Whereas extending their transfer, Indian equities superior greater and closed with one more weekly acquire. 4 out of 5 days over the previous week noticed the markets ending with beneficial properties. Within the earlier technical be aware, it was talked about that the undercurrents out there stay sturdy and NIFTY can retest the earlier excessive ranges. Whereas buying and selling on these anticipated strains, the headline index went on to submit an incremental lifetime excessive as nicely. The buying and selling vary remained modest; the NIFTY moved in a 357-point over the previous week. This month has been fairly sturdy for the markets; the index has gained 938.55 factors or 4.87% on this month; nevertheless, on a weekly foundation, the benchmark index has closed posting a internet acquire of 372.40 factors (+1.88%).

The approaching few days generally is a bit difficult to navigate because the markets are vulnerable to some consolidation or minor corrective retracement from present ranges. Importantly, the approaching week is a truncated one with Tuesday, September 19, a buying and selling vacation on account of Ganesh Chaturthi. Volatility elevated barely as INDIAVIX rose by 1.14% to 10.90 weekly; nevertheless, this now as soon as once more leaves us at one of many lowest ranges and as soon as once more exposes the markets to possible vulnerability and profit-taking bouts. That is one thing one must hold a eager eye on; moreover this, the derivatives knowledge suggests sturdy Name OI constructed up on the 20200-20300 zone and this creates a resistance space for the NIFTY over the rapid close to time period.

The approaching week is prone to see a bit jittery begin; the degrees of 20250 and 20390 are anticipated to behave as resistance ranges. The helps are available at 20000 and 19820 ranges.

The weekly RSI is 73.24 and is mildly overbought. Nonetheless, it additionally reveals a light bearish divergence in opposition to the worth because it has not posted a brand new excessive together with the worth. The weekly MACD is bullish and stays above its sign line.

The sample evaluation of the weekly charts reveals that after reaching a breakout by shifting previous 18900 ranges, the index went on to kind its excessive level at 20990 ranges. After this, it gave up near 75% of this transfer however resumed its uptrend to surpass the earlier excessive. Nonetheless, it additionally seems that the index could resist an intermediate development line drawn from 18900 ranges which subsequently joins the subsequent excessive level at 20990.

All in all, identical to the earlier week, the markets proceed to stay extremely stock-specific; we’re unlikely to see any sector dominance however as a substitute might even see choose shares from a number of sectors doing nicely. In addition to this, we might even see some defensive outlook enjoying out as nicely. The low VIX stays a priority as soon as once more and subsequently, it might be prudent to keep away from over-leveraged exposures. Whereas the monetary area is enjoying catchup, historically defensive pockets like IT, Pharma, FMCG/Consumption, and so forth. could try to comparatively outperform the broader markets.

