To many enterprise leaders, the accounts receivable cycle is regarded as solely money collections, however it’s truly extra complicated than that. Taking part in an important position within the accounting cycle and total enterprise features, the accounts receivable workforce is answerable for reviewing buy orders, checking every buyer’s credit score, granting acceptable credit score phrases, sending invoices, accumulating funds, and managing key monetary metrics comparable to AR getting older and unhealthy debt.

It doesn’t matter what services or products your small business is promoting, the complete cycle accounts receivable is important to your success. With out correct money assortment, you’ll have money movement and liquidity challenges; with out considerate buyer contracts, buyer relationships might undergo; and with out maintaining a detailed eye on AR metrics, your management workforce will probably be unable to make the correct enterprise choices. The accounts receivable course of is to thank for each cent of incoming money movement to your small business.

On this article, we’ll present you the complete cycle AR course of, spotlight the advantages of a well-managed AR cycle, and provide help to perceive the methods by which automation/expertise can streamline AR-related duties. You’ll get all of your burning questions answered.

What’s the Accounts Receivable Course of or AR Cycle?

AR processing is greater than sending cost reminders to prospects and chasing down late funds. If that’s the place your group’s AR technique begins, you’re going to hemorrhage money and spend extra time cleansing up messes than doing enterprise. The complete cycle AR truly begins with correctly reviewing each buy order your small business receives from a buyer trying to make a purchase order.

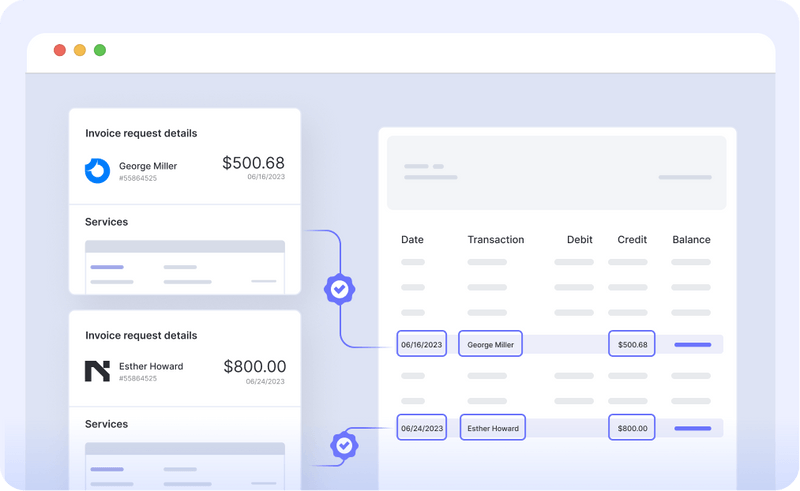

It’s best to take a look at the cycle visually, so let’s begin there.

Because the movement chart illustrates, there’s much more to AR administration than meets the attention. Sure, you want your AR workforce to really feel comfy having troublesome conversations with prospects who’ve unpaid invoices, however you additionally want them to be proactive, handle danger, and conduct detailed AR reporting.

To raised showcase the significance of every of the above steps, let’s undergo them 1 by 1.

Steps within the Accounts Receivable Course of: The Full AR Cycle Workflow

If the accounts receivable account, which is an asset, doesn’t materialize into money, you’re leaving cash on the desk and placing your small business in danger. When trying on the full cycle, accounts receivable optimization is dependent upon every step. One will not be extra essential than one other, however relatively, every step within the AR cycle impacts your group’s capacity to gather money and enhance revenue margins.

Step 1: Buyer Locations an Order

Whether or not you’re employed within the B2B house or the B2C house, prospects have to position orders to provoke the accounts receivable cycle. Within the B2B house, when a purchase order order is acquired, one of many first groups that can see it’s the AR workforce. They have to conduct correct due diligence to make sure that the acquisition order is authentic, accommodates the right info, and isn’t fraudulent. At this stage, the gross sales workforce could also be concerned to present AR a heads-up about an incoming order.

Step 2: Credit score Evaluate & Approval

With a authentic PO in hand, accounts receivables specialists should additional insulate your small business from danger by assessing the creditworthiness of every buyer. For brand spanking new prospects, an intensive credit score software course of ought to by no means be skipped. With present prospects, take a look at their cost historical past together with your group. Do they pay on time? Have they ever missed a cost? Holding an in depth buyer document is vital to decreasing unhealthy debt and mitigating monetary danger.

Step 3: AR Sends an Bill

As soon as a buyer’s creditworthiness is decided, and your AR workforce feels comfy persevering with with the achievement course of, an bill is distributed to the client. The bill ought to embody the cost phrases, what product is being bought, and the contact info for each firms. In the identical means AP automation helps the AP workforce routinely course of and pay incoming invoices, AR automation helps the sender aspect of that transaction.

Step 4: Ship Cost Reminders & Acquire Funds

After an bill is distributed, the clock begins. Prospects solely have the required cost window to submit funds. If their cost phrases are N30, that means they’re contractually obligated to pay the bill inside 30 days of its receipt, your AR workforce needs to be sending cost reminders periodically till cost is acquired. To make issues even simpler, automate cost reminders and different repetitive duties utilizing accounting automation software program.

