AI is fantastic for automating guide work, however automating enterprise processes is not only as easy as a 1-line immediate. Instruments like ChatGPT are unimaginable at answering your questions. Nevertheless, true automation appears completely different. Let’s dive in:

Introduction

There isn’t any escaping that AI would be the most talked about matter on the web in 2023. Chat-GPT, the favored chat-based interface for exploring the LLM (Massive Language Mannequin) capabilities developed by OpenAI, was launched to the general public earlier within the 12 months.

Mess around with it for only a few minutes, and you may start to grasp why everybody and their canine is speaking about this. Chat-GPT can show superhuman proficiency in nearly each area. AI guarantees to considerably rework many work areas, probably impacting thousands and thousands of jobs and careers.

Synthetic intelligence is now being utilized throughout skilled domains ripe for automation – work areas akin to software program, legislation, accounting, consulting, and many others. Inside accounting, the accounting operate comes into the highlight as considerably distinctive – particularly as there appears to be an equal quantity of noise on each side of the argument, with AI advocates and naysayers having a raging debate on what is going to (or received’t) occur.

The jury remains to be out on how precisely this speedy transformation can be achieved – and that is the place most discourses on the advantages of ChatGPT particularly (and AI on the whole) have a tendency to attract the road.

The necessity for AI in Accounting

In conventional accounting operations, corporations typically depend on guide processes, in depth paperwork, and repetitive duties to deal with their accounting operate. These duties embrace information entry, bill processing, and monetary evaluation, that are essential for decision-making, operational planning, and danger administration.

Nevertheless, these guide processes include vital drawbacks:

Potential for Errors: Guide information entry introduces a excessive potential for errors, as people could make errors when coming into information in excessive volumes. Fields like bill numbers, dates, and greenback quantities are notably inclined to errors, which may have vital penalties for accuracy and compliance.

Time-Consuming: Guide accounting work is time-consuming, requiring lengthy hours to reconcile accounts, generate reviews, and carry out monetary evaluation. This will result in delays in monetary reporting and decision-making.

Synchronous Communication: It’s heavy on synchronous communication. Have you ever encountered conditions like those under?

a. Approvals do not occur till you get the CFO and Enterprise Head on a name

b. Line gadgets do not get resolved till the AP operate schedules a gathering

All of this results in delays in vendor funds, insufficient expense planning, and difficulties in sustaining monetary integrity.

AI for Accounting would not need to imply an entire overhaul

The issues listed above are well-documented – and when requested, most accounting groups will agree that introducing AI will certainly assist them out. Applied sciences akin to machine studying and pure language processing can revolutionize the AP operate in a really deep method – offered they’re applied and built-in accurately.

Nevertheless, this normally leads many to the conclusion that AI-based automation just isn’t for them – it appears cumbersome, time-consuming, and costly to implement.

The fact, although, couldn’t be extra completely different – immediately, it’s doable to get began with utilizing AI on your AP course of inside minutes. You possibly can obtain this with out compromising in your present course of’s reliability, safety, and effectivity.

Put generative AI and LLMs apart for one second – the fact is that even entry-level AI automation will help considerably in addressing these points. Even the standard OCR – which has been round for many years – reduces the time taken to course of an bill by at the very least 60%, saving AP groups a number of days each month. And but adoption of this know-how is nonetheless not widespread.

Seeking to combine AI into your AP operate? E-book a 30-min reside demo to see how Nanonets will help your staff implement end-to-end AP automation.

Potential use-cases for AI throughout the Accounting course of

So how precisely are you imagined to combine AI into your Accounting course of? The place do you begin?

The primary place to start is to have a look at which a part of the method actually takes up more often than not. Typical bottlenecks which might be reported by AP groups are actions like:

- Bill coding

- Common Ledger (GL) mapping

- Fee Particulars Verification (to examine for fraud)

- Duplicate Detection

There’s a very clear underlying theme right here – guide information entry and verification are what causes these duties to be tedious and time-consuming.