Sector Evaluation for the approaching week

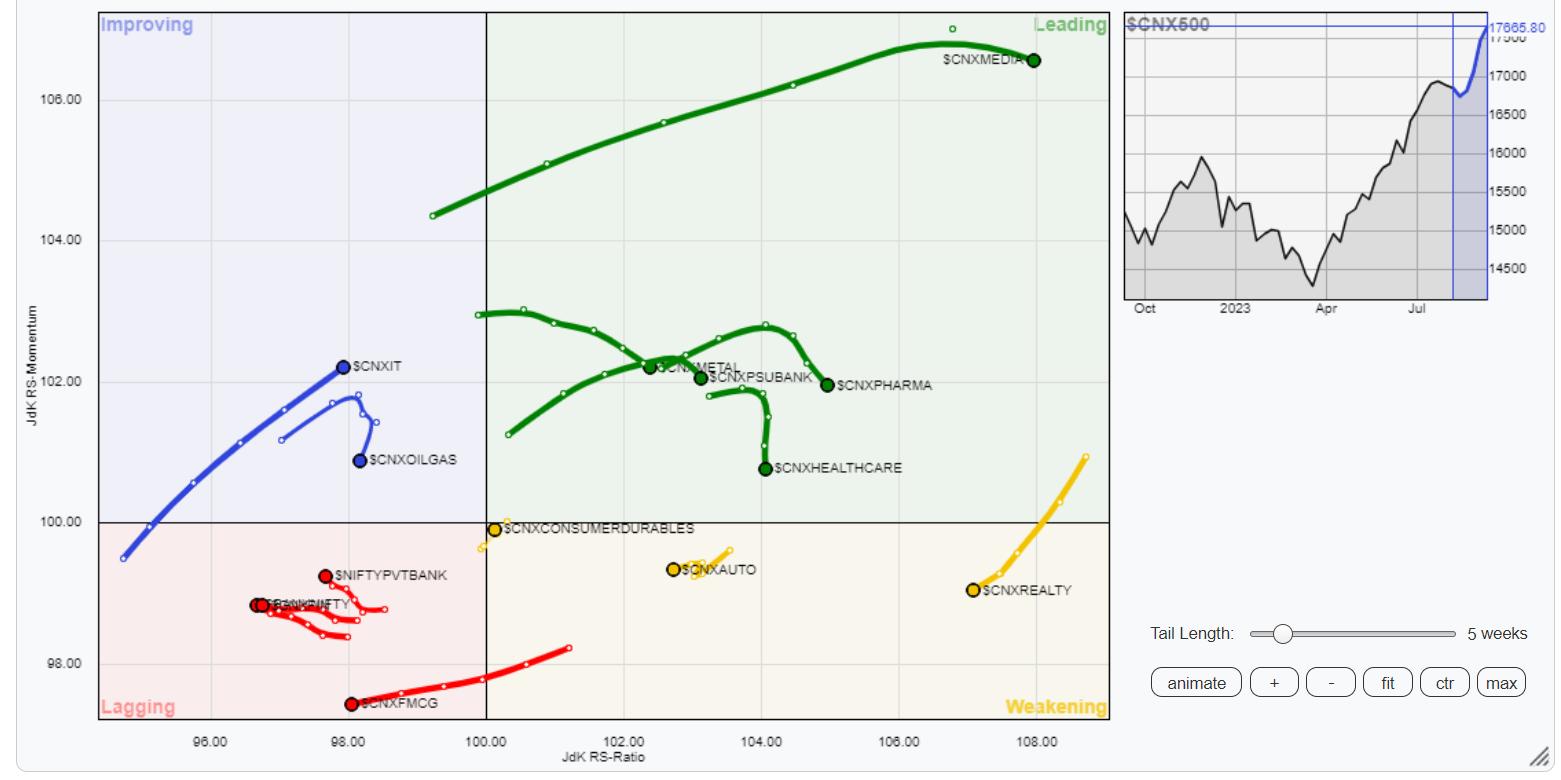

In our take a look at Relative Rotation Graphs®, we in contrast varied sectors in opposition to CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Relative Rotation Graphs (RRG) present that Nifty Power, Midcap 100, Media, Steel, PSU Financial institution, and Pharma indices are contained in the main quadrant. Whereas these teams could proceed to comparatively outperform the broader markets, they’re additionally seen modestly giving up on their relative momentum. This will likely result in each, relative outperformance and in addition some slowing down of momentum from these sectors.

The Nifty Realty and Auto Indices are contained in the weakening quadrant. Particular person stock-specific efficiency from these teams can’t be dominated out.

The Nifty FMCG, Consumption, Monetary Companies, Banknifty, and Companies sector indices are contained in the lagging quadrant. Once more, stock-specific efficiency might be anticipated from these teams however relative efficiency could take a while to point out.

The NIFTY IT and Commodities indices keep contained in the enhancing quadrant; they could proceed to higher their relative efficiency in opposition to the broader markets.

Vital Observe: RRG™ charts present the relative power and momentum of a gaggle of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used immediately as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near twenty years. His space of experience contains consulting in Portfolio/Funds Administration and Advisory Companies. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Companies. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Purchasers. He presently contributes every day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Day by day / Weekly Market Outlook” — A Day by day / Weekly E-newsletter, at present in its 18th yr of publication.