal copper straight, you’ll be able to profit from rising copper costs.

A number of the largest copper-producing firms embrace Freeport-McMoRan (NYSE: FCX) and BHP (BHP).

Simply remember that copper shares are affected not solely by the value of the steel but in addition the general route of the inventory market. Copper producers are additionally topic to issues with enterprise cycles, suppliers, rates of interest, labor disputes, and geopolitical points.

Benefits:

- Copper shares can outperform the steel itself, producing larger returns throughout bull markets

- You’ll be able to diversify between numerous copper-producing firms

Disadvantages:

- Copper shares will not be a direct method of proudly owning the steel itself

- A copper inventory value can fall even whereas copper rises attributable to enterprise points inside the firm

Copper Alternate Traded Funds (ETFs)

Copper ETFs provide a chance to spend money on funds that maintain a portfolio of copper mining firms or copper futures. Examples embrace International X Copper Miners ETF (COPX), which invests within the shares of copper mining firms, and america Copper Index (CPER), which invests in copper futures. The iShares Copper and Metals Mining ETF (ICOP) holds copper shares and the steel itself.

Benefits:

- You’ll be able to spend money on copper mining firms or futures with no need to be concerned with particular person funding choice

- Shares in an ETF may be simply purchased and bought

- ETF shares are normally traded commission-free

Disadvantages:

- Although you may be holding shares in a copper ETF, that isn’t the equal of holding the bodily steel

- Discovering an ETF that invests completely within the steel may be difficult

Copper Futures

Futures are a chance to capitalize on the motion of the value of copper, each larger and decrease. And since it entails leverage, you can also make a small funding that returns massive income.

Nevertheless, the reverse can be true. If the value of copper goes towards you, your complete place may be worn out. Copper futures are greatest reserved for many who are intimately aware of the steel and who’ve a high-risk urge for food.

Benefits:

- A chance to leverage a small amount of cash for vital positive factors in case your choice place goes in your favor

- You can also make cash when the value of copper rises or falls

Disadvantages:

- Futures will not be a long-term funding

- Your complete place may be worn out if the choice goes towards you

- Not well-suited for newbie or novice buyers

The place to Spend money on Copper

If you’ll spend money on copper bullion, it’s greatest to carry it with the vendor you purchase from. Simply understand that there might be storage prices, which can differ from one vendor to a different.

In contrast to gold and silver, which have a a lot larger worth, it’s in all probability not definitely worth the effort to take possession of the steel. Even a small amount of cash will purchase a big pile of copper, which might be troublesome to each ship and retailer.

If you wish to spend money on copper by shares or ETFs, M1 Finance, Ally Make investments, and SoFi Make investments are stable selections. For copper futures and choices, you could need to think about investing with bigger brokers, like Charles Schwab or Constancy.

Elements Affecting the Worth of Copper

The value of copper shouldn’t be at present trending in a transparent constructive route. Should you’re going to think about investing, it’s essential to perceive the variables that have an effect on its value.

The chart under exhibits the historic value of copper, going again to January 27, 2012, practically a dozen years. Primarily based on the screenshot under from Google Finance, we see that the value has bounced round significantly throughout that point. However with a value of $3.89 a pound on January 27, 2012, and a present value of $3.80, it’s primarily gone nowhere, regardless of the current rise in inflation.

The value of copper bottomed out at $2.17 a pound on March 27, 2020. However that was on the trough of the COVID-19 mini-crash when practically each different monetary asset and commodity additionally hit backside. Copper recovered quickly, then hit a peak of $4.94 a pound on March 4, 2022, simply days after the Russian invasion of Ukraine, when practically all different commodities exploded in value. It has since floated between $3.23 and $4.25 and at present sits at proper in regards to the center of the vary.

Retaining this historical past in thoughts, let’s take a look at the forces driving the value of copper.

