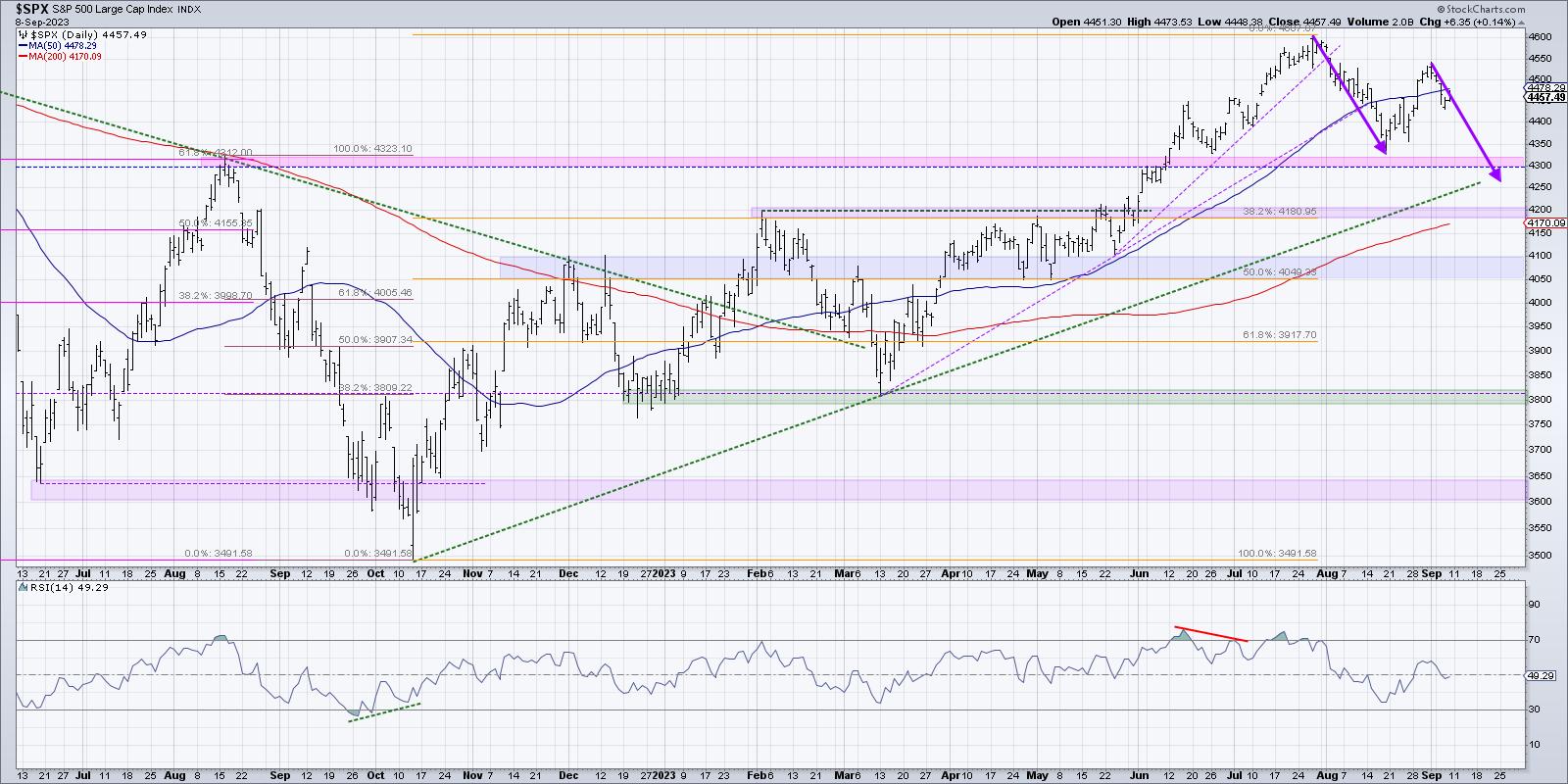

We are actually within the seasonally weakest a part of the calendar 12 months. The summer time doldrums typically result in a significant pullback within the third quarter, and 2023 has, thus far, not disillusioned by following the seasonal tendencies fairly nicely.

The month of August noticed main names like Apple (AAPL) and Microsoft (MSFT) pull again from new highs, inflicting many buyers to rethink the “2023 goes to go up all 12 months” thesis. So now that we have skilled an preliminary drop, what’s subsequent for the S&P 500?

Right this moment we’ll revisit the idea of “probabilistic evaluation”, the place we lay out 4 totally different potential eventualities for the S&P 500. There are three issues I hope you are taking away from this train.

- It is necessary to have a thesis as to what you suppose will come subsequent for shares. This ought to be based mostly on a significant mixture of 4 key pillars: elementary, technical, macroeconomic, and behavioral. And your portfolio ought to be positioned to mirror what you see because the almost certainly end result.

