Boeing Co., an aerospace titan, finds itself in a storm. For 9 consecutive days, its shares have been on a relentless descent, shedding 1.07% to shut at $208.40 in a buying and selling session that painted a blended image for the inventory market. Whereas the S&P 500 Index managed to eke out a modest 0.12% acquire, touchdown at 4,467.44, the Dow Jones Industrial Common slipped by 0.20% to settle at 34,575.53.

This descent isn’t with out purpose. Boeing faces a sequence of hurdles converging like a storm. Ongoing points with its 737 MAX deliveries, reducing demand for its wide-body jets, stiff competitors from Airbus and different rivals, and uncertainty within the world aviation business all contribute to this turbulence.

Intriguingly, a report by Bloomberg provides depth to this narrative. It revealed that Boeing delivered a mere 22 of its 737 MAX planes in August, a pointy decline from 35 in July and 50 in June. Sources within the know level fingers at Boeing’s provider, Spirit AeroSystems Holdings Inc., citing manufacturing woes with fuselages and different very important parts of the 737 MAX. The report went on to disclose Boeing’s have to droop deliveries of choose 787 Dreamliner planes resulting from high quality points and the need for rigorous inspections.

These supply numbers are very important, providing perception into Boeing’s monetary well being. The corporate continues to grapple with the aftermath of the grounding of its best-selling 737 MAX jets in 2019 following two deadly accidents that claimed 346 lives. Moreover, decrease demand for its wide-body planes, just like the 787 and the 777X, displays altering developments in aviation. The shift in direction of smaller, fuel-efficient planes and decreased worldwide journey has impacted these once-prominent fashions.

Throughout the aisle, arch-rival Airbus SE is gobbling up market share and securing substantial orders. Airbus chalked up 40 deliveries in August, taking its yearly whole to 384. A coup de maître arrived within the type of a colossal order from China, valued at an estimated $37 billion. This hefty order included 260 of Airbus’s A320neo household jets and 40 of its A350 wide-body plane.

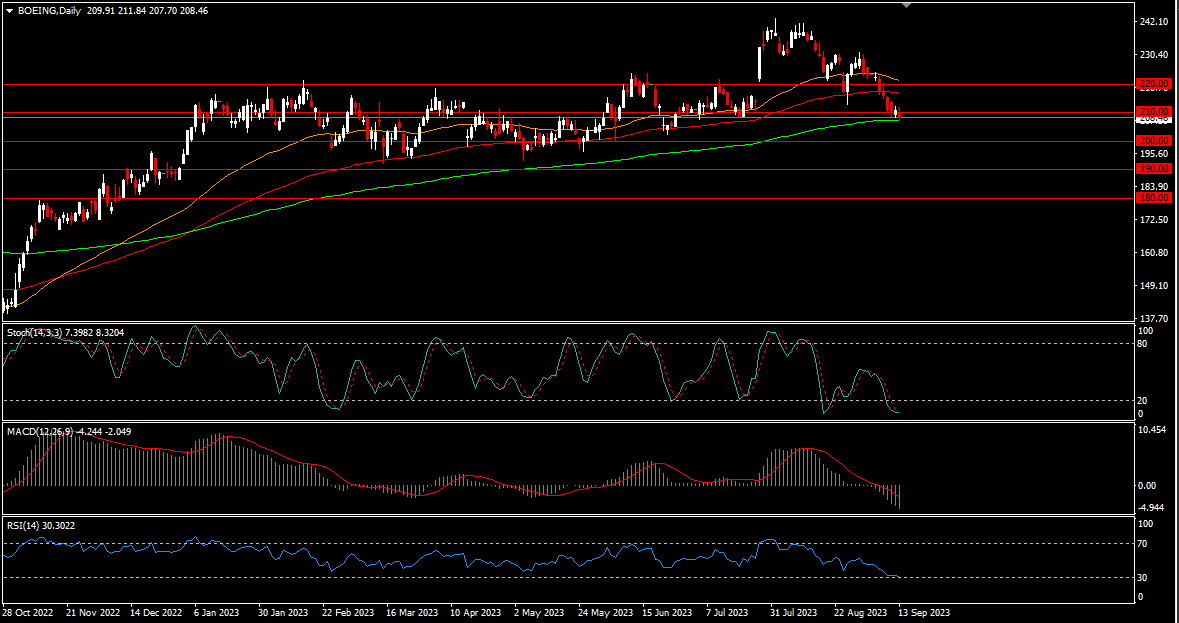

For Boeing, the inventory worth paints a disheartening image. Since reaching a zenith of $243.10 in August 2023, it has been a dangerous journey. Assist ranges have crumbled, together with the 50-day and 100-day shifting averages, with the inventory teetering simply above the 200-day shifting common. Psychological boundaries at $220 and $210 have been breached, and now the $200 threshold beckons ominously. This degree carried significance from February to Could 2023. Ought to the inventory worth plummet beneath, a path to $190 and $180 opens broad. Conversely, if it claws again, resistance looms at $210 and $220, bolstered by the shifting averages.

Technical indicators echo this sombre tune. The MACD stays beneath the zero line and sign line, signalling unfavorable momentum. The RSI sits beneath the 50 degree, indicating bearish strain. The Stochastic oscillator hovers in oversold territory, suggesting a possible reversal or consolidation.

Boeing, as soon as the enormous of the skies, now faces turbulence, battling headwinds from all instructions. The trail forward stays unsure, and buyers watch with bated breath as this aviation behemoth navigates by stormy skies.

Click on right here to entry our Financial Calendar

Francois du Plessis

Market Analyst

Disclaimer: This materials is supplied as a basic advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.