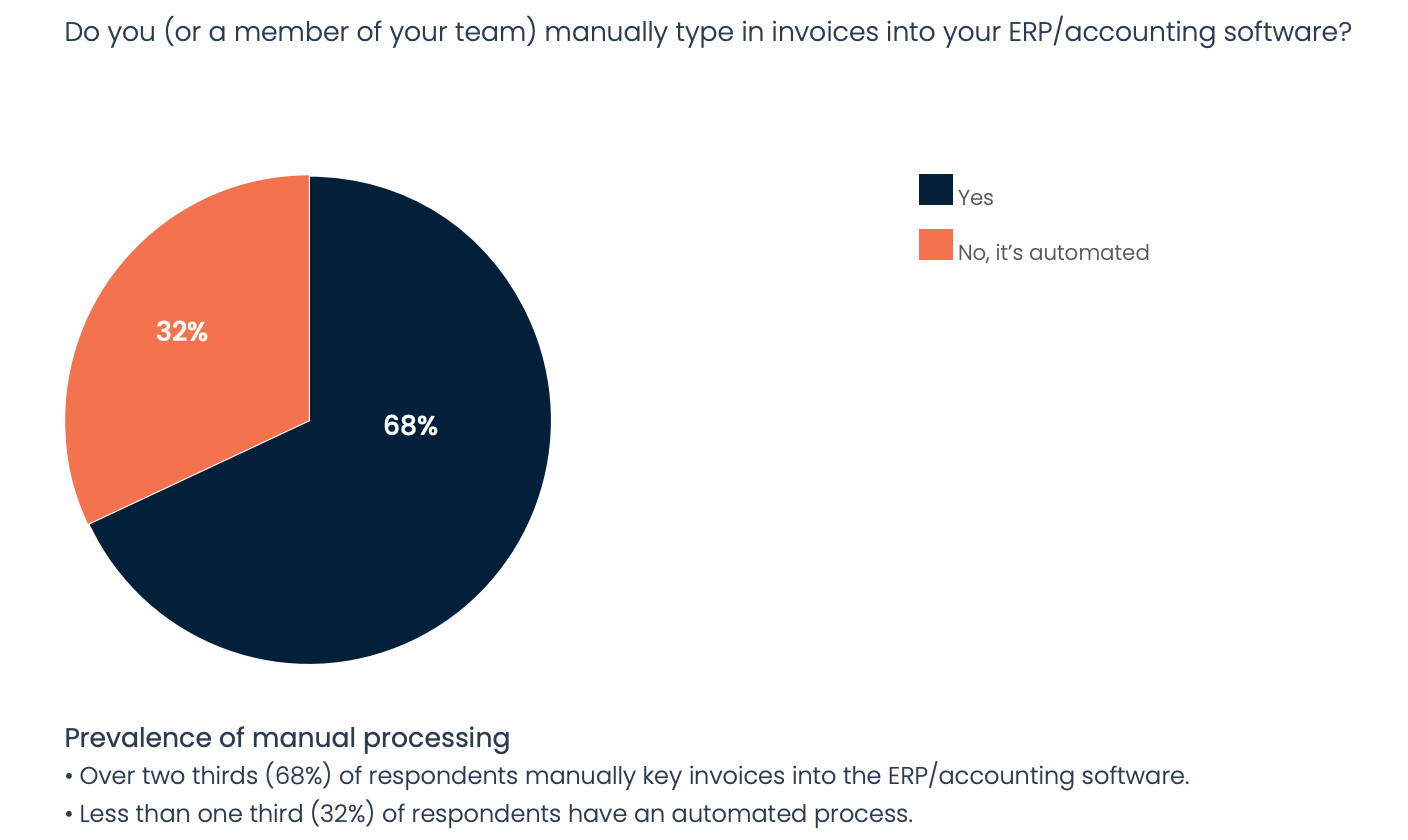

This survey graphic above (from the Automation Developments 2022 report) reveals loads – nearly 70% of individuals have nonetheless not automated probably the most urgent points of their AP course of. The duties listed above are all guide – somebody wants to have a look at the precise information on the bill and ensure that it’s right earlier than continuing additional.