- It is also necessary to think about various eventualities. What if the market is far more bullish than you’d anticipate? What if some five-standard-deviation occasion pops up, and shares all of the sudden drop 20 p.c? The easiest way to interrupt out of your predetermined biases is to actively think about various factors of view.

- It is extremely necessary to consider how you’ll adapt to a type of alternate eventualities. How would your portfolio carry out in a risk-off atmosphere within the coming months? Are you ready for a sudden spike in threat property, and at what level would you must change your positions to match this new actuality?

I’ve discovered that essentially the most profitable buyers do not know all of the solutions, however they ask the very best questions. So let’s broaden our horizons a bit, and think about 4 potential future paths for the S&P 500 over the subsequent six to eight weeks. However first, we’ll overview the current pullback for the most important fairness averages.

A transient seasonality verify on the S&P 500 will present that August and September are usually fairly weak for the primary US fairness benchmark. So the drop we noticed in early August truly follows the seasonal playbook fairly nicely, as would additional weak spot in September.

We have been fascinated about the opportunity of a a lot deeper correction for threat property, and it is a distinct risk that we’re now in an A-B-C pullback, which might take us to a brand new swing low proper round choices expiration within the third week of September. However on the similar time that charts like LVS are displaying basic topping patterns, we will not assist however discover that shares like Alphabet (GOOGL) look like firmly entrenched in a protracted bullish section.

An uptrend is outlined by a persistent sample of upper highs and better lows, and GOOGL definitely appears to be displaying that basic bullish section fairly nicely. How bearish do you wish to be when Alphabet is simply pounding larger month after month?

With our benchmarks pulling again and breadth circumstances deteriorating, in addition to key development shares like GOOGL nonetheless holding above assist, let’s lay out 4 potential eventualities for the S&P 500 over the subsequent six-to-eight weeks. And bear in mind the purpose of this train is threefold:

- Contemplate all 4 potential future paths for the index, take into consideration what would trigger every situation to unfold by way of the macro drivers, and overview what indicators/patterns/indicators would verify the situation.

- Determine which situation you are feeling is almost certainly, and why you suppose that is the case. Do not forget to drop me a remark and let me know your vote!

- Take into consideration every of the 4 eventualities would influence your present portfolio. How would you handle threat in every case? How and when would you are taking motion to adapt to this new actuality?

Let’s begin with essentially the most optimistic situation, involving a robust summer time push for shares.

Situation #1: The Very Bullish Situation

What if the pullback of the subsequent 5 weeks is over, and the market goes proper again to a full risk-on mode? Shares like AAPL and MSFT would almost certainly return again to check new highs and rates of interest would in all probability come down sufficient, as financial knowledge continues to indicate on the Fed’s efforts have efficiently slowed down the economic system.

This Very Bullish Situation would imply a break above 4600, and after we revisit the chart in late September, we’re speaking about the opportunity of new all-time highs for the S&P 500 and Nasdaq in October.

Situation #2: The Mildly Bullish Situation

Markets can right in two methods: value and time. A value correction (see February 2023) includes the chart shifting decrease shortly because the market shortly sheds worth. A time correction (see April-Could 2023) means there’s not a lot of a value drop, and the “correction” is extra of a pause of the uptrend.

There is a risk that the July excessive round 4600 nonetheless holds as resistance, and a time correction retains the S&P 500 within the 4300-4600 vary. Needless to say there are many alternatives for sectors like Vitality to thrive in a sideways market, however the main indexes do not make any headway in both course.

Situation #3: The Mildly Bearish Situation

What if the A-B-C correction outlined above performs out, and the S&P 500 index pushes decrease to retest the 200-day shifting common? If rates of interest stay elevated, and development shares proceed to tug again, this may be a really cheap end result for the fairness markets.

One in every of my mentors used to say, “Nothing good occurs under the 200-day shifting common.” The excellent news is the Mildly Bearish Situation means we drop farther from present ranges, however nonetheless handle to search out assist at this necessary long-term barometer.

Situation #4: The Tremendous Bearish Situation

That is the place issues may get actually nasty. What if the market goes full risk-off, rates of interest push larger, financial knowledge is available in hotter than anticipated, and the Fed is compelled to think about additional fee hikes as a substitute of debating when to ease financial circumstances?

This Tremendous Bearish Situation would imply the S&P 500 breaks down via 4300 and 4200, leaving the 200-day shifting common within the rearview mirror, and in late September we’re debating whether or not the S&P 500 and Nasdaq will make a brand new low earlier than year-end 2023.

Have you ever determined which of those 4 potential eventualities is almost certainly based mostly in your evaluation? Head over to my YouTube channel and drop a remark together with your vote and why you see that because the almost certainly end result.

Additionally, we did the same evaluation again on the S&P 500 again in June. The “mildly bullish” situation ending up matching the market motion fairly carefully. Which situation did you vote for?

Solely by increasing our pondering via probabilistic evaluation can we be finest ready for regardless of the future might maintain!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any approach characterize the views or opinions of some other individual or entity.