Step 5: Replace Dangerous Debt/Write Off Uncollected Funds

Though not perfect, a actuality in doing enterprise is that there’s all the time going to be a buyer or two that don’t pay. It may be a significant monetary hit when this occurs, which is why completely conducting every step within the accounts receivable cycle is crucial. If all makes an attempt to gather cost are ignored by the client, the debt will probably be written off as a nasty debt. The timeline for writing off a nasty debt will rely in your business, the client’s cost phrases, and any particular circumstances concerned with that particular PO.

Step 6: Obtain & Course of Incoming Funds

On the plus aspect, most prospects can pay their payments. When funds are acquired, the AR workforce wants to shut out the bill and replace the account receivables monitoring mechanisms you’ve in your group. Make it as straightforward as doable for patrons to pay by providing automated funds, ACH, wire transfers, or different methods to pay.

Step 7: Take care of Disputes

This received’t be a part of each AR course of, but when a buyer is disputing an bill for any purpose, that is the time to deal with that scenario. Maybe they weren’t happy with the product they acquired or declare to have by no means acquired it. AR might want to do its finest to resolve disputes and gather funds. Typically, prospects can pay a portion of the bill – a brief cost – and it’s as much as AR to seek out out why that occurred and chart a path to accumulating the cost in full.

Step 8: Handle AR Reporting

There are lots of metrics which can be important on the subject of the complete cycle accounts receivable course of. The AR Turnover Ratio, Days Gross sales Excellent (DSO), and the Collections Effectiveness Index are a couple of frequent metrics managed by the AR workforce. Through the month-end shut course of, which is the final step of the general accounting cycle, the AR workforce will submit crucial journal entries and make sure the AR accounts on the overall ledger are correctly up to date.

Advantages of Automating the Accounts Receivables Cycle

In the identical means that manufacturing software program can be utilized to automate a lot of the manufacturing course of, automation software program can (and may!) be deployed all through the AR cycle. AR processing is tedious, complicated, and requires numerous detailed monitoring to “get it proper.” It may be laborious for even the perfect AR groups to maintain up with cost reminders, credit score checks, month-end reporting, and the various different calls for that include their roles.

With the correct automation instruments and correct implementation, your AR workforce will expertise enhanced productiveness, higher reporting, and plenty of different advantages.

Decreased Processing Time

AR processing is nothing if not time-consuming. The extra buy orders you’ve coming in – which is nice for enterprise – the extra pressure your AR workforce experiences. With automation, e-invoices could be created and despatched to prospects routinely, funds could be acquired with out human intervention, and even credit score checks could be initiated by a pc. With on a regular basis financial savings your AR workforce will expertise, they’ll be capable to focus their days on extra value-add actions.

Enterprise Scalability

If you’d like to have the ability to develop your small business, AR wants to have the ability to sustain with that progress. The identical workforce of, let’s say 3 folks, can’t go from managing all AR processing for 30 prospects to managing all AR processing for 3,000 prospects. To attain that degree of scale, automation instruments are important.

Automated Reminders and Collections

Chasing down funds generally is a full-time job in and of itself. With automated reminders, automated cost processing, and automatic system updates, AR groups can concentrate on up-front due diligence, buyer relationships, and purposeful KPIs. Automated reminders alone can enhance your AR Turnover Ratio, enhance money movement, and finally, influence the underside line.

Fewer Knowledge Errors

When it’s time for the month-end shut, if any knowledge all through the month was recorded incorrectly, it could actually take a very long time to unravel the thread and perceive the place the error occurred. However, with automation, computer systems copy knowledge seamlessly, very hardly ever making knowledge entry errors like their human counterparts.

Price Financial savings

Past bettering the collections effectiveness index, there are very actual price financial savings ready to be realized by automating the accounts receivable cycle. Fewer folks can course of extra transactions, your group’s money movement ranges will probably be more healthy, and also you’ll write off much less unhealthy debt than ever earlier than.

Improved Insights & Reporting Capabilities

Monetary reporting and data-driven insights assist drive enterprise choices. Prior to now, AR groups didn’t have the bandwidth for top-notch reporting as a result of all of their time was spent making collections calls and conducting credit score checks. Now, with automation, that point has freed up, however it doesn’t cease there. One of the best software program options include built-in dashboard capabilities and reporting options that present real-time updates on crucial metrics that your management workforce depends on.

Cease Leaving Cash on the Desk

It’s a easy undeniable fact that the simpler a company’s AR course of is, the higher that group will carry out. You possibly can’t proceed doing enterprise with out sufficient money movement to maintain your operations, and also you received’t have any money movement with out the accounts receivable course of.

The accounts receivable course of has been and can all the time be a key enterprise operate, however with at present’s robotic course of automation capabilities, it could actually have an excellent greater influence on your small business. Investing in AR automation will price cash, however not investing in AR automation will find yourself costing extra in the long term. Don’t depart cash on the desk.