Can we beat inflation by investing in Gold? Can we beat inflation by investing in Gold? Allow us to attempt to discover out by previous knowledge from 1979 to 2023 with round 11,600 day by day knowledge factors.

Our concept of investing for the long run is to beat the inflation. Whether or not it’s fairness, gold, actual property, or a mixture of these belongings. Therefore, we at all times search for the asset which may help us to beat the inflation.

Amongst out there asset courses, gold and actual property are the most well-liked amongst Indians. We’ve got a agency perception that the worth of those two belongings won’t ever give us detrimental or decrease returns.

Whether or not investing in Gold beats inflation?

Allow us to attempt to discover out the historical past of gold by wanting on the previous 44 years of knowledge. I obtained this knowledge from the World Gold Council. The values are by way of rupee and gram. Now, we’ve got 11,660 day by day knowledge factors to research.

To know the volatility, I’m contemplating the 1-year, 3-year, 5-year, and 10-year rolling returns. This can truly give us readability in regards to the volatility.

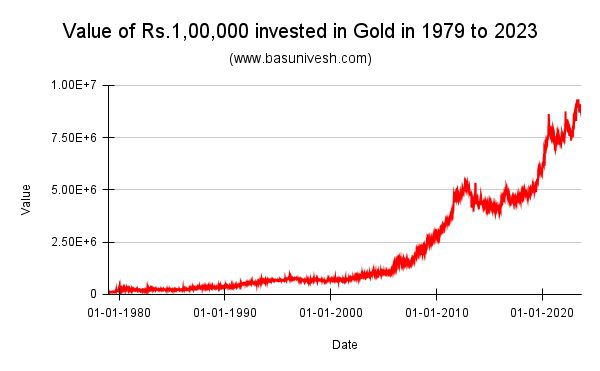

As traditional, allow us to begin the journey of understanding to know what if somebody invested Rs.1,00,000 in 1979.

Rs.1,00,000 invested in gold in 1979 is price of Rs.89,24,859. If we think about the CAGR, then it’s round 10%. However the journey shouldn’t be so easy and there are solely few who’re holding it for 44 years. Therefore, quite than level to level return, we’ve got to depend upon rolling returns.

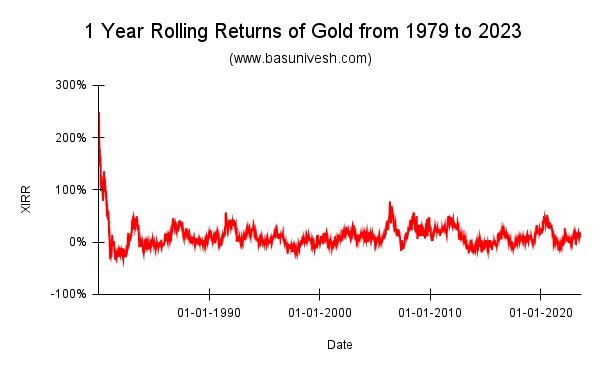

# 1 Yr Rolling Returns of Gold from 1979 to 2023

You discover the volatility vary. The utmost return is 249%, the minimal return is -34%, and the typical return is 12%. Nearly 43% of the 1-year returns are lower than 6% for 1 12 months holding interval between 1979 to 2023.

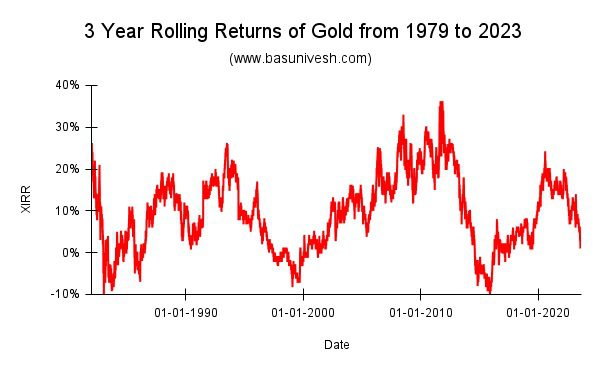

# 3 Yr Rolling Returns of Gold from 1979 to 2023

After holding for 3 years, the volatility is definitely seen. The utmost return is 36%, the minimal return is -10%, and the typical return is 10%. Nearly 35% of the 3-year returns are lower than 6% for the 3-year holding interval between 1979 to 2023.

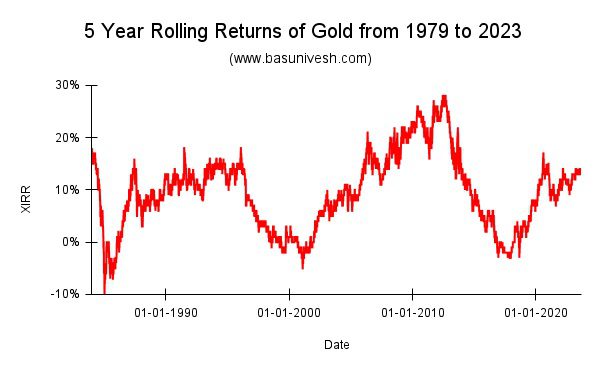

# 5 Yr Rolling Returns of Gold from 1979 to 2023

Within the case of 5-year rolling returns additionally the volatility is definitely seen. The utmost return is 28%, the minimal return is -10%, and the typical return is 10%. Nearly 29.3% of the 5-year returns are lower than 6% for the 5-year holding interval between 1979 to 2023.

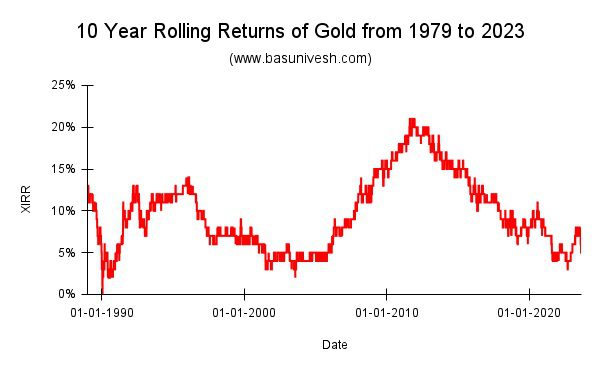

# 10 Yr Rolling Returns of Gold from 1979 to 2023

You seen that after holding for 10 years, the returns potentialities vary from 21% as the best, the minimal is 0% and the typical is 10%. Nearly 20.5% of the 10-year returns are lower than 6% for the 10-year holding interval between 1979 to 2023.

Conclusion – Primarily based on 44 years knowledge from 1979 to 2023, what we will conclude that if we think about the inflaiton as 6%, then even after holding for long run like 10 years, the possibilities of not beating the inflaiton is 20%. For medium to quick time period durations like 5 years, 3 years and 1 12 months, the probbility of not beating the inflation will increase drastically.

It’s a delusion to imagine that if we put money into gold, then we will simply beat the inflaiton as gold will at all times goes up. The above knowledge once more show the volatility nature of the gold. In the event you nonetheless imagine gold is price so that you can beat the inflation, then you possibly can go forward.