Automating these duties would possibly really feel overwhelming because you’re now trusting a machine to have the identical degree of discretion as a (skilled) human.

The excellent news? AI may be skilled equally effectively too! We go deeper into some use instances of this under.

1. Bill coding and Common Ledger (GL) account mapping

Maybe some of the troublesome duties to automate is assigning invoices and receipts to the precise class and GL code inside your accounting system. Why is that this notably difficult?

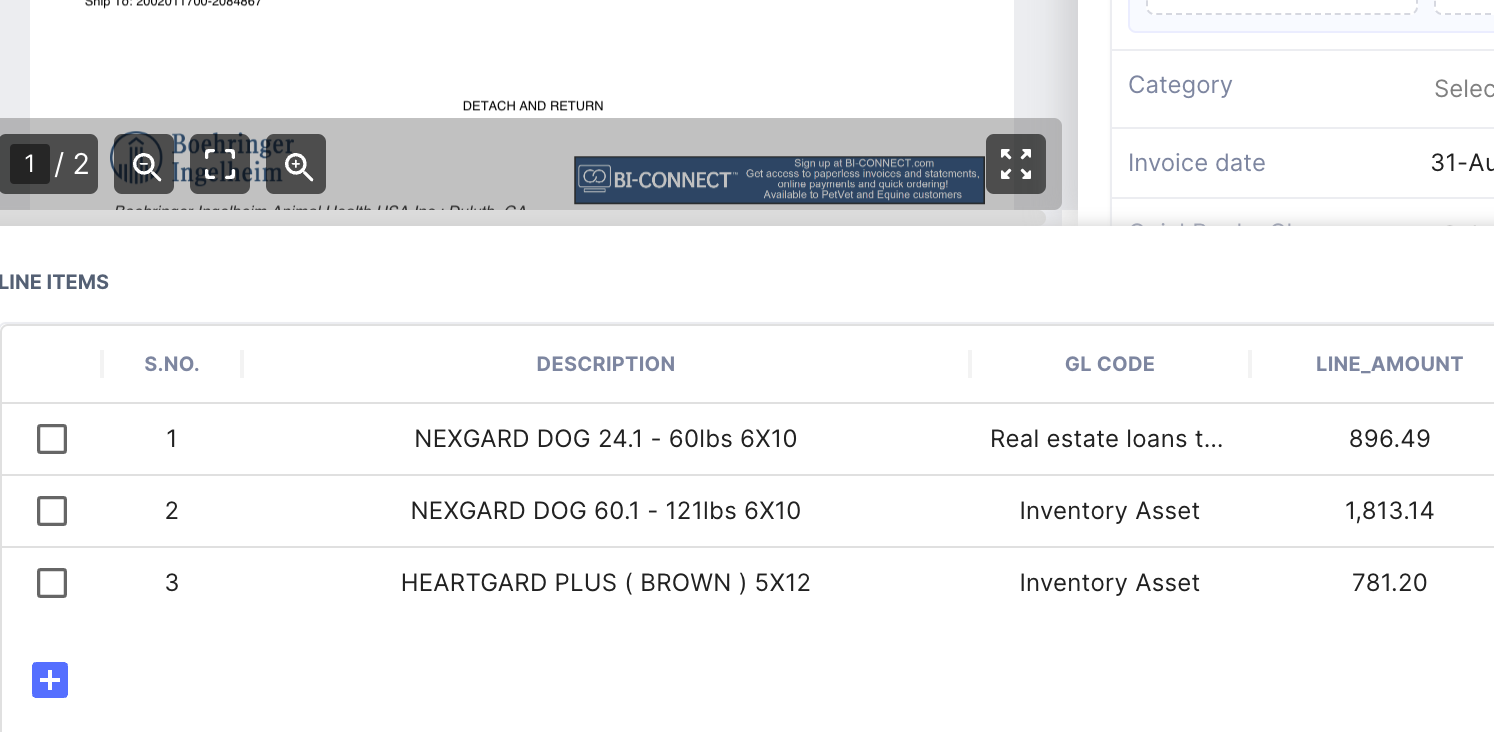

- A number of GL codes typically apply to the identical expense, break up by line gadgets/particular person product codes. Task of those GL codes is normally guide and should be carried out in session with enterprise groups and the CFO.

