You may request a debit card whenever you use Constancy as a checking or financial savings account. Constancy says this of their debit card FAQs:

For every international transaction, there’s a international transaction payment (at present, 1% of the transaction for non-US greenback transactions), which can be included within the quantity charged to your account. This cost might apply whether or not or not there’s a forex conversion.

Constancy customer support additionally repeated this as an official response in this Reddit submit. As a result of I don’t use a debit card for purchases whether or not within the U.S. or in international nations (no rewards), the one means this international transaction payment could possibly be related to me is on ATM withdrawals after we journey internationally.

The FAQ says {that a} international transaction payment “could also be included.” It implies that the payment isn’t all the time included. When precisely is it included and never included?

A Actual-World Take a look at

I had an opportunity to see in actual life whether or not a international transaction payment utilized to an ATM withdrawal utilizing the Constancy debit card.

My spouse took a visit to Canada final week. She withdrew $200 Canadian from an ATM at a gasoline station. Constancy despatched me this debit card exercise alert in real-time:

A financial institution teller withdrawal on card ending in XXXX for $153.06 from CANCO #XXX XXXXXXXXX was posted to your account on 08/03.

$200 Canadian for $153.06 U.S. gave an change fee of 1 US greenback = 1.307 Canadian {dollars}. Google confirmed that the change fee on that day was 1 US greenback = 1.33 Canadian {dollars}. Utilizing that change fee, we must be charged $200 Canadian / 1.33 = $150.38. Constancy charged us $2.68 greater than that. Did Constancy embrace a international transaction payment within the quantity charged to us?

Constancy posted one other entry to our account a day later:

ADJUST FEE CHARGED ATM FEE REBATE (Money) +$2.26

Ah, the unique $153.06 included an ATM payment charged by the machine. Constancy reimbursed us that payment. The online cost after the ATM payment reimbursement was $153.06 – $2.26 = $150.80. This makes the change fee $200 Canadian / $150.80 U.S. = 1.326. That’s near the 1.33 quantity from Google but it surely nonetheless doesn’t fairly match it. Was the distinction a international transaction payment that Constancy included?

Card Community Alternate Price

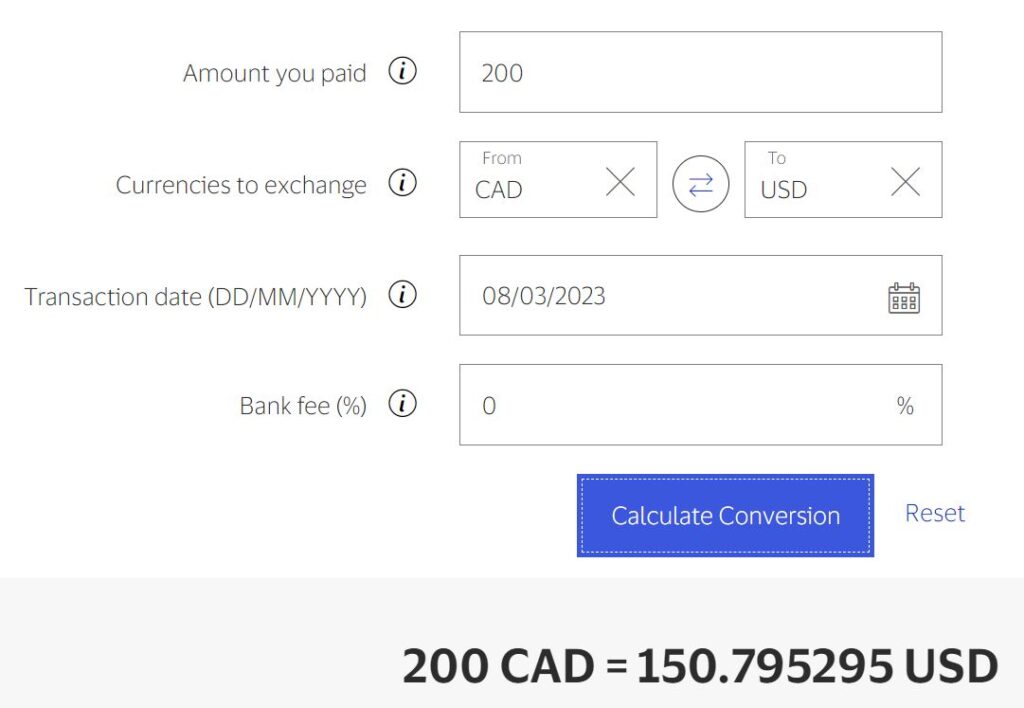

Constancy’s debit card is a Visa debit card. Visa has an internet Alternate Price Calculator to indicate how the Visa community transformed currencies every day. The calculator confirmed this once I put within the transaction date and a 0% financial institution payment:

$150.795295 USD rounds to $150.80. That’s precisely the online quantity Constancy charged us after the ATM payment reimbursement. There was NO international transaction payment from Constancy on the ATM withdrawal.

Visa has a small markup within the change fee used on its community. Constancy is barely passing alongside the change fee from Visa. It’s the very best change fee you will get as lengthy you’re utilizing a Visa card. A Schwab Visa debit card can’t do any higher.

***

Some aspect notes on spending cash abroad:

Get Native Forex from ATM

One of the best ways to get native forex is to make use of an area ATM machine. You pay no ATM payment and also you get the very best change fee when you could have the correct card. Don’t purchase international forex within the U.S. earlier than you allow. Don’t use the forex change cubicles on the airport. Simply take your debit card and use an ATM machine whenever you’re there. You don’t must deliver US greenback payments to change them besides as a backup in case you lose your debit card or you may’t discover a working machine.

It doesn’t matter which ATM you employ. An ATM on the airport works. One at a gasoline station additionally works, as you see in my spouse’s ATM withdrawal. So does an ATM outdoors a financial institution department.

In case your financial institution prices an out-of-network ATM payment plus a international transaction payment and it doesn’t reimburse you the ATM payment charged by the machine, you’re with the incorrect financial institution. Contemplate one of many 3 Methods to Use Constancy as a Checking or Financial savings Account.

Use Contactless

Contactless cost terminals (“tap-and-pay”) are widespread in lots of nations. Many playing cards are already contactless-enabled (search for a sideways wifi image on the cardboard) but when yours nonetheless doesn’t have it, you may put it into Apple Pay or Google Pay and faucet your cellphone to pay. You received’t need to take the cardboard out of your pockets whenever you use Apple Pay or Google Pay. You received’t be requested to signal should you use contactless.

Act as a Native

Act as an area whenever you’re abroad. For those who see any point out of the U.S. greenback on any ATM machine or bank card terminal, again out and press a distinct button to transact within the native forex. They actually don’t provide to cost locals in U.S. {dollars} and also you shouldn’t pay any in a different way.

For those who’d prefer to confirm whether or not your financial institution included a international transaction payment in your worldwide prices, use the Alternate Price Calculator from Visa (or the Forex Converter Calculator from MasterCard in case your card is a MasterCard). MasterCard might give higher change charges on its community than Visa. For those who do a variety of international transactions, get a MasterCard when all else is equal.

Say No To Administration Charges

If you’re paying an advisor a proportion of your belongings, you’re paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.