1. Demand as an Industrial Steel

Copper has lengthy been valued as an industrial steel, notably for its makes use of in reference to electrical energy and plumbing. It’s additionally incessantly used within the manufacturing of knickknack, musical devices, doorknobs, and kitchen cupboard handles.

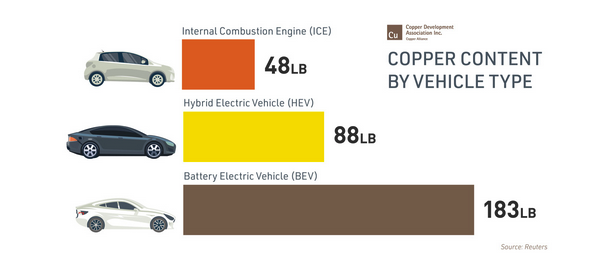

Lately, copper has develop into much more wanted due to its use in electrical autos. Actually, there’s a vital quantity of copper in just about all forms of motor autos. However in electrical autos, particularly, copper is utilized in motors, batteries, inverters, wiring, and charging stations.

The screenshot under exhibits the typical quantity of copper wanted to make completely different motor autos:

With the rise within the manufacturing of each hybrid and electrical autos, elevated demand for copper appears inevitable.

2. A Future Copper Provide Deficit?

There’s been a whole lot of dialogue lately a few copper provide deficit attributable to its use in EVs. However regardless of the rise in EV manufacturing, there was a surplus of copper in 2023. The decline is because of a drop in financial output in China, which is a significant shopper of copper.

Going ahead, preserve an in depth eye on financial developments in China. If that nation’s financial system begins to rebound, demand for copper ought to enhance. That may even restore the copper deficit, placing vital upward stress on its value.

3. Diversification from Shares and Bonds

Copper presents diversification from a portfolio of paper belongings, like shares and bonds. And if projections for the rise in demand for copper come to cross, it may show to be one of many higher different investments.

Simply remember that copper shouldn’t be as reactive to world occasions in the identical method different different belongings are. For instance, vitality, gold, and silver are likely to have far more dramatic value responses to main financial and geopolitical adjustments.

4. Copper is a Financial Asset

It’s value noting that copper has been a financial steel for hundreds of years. Due to its worth as an industrial steel, it has traditionally served because the lowest frequent financial denominator in numerous currencies. That features the U.S. greenback, the place a copper penny has traditionally been the smallest denomination of the foreign money.

Different Elements that Have an effect on the Worth of Copper

Whereas the components mentioned above are particular to copper itself, there are big-picture components that additionally play a task.

Rate of interest adjustments: It’s arduous to seek out an funding or commodity that isn’t affected by adjustments in rates of interest to 1 diploma or one other. That features copper. Rising rates of interest are likely to suppress demand, placing downward stress on copper costs. Falling rates of interest assist demand and can lead to elevated costs.

The state of the worldwide financial system: Like oil, silver, and wheat, copper is a world foreign money. Its value is affected by provide and demand, which is a worldwide phenomenon. As mentioned earlier, the financial decline in China has turned a copper provide deficit right into a provide surplus.

Geopolitical points. The U.S. is just the world’s fifth largest producer of copper. Different main copper-producing nations embrace Chile, Peru, Congo, Russia, China, and Indonesia. Given the geographic range of manufacturing sources, it’s simple to understand how worldwide instability can have an effect on the provision of copper.

Pure provide. Copper is produced from underground mines. Costs may be affected by the invention of recent mines (or the dearth thereof) or the exhaustion of present mines.

The Backside Line: Is Copper a Good Funding?

Copper is a commodity, and as such, it isn’t a mainstream funding like a inventory or bond. Because it pays no curiosity or dividends, it’s a pure play on value development. And whereas long-term development is feasible, there’s no assure.

If you wish to spend money on copper, it’s greatest to carry your positions at not more than 2% or 3% of your complete portfolio. Whereas copper could enhance in worth over the long run, different investments can present higher returns with much less threat.