- Assigning a GL code to an bill is typically subjective – for instance, whereas common gross sales invoices would possibly at all times be assigned to “Gross sales” in your chart of accounts, typically the very same bill format finally ends up getting used for contractors and non-employees. This will result in contractual bills being incorrectly tagged as “Gross sales” by fundamental automation instruments.

How can AI assist right here?

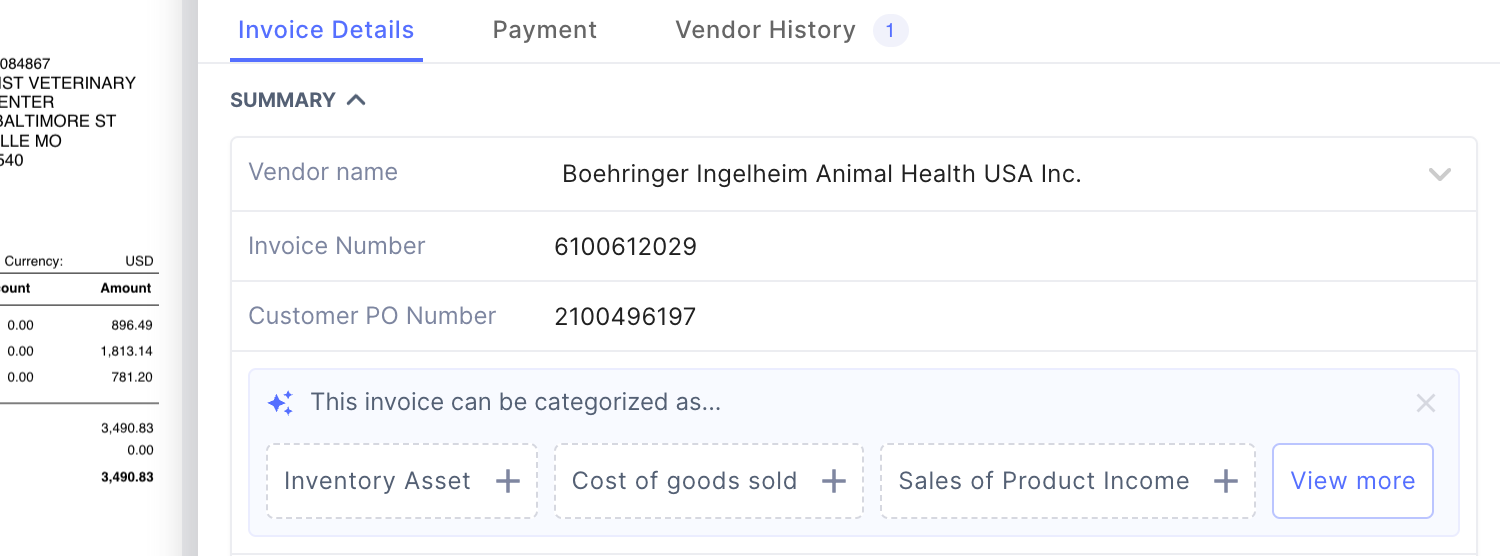

- Automate bill coding primarily based on LLM processing – right here, the AI mainly tells you which of them GL this bill needs to be categorized in, and this may be configured to supply a number of strategies that may be acceptable. This makes the person’s process considerably simpler.

- Study and memorize person inputs – As soon as a person truly selects the GL code, the system can keep in mind the choice and automate it the following time for a similar vendor.

2. Fraud detection and error dealing with

One other essential process that an AP staff has is catching errors earlier than they occur. It could be as severe as unsuitable cost particulars and bill fraud or so simple as a replica bill.

Unquestionably, these issues are finest prevented earlier than they occur. Most organizations insist on making this course of guide. Nevertheless, having a human examine every bill makes issues troublesome as a result of:

- It provides a single level of failure (and bottleneck) for the method – whereas it’s good to have an worker examine each expense for errors, typically issues can slip by way of the cracks.

