From a bullish perspective, I hoped to see the “goldilocks” jobs report, one which nonetheless confirmed job development, however got here in under consensus estimates. The thought there may be that the Fed would see that its rate-hiking marketing campaign was working and the economic system was slowing. As an alternative, we noticed a much-larger-than-expected jobs quantity, 336,000 vs. 160,000. Instantly, futures fell from optimistic to destructive, and we’ll seemingly be experiencing worth motion at the moment that checks, if not pierces, current worth lows throughout our main indices.

However have been there any silver linings? Effectively, really sure. The plain is that our economic system stays resilient, preserving alive the potential of a smooth touchdown. A giant lower in jobs and a destructive quantity may need altered that potential consequence. Second, the unemployment charge was anticipated to drop from 3.8% to three.7%, however as a substitute remained at 3.8%. Additionally, common hourly earnings, which is watched by the Fed for additional strain from wage inflation, remained unchanged from the prior month at +0.2%, decrease than the +0.3% rise that was forecast.

So whereas the headline jobs quantity could have spooked bond buyers initially, it’s going to be fascinating to see the response as the remainder of the day unfolds and, in fact, subsequent week. The September PPI and CPI shall be launched subsequent Wednesday and Thursday, October eleventh and twelfth, respectively.

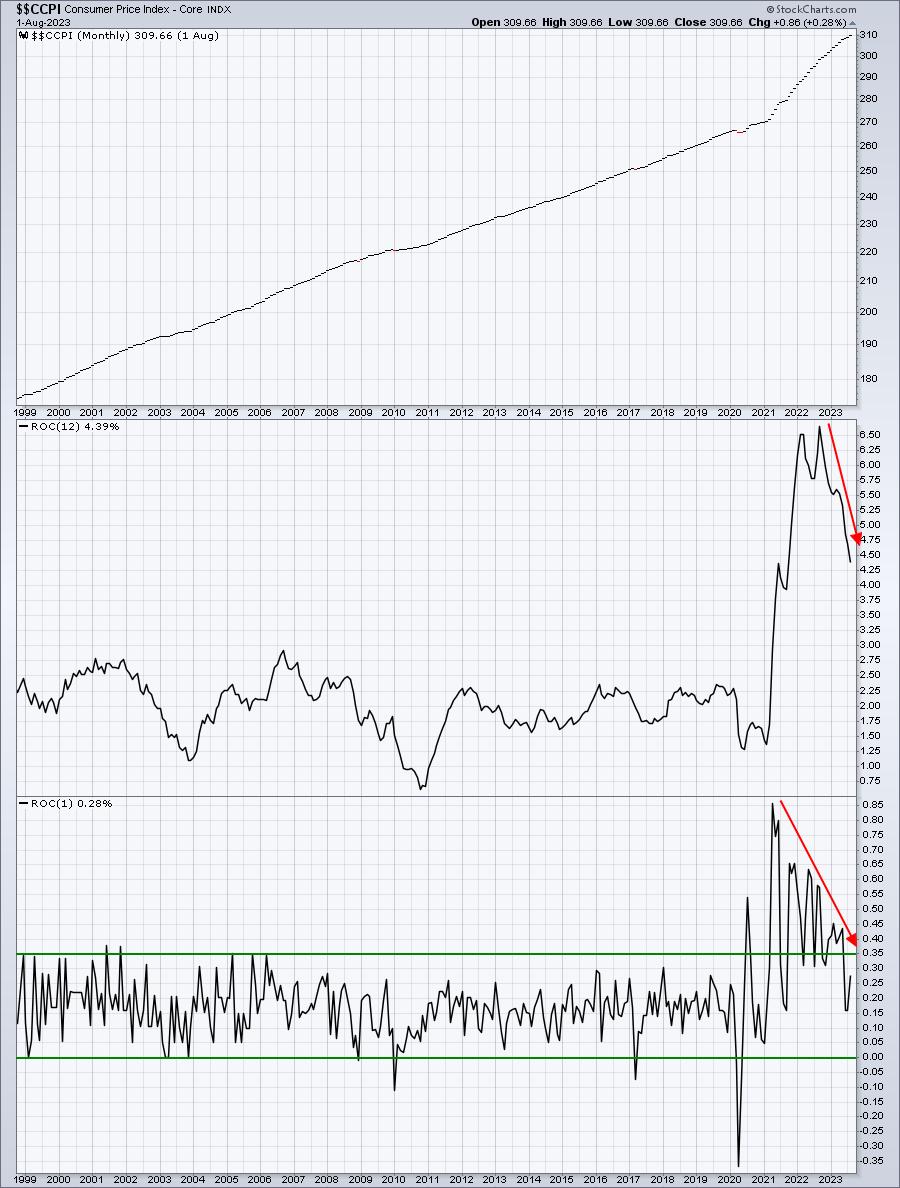

The month-to-month core CPI is what we should always watch most intently and this is a chart that reveals the route it has been heading:

Bear in mind, not too way back, Fed Chief Powell mentioned that the Fed wished to see a constant transfer decrease in direction of its 2% goal. Are you studying the above chart in a different way than me? Not solely have we seen the annual core charge of inflation fall from 6.7% to 4.4% in a single 12 months, however we have additionally seen the month-to-month change fall all the way in which again into its twenty first century “regular” vary. I am unable to assist however consider that if subsequent week’s September Core CPI studying is available in at or under 0.4%, we’ll see the beginning of a This fall inventory market rally, if it hasn’t already begun by then.

On Monday, in our FREE EB Digest e-newsletter, I will be highlighting a chart that claims inflation is NOT an issue, regardless of what the Fed would possibly counsel. If you would like to see this chart and you are not already an EB Digest free subscriber, merely CLICK HERE to enter your identify and e-mail deal with. There isn’t any bank card required and chances are you’ll unsubscribe at any time.

Comfortable buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person buyers. Tom writes a complete Day by day Market Report (DMR), offering steering to EB.com members each day that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a basic background in public accounting as properly, mixing a singular talent set to strategy the U.S. inventory market.