- It ensures that solely the individual with probably the most context on vendor funds (CFO/AP head) could make corrections and nobody else. All of the information and context is just with just a few individuals and never unfold throughout the group.

How can AI assist right here?

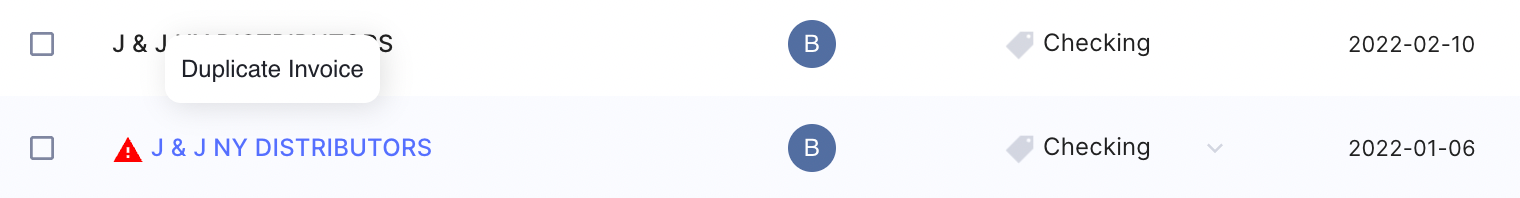

- Smarter duplicate detection/unsuitable info – Fundamental file duplicate checks solely confirm if the 2 recordsdata are similar. With superior AI duplicate checks, you possibly can go one step additional – checking if the contents of two completely different recordsdata are suspiciously comparable.

- A number of information validations on bill information – Simply auto-reading the bill information isn’t any use if somebody has to log in and confirm it anyway. Superior AI instruments can now perform information validation to make sure hygiene checks (for instance, if a brand new checking account quantity on an bill doesn’t match the standard one for a vendor, you’ll get notified!)

3. Studying easy actions which might be repeatable

Ask anybody what they REALLY need AI to do, and that is the reply that comes out on prime – many individuals really feel that AI’s actual worth is studying patterns and saving time for them.

For instance, there are a lot of small duties which might be carried out precisely the identical method for a number of forms of invoices/receipts. Some examples:

- Assigning an bill to the precise class/class/venture in your ERP

- Altering the GL mapping for one particular line merchandise of an bill

- Sending a selected vendor’s bill for approval to the identical individual each time

How can AI assist right here?

Step one is figuring out the steps within the AP course of which might be ideally suited to iterated re-learning (i.e., actions that you simply maintain doing every day that may finally be memorized by the AI and automatic 90% of the time).

Good examples of this are:

- GL code project – The logic right here is easy: if the applying assigns the precise GL code to an bill, nice! If not, you alter it your self, and the AI remembers this alteration for subsequent time. Because of this, the automated GL code project retains getting higher with each click on you make.

- Class/Class/Mission classification – If a selected vendor bill can’t be auto-classified into the precise class, AI can be taught patterns in your choice (as an illustration, are you at all times classifying Uber receipts as “Mission Prices” as a substitute of “Journey”?). Over time, this turns into a rule-set inside your platform, and is robotically utilized.

Wanting so as to add AI to your Accounting course of? E-book a 30-min reside demo to see how Nanonets will help your staff implement end-to-end AP automation.

How Nanonets will help you implement AI in your Accounting Course of

The examples above are most likely simply the tip of the iceberg – there may be much more than AI can do on your AP course of that’s solely restricted by how deep you’ll be able to go into the method of automation and machine studying.

Luckily, immediately you don’t have to be technically savvy as a way to start implementing AI capabilities into your AP course of – there are instruments that will let you get began nearly instantly.

For example, Nanonets has an AI platform known as Movement that may rework your present AP course of, and add these very important AI components to your workflow. It could do all that has been demonstrated above – and far, way more.

Easy to implement but advanced in its capabilities, that is the best start line for these seeking to actually step up their AP course of and scale their workload extra effectively. Get in contact immediately for a free demonstration of what this AI platform can do on your AP operate.